Taking control of your finances often feels like navigating a complex maze, especially when weighed down by outstanding obligations. Many Americans face the daily stress of managing various forms of credit, from credit card balances to student loans and auto payments, each with its own interest rate and due date. The path to financial liberation can seem daunting, but it doesn’t have to be an unsolvable puzzle.

The secret to transforming this overwhelming challenge into a manageable journey lies in a structured approach, a personalized roadmap that guides every dollar you earn. This is precisely where a robust Debt Repayment Budget Template becomes an indispensable tool. It’s not merely a spreadsheet; it’s a strategic framework designed to bring clarity, focus, and ultimately, accelerated freedom from the burden of debt, empowering you to reclaim your financial future with confidence and intention.

Why a Dedicated Debt Budget Matters

Managing debt effectively goes far beyond simply making minimum payments each month. Without a clear plan, you risk falling into a cycle where high-interest obligations grow faster than you can pay them down. A dedicated budget for debt provides a critical bird’s-eye view of your entire financial landscape, allowing you to see exactly where your money is going and, more importantly, where it *could* be going to tackle your financial obligations.

This focused approach helps you identify opportunities to allocate more funds towards your debts, potentially saving you thousands in interest over time. It transforms a passive, reactive stance into an active, proactive strategy. By organizing your income, expenses, and all outstanding amounts in one place, you gain the clarity needed to make informed decisions and accelerate your path to a debt-free life, reducing stress and boosting your overall financial well-being.

The Core Components of Your Debt Repayment Plan

Crafting an effective financial repayment framework begins with understanding and documenting your current financial situation. This comprehensive overview is the foundation upon which your entire debt management tool will be built, ensuring every decision is backed by accurate data. It brings all the disparate elements of your financial life into a cohesive, actionable plan.

A complete and personalized debt reduction strategy needs to encompass several key areas. These elements, when meticulously detailed, provide the necessary insights to optimize your spending and maximize your repayment efforts. By itemizing each part, you can precisely identify where adjustments can be made to achieve your goals faster.

- Total Monthly Income: Detail all sources of income, including salaries, freelance earnings, or any other regular inflow of funds. This establishes the base amount you have available to work with.

- Fixed Monthly Expenses: List all expenses that remain consistent each month, such as rent/mortgage, insurance premiums, and subscription services. These are non-negotiable costs that inform your disposable income.

- Variable Monthly Expenses: Account for fluctuating costs like groceries, utilities, transportation, and entertainment. This category often holds the most potential for finding extra funds for repaying obligations.

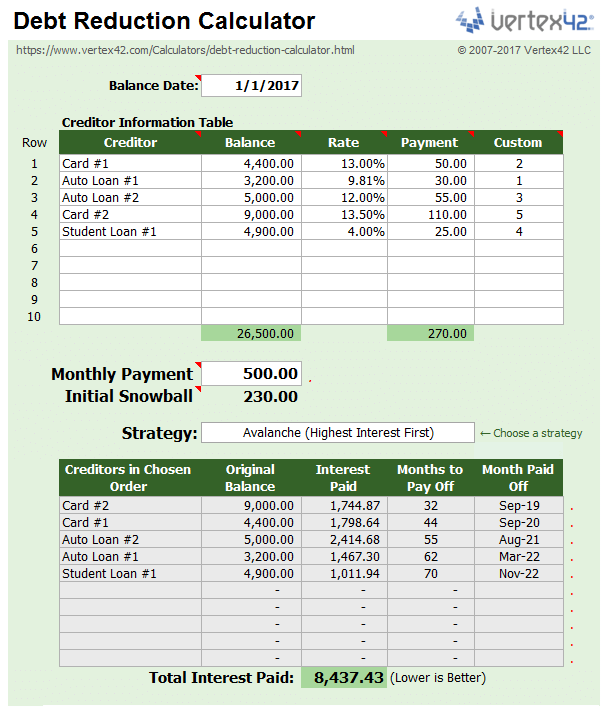

- Comprehensive Debt List: For each debt, record the creditor, the current balance, the interest rate, and the minimum monthly payment. This crucial data empowers you to prioritize and strategize.

- Disposable Income Calculation: Subtract your total monthly expenses (fixed + variable) from your total monthly income. The remaining amount is your disposable income, which can then be strategically allocated towards accelerated payments.

- Desired Extra Payment Allocation: Decide how much of your disposable income you will dedicate to paying more than the minimum on specific debts. This is where your chosen strategy (snowball or avalanche) comes into play.

Building Your Personalized Debt Repayment Budget Template

Once you have gathered all the necessary financial information, the next step is to synthesize it into a functional and easy-to-use template. This process involves more than just plugging numbers into a spreadsheet; it requires thoughtful consideration of your financial habits and goals. The goal is to create a living document that adapts to your life, not a rigid constraint.

Start by choosing your preferred format. This could be a simple spreadsheet program like Microsoft Excel or Google Sheets, a dedicated budgeting app, or even a pen-and-paper ledger if you prefer a tangible approach. What matters most is consistency and ease of access. Lay out the categories identified above, creating clear columns for income, expenses, and each individual debt.

