Navigating the often-complex world of financial discrepancies can be a daunting task. Whether it’s an incorrect charge, an account reported in error, or a matter of identity theft impacting your credit, the need for clear, decisive communication with creditors is paramount. A well-crafted dispute letter isn’t just a formality; it’s a critical tool in safeguarding your financial standing, ensuring your voice is heard, and initiating a formal resolution process. For individuals, small business owners, or even credit repair professionals, understanding how to construct such a letter effectively can be the difference between a swift resolution and prolonged frustration.

This is where a robust dispute letter to creditor template becomes an invaluable asset. Far from being a rigid, one-size-fits-all solution, a professionally designed template provides a structured framework that empowers you to communicate with precision and authority. It demystifies the process, ensuring that all essential information is included, the tone is appropriate, and your correspondence carries the weight it needs to elicit a proper response from the recipient. Embracing such a template means taking proactive control of your financial narrative, turning a potential headache into a manageable, actionable process.

The Power of Polished Correspondence

In an age dominated by digital communication, the art of written correspondence, especially when it comes to sensitive financial matters, retains immense power. A meticulously written and properly formatted letter to a creditor signals professionalism and seriousness, immediately setting a more respectful and efficient tone for the interaction. It demonstrates that you have taken the time to clearly articulate your position, backed by facts and relevant details, which can significantly influence how your dispute is perceived and handled.

Beyond first impressions, such correspondence creates an indisputable paper trail. This is not merely about having a record; it’s about establishing a formal timeline and documentation that can be crucial if the dispute escalates or requires further legal review. Clarity, conciseness, and accuracy are non-negotiable. Any ambiguity, emotional language, or lack of factual support can undermine your credibility and delay resolution. A professional layout, proper addressing, and a clear subject line all contribute to a document that demands attention and, more importantly, a considered response.

Streamlining Your Efforts with a Ready-Made Framework

The prospect of drafting a formal letter from scratch, particularly under the stress of a financial dispute, can be overwhelming. This is one of the primary benefits of leveraging a dispute letter to creditor template. It significantly reduces the time and mental energy required to initiate the communication process, allowing you to focus on gathering supporting evidence rather than perfecting sentence structure.

A ready-made framework ensures that no critical piece of information is overlooked. Templates are designed with best practices in mind, guiding the sender through all the necessary sections and details that creditors typically require. This leads to a more comprehensive and effective initial communication, often preventing back-and-forth exchanges caused by incomplete information. Furthermore, using a template guarantees a consistent, professional layout, which enhances readability and makes it easier for the recipient to process your request. It instills confidence in the sender, knowing that their correspondence is polished, thorough, and poised to achieve the desired outcome. The consistency and thoroughness provided by a robust dispute letter to creditor template are invaluable.

