Navigating the often-complex world of debt collection can be a daunting experience, particularly when you’re unsure if a claimed debt is legitimate or accurate. For individuals and businesses alike, clarity and verification are paramount. This is precisely where the concept of a debt validation letter comes, serving as a critical first step in asserting your rights and seeking necessary information. It’s not merely a formality; it’s a strategic communication tool designed to empower you with the facts, ensuring that any financial obligation you might ultimately accept is indeed your responsibility and correctly reported.

Understanding the power of structured and professional correspondence in such sensitive situations cannot be overstated. A well-crafted debt validation letter template offers a clear, concise, and legally informed pathway to request verification from debt collectors, ensuring compliance with consumer protection laws like the Fair Debt Collection Practices Act (FDCPA). It provides a vital shield against erroneous claims and aggressive tactics, offering peace of mind and a solid foundation for any subsequent actions. Whether you’re a small business owner dealing with an old ledger entry or an individual encountering an unfamiliar collection notice, having a reliable template at your disposal transforms a potentially stressful situation into a manageable process.

The Imperative of Professional Correspondence

In today’s digital age, where information flows rapidly and miscommunication can have significant repercussions, the quality of your written correspondence remains crucial. When dealing with sensitive matters like debt validation, the clarity, tone, and format of your letter speak volumes. A professionally drafted document conveys seriousness and competence, signaling to the recipient that you understand your rights and are prepared to assert them. This immediately establishes a more respectful and potentially more productive dialogue.

Beyond mere aesthetics, a well-written letter serves a functional purpose. It minimizes ambiguity, ensuring that your request for debt validation is crystal clear and legally compliant. This precision helps prevent misunderstandings, delays, or even the dismissal of your claims due to poorly articulated demands. For business professionals, maintaining a high standard of communication in all dealings, especially legal ones, reinforces brand integrity and operational rigor. It’s an investment in your reputation and your financial well-being.

The Advantages of a Pre-Designed Letter Structure

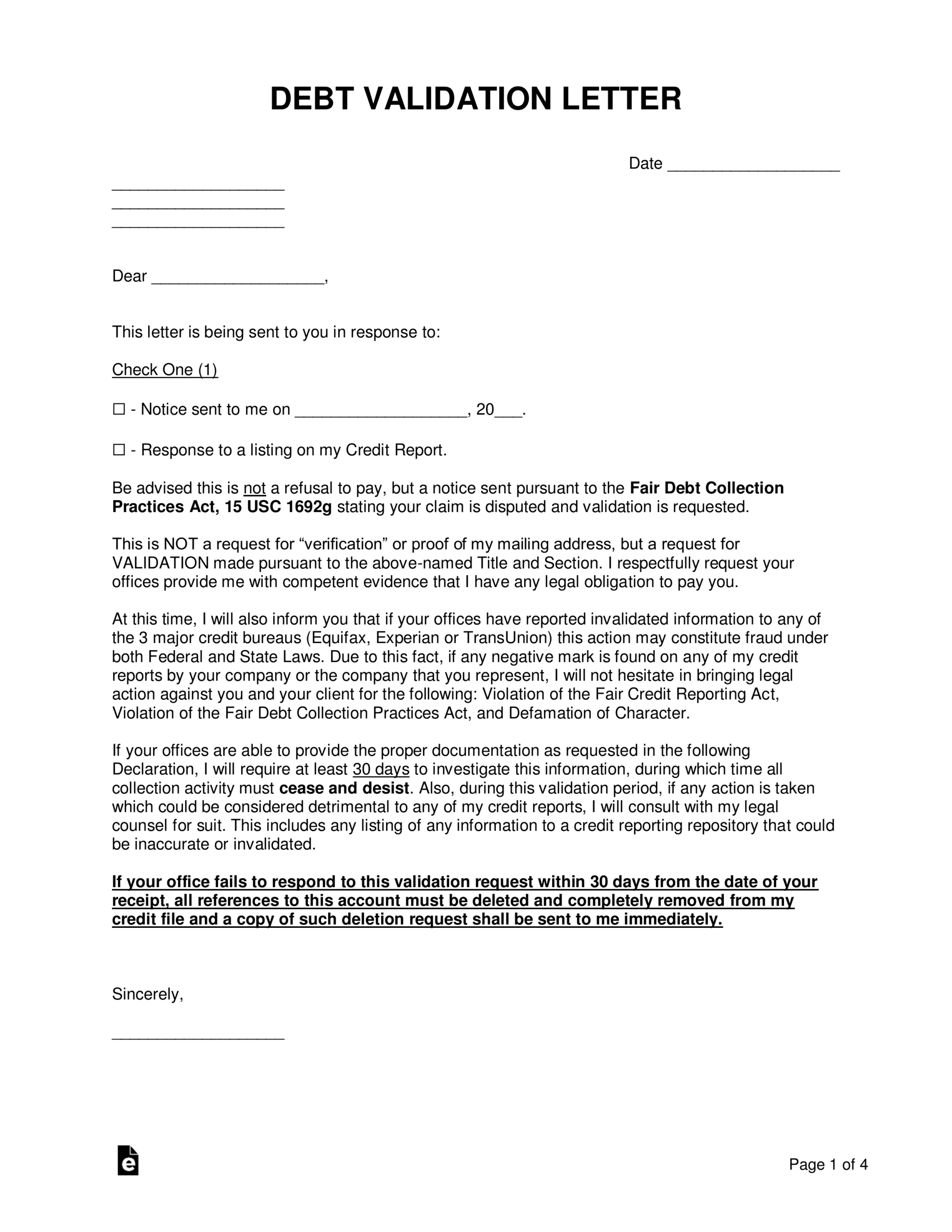

Leveraging a ready-made structure, such as a debt validation letter template, offers a multitude of benefits that extend beyond simply saving time. Firstly, it provides a foundational framework that ensures all legally required elements are included. This guards against omissions that could weaken your position or invalidate your request under consumer protection laws. You won’t have to second-guess what information to include or how to phrase crucial demands.

