Navigating the complexities of lending, whether as a financial institution, a private lender, or even a business extending credit, often involves mitigating risk. One common strategy is requiring a cosigner, a party who agrees to take on financial responsibility for a loan if the primary borrower defaults. While seemingly straightforward, the legal and financial implications of such an arrangement are anything but simple. This is precisely where a robust, well-structured cosigner loan agreement template becomes an indispensable tool for clarity, protection, and effective risk management.

For anyone operating in the realm of business and legal documentation, understanding and utilizing a comprehensive template is not just a best practice—it’s a necessity. It serves as the bedrock for defining obligations, outlining terms, and preempting disputes, ensuring all parties are unequivocally aware of their roles and responsibilities. This article delves into the critical elements, strategic advantages, and practical applications of an expertly crafted cosigner loan agreement template, providing invaluable insights for professionals seeking to safeguard their interests and streamline their lending processes.

The Indispensable Nature of Written Agreements Today

In an increasingly litigious and regulated environment, relying on verbal assurances or handshake deals is a recipe for potential disaster. A meticulously drafted written agreement transcends the inherent fallibility of memory and subjective interpretation, establishing an irrefutable record of understanding. This foundational principle is especially true when a third party, a cosigner, introduces an additional layer of complexity to a financial transaction.

A clear, written contract provides a definitive legal framework that stands up to scrutiny, offering a concrete point of reference for all involved. It serves as vital evidence in the event of misunderstandings or disputes, significantly expediting resolution and reducing the need for costly and time-consuming litigation. In essence, formal documentation isn’t merely administrative overhead; it’s a proactive shield against uncertainty and conflict in all business dealings.

Unlocking the Protections of a Structured Document

The strategic value of a well-designed agreement extends far beyond simple record-keeping; it actively delivers tangible benefits and robust protections for every party involved. For the lender, it solidifies the secondary promise of payment, significantly enhancing the security of the loan and outlining specific recourse options should the primary borrower fail to meet their obligations. This foresight is crucial for managing financial exposure.

For the primary borrower, the agreement provides transparent terms, ensuring they understand their commitments and the exact nature of their debt. It also delineates the cosigner’s specific liabilities, preventing potential overreach or unwarranted claims against them. Furthermore, a professional cosigner loan agreement template brings a level of standardization and efficiency to lending operations, saving time and resources that would otherwise be spent drafting bespoke documents for each transaction. This systematic approach minimizes errors and ensures consistent legal compliance across the board.

Tailoring Your Agreement to Unique Needs

One of the most powerful advantages of a well-designed cosigner loan agreement template is its inherent flexibility and adaptability. While core clauses remain constant, the specific details often need customization to align with diverse industries, loan types, and unique financial arrangements. A template should serve as a dynamic starting point, not a rigid constraint.

Consider, for instance, a small business loan where the cosigner is a business partner versus a personal loan where the cosigner is a family member. The nature of the relationship, the collateral involved, and the specific terms of default might vary significantly. Similarly, an agreement for an auto loan would differ from one for an educational loan, particularly concerning repayment schedules, grace periods, and specific default conditions. The template’s structure should allow for seamless integration of these bespoke elements, ensuring the final document accurately reflects the precise intent and specifics of the agreement. This adaptability makes the cosigner loan agreement template an invaluable asset across various financial scenarios.