Adapting Your Message for Specific Situations

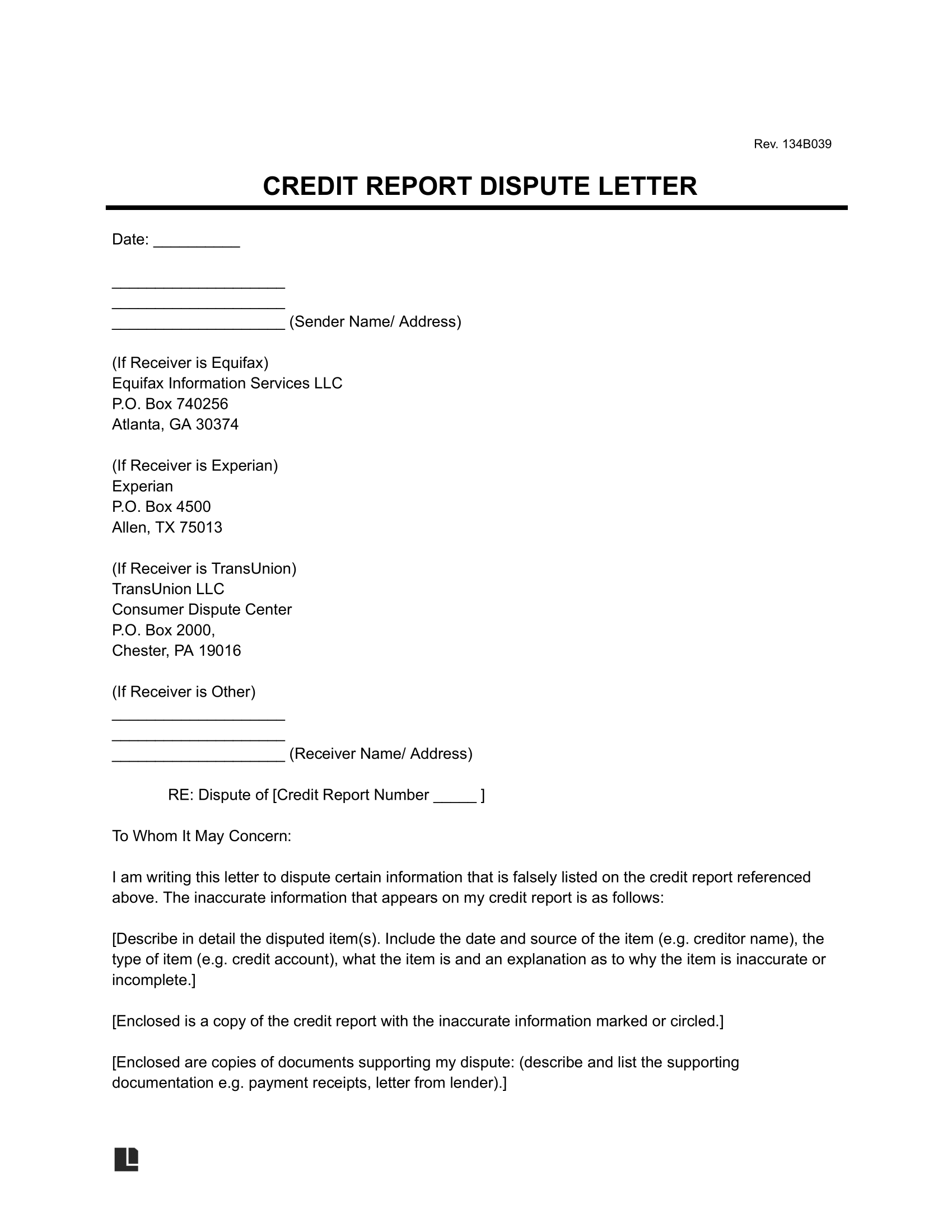

While the core structure of a dispute letter remains consistent, its effectiveness hinges on personalization. A versatile template acts as a strong foundation, but the specific details of your situation will dictate how you customize it. For instance, disputing an incorrect balance due to a payment not being recorded requires different details than contesting a fraudulent charge resulting from identity theft, or arguing against a collection agency for an old debt that has passed its statute of limitations.

When modifying a template for a financial dispute, you’ll need to clearly articulate the nature of the discrepancy, the specific account numbers involved, and any relevant dates or transaction IDs. If you’re disputing charges on a credit card, you’ll reference statement dates and specific line items. If it’s a matter reported on your credit report, you’ll cite the credit bureau, the account name, and the specific entry you are challenging. The principle of using a template for professional correspondence extends broadly; just as a template for a request letter would be tailored with specific needs and deadlines, or a formal notice would carry precise legal language, a dispute letter needs meticulous customization to reflect your unique circumstances and present a compelling case to the creditor. The goal is always to provide clarity and leave no room for misinterpretation of your claim.

Essential Elements of Effective Communication

Every well-structured letter, especially one concerning a financial dispute, must contain specific components to be considered complete and professional. These elements ensure that the communication is clear, actionable, and legally sound.