Secondly, a template brings consistency and professionalism to your correspondence. It establishes a recognizable layout and tone, which is vital when engaging with collection agencies or creditors. This standardized approach allows you to focus on the specifics of your situation rather than the mechanics of letter writing. Furthermore, a good template is often developed with legal considerations in mind, offering a degree of assurance that your communication adheres to best practices and legal standards, thus bolstering your position.

Tailoring Your Request for Verification

While a debt validation letter template provides a robust starting point, its true strength lies in its adaptability. Not all debt situations are identical, and effective communication often requires a degree of personalization. For instance, the specific details you need to validate might vary depending on the type of debt — whether it’s a medical bill, credit card debt, or a personal loan. The template allows you to insert the unique account numbers, dates, and creditor names relevant to your specific case, ensuring accuracy.

You might also need to customize the language slightly based on prior interactions. If you’ve already received some information but it was insufficient, your letter can be tailored to request specific missing details. The template serves as a flexible blueprint, enabling you to clearly articulate the precise information you are seeking, such as proof of the original creditor, the amount owed, or the history of the debt. This personalization ensures your correspondence is not just generic but directly addresses the nuances of your financial circumstances, making your request far more impactful.

Essential Components of Effective Correspondence

Regardless of the specific scenario, every debt validation letter template should incorporate certain key elements to be both comprehensive and legally sound. These components ensure that your message is clear, your intentions are understood, and your legal rights are properly asserted.

- Your Contact Information: Clearly state your full name, address, phone number, and email. This ensures the recipient knows who is sending the correspondence and how to reply.

- Date: Always include the date the letter is being sent. This is crucial for tracking timelines, especially regarding the FDCPA’s 30-day validation period.

- Recipient’s Contact Information: Provide the full legal name and address of the debt collector or agency you are sending the letter to. Verify this information to ensure it reaches the correct department.

- Subject Line: A clear and concise subject line, such as "Request for Debt Validation – Account [Your Account Number]," immediately informs the recipient of the letter’s purpose.

- Reference Account Number: Include any account numbers or reference numbers provided by the debt collector. This helps them quickly identify the specific debt they are trying to collect from you.

- Statement of Dispute: Explicitly state that you dispute the debt and are requesting validation. It’s important to use clear language like "I am disputing this debt and requesting validation."

- Request for Specific Information: Clearly enumerate the specific documentation and information you require for validation. This typically includes:

- Proof that you owe the debt.

- The original creditor’s name.

- The amount of the debt, including any interest or fees.

- Documentation of how the debt was calculated.

- Proof that the collector is authorized to collect the debt.

- Statement of Rights (FDCPA): Reference your rights under the Fair Debt Collection Practices Act, particularly regarding the collector’s obligation to cease collection activities until the debt is validated.

- No Credit Reporting While Disputed: Request that the debt not be reported to credit bureaus or that any existing reporting be updated to reflect that the debt is disputed, until validation is provided.

- Closing: A professional closing such as "Sincerely" or "Respectfully."

- Your Signature: A physical signature, followed by your typed name, adds authenticity and formality to the document.

Mastering Presentation and Tone

The effectiveness of any communication is profoundly influenced by its presentation and the tone it conveys. For a formal document like a debt validation letter template, maintaining a professional yet firm tone is paramount. Avoid emotional language, threats, or aggressive accusations. Instead, focus on clear, factual statements and direct requests. A calm and authoritative tone suggests you are serious about your rights and expect a proper response, rather than engaging in an emotional dispute.

Formatting is equally critical for both digital and printable versions. For a printable document, use a standard, legible font (e.g., Times New Roman, Arial, Calibri) in a size between 10-12 points. Ensure ample white space, clear paragraph breaks, and logical flow. Using a standard business letter format, with proper alignment for dates, addresses, and salutations, enhances readability and professionalism. When preparing a digital version, ideally save it as a PDF to preserve formatting and prevent unauthorized alterations. If sending via email, it is usually best to attach the PDF rather than pasting the letter directly into the email body, as attachments retain formatting and appear more formal. Always keep a copy for your records, along with proof of delivery if sent via certified mail.

The diligent application of these tips ensures that your correspondence is not only informative but also reflects your professionalism and attention to detail. This meticulous approach can significantly influence how your request is perceived and handled by the recipient, fostering a more constructive interaction during a potentially challenging financial period.

By taking the initiative to send a well-structured and thoughtfully composed debt validation letter, you are not just reacting to a collection notice; you are proactively managing your financial health. This document serves as a powerful instrument, ensuring that you receive the necessary information before making any decisions about a claimed debt. It underscores the importance of informed consent and due diligence in every financial interaction.

Ultimately, having access to and utilizing a robust debt validation letter template transforms a potentially intimidating situation into a structured, manageable process. It’s an indispensable tool for anyone facing debt collection, offering a clear path to clarity and protection. By providing a framework that is both legally sound and easy to customize, it empowers individuals and businesses to communicate effectively, save valuable time, and achieve a fair resolution in their financial dealings.