Navigating financial challenges can be one of the most stressful experiences an individual or business owner faces. The weight of outstanding obligations, coupled with the often-daunting prospect of communicating with creditors, can feel overwhelming. Yet, clear, confident, and professional communication is not just a courtesy; it’s a strategic necessity that can significantly alter the outcome of your financial discussions. It’s in these critical moments that a well-structured approach to correspondence can transform a potentially hostile interaction into a constructive negotiation.

Understanding the power of a meticulously crafted message is the first step towards taking control of your financial narrative. For anyone looking to proactively address liabilities, propose a settlement, or request more manageable payment terms, the right tools are indispensable. This article will delve into the profound impact of using a robust debt negotiation letter template, offering a roadmap for anyone from individuals feeling the pinch to small business owners striving to maintain liquidity and reputation. It’s about empowering you to communicate effectively, professionally, and with a clear objective, setting the stage for favorable resolutions.

The Indispensable Role of Professional Correspondence

In an age dominated by instant messages and casual digital exchanges, the impact of a well-written, properly formatted letter might seem diminished. However, when it comes to serious matters like financial obligations, the opposite is true. A formal letter conveys a level of seriousness, professionalism, and respect that a phone call or email often cannot. It signals to the recipient that you are organized, thoughtful, and genuinely committed to resolving the issue at hand.

Beyond the initial impression, such correspondence creates a tangible record of your communication. This document serves as undeniable proof of your efforts, proposals, and agreements, which can be invaluable in future discussions or if disputes arise. It sets a professional tone, demonstrating your commitment to a structured resolution process, and can significantly influence how your situation is perceived by creditors or collection agencies. In essence, it’s not just a letter; it’s a statement of intent and a foundational piece of your negotiation strategy.

Streamlining Your Financial Dialogues

The prospect of drafting a formal letter from scratch, especially under financial duress, can be paralyzing. This is where the profound benefits of utilizing a ready-made document truly shine. Adopting a pre-designed framework for your financial communication eliminates guesswork and ensures that all critical information is included and presented logically.

One of the primary advantages of a debt negotiation letter template is the significant time savings it offers. Instead of spending hours pondering structure and wording, you can focus on personalizing the core content. Furthermore, templates help maintain consistency in your communication, ensuring that every piece of correspondence adheres to a high standard of professionalism. This consistency builds credibility and trust with the recipient over time. Finally, using a template reduces the risk of overlooking crucial details or making grammatical errors, providing you with a polished document that instills confidence in both the sender and the recipient.

