In the intricate dance of commerce, the extension of credit is often the pivot on which business relationships turn. Whether you’re a supplier offering payment terms to a new distributor, a service provider billing clients on a net-30 basis, or a wholesaler managing accounts receivable, the ability to extend credit responsibly is paramount. However, with the promise of increased sales and strengthened partnerships comes the inherent risk of non-payment, disputes, and potential financial strain. This is where the strategic importance of a well-crafted credit application and agreement template becomes undeniably clear, serving as the foundational legal document that safeguards both parties.

For businesses operating in the competitive US market, particularly those in the business and legal documentation niche, understanding and utilizing a comprehensive credit agreement isn’t just good practice—it’s essential for sustainable growth and risk mitigation. This document provides a framework for transparent terms, outlines expectations, and establishes recourse in the event of default, offering peace of mind and operational clarity. It’s an invaluable tool for finance departments, sales teams, legal counsel, and business owners seeking to formalize credit relationships with professionalism and legal rigor.

Navigating the Complexities of Commercial Credit

In today’s fast-paced business environment, the need for clear, written agreements has never been more critical. The digital age, while offering unprecedented convenience, also presents new challenges related to identity verification and the enforceability of electronic contracts. Without a comprehensive document, businesses expose themselves to significant vulnerabilities, from ambiguous payment schedules to difficulties in debt recovery. A robust agreement acts as a legal shield, providing a definitive record of the terms agreed upon by all parties.

Beyond mere convenience, a meticulously prepared credit agreement helps businesses stay compliant with various federal and state regulations governing commercial credit practices. It minimizes the likelihood of misunderstandings that can sour business relationships and lead to costly legal disputes. By setting explicit expectations from the outset, it fosters trust and professionalism, laying a strong groundwork for long-term collaborations. This foresight is especially crucial when dealing with high-value transactions or new clients where a track record is yet to be established.

Advantages of a Standardized Credit Document

The proactive adoption of a well-designed credit application and agreement template offers a multitude of benefits that extend far beyond simply having a piece of paper signed. Firstly, it ensures consistency across all your credit-extending activities. Every client receives the same clear terms, reducing the chance of preferential treatment accusations or internal procedural inconsistencies that could lead to legal challenges. This standardization also streamlines the application and approval process, making it more efficient for both your team and your applicants.

Furthermore, using a robust credit application and agreement template significantly mitigates financial risks. It clearly defines the credit limit, payment due dates, interest rates on overdue amounts, and consequences for default, providing a transparent roadmap for both parties. For the creditor, this means a stronger legal position if collection efforts become necessary, potentially saving substantial legal fees and recovery costs down the line. It also enhances the professional image of your business, demonstrating a commitment to structured, legally sound operations.

Tailoring Your Credit Terms to Specific Needs

While a standardized template offers consistency, its true power lies in its adaptability. The underlying credit application and agreement template should be designed with enough flexibility to be customized for various industries, client types, and specific credit scenarios. For instance, a template used for a large wholesale distributor might include clauses related to bulk order discounts and inventory management, while one for a professional services firm might focus more on retainer agreements and project milestones.

Consider the distinct needs of different sectors. A template for equipment leasing might require detailed clauses about maintenance responsibilities, insurance, and return conditions. Conversely, a template for a SaaS provider offering monthly subscriptions would emphasize recurring billing, service level agreements, and data privacy. The ability to modify sections like payment terms, security interests, or personal guarantees ensures that the document precisely reflects the unique risks and requirements of each specific credit extension, offering targeted protection without the need to draft a new agreement from scratch every time.

Core Components of a Robust Credit Contract

Every comprehensive credit application and agreement template must include certain essential clauses to be effective and legally sound. These components ensure all critical aspects of the credit relationship are addressed, protecting both the creditor and the debtor. Omitting any of these could leave significant gaps in legal protection.

