In today’s dynamic economic landscape, taking firm control of your finances isn’t just a wise choice—it’s an absolute necessity. Many of us navigate our daily lives with a general idea of our income and expenses, but often lack the granular insight needed to truly optimize our financial well-being. This common approach, while seemingly manageable in the short term, can lead to missed savings opportunities, unaddressed debt, and a constant undercurrent of financial stress.

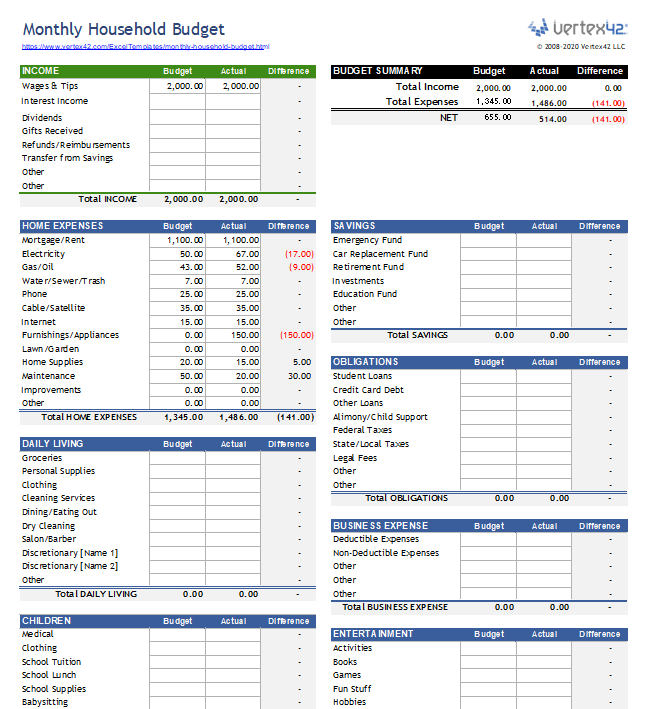

Imagine a clear roadmap for every dollar you earn and spend, giving you the power to make informed decisions, achieve your financial goals, and build a secure future. That’s precisely what a well-crafted Detailed Household Budget Template offers. It transforms abstract financial concepts into actionable steps, providing clarity and control that empowers individuals and families across the US to live within their means, save strategically, and invest confidently in their aspirations.

Why a Detailed Budget Matters More Than Ever

In an era of rising costs and economic uncertainties, understanding where every dollar goes is paramount. A comprehensive budget is more than just an accounting exercise; it’s a powerful tool for financial empowerment. It reveals spending patterns, highlights areas for potential savings, and provides the data necessary to align your financial habits with your long-term objectives, whether that’s buying a home, saving for retirement, or funding your children’s education.

Without a robust spending plan, it’s easy for discretionary spending to creep up, eroding savings and making it harder to meet essential financial commitments. This financial framework acts as your personal financial compass, guiding you through the complexities of household economics and helping you identify both opportunities and challenges before they become critical. It turns vague financial hopes into concrete, measurable goals, giving you a clear path forward.

The Core Components of a Comprehensive Financial Plan

A truly effective household budget goes beyond simply listing income and expenses. It’s a holistic view that categorizes, tracks, and analyzes your financial flows to provide actionable insights. The best financial planning tools are designed to be thorough yet intuitive, capturing all relevant data points without overwhelming the user.

Here are the fundamental elements you should expect in any robust financial framework:

- **Income Sources:** A clear breakdown of all money coming into the household. This includes salaries, freelance income, bonuses, rental income, and any other regular infusions of cash. It’s crucial to distinguish between **net income** (after taxes and deductions) and gross income for realistic planning.

- **Fixed Expenses:** These are costs that typically remain the same month after month and are often contractual. Examples include:

- **Mortgage/Rent Payments**

- **Loan Payments** (car, student, personal)

- **Insurance Premiums** (health, auto, home)

- **Subscription Services** (streaming, gym memberships)

- **Variable Expenses:** These fluctuate based on usage or choice. Tracking these is vital for finding areas to adjust spending. Examples often include:

- **Groceries**

- **Utilities** (electricity, water, gas, internet)

- **Transportation** (gas, public transit, ride-shares)

- **Dining Out/Entertainment**

- **Personal Care**

- **Savings & Investments:** Dedicated categories for financial growth. This should include regular contributions to:

- **Emergency Fund**

- **Retirement Accounts** (401k, IRA)

- **Education Savings** (529 plans)

- **Specific Goals** (down payment, vacation)

- **Debt Repayment:** Beyond minimum payments, a good budget includes a strategy for accelerating debt reduction, especially high-interest debts like credit cards.

Getting Started: Implementing Your Household Budget

The thought of creating a detailed spending plan can feel daunting, but breaking it down into manageable steps makes the process straightforward and effective. The goal is not perfection from day one, but consistent progress and understanding.

- Gather Your Financial Data: Before you even look at a budgeting system, collect all your financial statements. This includes bank statements, credit card statements, loan summaries, and pay stubs from the last 1-3 months. This provides a realistic snapshot of your current income and spending.

- Input Your Income: Start by clearly listing all sources of net income for the month. Be conservative with variable income sources if they aren’t guaranteed.

