Navigating the complexities of your credit report can often feel like deciphering an ancient scroll, especially when you uncover inaccuracies or errors. These discrepancies, whether minor or significant, can unjustly impact your financial standing, affecting everything from loan approvals to interest rates. For many professionals and individuals alike, addressing these issues effectively is not just a preference; it’s a financial imperative. This is precisely where the invaluable tool known as a credit dispute letter template steps in, transforming a potentially daunting task into a structured and manageable process.

This article delves into the critical role such a template plays in empowering you to challenge erroneous credit report entries with clarity and authority. It’s designed for anyone who values precise communication and seeks to protect their financial reputation, from business owners monitoring their enterprise’s credit to individuals ensuring their personal financial data is accurately reflected. Understanding how to leverage a well-structured template not only streamlines the dispute process but also significantly enhances your chances of a favorable resolution, ensuring your voice is heard loud and clear by credit reporting agencies and creditors alike.

The Imperative of Precision in Financial Correspondence

In the realm of finance, accuracy and professionalism are paramount, and nowhere is this more evident than in official correspondence concerning your credit. A poorly worded or incorrectly formatted dispute letter can be easily dismissed or misinterpreted by credit bureaus and creditors, leading to frustrating delays and potentially protracted battles. When you’re dealing with entities that process millions of documents, a clear, concise, and professionally presented communication stands out and commands attention.

The impact of a meticulously crafted letter extends beyond mere readability. It signals to the recipient that the sender is serious, informed, and expects a thorough investigation. This level of professionalism reinforces the legitimacy of your claim, making it harder for the receiving party to overlook or trivialize your dispute. In an environment where every detail counts, a well-structured document is your strongest advocate, ensuring your message is not just delivered but also taken seriously.

Streamlining Your Credit Correction Process

The immediate benefit of utilizing a ready-made document for your credit dispute is the sheer efficiency it offers. Instead of starting from scratch, wrestling with appropriate phrasing and formatting, a robust credit dispute letter template provides a proven framework. This not only saves valuable time but also alleviates the stress often associated with drafting such critical correspondence. You can focus your energy on gathering supporting documents and verifying details rather than agonizing over sentence structure.

Beyond time savings, a template ensures consistency and completeness. It acts as a checklist, reminding you to include all necessary information, from account numbers and specific error descriptions to the actions you expect the recipient to take. This structured approach minimizes the risk of omitting crucial details that could weaken your claim or cause further delays. For individuals juggling multiple responsibilities, having a reliable guide for this important communication is an invaluable asset that enhances both speed and effectiveness.

Adapting Your Blueprint for Specific Discrepancies

While a standardized framework is highly beneficial, the versatility of your credit dispute letter template truly shines when it comes to personalization. Not all credit report errors are identical; they can range from simple data entry mistakes to instances of identity theft or outdated information. A quality template is not a rigid form but a flexible blueprint that can be customized to articulate the nuances of your specific situation, ensuring your communication is highly targeted and relevant.

Consider a scenario where you’re disputing an account that doesn’t belong to you due to identity theft. Your template can be adapted to include details about police reports and fraud alerts. Conversely, if you’re challenging a late payment that was actually made on time, you can tailor the letter to reference specific payment dates and provide bank statements. This ability to personalize ensures that each letter is a precise reflection of your unique dispute, addressing the specific credit bureau (Experian, Equifax, TransUnion) and the exact nature of the error, thereby maximizing its impact and effectiveness.

