In the dynamic world of business and finance, clarity and precision are not merely preferences but necessities. Every transaction, especially those involving financial obligations, carries inherent risks and requires a solid foundation of understanding between all parties. Whether you are a small business owner extending credit, a legal professional drafting terms for a client, or an individual formalizing a loan, the absence of a clear, written agreement can lead to misunderstandances, disputes, and significant financial or legal repercussions down the line.

Navigating these complexities while ensuring legal compliance and protecting your interests demands efficient and reliable tools. This is precisely where the strategic utility of comprehensive debt agreement templates becomes strikingly clear. These pre-formatted, legally sound documents serve as an indispensable resource, offering a structured framework to outline the terms of a financial arrangement, define obligations, and mitigate potential conflicts, ultimately saving time, reducing legal costs, and providing peace of mind for everyone involved.

The Imperative of Documented Financial Arrangements

In today’s fast-paced commercial landscape, where handshake deals are increasingly relics of the past, the importance of committing financial arrangements to writing cannot be overstated. A written contract transforms vague promises into concrete, enforceable terms. It provides a definitive record of what was agreed upon, leaving little room for misinterpretation or selective memory.

This foundational principle applies whether you’re dealing with a multi-million dollar corporate loan or a simple payment plan between a vendor and a client. Documenting these arrangements not only serves as proof of intent but also delineates responsibilities, sets clear timelines, and establishes recourse mechanisms should issues arise. Without such documentation, resolving disputes can become a protracted, costly, and often fruitless endeavor.

Safeguarding Interests with Pre-structured Forms

Leveraging robust debt agreement templates provides a strong foundation for any financial transaction, offering a multitude of benefits and crucial protections. For businesses, they standardize processes, ensuring consistency across all agreements and reducing the potential for oversight. Legal professionals can streamline their drafting process, reallocating valuable time from formatting to critical client-specific negotiations.

These templates act as a protective shield, outlining the obligations of each party and clearly defining payment schedules, interest rates, collateral, and default clauses. This preemptive clarity minimizes the likelihood of disputes, as all terms are explicit from the outset. In the event a disagreement does occur, the written agreement stands as a vital piece of evidence, simplifying arbitration or litigation by providing an undeniable record of the agreed-upon conditions.

Tailoring Agreements for Diverse Situations

One of the most significant advantages of utilizing a well-designed agreement template is its inherent adaptability. While a core structure remains consistent, the specifics can be customized to suit a vast array of industries and unique scenarios. A template designed for a small business offering credit to customers, for instance, can be subtly yet effectively altered to serve a construction company outlining payment terms for a large project.

Consider the nuances: a template for a secured loan will require sections for collateral description and perfection, while a simple promissory note might focus solely on repayment schedule and interest. Whether it’s a vendor financing arrangement, an intercompany loan, a deferred payment agreement, or a personal loan, the underlying template provides a versatile starting point. Its modular nature allows for the addition or removal of clauses, ensuring the final document precisely reflects the specific financial commitment and legal requirements of the parties involved.