- Categorize Your Expenses: Go through your bank and credit card statements and assign every transaction to a category (e.g., groceries, utilities, rent, entertainment). This is where the true power of a detailed spending plan becomes evident. Don’t forget those smaller, often overlooked expenses.

- Analyze and Adjust: Once you have a clear picture of your income versus expenses, it’s time for analysis. Are you spending more than you earn? Are your savings goals being met? Identify areas where you can cut back or reallocate funds. This might mean reducing dining out, finding cheaper insurance, or re-evaluating subscriptions.

- Set Realistic Goals: Based on your analysis, define specific, measurable, achievable, relevant, and time-bound (SMART) financial goals. These could be saving a certain amount for a down payment, paying off a credit card, or building a three-month emergency fund.

- Review Regularly: A budget isn’t a "set it and forget it" tool. Life changes, and so should your financial roadmap. Schedule a weekly or monthly review to track progress, make necessary adjustments, and ensure it continues to serve your needs.

Beyond the Basics: Customization and Optimization Tips

While a standard money management template provides an excellent foundation, its true potential is unlocked through customization and continuous optimization. Tailoring your financial roadmap to your unique circumstances and evolving goals is key to its long-term success.

- Embrace Digital Tools: While a spreadsheet can be a great starting point, consider dedicated budgeting apps or software. Many offer automatic transaction categorization, visual reports, and goal tracking, making the process more efficient and engaging.

- Allocate "Fun Money": Don’t make your budget so restrictive that it becomes unsustainable. Allocate a reasonable amount for discretionary spending or "fun money." This helps prevent budget burnout and ensures you can still enjoy life’s pleasures within your means.

- Factor in Irregular Expenses: Think about annual insurance premiums, holiday gifts, or car maintenance. These larger, less frequent expenses can derail a monthly budget if not accounted for. Set aside a small amount each month into a sinking fund for these items.

- Track Net Worth: Beyond just income and expenses, consider adding a net worth tracker to your comprehensive budget guide. This provides a broader perspective of your financial health, showing the growth of assets against liabilities over time.

- Automate Savings: One of the most effective strategies is to automate your savings. Set up automatic transfers from your checking to your savings or investment accounts immediately after payday. Treat savings as a fixed expense.

Common Pitfalls and How to Avoid Them

Even with the best intentions and a robust budgeting system, certain challenges can emerge. Being aware of these common pitfalls can help you navigate them more effectively, ensuring your financial planning tool remains a powerful ally.

- Being Unrealistic: Overly restrictive budgets are often abandoned. Be honest about your spending habits and needs. Start with small, achievable changes rather than drastic cuts that are hard to maintain.

- Ignoring Small Expenses: The "latte factor" is real. Small, daily purchases add up quickly. Neglecting these seemingly insignificant transactions can lead to a significant budget deficit by month-end. Track everything, even the minor expenditures.

- Giving Up After One Bad Month: Life happens. There will be months where unexpected expenses arise or you simply overspend. Don’t let one off-month derail your entire effort. Adjust, learn, and get back on track. Consistency, not perfection, is the goal.

- Not Categorizing Accurately: Vague or incorrect categorization makes it impossible to understand your spending patterns. Be specific. "Miscellaneous" should be used sparingly, if at all.

- Failing to Review and Adjust: A budget is a living document. It needs regular attention. Without consistent review, it quickly becomes outdated and ineffective, losing its value as a dynamic financial roadmap.

Frequently Asked Questions

What is the main difference between a basic budget and a detailed household budget?

A basic budget typically tracks income and major expenses, offering a broad overview. A detailed household budget, however, meticulously categorizes every single transaction, providing granular insight into spending patterns, uncovering hidden costs, and allowing for precise financial adjustments and goal setting. It’s about depth and actionable data.

How often should I update my household budget template?

Ideally, you should review your household budget weekly or bi-weekly to log expenses and check against your plan. A more comprehensive review and adjustment should be performed monthly to assess progress, reallocate funds, and account for any changes in income or expenses.

What if my income is irregular or fluctuates significantly?

For irregular incomes, it’s best to budget based on your lowest expected monthly income. Treat any income above that baseline as “bonus” funds that can be allocated to savings, debt repayment, or specific financial goals. Another strategy is to average your income over several months to create a more stable projection.

Is it necessary to track every single penny?

While tracking every penny offers the most precise insight, the level of detail can be adjusted to what is sustainable for you. The key is to track enough to understand where your money is going and make informed decisions. Many find that grouping small, similar transactions (e.g., “coffee shop purchases”) works well without losing critical detail.

Can a detailed budget help me pay off debt faster?

Absolutely. By meticulously tracking your income and expenses, a detailed spending plan helps you identify surplus funds that can be strategically applied to accelerate debt repayment. It also highlights areas where you can cut back on discretionary spending to free up even more capital for debt reduction, often leading to significant savings in interest over time.

Taking charge of your financial future doesn’t have to be overwhelming. With the right tools and a disciplined approach, you can transform your relationship with money, moving from reactive spending to proactive financial management. A comprehensive budget guide isn’t just about restricting spending; it’s about optimizing it, ensuring every dollar works harder for you.

By consistently utilizing and refining your financial planning tool, you’ll gain unparalleled clarity into your financial life. This newfound understanding empowers you to make smarter choices, build substantial savings, and confidently pursue your most ambitious financial dreams. Start today, and unlock the peace of mind that comes with complete financial control.