Core Provisions for a Watertight Contract

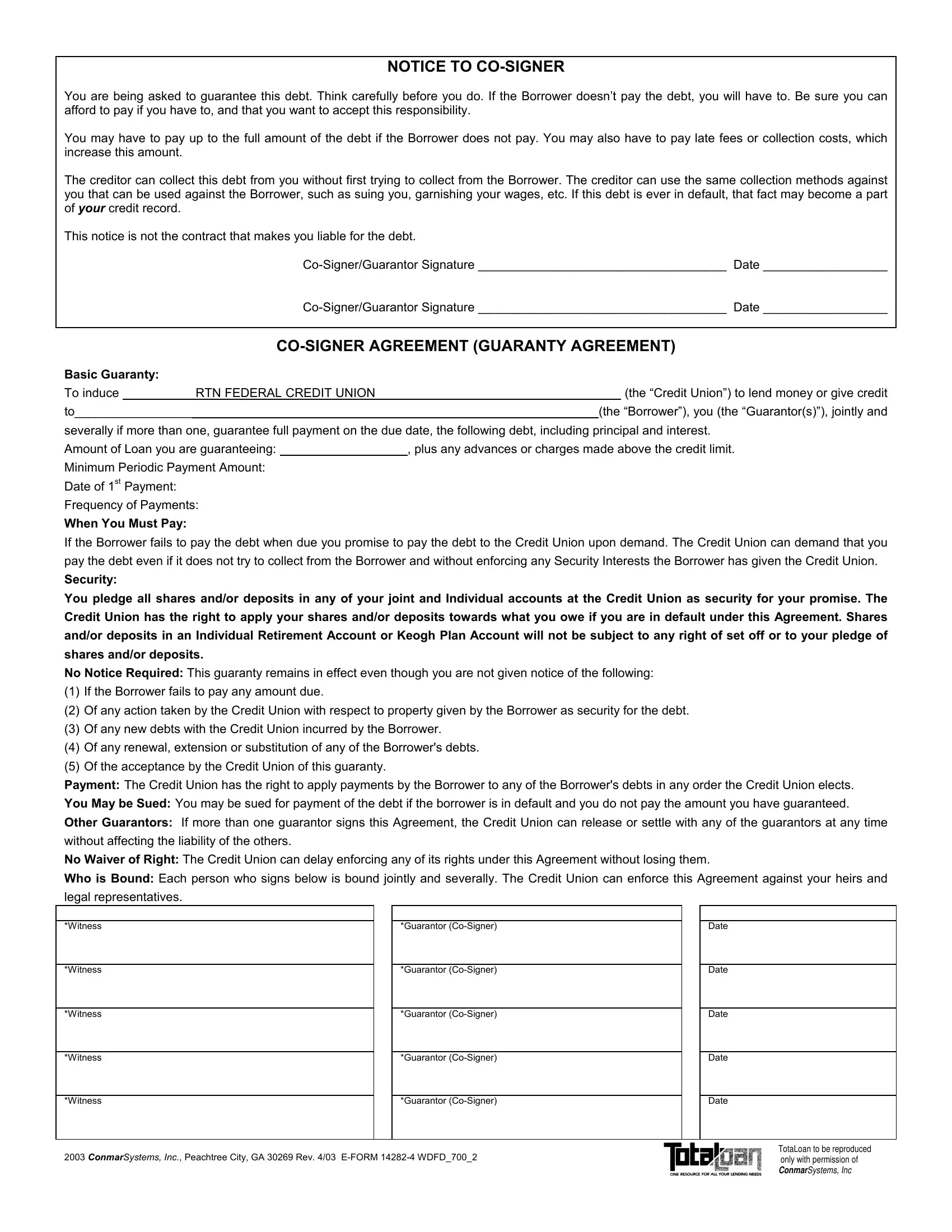

Any effective cosigner agreement must contain several fundamental clauses to ensure clarity, enforceability, and comprehensive protection for all parties. These provisions form the backbone of the contract, addressing critical aspects of the loan and the cosigner’s involvement. Without these essential components, the agreement risks being incomplete or legally vulnerable.

- Identification of Parties: Clearly states the full legal names and contact information for the lender, the primary borrower, and the cosigner, establishing who is bound by the contract.

- Loan Amount and Purpose: Specifies the exact principal amount being loaned and, if relevant, the intended use of the funds.

- Interest Rate and Calculation: Outlines the annual interest rate, whether fixed or variable, and the method for calculating interest on the outstanding balance.

- Repayment Schedule: Details the frequency (e.g., monthly, quarterly), due dates, and exact amount of each payment, including any provisions for early repayment or late payment penalties.

- Default Conditions: Clearly defines what constitutes a default by the primary borrower (e.g., missed payments, bankruptcy) and the immediate consequences.

- Cosigner’s Obligations: Explicitly states the cosigner’s responsibility to repay the loan, including principal, interest, and any associated fees, if the primary borrower defaults. It should specify if the cosigner is primarily or secondarily liable.

- Indemnification Clause: Protects the cosigner from certain liabilities or obligates the primary borrower to reimburse the cosigner for any payments made due to default. Conversely, it might protect the lender from claims by the cosigner.

- Governing Law: Identifies the specific state or jurisdiction whose laws will govern the interpretation and enforcement of the agreement, crucial for legal compliance.

- Severability Clause: Ensures that if any part of the agreement is found to be unenforceable, the remaining provisions of the contract will still remain valid and in effect.

- Entire Agreement Clause: States that the written document constitutes the entire agreement between the parties, superseding all prior oral or written understandings.

- Signatures and Dates: Requires the signatures of all parties involved, along with the date of signing, often accompanied by a witness or notary public for enhanced legal standing.

Crafting for Clarity: Design and Readability Tips

Beyond the legal substance, the practical presentation of a legal document significantly impacts its effectiveness and usability. A clear, well-formatted cosigner loan agreement template is not only easier to read and understand but also projects professionalism and attention to detail. This is vital for fostering trust and ensuring compliance.

For both print and digital use, prioritize a clean, uncluttered layout. Use legible fonts (e.g., Arial, Times New Roman, Calibri) in a comfortable size (10-12pt for body text). Employ consistent headings and subheadings to break up large blocks of text, making the document scannable and easy to navigate. Adequate line spacing and generous margins contribute significantly to readability, preventing the document from appearing dense or intimidating. Utilize bullet points and numbered lists for itemizing complex information, such as the essential clauses mentioned previously, or repayment schedules, allowing readers to quickly grasp key details. Finally, ensure language is clear, concise, and unambiguous, avoiding overly technical jargon where plain English suffices. A well-formatted document reduces the likelihood of misinterpretation and promotes a smoother, more transparent process for all parties.

In today’s fast-paced business environment, precision and efficiency are paramount. A thoughtfully designed cosigner loan agreement template is more than just a piece of paperwork; it’s a strategic asset that underpins trust, mitigates financial risk, and establishes clear expectations from the outset. By leveraging such a professional template, businesses and individuals can navigate the complexities of cosigned loans with confidence, ensuring legal compliance and fostering healthy financial relationships.

The investment in a robust, customizable cosigner loan agreement template ultimately pays dividends in saved time, reduced legal fees, and enhanced operational integrity. It equips all parties with a definitive roadmap, transforming potential points of conflict into clear, actionable terms. For those committed to sound business practices and meticulous documentation, this template is an essential tool for achieving peace of mind and securing successful financial outcomes.