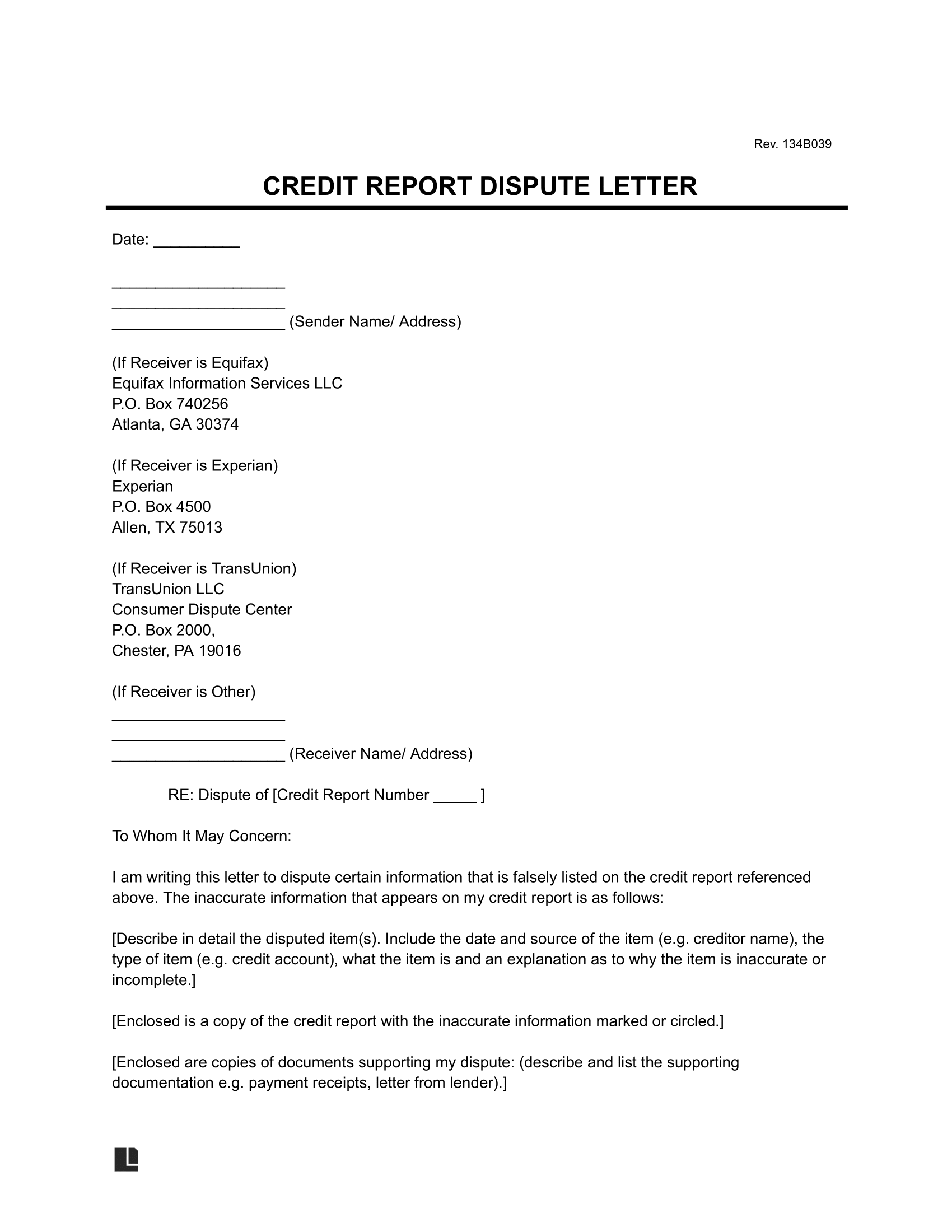

Anatomy of an Effective Dispute

Every impactful piece of formal correspondence, especially one as crucial as a credit dispute, relies on a clear, logical structure. A well-designed letter leaves no room for ambiguity, guiding the recipient through your concerns with utmost clarity. Here are the key components that every dispute letter should meticulously include to ensure comprehensive and effective communication:

- Sender’s Contact Information: Your full name, current address, phone number, and email. This ensures the recipient can easily identify and reach you.

- Date: The precise date the letter is being sent. This is vital for tracking timelines, especially for legal requirements related to dispute resolution.

- Recipient’s Contact Information: The correct mailing address for the specific credit bureau or creditor you are disputing with. Accuracy here is non-negotiable.

- Clear Subject Line: A concise subject line that immediately indicates the purpose of the letter, such as "Dispute of Inaccurate Information on Credit Report – [Your Name] – [Account Number]."

- Personal Identification Details: Your full name, date of birth, and Social Security Number. While sensitive, these details are necessary for the credit bureau to accurately locate your file.

- Account Information (if applicable): The name of the creditor, the account number, and the specific item on your credit report you are disputing. Be as precise as possible.

- Detailed Description of the Error: Clearly state what information is incorrect and why. Provide a factual, objective explanation without emotional language.

- Requested Action: Explicitly state what you want the credit bureau or creditor to do (e.g., "please investigate and remove this inaccurate entry," or "correct this reporting error").

- Supporting Documentation: A list of all enclosed documents that support your claim (e.g., bank statements, cancelled checks, police reports, payment confirmations). Crucially, send copies, not originals.

- Formal Closing: A professional closing, such as "Sincerely" or "Respectfully."

- Your Signature: Your physical signature, along with your typed name beneath it. This authenticates the correspondence.

- List of Enclosures: A clear list at the end detailing all attached documents.

Crafting a Compelling Presentation

The success of your credit dispute is not solely dependent on the facts; how those facts are presented significantly influences the outcome. The tone, formatting, and overall presentation of your correspondence are critical elements that can either bolster your claim or undermine it. Mastering these aspects ensures that your message is not just received, but also respected and acted upon.

When it comes to tone, maintain a professional, assertive, and factual approach. Avoid emotional language, threats, or accusations. Your goal is to inform and demand action based on evidence, not to express frustration. A calm, authoritative tone conveys confidence in your position and encourages the recipient to treat your communication with the seriousness it deserves. Remember, the goal is resolution, not confrontation.

Regarding formatting, clarity and readability are paramount. Use a standard, professional font (like Times New Roman or Arial) in a legible size (10-12 points). Ensure adequate line spacing and margins to avoid a cluttered appearance. Break up long paragraphs into shorter ones or use bullet points when listing details, as seen in the previous section. For printable versions, use high-quality paper and a reliable printer. When sending digitally, a PDF format is generally preferred as it preserves layout and prevents unauthorized alterations. Always retain copies of everything you send, including certified mail receipts, as proof of correspondence and delivery. This meticulous approach to presentation underscores your professionalism and commitment to resolving the issue.

The process of sending your dispute also requires attention. While email might seem convenient, official credit disputes are often best sent via certified mail with a return receipt requested. This provides irrefutable proof that your letter was sent and received, along with the date of delivery. This documented communication is invaluable if further action is required and demonstrates your diligent approach to the dispute.

Leveraging a well-constructed credit dispute letter template is more than just a convenience; it’s a strategic move in managing your financial health. It transforms a potentially overwhelming task into a clear, concise, and professional communication. By providing a structured framework, it empowers individuals and businesses to address inaccuracies with confidence, ensuring their credit reports accurately reflect their financial standing.

The value of using a meticulously crafted template extends far beyond the immediate dispute. It reinforces the importance of polished and professional correspondence in all areas of business and personal communication. In an era where efficiency and clarity are prized, employing such a tool is an intelligent investment in both your time and your financial future, ultimately serving as an indispensable aid for anyone committed to maintaining an impeccable credit profile.