- Sender’s Contact Information: Your full name, address, phone number, and email. This ensures the creditor can easily respond to you.

- Date: The exact date the letter is written and sent, critical for tracking timelines.

- Recipient’s Contact Information: The full name and address of the creditor or collection agency, including department name if known. Precision here is key to ensure it reaches the right party.

- Subject Line: A concise yet informative summary of the letter’s purpose, including account numbers (e.g., “Dispute Regarding Account #1234-5678-9012”). This aids immediate identification.

- Salutation: A professional greeting, ideally addressing a specific individual if possible, otherwise a general but formal address (e.g., “To Whom It May Concern” or “Dear [Creditor Name] Customer Service”).

- Opening Statement: A clear, direct statement of your intent to dispute a specific item or balance, referencing the account number immediately.

- Detailed Explanation of the Dispute: This is the core of your letter. Present a factual, chronological account of the problem. Be specific with dates, amounts, transaction details, and explain *why* you believe there is an error. Avoid emotional language; stick to verifiable facts.

- Request for Specific Action: Clearly state what you expect the creditor to do (e.g., “investigate this matter,” “remove the erroneous entry from my credit report,” “adjust the balance to $X”).

- Supporting Documentation: List all enclosed documents that support your claim (e.g., “copies of payment records,” “bank statements,” “police reports for identity theft,” “previous correspondence”). Do not send originals.

- Call to Action Regarding Response Time: Politely request a response within a reasonable timeframe (e.g., “Please respond within 30 days of the date of this letter”).

- Professional Closing: A formal closing such as “Sincerely” or “Respectfully.”

- Signature Block: Your typed name, with space above for your physical signature.

Crafting Your Message: Tone, Structure, and Delivery

The efficacy of your dispute letter is profoundly influenced by its tone, structural integrity, and the method of its presentation. Even the most factual letter can lose impact if these elements are neglected.

When considering the tone, professionalism is paramount. Be firm and assertive in stating your case, but always remain polite and factual. Avoid emotional outbursts, accusations, or aggressive language. Your objective is to present an objective account of the situation and seek a resolution, not to engage in a confrontation. A calm, reasoned tone enhances your credibility and encourages the recipient to approach your request with similar professionalism.

Regarding structure and formatting, clarity and readability are key. Use standard, easy-to-read fonts such as Times New Roman or Arial, typically in 10-12 point size. Maintain standard one-inch margins and use single spacing within paragraphs, with double spacing between paragraphs for visual breaks. If you have a professional letterhead, this is an excellent opportunity to use it. A clean, uncluttered layout ensures that your message is easy to follow and that important details stand out.

For presentation and delivery, particularly for a critical document like a dispute letter to creditor template, the choice of method is crucial. For digital versions, always save and send your letter as a PDF document. This preserves the formatting, prevents unauthorized edits, and ensures it looks the same on any device. If emailing, ensure your email subject line is clear, and the email body itself is concise, directing the recipient to the attached PDF. For printable versions, use good quality paper. Most importantly, always send dispute letters via certified mail with a return receipt requested. This provides irrefutable proof that the letter was sent and received, along with the date of delivery, which is vital for any future legal proceedings or follow-ups. Always retain copies of your letter and all supporting documentation for your own records.

In the often-stressful landscape of financial disagreements, having a reliable and comprehensive dispute letter to creditor template is more than just a convenience; it’s a strategic asset. It empowers you to approach sensitive financial issues with confidence and precision, transforming potential chaos into structured, actionable communication. By ensuring every critical detail is addressed and presented professionally, you elevate your chances of a successful resolution.

Ultimately, a well-utilized dispute letter to creditor template serves as a testament to your diligence and commitment to resolving financial matters responsibly. It’s an investment in clear communication, providing a polished, efficient, and time-saving method to protect your financial well-being. Empower yourself with this essential tool, and take control of your financial narrative with every meticulously crafted piece of correspondence.