Navigating the complexities of divorce is an arduous journey, fraught with emotional challenges and significant legal hurdles. Amidst the personal upheaval, the division of marital assets and liabilities stands as one of the most critical and often contentious aspects. This is precisely where a meticulously structured divorce financial settlement agreement template becomes not just helpful, but absolutely essential. It serves as the bedrock for formalizing the financial terms of a separation, ensuring that both parties achieve a clear, equitable, and legally binding resolution for their financial futures.

For individuals going through this process, as well as for legal professionals, mediators, and financial advisors operating within the business and legal documentation niche, a robust template offers invaluable benefits. It provides a standardized framework that streamlines negotiations, clarifies obligations, and significantly reduces the potential for future disputes. By offering a comprehensive starting point, it empowers users to focus on the unique specifics of their situation, rather than spending precious time and resources on drafting foundational language from scratch.

The Imperative of a Defined Written Accord in Modern Divorce

In today’s intricate financial landscape, the notion of a handshake agreement in divorce is not only naive but also legally perilous. Modern marriages often involve diverse asset portfolios, from traditional real estate and investment accounts to complex business interests, digital currencies, and intellectual property. Without a clearly articulated, written agreement, the ambiguity surrounding these assets can lead to protracted legal battles, significant financial drain, and immense emotional distress for all parties involved.

A well-crafted financial settlement document provides a definitive roadmap for asset division and ongoing financial responsibilities. It eliminates guesswork, records intent, and most importantly, offers legal enforceability in a court of law. This clarity is paramount for ensuring that both spouses understand and adhere to the agreed-upon terms, laying a stable foundation for their respective post-divorce lives and minimizing the risk of future litigation over unsettled matters.

Unlocking Clarity and Protection: The Template’s Strategic Advantages

Utilizing a comprehensive template for a divorce financial settlement offers a multitude of strategic advantages, acting as a powerful tool for clarity, efficiency, and protection. Firstly, it provides a structured framework, ensuring that no critical financial or legal elements are inadvertently overlooked during what can be an emotionally charged negotiation process. This systematic approach helps both parties address all necessary components from the outset.

Secondly, a template significantly reduces drafting time and associated legal costs. Legal professionals can leverage pre-vetted language, allowing them to allocate more time to strategic negotiation and client-specific customization rather than basic document construction. This efficiency translates directly into cost savings for clients. Furthermore, the inherent structure of a template helps to de-escalate emotional tensions by presenting a neutral, objective document around which discussions can revolve, fostering a more collaborative approach to resolution.

Tailoring Your Financial Settlement: Adaptability Across Diverse Scenarios

One of the most powerful features of a high-quality divorce financial settlement agreement template is its inherent adaptability. While it provides a strong foundation, it is designed to be fully customizable to fit the unique nuances of various financial situations and individual circumstances. This flexibility ensures that the final document accurately reflects the specific terms agreed upon by the divorcing parties, regardless of their asset levels or family structures.

For high-net-worth divorces, the template can be expanded to include intricate clauses addressing complex investment portfolios, offshore accounts, trusts, and business valuations. Conversely, for cases with more modest assets, it can be streamlined to focus on essential property division and support agreements. Legal professionals can easily modify sections to align with specific state laws, integrate clauses for shared family businesses, or incorporate future financial planning considerations, ensuring the document remains legally sound and practically effective.

Core Components of a Robust Financial Settlement Document

Every comprehensive financial settlement agreement must include specific clauses and sections to ensure all aspects of the marital estate are properly addressed and resolved. These foundational elements provide the backbone of the agreement, outlining responsibilities and expectations for both parties.

