In the intricate world of business ownership, foresight and meticulous planning are not just advisable; they are absolutely essential. Imagine a scenario where a co-owner unexpectedly passes away, retires, or decides to leave the company under less than ideal circumstances. Without a clear, pre-defined roadmap for such transitions, a business can quickly find itself mired in disputes, financial instability, and even potential dissolution. This is precisely where a robust framework, often facilitated by a well-structured corporate buy sell agreement template, becomes an invaluable asset for any privately held corporation, partnership, or even multi-member LLC.

This crucial document acts as a prenuptial agreement for your business, establishing the terms and conditions under which an owner’s share of the business can be bought or sold. It provides a blueprint for managing major life events or business disagreements, ensuring continuity, fair valuation, and a smooth transition of ownership interests. For legal professionals advising business clients, financial planners, and entrepreneurs navigating complex ownership structures, understanding and utilizing such a template is paramount to protecting the business’s long-term health and the financial interests of all its stakeholders.

The Indispensable Role of a Formal Agreement

In today’s fast-paced business environment, the need for clear and written agreements has never been more pronounced. Market dynamics shift rapidly, legal landscapes evolve, and personal circumstances can change in an instant, all of which can have profound effects on business ownership. Relying on verbal understandings or handshake deals is a recipe for disaster, leaving critical decisions to be made in times of stress or conflict, often with significant financial and emotional costs.

A formal buy-sell agreement eliminates ambiguity by laying out the rules of engagement for all possible eventualities. It defines who can buy an owner’s shares, how those shares will be valued, and when such a transaction can occur. This proactive approach prevents future litigation, preserves valuable business relationships, and maintains operational stability, regardless of what changes occur in an owner’s personal or professional life.

Safeguarding Your Business Future

The benefits of implementing a comprehensive agreement extend far beyond merely outlining exit strategies. It provides a multi-layered shield of protection for the business itself, the remaining owners, and the departing owner or their heirs. This proactive planning tool serves as a cornerstone of good corporate governance and risk management.

A well-crafted corporate buy sell agreement template offers numerous key benefits:

- Ensures Business Continuity: It prevents an owner’s departure from disrupting operations or forcing a liquidation by dictating the transfer of ownership.

- Provides Fair Valuation: Establishes a pre-agreed method for valuing ownership interests, avoiding contentious negotiations and ensuring equitable compensation.

- Protects Against Unwanted Owners: Prevents shares from falling into the hands of external parties, competitors, or heirs who may not align with the company’s vision or values.

- Facilitates Estate Planning: Simplifies the estate settlement process for a deceased owner’s heirs, providing a ready market for their shares.

- Secures Funding: Often used in conjunction with life insurance policies or disability insurance, ensuring that funds are available to execute the buy-out.

- Reduces Disputes: Minimizes potential disagreements among owners by clearly defining rights, obligations, and procedures in advance.

- Maintains Stability: Offers a sense of security and stability to employees, clients, and investors, knowing the business has a plan for transitions.

Tailoring the Framework to Your Unique Needs

While the core principles of a buy-sell agreement remain consistent, a robust corporate buy sell agreement template is designed to be highly customizable. No two businesses are exactly alike, and their ownership structures, financial situations, and long-term goals will vary significantly. The beauty of a comprehensive template lies in its flexibility to adapt to these unique circumstances, making it a powerful tool for diverse industries and scenarios.

Whether you operate a technology startup, a manufacturing firm, a professional services practice, or a family-owned enterprise, the template can be fine-tuned. You might adjust the valuation method based on industry standards, incorporate specific triggers for different types of departures (e.g., retirement vs. felony conviction), or outline specific funding mechanisms suitable for your company’s financial health. This adaptability ensures the agreement remains relevant and effective, serving as a living document that grows with the business.

