In the dynamic landscape of modern business, establishing a clear and robust framework for your corporate entity is not just a best practice; it’s a foundational necessity. While articles of incorporation and bylaws lay the groundwork, a comprehensive operating agreement serves as the internal constitution, meticulously defining the operational, financial, and managerial relationships among the corporation’s key stakeholders. It’s the essential document that transcends state default rules, offering tailored clarity and foresight to prevent potential conflicts and ensure smooth governance.

For founders, shareholders, directors, and even prospective investors in a US-based corporation, understanding and utilizing a well-crafted operating agreement can be the difference between harmonious growth and debilitating disputes. This crucial document empowers you to set specific terms for everything from profit distribution to decision-making authority, reflecting the unique vision and agreements of your enterprise. It acts as a detailed blueprint, articulating the rights, responsibilities, and expectations of everyone involved, thereby safeguarding the company’s future and personal investments.

The Imperative of Documented Governance in Today’s Business

In an increasingly complex legal and business environment, relying solely on verbal understandings or the general provisions of state law is a significant risk. Business relationships, like any human relationship, can become strained, and memories can differ. When ambiguity arises regarding ownership stakes, management roles, or financial distributions, a clear, written agreement becomes the ultimate arbiter.

A meticulously drafted document provides an indisputable record of the original intentions and agreements among the corporate parties. It prevents misunderstandings from escalating into costly legal battles, saving both time and resources. For any growing corporation, having these foundational rules explicitly stated ensures continuity and stability, especially during changes in leadership or ownership.

Safeguarding Your Enterprise with a Solid Framework

The strategic adoption of a robust internal agreement offers a multitude of benefits that extend far beyond simple record-keeping. Foremost, it acts as a preventative measure, addressing potential points of contention before they can materialize into disputes. By clearly outlining roles, responsibilities, and decision-making processes, it removes guesswork and fosters accountability among all parties.

Furthermore, this foundational document helps protect the personal liability of shareholders and directors by reaffirming the corporate veil. It defines how profits are distributed, how capital calls are managed, and how new members are admitted or existing ones exit. A well-structured corporation operating agreement template also serves as a critical reference for external stakeholders, such as lenders or potential investors, demonstrating a professionally managed and transparent governance structure.

Tailoring the Blueprint for Diverse Ventures

One of the most powerful aspects of an internal corporate agreement is its inherent flexibility. Unlike the more rigid state-mandated articles of incorporation, this document can be precisely customized to suit the specific needs, industry, and strategic goals of virtually any corporate entity. Whether you’re launching an innovative tech startup, managing a multi-generational family business, or overseeing a specialized service corporation, the agreement can be adapted.

For example, a tech company might require intricate clauses regarding intellectual property ownership and licensing, while a manufacturing business might focus more on operational control and supply chain management. Joint ventures or corporations with external investors will need detailed provisions on voting rights, capital contributions, and exit strategies. The beauty of starting with a comprehensive corporation operating agreement template is that it provides a strong foundation that can then be finely tuned with specific provisions, ensuring it aligns perfectly with the unique nuances of your business model and stakeholder relationships. Engaging legal counsel during this customization process is always recommended to ensure compliance and comprehensive coverage.

Core Components of a Comprehensive Corporate Agreement

A well-structured corporate agreement serves as the backbone of your company’s internal governance, covering all critical aspects of its operation and stakeholder relationships. While each business is unique, certain clauses are universally essential for providing clarity and preventing future disputes.

Here are the indispensable sections every robust corporate agreement should contain:

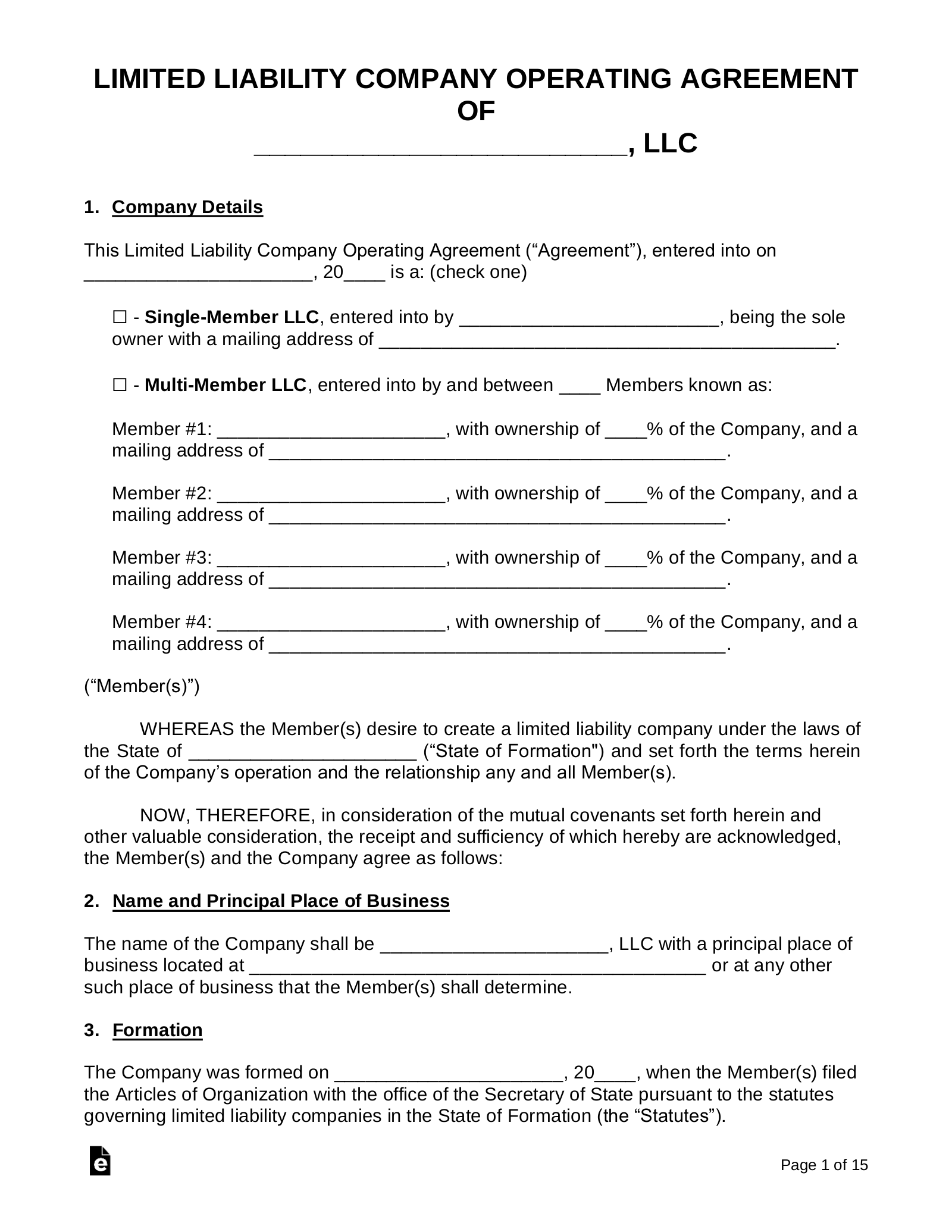

- Identification of Parties and Purpose: Clearly lists all initial shareholders/members, their contact information, and formally states the corporation’s official name, address, and primary business purpose.

- Ownership Structure: Details the percentage of ownership or number of shares each shareholder holds, differentiating between common and preferred stock if applicable, and outlining any specific voting rights associated with different classes of shares.

- Capital Contributions: Specifies the initial monetary or in-kind contributions made by each shareholder, outlining procedures for future capital calls, and the consequences of failing to meet them.

- Management Structure: Defines the roles and responsibilities of the Board of Directors, officers (e.g., CEO, CFO), and any key managers. It outlines their powers, duties, and the scope of their authority.

- Decision-Making Processes: Establishes clear rules for making significant corporate decisions, including voting thresholds for different types of matters (e.g., simple majority, supermajority), quorum requirements for meetings, and procedures for calling meetings.

- Profit Distribution and Dividends: Outlines how and when profits will be distributed to shareholders, whether through dividends, reinvestment, or other mechanisms, and defines the criteria for such distributions.

- Transfer of Ownership/Exit Strategies (Buy-Sell Provisions): Crucial clauses that dictate the terms under which a shareholder can sell their shares (e.g., right of first refusal for existing shareholders), what happens upon death, disability, or divorce of a shareholder, and valuation methods for shares.

- Dispute Resolution: Specifies the process for resolving internal conflicts or disagreements among shareholders or management, often including mediation or arbitration before resorting to litigation.

- Confidentiality and Non-Compete Clauses: Protects proprietary information and prevents shareholders or key personnel from competing with the corporation during or after their involvement.

- Amendments: Details the procedure for amending the agreement itself, usually requiring a unanimous or supermajority vote of the shareholders.

- Dissolution: Outlines the process for dissolving the corporation, including the distribution of assets and settlement of liabilities, should the business cease operations.

- Governing Law: Specifies the state laws that will govern the interpretation and enforcement of the agreement.

Each of these clauses plays a vital role in creating a clear, equitable, and legally sound framework for your corporation, minimizing ambiguity and setting clear expectations for all involved parties.

Enhancing Accessibility and Practicality

Beyond the legal substance, the practical usability and readability of your corporate agreement are paramount. A document that is difficult to navigate or understand diminishes its effectiveness, regardless of its robust content. Whether intended for print or digital distribution, thoughtful formatting and presentation can significantly enhance its value as an ongoing reference tool.

Consider using clear, concise language, avoiding overly dense legal jargon where possible, or providing definitions for complex terms. Employ logical headings and subheadings, perhaps using a numerical or hierarchical system, to create an intuitive structure. Ample white space, consistent font styles, and appropriate font sizes contribute greatly to readability. For digital versions, ensure the document is easily searchable and that key sections can be linked for quick navigation. Implementing a table of contents with hyperlinks is especially beneficial. Maintaining version control and ensuring secure, accessible storage (e.g., cloud-based, password-protected files) will also prove invaluable as your corporation evolves, ensuring all parties always refer to the most current and officially agreed-upon terms.

In essence, a well-formatted and accessible agreement encourages regular consultation, fostering a greater understanding among stakeholders and proactively addressing potential issues before they escalate. It transforms a static legal document into a living guide for your corporate governance.

The journey of building and growing a successful corporation is complex, filled with opportunities and challenges. At its core, the stability and longevity of any business entity hinge upon clear communication, defined roles, and agreed-upon procedures. A meticulously prepared corporation operating agreement template serves as the bedrock for this stability, providing a comprehensive, adaptable, and legally sound framework for your corporate governance.

By leveraging such a template, you are not just drafting a document; you are investing in foresight, risk mitigation, and the harmonious operation of your business. It is a proactive step that protects not only the enterprise itself but also the individual interests of its founders and shareholders, offering a clear roadmap for success and a definitive guide for navigating potential complexities. Embrace this essential tool to safeguard your corporation’s future and empower its growth with confidence and clarity.