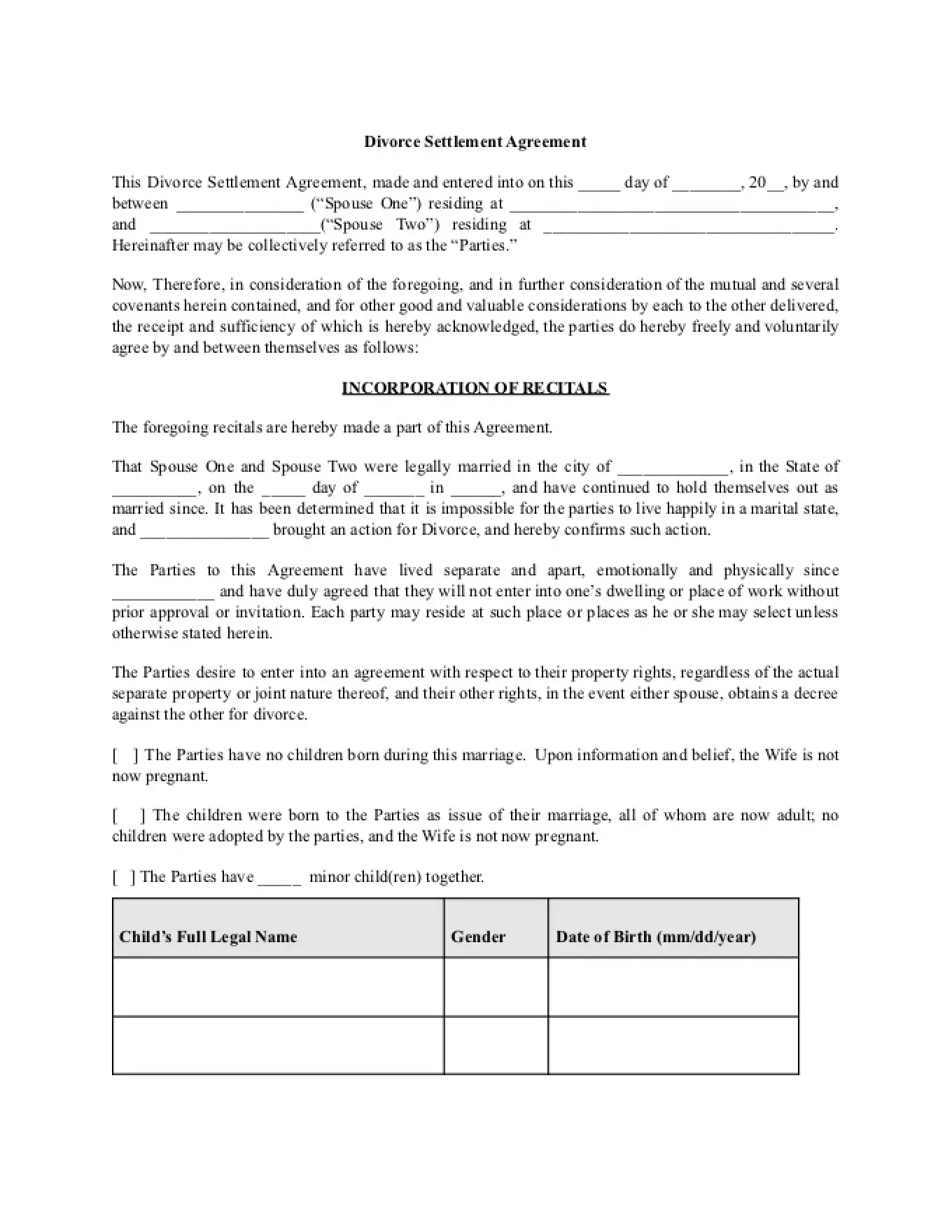

- Identification of Parties: Full legal names and current addresses of both spouses.

- Date of Separation and Divorce Filing: Crucial for establishing valuation dates for assets and debts.

- Marital vs. Separate Property: Clear definitions and schedules detailing which assets and debts are considered marital property (subject to division) and which are separate property (belonging solely to one spouse).

- Asset Division: Detailed listing and allocation of all marital assets, including:

- Real Estate (primary residence, vacation homes, investment properties).

- Vehicles, boats, and other registered property.

- Bank Accounts (checking, savings, money market).

- Investment Accounts (stocks, bonds, mutual funds, brokerage accounts).

- Retirement Accounts (401(k)s, IRAs, pensions, defined benefit plans), often requiring Qualified Domestic Relations Orders (QDROs) or similar division orders.

- Business Interests (partnerships, sole proprietorships, corporations).

- Intellectual Property and other valuable intangible assets.

- Personal Property (furniture, jewelry, art, collectibles).

- Debt Allocation: Comprehensive division of all marital liabilities, such as:

- Mortgages and home equity lines of credit.

- Credit card debts.

- Personal loans and student loans (if marital).

- Business debts.

- Spousal Support (Alimony): Specific terms regarding the amount, duration, payment schedule, and modifiability of spousal support, along with any relevant tax implications.

- Child Support and Related Expenses: If applicable, details on child support payments, responsibility for healthcare premiums and out-of-pocket medical costs, educational expenses, and extracurricular activities. (Note: While distinct from pure financial, these are often inextricably linked in a full settlement).

- Tax Implications: Allocation of responsibility for past, current, and future tax liabilities, including capital gains taxes on asset sales and tax deductions.

- Life and Health Insurance: Provisions for the continuation or establishment of life and health insurance policies for ex-spouses and children.

- Future Earnings and Inheritances: Clauses addressing how future income or inherited assets will be treated.

- Dispute Resolution: Mechanisms for resolving future disagreements, such as mediation or arbitration, before resorting to litigation.

- Attorneys’ Fees: Agreement on who will bear the cost of legal fees incurred during the divorce process.

- Full Disclosure Clause: An affirmation from both parties that they have fully and honestly disclosed all assets, debts, and financial information.

- Governing Law: Specification of the state whose laws will govern the interpretation and enforcement of the agreement.

- Signatures: Spaces for the notarized signatures of both parties and their legal counsel, signifying their acceptance and understanding of the terms.

Optimizing for Clarity and Accessibility: Practical Formatting Guidelines

Beyond the substantive content, the presentation and formatting of a divorce financial settlement agreement template are crucial for its usability and readability, whether in print or digital form. A well-formatted document enhances comprehension, reduces errors, and projects professionalism. Start by ensuring clear, hierarchical headings and subheadings (like using <h2> and <h3> tags) to provide a logical flow and easy navigation through potentially complex information.

Employ concise and unambiguous language, minimizing legal jargon where possible, or clearly defining it when necessary. Consistent formatting, including font styles, sizes, and spacing, contributes significantly to readability. For lengthy agreements, incorporating a Table of Contents and pagination allows for quick referencing. Ample white space around text blocks and between sections prevents an overwhelming visual density. When considering digital use, ensure the document is readily searchable (e.g., a well-processed PDF) and maintain version control during collaborative drafting, especially when multiple revisions are made. Utilizing appendices and exhibits for detailed schedules of assets, debts, or property descriptions can keep the main body of the agreement focused and clean.

In the intricate landscape of divorce, a robust divorce financial settlement agreement template stands as an indispensable tool. It transforms what could be a chaotic and financially draining ordeal into a structured, manageable process, offering a clear path forward for all parties involved. By meticulously outlining financial responsibilities and asset divisions, it minimizes ambiguity and provides a legally sound foundation for transitioning into separate lives.

For legal professionals, mediators, and individuals, leveraging such a template is not merely a matter of convenience; it’s a strategic choice that promotes fairness, reduces stress, and saves valuable time and resources. It empowers users to approach a sensitive and critical life event with professionalism and foresight, ensuring that the financial aspects of a divorce are resolved with precision and integrity, ultimately fostering greater peace of mind and stability for the future.