Here are the vital sections every credit agreement should contain:

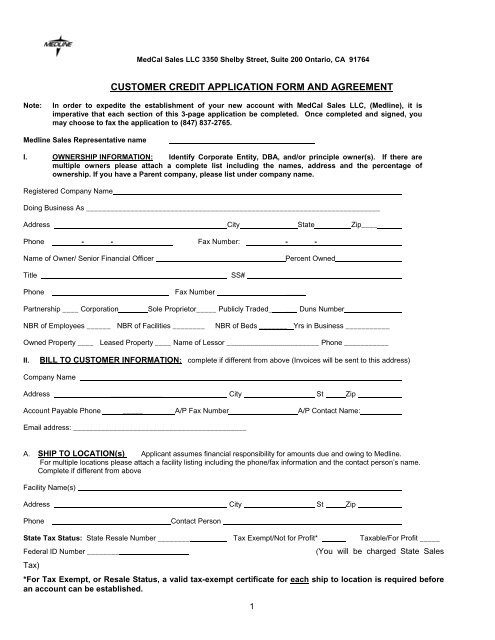

- Identification of Parties: Clearly states the full legal names, addresses, and contact information for both the creditor and the applicant (debtor). This ensures there is no ambiguity about who is entering into the agreement.

- Credit Amount and Limit: Specifies the maximum amount of credit extended, or the terms under which credit will be granted (e.g., net-30, credit line up to $X).

- Payment Terms: Outlines the schedule of payments, due dates, acceptable payment methods, and any early payment incentives or penalties. This is critical for managing cash flow.

- Interest Rates and Late Fees: Clearly defines the interest rate applied to overdue balances and any fees incurred for late payments, adhering to state usury laws.

- Default Provisions: Describes what constitutes an event of default (e.g., non-payment, bankruptcy, breach of other terms) and the remedies available to the creditor, such as acceleration of the outstanding balance.

- Security Interests/Collateral: If the credit is secured, this section details the assets pledged as collateral and the creditor’s rights regarding these assets in case of default, often involving a Uniform Commercial Code (UCC) filing.

- Guarantees: Specifies if a personal guarantee from the applicant’s principal or a corporate guarantee from a parent company is required, making another party liable for the debt.

- Representations and Warranties: Statements made by the applicant assuring the accuracy of information provided in the credit application and confirming their legal capacity to enter the agreement.

- Governing Law and Jurisdiction: Designates the state laws that will govern the interpretation and enforcement of the agreement, and the specific courts where any disputes will be resolved.

- Dispute Resolution: Outlines the process for resolving disagreements, which might include mediation, arbitration, or litigation, specifying the preferred method.

- Confidentiality Clause: If applicable, this section protects sensitive financial or business information shared during the credit application process.

- Amendments and Waivers: Specifies how the agreement can be modified and that any waiver of a provision must be in writing.

- Entire Agreement Clause: States that the written document constitutes the complete and final agreement between the parties, superseding all prior oral or written communications.

- Signatures: Requires the authorized signatures of both the creditor and the applicant, along with the date, making the document legally binding.

Enhancing Your Document’s Clarity and Accessibility

Beyond legal content, the presentation and structure of your credit documents play a crucial role in their effectiveness. When developing your credit application and agreement template, prioritize clarity, usability, and readability. Use plain language wherever possible, avoiding overly complex legal jargon that might confuse applicants or lead to misinterpretations. If technical terms are necessary, provide clear definitions.

Adopt a logical flow with clear, descriptive headings and subheadings. Numbered paragraphs or sections improve navigability, especially in lengthy documents, making it easier to reference specific clauses during discussions or disputes. For both print and digital use, choose a professional, legible font (e.g., Arial, Calibri, Times New Roman) in an appropriate size (10-12 points) with sufficient line spacing to prevent eye strain. For digital applications, consider creating fillable PDF forms that support electronic signatures, enhancing efficiency and reducing paper waste. Ensure the document is accessible, perhaps by offering different formats or using accessibility-friendly fonts and structures. Regularly review and update your template to ensure it remains current with legal requirements and reflects your evolving business practices.

In the complex ecosystem of modern business, extending credit is a powerful growth lever, but one that demands rigorous preparation and clear documentation. A professionally developed credit application and agreement template is more than just a formality; it is a critical asset that underpins financial stability and fosters trustworthy client relationships. It empowers businesses to confidently navigate the inherent risks of credit extension, ensuring that all parties operate from a position of clarity and mutual understanding.

By providing a standardized, legally robust framework, a high-quality credit application and agreement template streamlines operations, minimizes potential disputes, and offers comprehensive legal protection. It frees up valuable time and resources that would otherwise be spent on ad-hoc document creation or dispute resolution, allowing businesses to focus on their core competencies and strategic growth. Ultimately, investing in a superior template is investing in the long-term health, efficiency, and legal security of your commercial endeavors.