In the intricate world of business, financial transactions between a company and its shareholders or related entities are commonplace. However, these transactions are rarely straightforward and come laden with specific compliance requirements, particularly concerning tax implications. Without proper documentation, what might seem like a simple loan could be recharacterized by tax authorities as an undeclared dividend or distribution, leading to severe penalties and unexpected tax liabilities. Navigating these complexities demands meticulous attention to detail and a robust understanding of legal frameworks.

This is precisely where a clear, well-structured loan agreement becomes not just a recommendation, but a critical necessity. For entrepreneurs, small business owners, corporate finance teams, and legal professionals alike, having a reliable template for such agreements can streamline processes, ensure compliance, and mitigate significant risks. It provides a standardized foundation, saving countless hours and potential legal fees, while offering the peace of mind that comes with thoroughly documented financial dealings.

The Imperative for Formal Loan Documentation

In today’s highly regulated business environment, the days of handshake agreements for internal financial transfers are long gone. Tax authorities, including the IRS in the United States, scrutinize transactions between companies and their owners or associates to prevent tax avoidance. A key area of focus involves loans made from a company to its shareholders, or from one related company to another. Without formal, legally sound documentation, such "loans" can easily be reclassified as taxable income, dividends, or even capital contributions, creating unforeseen tax burdens for both the company and the recipient.

A clearly written agreement provides an irrefutable record of the parties’ intentions, the terms of the loan, and the obligations of each party. This clarity is paramount not only for tax compliance but also for internal governance and dispute resolution. It establishes the bona fide nature of the transaction, clearly outlining repayment schedules, interest rates, and any security provisions. This proactive approach safeguards the financial integrity of the business and protects its stakeholders from potential legal and financial challenges down the line.

Unlocking Advantages with a Standardized Agreement Template

The primary benefit of utilizing a standardized loan agreement template is its sheer efficiency. Developing a comprehensive legal document from scratch for every internal loan can be an incredibly time-consuming and expensive endeavor. A well-designed template drastically reduces this burden, providing a pre-vetted structure that incorporates essential legal and financial provisions. This allows businesses to execute transactions quickly and confidently, without reinventing the wheel each time.

Beyond efficiency, a template offers critical protections. It ensures that no vital clauses are overlooked, which is particularly important in the context of avoiding adverse tax treatment for related party loans. By formalizing the terms, it prevents misunderstandings and potential disputes between the company and its owners or other related entities. This proactive measure fosters transparency and accountability, reinforcing professional standards within the organization. Ultimately, leveraging a comprehensive division 7a loan agreement template free from common omissions can serve as a cornerstone for maintaining financial integrity and regulatory compliance.

Adapting Your Loan Document for Diverse Needs

While a template provides a robust starting point, the reality of business finance dictates that no two loan scenarios are exactly alike. The beauty of a well-crafted agreement template lies in its inherent flexibility, allowing for customization to suit a myriad of industry-specific needs and unique transactional scenarios. Whether it’s a shareholder loan to fund personal ventures, an inter-company loan for working capital, or a specialized arrangement requiring particular covenants, the core template serves as a adaptable foundation.

For instance, a template designed for a general corporate loan can be modified to include specific clauses pertinent to the real estate sector, such as lien rights or property-specific default conditions. Similarly, a technology startup might need provisions for intellectual property as collateral, while a manufacturing firm might focus on equipment or inventory. The ability to tailor interest rates, repayment schedules, grace periods, and default triggers ensures that the agreement accurately reflects the commercial realities and risk profiles of each specific transaction. This adaptability makes the initial investment in a quality template invaluable across various business functions and stages of growth.

Essential Clauses for a Robust Loan Agreement

A comprehensive loan agreement must be meticulously structured to leave no room for ambiguity. The strength of any financial contract lies in the clarity and completeness of its clauses. For any intra-company or shareholder loan, including those scrutinized under the principles of division 7a loan agreement template free to avoid tax issues, certain elements are non-negotiable. These core components ensure legal enforceability and provide a clear framework for all parties involved.

Here are the essential clauses every effective loan agreement should contain:

- Identification of Parties: Clearly state the full legal names and addresses of the lender and the borrower, specifying their roles in the transaction.

- Loan Amount and Purpose: Explicitly define the principal amount of the loan and, where relevant, its intended use. This reinforces the bona fide nature of the loan.

- Interest Rate and Calculation: Detail the annual interest rate, how it will be calculated (e.g., simple or compounded), and the basis for calculation (e.g., daily, monthly).

- Repayment Schedule: Outline the specific terms of repayment, including frequency (e.g., monthly, quarterly), due dates, and the amount of each payment. Include any provisions for balloon payments or early repayment.

- Default Provisions: Clearly define what constitutes an event of default (e.g., missed payments, bankruptcy) and the remedies available to the lender in such scenarios.