Anatomy of a Robust Financial Contract

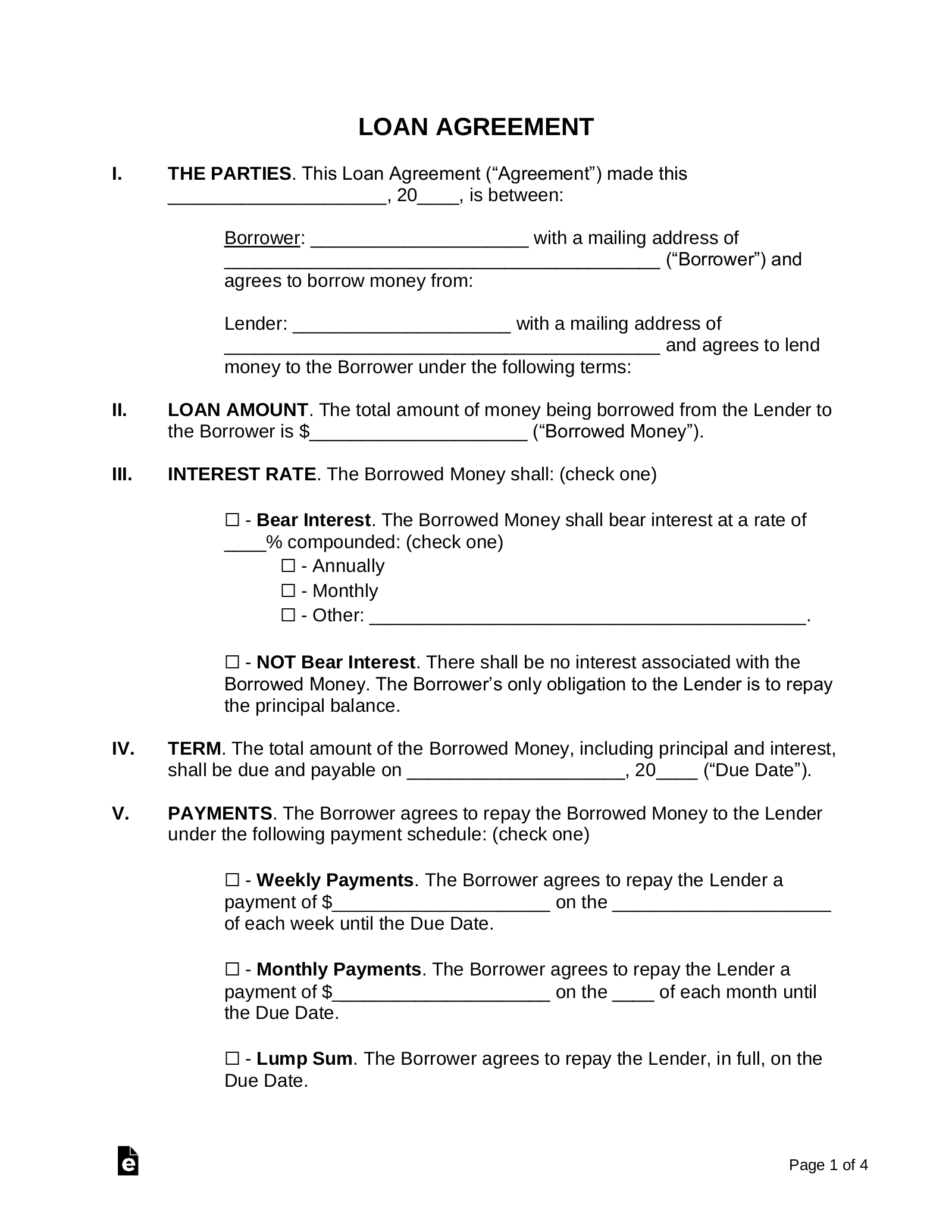

Every effective debt agreement, regardless of its specific application, shares a common set of essential components that ensure clarity, enforceability, and comprehensive coverage. These core clauses are the backbone of the agreement, outlining the rights and responsibilities of each party.

- Identification of Parties: Clearly state the full legal names and addresses of all involved parties (borrower, lender, guarantors if any). This ensures there is no ambiguity about who is bound by the agreement.

- Principal Amount and Loan Details: Explicitly state the exact principal sum of the debt. Also include details such as the date the loan was issued and any specific purpose for the funds.

- Interest Rate and Calculation: Define the interest rate (fixed or variable), how it is calculated (e.g., annually, daily), and any compounding periods. Ensure compliance with usury laws.

- Repayment Schedule: Detail the payment amounts, frequency (e.g., monthly, quarterly), due dates, and the total number of payments. Specify whether payments are applied first to interest or principal.

- Late Payment Penalties: Outline any fees or additional interest charged for overdue payments. This encourages timely repayment and compensates the lender for default.

- Default and Acceleration Clauses: Define what constitutes a "default" (e.g., missed payments, bankruptcy) and the lender’s rights upon default, including the ability to demand immediate full repayment of the outstanding balance.

- Collateral (if applicable): If the loan is secured, fully describe the assets pledged as collateral. Include provisions for the lender’s rights to repossess or sell the collateral in case of default.

- Governing Law: Specify the state or jurisdiction whose laws will govern the interpretation and enforcement of the agreement. This is crucial for legal certainty.

- Dispute Resolution: Include a clause outlining how disputes will be resolved, such as mediation, arbitration, or litigation in a specific court.

- Prepayment Penalties/Options: State whether the borrower can repay the loan early without penalty, or if there is a fee for early repayment.

- Confidentiality: If sensitive financial or business information is being exchanged, a confidentiality clause protects against unauthorized disclosure.

- Signatures and Date: All parties must sign and date the agreement, ideally in the presence of witnesses or a notary public for enhanced legal weight.

Crafting User-Friendly Legal Documents

Even the most legally robust agreement is diminished if it’s difficult to read or understand. Practical tips for formatting, usability, and readability are paramount, whether the document is intended for print or digital use. Clarity and accessibility ensure that all parties fully comprehend their obligations and rights, minimizing future misunderstandings.

Start with a clean, professional layout. Use a legible font (e.g., Arial, Times New Roman, Calibri) at a comfortable size (10-12 points). Employ clear headings and subheadings to break up large blocks of text, making the document scannable and easier to navigate. White space is your friend; ample margins and spacing between paragraphs prevent the document from looking dense and overwhelming. Bullet points, as demonstrated for the essential clauses, are excellent for listing terms or conditions clearly. For digital use, ensure the document is easily searchable and accessible across different devices. Providing a table of contents, especially for longer documents, can also significantly enhance usability. Ultimately, the goal is to make a legally sound document also a user-friendly one.

In an environment where financial commitments are the bedrock of economic activity, the reliance on meticulously crafted documentation cannot be overstated. From mitigating risks to ensuring legal compliance and fostering transparent relationships, well-designed debt agreement templates are more than just forms; they are strategic assets. They empower businesses and individuals alike to approach financial arrangements with confidence, providing a clear roadmap for mutual obligations and expectations.

The investment in acquiring and customizing high-quality debt agreement templates is an investment in efficiency, legal protection, and ultimately, peace of mind. By standardizing the framework for financial agreements, these tools free up valuable time and resources, allowing professionals to focus on the substantive aspects of their deals rather than the intricacies of document creation. In a world that values both speed and accuracy, the strategic use of these templates is an essential component of professional success.