Populate the template with your current financial figures. Be honest and thorough; accuracy is paramount for the effectiveness of your debt repayment budget. Once your baseline is established, you can begin to experiment with different scenarios. How would an extra $50 towards your highest-interest credit card impact your payoff date? Your personalized budget for debt becomes a powerful simulation tool, allowing you to visualize the effects of your decisions.

Strategies for Accelerated Debt Freedom

Having a structured debt approach is essential, but choosing the right strategy to apply within your budget can significantly accelerate your journey to financial freedom. Two popular and highly effective methods are the debt snowball and debt avalanche. Both leverage the power of focused repayment, but they differ in their psychological and mathematical benefits.

The debt snowball method involves paying off your smallest debt first, regardless of interest rate, while making minimum payments on all other debts. Once the smallest debt is paid off, you take the amount you were paying on it and add it to the payment of your next smallest debt. This creates a "snowball" effect, building momentum and motivation as you quickly eliminate smaller obligations. Its strength lies in the psychological wins, providing tangible progress that encourages continued effort.

Conversely, the debt avalanche method prioritizes paying off the debt with the highest interest rate first, while still making minimum payments on all other debts. Once that high-interest debt is gone, you direct those funds to the next highest interest debt. Mathematically, this method saves you the most money in interest charges over time, as you’re attacking the most expensive obligations first. Your Debt Repayment Budget Template will be crucial in tracking your progress with either of these methods, allowing you to see the impact of your focused payments.

Making Your Budget Work for You: Tips for Success

Creating a structured debt approach is an excellent first step, but its true power lies in consistent application and adaptation. A budget is not a static document; it’s a dynamic tool that should evolve with your life. To truly harness the potential of your personal finance template and achieve lasting debt reduction, consider these actionable tips.

- Automate Payments: Set up automatic minimum payments for all your obligations to avoid late fees and protect your credit score. If you’re able to make extra payments, manually add those after your automatic payments clear.

- Track Everything: Regularly log your spending. This helps you stay aware of where your money is going and identify areas where you might be overspending, which can then be reallocated to your debt reduction strategy.

- Review and Adjust Monthly: Life happens. Your income might change, or unexpected expenses could arise. Make it a habit to review your budget at least once a month and adjust it as needed to reflect your current financial reality.

- Find Extra Income: Consider taking on a side hustle, selling unused items, or picking up extra shifts to boost your income. Even a small amount of extra cash can significantly accelerate your debt repayment efforts.

- Cut Unnecessary Expenses: Scrutinize your variable expenses. Can you reduce dining out, cancel unused subscriptions, or find cheaper alternatives for services? Every dollar saved is a dollar that can be put towards tackling debt.

- Celebrate Milestones: Acknowledge your progress! Whether it’s paying off your first small debt or hitting a significant reduction in your total balance, celebrating these wins keeps you motivated and reinforces positive financial habits.

- Seek Professional Advice: If you feel overwhelmed or need specialized guidance, consider consulting with a financial advisor or a credit counseling service. They can offer tailored strategies and support to help you manage your financial obligations more effectively.

Frequently Asked Questions

How often should I review my debt repayment budget?

You should review and update your personal finance template at least once a month. This ensures it remains accurate and reflects any changes in your income, expenses, or debt balances. A monthly review also helps you stay accountable and make necessary adjustments to your debt reduction strategy.

What if I can’t afford to pay more than the minimum payments?

Even if you can only afford minimum payments initially, organizing your debts with a structured debt approach is incredibly valuable. It provides clarity and a starting point. Focus on tracking your spending to identify any small cuts you can make, and actively look for opportunities to increase your income, even marginally. Every little bit helps.

Should I use the debt snowball or debt avalanche method?

The choice between the debt snowball and debt avalanche method depends on your personal motivation. The snowball offers quicker psychological wins by eliminating small debts fast, while the avalanche saves you the most money in interest over time by targeting high-interest obligations first. Review your current balances and interest rates within your template to see which approach feels more sustainable for you.

Can this budget help with all types of debt, including student loans and credit cards?

Absolutely. A comprehensive financial repayment framework is designed to manage all forms of debt. Whether you have credit card balances, student loans, auto loans, personal loans, or medical debt, the principles remain the same: list each obligation, understand its terms, and strategically allocate funds for repayment. This unified approach simplifies managing diverse financial commitments.

What should I do if my income changes unexpectedly?

If your income changes, it’s crucial to immediately update your budget for debt. If your income decreases, prioritize essential expenses and adjust your debt repayment amounts to avoid missing payments. If your income increases, seize the opportunity to significantly boost your extra debt payments, accelerating your journey towards financial freedom. Flexibility is key to an effective debt management tool.

Embarking on the journey to financial freedom can feel like a monumental task, but with the right tools and strategies, it becomes an achievable goal. A well-constructed Debt Repayment Budget Template is more than just a financial document; it’s a testament to your commitment to a healthier financial future. It transforms abstract numbers into actionable steps, providing clarity and empowerment every step of the way.

By diligently tracking your income and expenses, strategically allocating funds, and consistently reviewing your progress, you are not just paying off debts—you are building lasting financial habits. This structured approach not only accelerates your path to a debt-free life but also equips you with the knowledge and discipline to maintain financial stability long after your final payment. Take the first step today; your future self will thank you for gaining control of your financial destiny.