Introduction

A hardship letter is a formal document that explains your current financial difficulties to a creditor, landlord, or other entity. It’s essentially a heartfelt plea for understanding and a request for some form of assistance. While it might seem daunting, writing an effective hardship letter can significantly improve your chances of getting the help you need. This guide will provide you with a casual approach to crafting a compelling hardship letter that resonates with the recipient.

Understanding Your Audience

Before you start writing, it’s crucial to understand who you’re writing to.

Landlord: If you’re facing eviction due to an inability to pay rent, your letter should focus on the unexpected events that led to your financial hardship and explain your current efforts to resolve the situation.

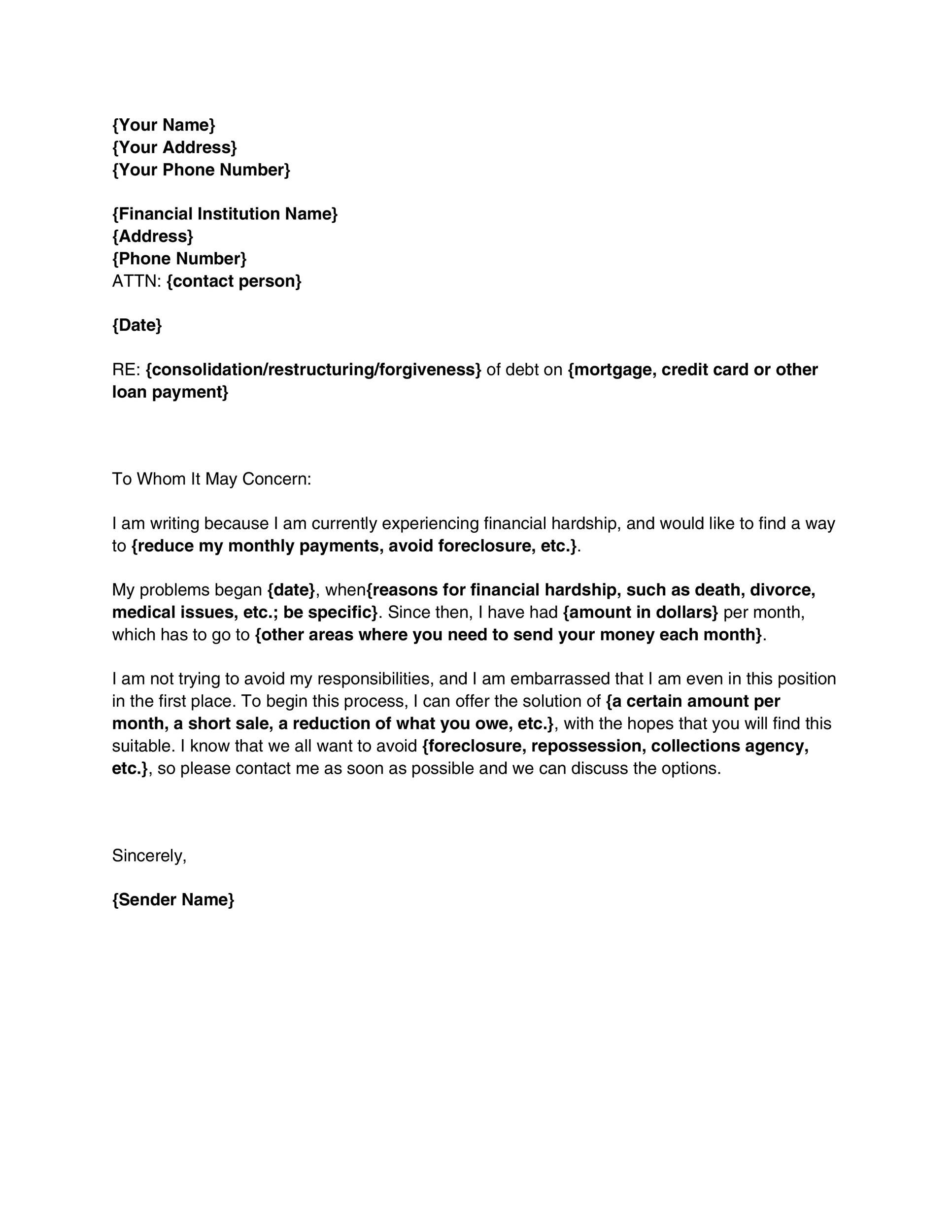

Image Source: templatelab.com

Crafting Your Narrative

The heart of your hardship letter lies in your story.

Start with a concise and polite introduction. Briefly state your purpose and the nature of your hardship.

Job loss or reduced income

Medical emergencies

Unexpected expenses (e.g., car repairs, home repairs)

Divorce or separation

Natural disasters

Seeking employment or a new job

Reducing expenses (e.g., cutting back on non-essential spending, downsizing)

Negotiating with other creditors

Exploring government assistance programs

Hardship Letter Example (Casual Tone)

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Recipient Name (if known)]

[Recipient Title]

[Company Name]

[Company Address]

Subject: Hardship Letter – Account Number [Your Account Number]

Dear [Mr./Ms./Mx. Recipient Name],

I am writing to you today to request a temporary hardship plan for my account number [Your Account Number]. As you know, I have been a [customer/tenant] of [Company Name] for [Number] years and have always made my payments on time.

Unfortunately, I have recently experienced a series of unforeseen events that have significantly impacted my financial stability. On [Date], I was [briefly explain the situation that caused your hardship]. This [event] has resulted in [explain the financial consequences, e.g., a loss of income, unexpected medical expenses].

I understand the importance of fulfilling my financial obligations and I am committed to resolving this situation as quickly as possible. To this end, I am [explain the steps you’re taking to improve your financial situation, e.g., actively seeking employment, reducing expenses, exploring government assistance programs].