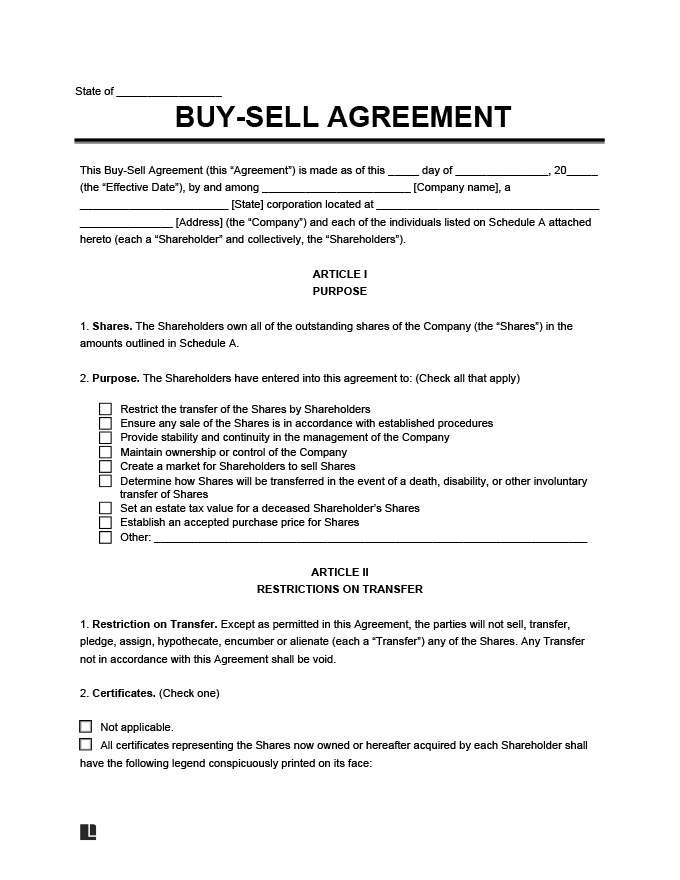

Anatomy of a Robust Buy-Sell Document

Every effective buy-sell agreement must contain several critical clauses that address the various facets of an ownership transition. These clauses form the backbone of the document, ensuring clarity and enforceability.

- Identification of Parties: Clearly lists all owners and the business entity involved.

- Triggering Events: Defines the specific circumstances that will initiate a buy-out or sell-out. Common triggers include:

- Death of an owner

- Disability of an owner

- Retirement

- Termination of employment

- Bankruptcy or insolvency

- Divorce (affecting ownership shares)

- Breach of agreement or other specific actions

- Valuation Method: Specifies how the value of the shares will be determined at the time of a triggering event. This could involve:

- An agreed-upon fixed price (often reviewed annually)

- A formula based on earnings, book value, or a multiple of revenue

- Appraisal by an independent third party

- Purchase Price and Payment Terms: Outlines how the purchase price will be paid (e.g., lump sum, installment payments, promissory notes).

- Funding Mechanisms: Describes how the purchase will be financed. This often includes:

- Life insurance policies (for death triggers)

- Disability insurance (for disability triggers)

- Company cash flow or reserves

- Bank loans

- Installment payments by the remaining owners

- Transfer Restrictions: Limits an owner’s ability to sell or transfer their shares to outside parties without the consent of other owners or the company.

- Option to Purchase/Obligation to Sell: Clarifies whether the remaining owners have the option to buy or are obligated to buy, and if the departing owner (or their estate) is obligated to sell.

- Right of First Refusal: Grants existing owners the first opportunity to purchase shares if an owner wishes to sell to an outside party.

- Spousal Consent: Often includes provisions requiring spousal consent to ensure the enforceability of the agreement against marital property claims.

- Governing Law: Specifies the jurisdiction whose laws will govern the interpretation and enforcement of the agreement.

- Dispute Resolution: Outlines the process for resolving disagreements that may arise concerning the agreement, such as mediation or arbitration.

Crafting a User-Friendly Contract

While legal precision is paramount, a buy-sell agreement should also be accessible and understandable to all parties involved. Practical tips for formatting, usability, and readability are essential, whether the document is intended for print or digital consumption. A complex contract that few can easily navigate risks being ignored or misinterpreted.

Begin by using clear, concise language, avoiding excessive legal jargon where simpler terms suffice. Employ consistent formatting with distinct headings and subheadings to break up large blocks of text, making it easier to scan and comprehend. Utilize bullet points and numbered lists, especially for outlining procedures, triggers, and payment terms, as this improves readability significantly. Ensure ample white space around paragraphs and sections to prevent a cluttered appearance. For digital use, consider creating a navigable document with a table of contents that links to specific sections, enhancing user experience. A well-organized, readable document encourages understanding and compliance, reinforcing its protective power.

A professionally developed corporate buy sell agreement template is far more than just a legal document; it is a strategic business asset. It acts as a preemptive solution, addressing potentially disruptive events before they even occur, thereby safeguarding the financial stability and operational continuity of a business. For any enterprise with multiple owners, investing the time and resources to tailor and implement such an agreement is a fundamental step in responsible business stewardship.

By clearly defining the terms of ownership transitions, this template provides peace of mind for all stakeholders, allowing them to focus on growth and innovation rather than worrying about unforeseen contingencies. It represents a commitment to the long-term health of the business and ensures that the legacy and hard work invested by its founders and owners are protected for years to come, making it an indispensable tool in the modern business world.