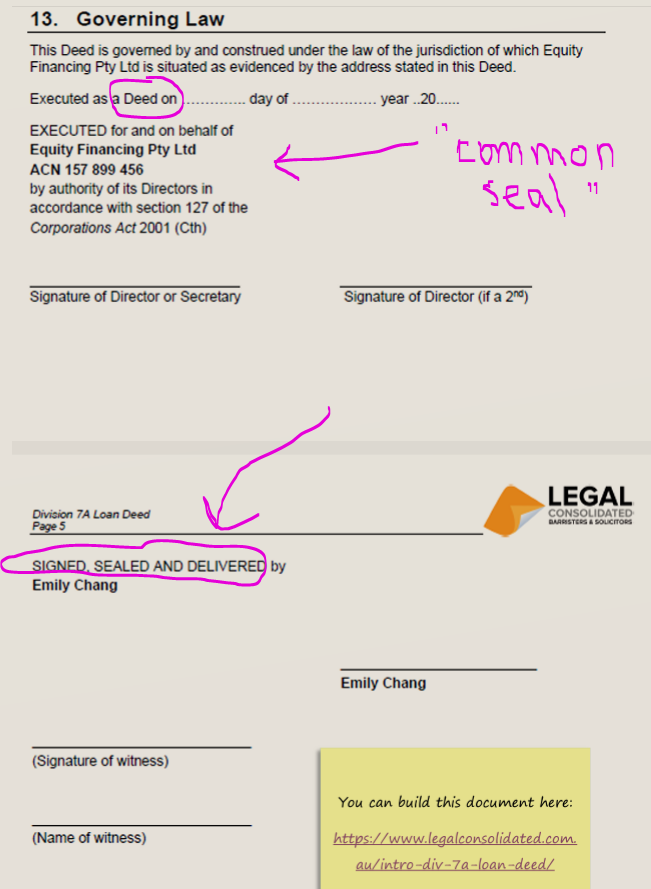

- Governing Law: Specify the state or jurisdiction whose laws will govern the interpretation and enforcement of the agreement. This is crucial for US-based businesses.

- Representations and Warranties: Statements made by each party affirming certain facts (e.g., legal capacity to enter the agreement, accuracy of financial information).

- Covenants: Promises made by the borrower to perform or refrain from certain actions during the loan term (e.g., maintaining certain financial ratios, not incurring additional debt).

- Security/Collateral (if applicable): Detail any assets pledged by the borrower to secure the loan, including a description of the collateral and the lender’s rights upon default.

- Waivers and Amendments: Outline procedures for modifying the agreement and how either party can waive a provision without affecting the rest of the contract.

- Notices: Specify how formal communications between the parties should be delivered.

- Signatures: Include spaces for the authorized representatives of all parties to sign and date the agreement, preferably with witness attestations or notarization to enhance legal standing.

Enhancing Usability and Readability: Practical Tips

Beyond the legal substance, the practicality of a loan agreement hinges on its usability and readability. A document, however legally sound, loses its effectiveness if it’s difficult to understand or navigate. When preparing your loan agreement, whether for print or digital distribution, consider several key formatting and presentation tips to ensure maximum clarity and accessibility for all parties involved.

First, employ clear and logical section headings and subheadings. These act as signposts, guiding readers through the document and allowing them to quickly locate specific clauses. Utilize ample white space around paragraphs and between sections to reduce visual clutter and prevent reader fatigue. Secondly, opt for a professional, legible font (e.g., Arial, Calibri, Times New Roman) in a comfortable size (10-12 points for body text). Consistency in font choice and sizing throughout the document enhances its professional appearance.

For digital use, ensure the document is easily convertible to PDF format, preserving layout and formatting across different devices and operating systems. Consider adding interactive elements if used in a secure digital environment, such as clickable table of contents links. For printed versions, ensure appropriate page margins for binding or filing. Finally, strive for plain language where possible, avoiding overly complex legal jargon unless absolutely necessary, and always define technical terms. This commitment to clarity ensures that all parties fully comprehend their obligations and rights, minimizing potential for misinterpretation.

In the complex landscape of corporate finance and tax compliance, overlooking the formal documentation of internal loans is a risk no business should take. The potential for recharacterization by tax authorities can lead to significant and unforeseen financial liabilities, undermining the stability and growth of an enterprise. Proactive, precise legal documentation is not merely a formality but a fundamental component of sound financial governance.

Leveraging a well-designed division 7a loan agreement template free from common pitfalls offers an invaluable solution. It provides the legal rigor required to define the true nature of transactions, ensuring compliance, preventing disputes, and protecting the interests of both the company and its stakeholders. By adopting such a professional, time-saving solution, businesses can navigate the intricacies of intra-company lending with confidence, clarity, and unwavering legal integrity, paving the way for sustained financial health and operational efficiency.