I am requesting [explain your request, e.g., a temporary payment reduction, a deferral of payments, a payment plan]. I believe that this arrangement would allow me to [explain how this arrangement will help you, e.g., catch up on missed payments, avoid further penalties, maintain my good standing with your company].

I have attached [list of supporting documents, e.g., proof of income, medical bills, layoff notice] for your review. I would appreciate the opportunity to discuss this matter further and work with you to find a mutually agreeable solution.

Thank you for your time, understanding, and consideration.

Sincerely,

[Your Signature]

[Your Typed Name]

Conclusion

Remember, a hardship letter is a personal document. Tailor it to your specific circumstances and ensure it accurately reflects your situation. Be honest, sincere, and demonstrate a genuine commitment to resolving your financial challenges. While there are no guarantees, a well-written hardship letter can significantly increase your chances of receiving the assistance you need.

FAQs

1. What if my hardship situation is ongoing?

If your financial difficulties are not resolved quickly, you may need to write updated hardship letters periodically. Keep your creditor or landlord informed of your progress and any changes in your situation.

2. Should I include personal details in my hardship letter?

While it’s important to be honest and transparent, avoid sharing overly personal details that are not relevant to your financial situation. Focus on the facts and how they have impacted your ability to meet your financial obligations.

3. Can I use a template for my hardship letter?

Using a template can be a helpful starting point, but it’s crucial to personalize it to fit your specific circumstances.

4. What if my hardship letter is denied?

If your initial request is denied, don’t give up. Explore alternative solutions, such as negotiating with your creditor or seeking assistance from a non-profit credit counseling agency.

5. How long should my hardship letter be?

There is no strict word limit for a hardship letter. However, it’s best to keep it concise and to the point. Aim for a letter that is easy to read and understand.

I hope this guide helps you effectively communicate your financial challenges and secure the assistance you need.

Disclaimer: This article is for informational purposes only and does not constitute legal or financial advice.

Hardship Letter Example