Customizing Your Outreach for Specific Needs

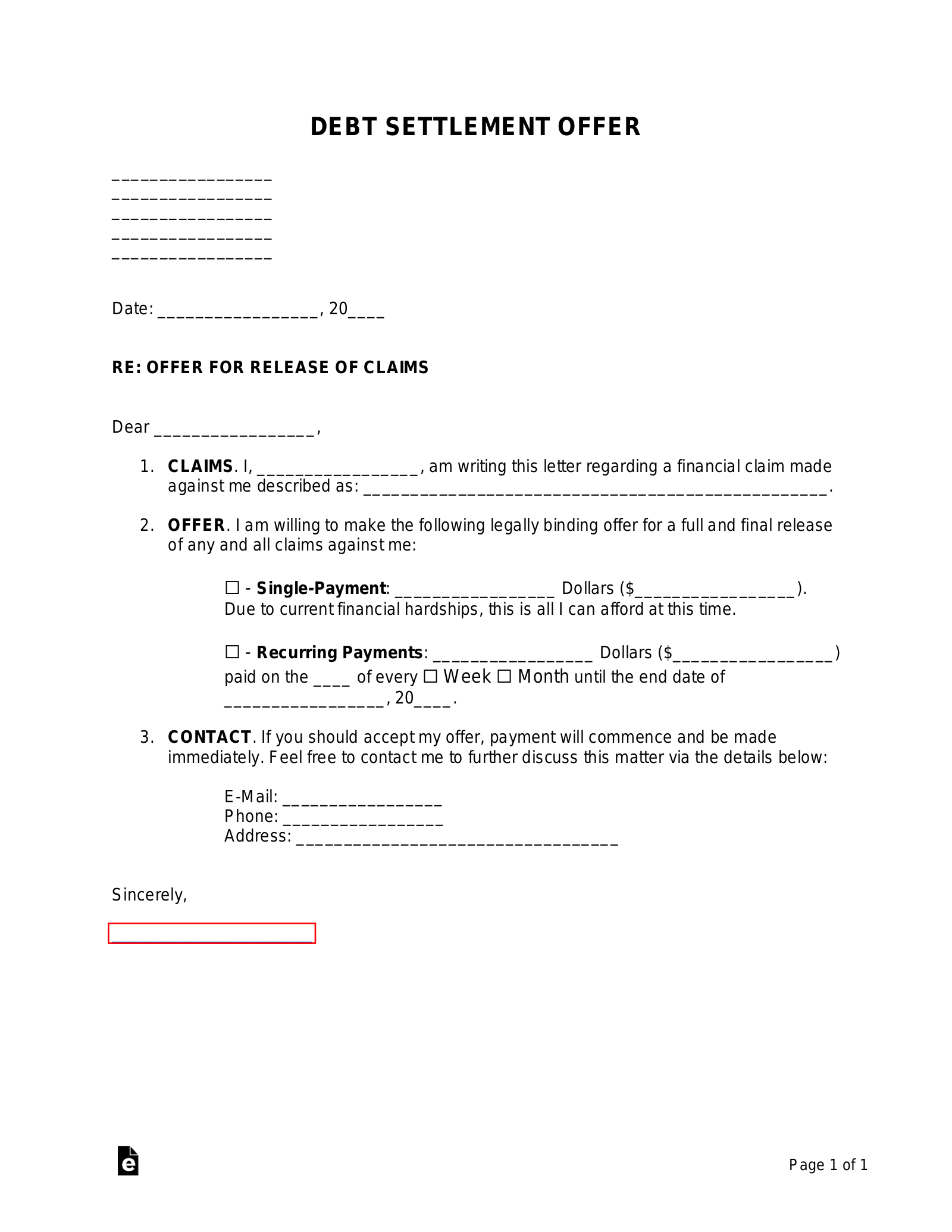

While a template provides a solid foundation, its true power lies in its adaptability. A versatile template can be customized to suit various stages and scenarios within the debt resolution process. You might need to draft an initial offer for a lump-sum settlement, propose a structured payment plan, dispute an inaccurate charge, or even request a cease and desist for collection calls. Each scenario demands a slightly different emphasis and specific details.

For instance, an initial settlement offer would require clear articulation of the proposed amount, the payment timeline, and any conditions, such as a full and final release of the debt. Conversely, a request for a payment plan would detail your current financial situation, proposed monthly payments, and a commitment to ongoing communication. The key is to leverage the template’s structure while injecting your specific circumstances and objectives into the body of the letter, ensuring the final correspondence is a precise reflection of your needs and proposals. This personalization transforms a generic form into a powerful, tailored communication tool.

Essential Components of Effective Correspondence

Regardless of the specific negotiation you are undertaking, every professional letter must contain certain fundamental elements to be complete, clear, and legally sound. Omitting any of these can weaken your message or delay a response.

- Sender’s Contact Information: Your full name, address, phone number, and email. This should be prominently placed at the top of the letter.

- Date: The exact date the letter is written. Essential for tracking communication timelines.

- Recipient’s Contact Information: The full name of the creditor or collection agency, their correct address, and any relevant account numbers. Accuracy here is paramount.

- Subject Line: A clear, concise subject line that immediately informs the recipient of the letter’s purpose and references your account number. Example: "Account #[Your Account Number] – Settlement Offer."

- Salutation: A formal and respectful greeting, e.g., "To Whom It May Concern," or "Dear [Creditor Name] Representative."

- Opening Paragraph: Briefly state the purpose of your letter and reference the account or debt in question.

- Body Paragraphs: This is where you elaborate on your proposal, explain your situation, or present your dispute. Keep it factual, concise, and professional.

- Call to Action: Clearly state what you expect from the recipient (e.g., "Please respond within 15 business days," "I await your written confirmation").

- Closing Paragraph: Reiterate your willingness to resolve the matter and express hope for a positive outcome.

- Complimentary Closing: A professional closing, such as "Sincerely" or "Respectfully."

- Signature: Your handwritten signature (for printable versions) above your typed full name.

- Enclosures (if any): A notation indicating any documents attached to the letter (e.g., "Enclosures: Proof of Income").

Presentation Matters: Tone, Formatting, and Delivery

The content of your letter is undoubtedly crucial, but its presentation – including tone, formatting, and delivery method – plays an equally significant role in how your message is received. A polished appearance reinforces the professionalism of your communication and respect for the recipient.

When it comes to tone, always aim for professional, respectful, and firm. Avoid emotional language, accusations, or aggressive demands, as these can alienate the recipient and hinder negotiation. Even in challenging situations, maintaining a constructive tone signals your genuine desire for a resolution. The layout of your correspondence is also vital; use standard business letter format, with clear paragraph breaks, adequate margins, and a readable font (like Times New Roman or Arial, 10-12 point). Ensure there are no typos or grammatical errors, as these can detract from your credibility. For digital versions, a PDF format is often preferred as it preserves the original layout and prevents unauthorized alterations. For printable versions, use high-quality paper and ensure your signature is clear. Always send sensitive correspondence via certified mail with a return receipt requested. This provides irrefutable proof that the letter was sent and received, along with the date of delivery, which is an invaluable asset in any future correspondence or legal proceedings.

Utilizing a comprehensive debt negotiation letter template is more than just a convenience; it’s a strategic advantage in managing your financial well-being. It provides the structure, professionalism, and clarity needed to communicate effectively with creditors, transforming uncertainty into proactive engagement. By offering a consistent format and ensuring all crucial information is included, it empowers you to present your case with confidence and competence.

Ultimately, a well-crafted debt negotiation letter template serves as an indispensable tool, saving you valuable time and reducing stress while enhancing your chances of a favorable outcome. It allows you to focus on the substance of your negotiation, knowing that the presentation and structure are already optimized. Embrace this efficient, polished, and time-saving communication tool to navigate your financial discussions successfully and move forward with greater peace of mind.