A condominium association’s financial well-being is the bedrock of a thriving community. It ensures property values are maintained, amenities are operational, and residents enjoy a high quality of life. At the heart of this financial stability lies a meticulously crafted and effectively managed budget. Without a clear financial roadmap, associations risk unforeseen expenses, depleted reserves, and ultimately, dissatisfaction among homeowners.

Navigating the complexities of shared ownership finances can be daunting, even for seasoned board members. From projecting common area maintenance to planning for major capital improvements, every dollar needs to be accounted for with precision and foresight. This is where a robust framework, like a Condominium Association Budget Template, becomes an indispensable tool, offering clarity, structure, and peace of mind to boards and residents alike. It’s not just about numbers; it’s about fostering trust and ensuring the long-term viability of your community.

Why a Robust Budget is Your Association’s Blueprint

A condo association budget isn’t merely an annual financial report; it’s the strategic blueprint guiding every decision from routine landscaping to emergency repairs. It articulates the financial obligations and aspirations of the community, detailing how homeowner assessments are collected and allocated. For board members, it serves as a critical governance tool, promoting transparency and accountability in all financial matters.

For residents, a well-communicated association budget provides insight into the value they receive for their monthly contributions. It assures them that their community’s assets are being protected and enhanced responsibly. A comprehensive financial plan helps prevent unexpected special assessments, which can be a significant source of contention and financial strain for homeowners. It’s the foundation upon which trust and stability are built within any shared living environment, ensuring the fiscal health of the entire property.

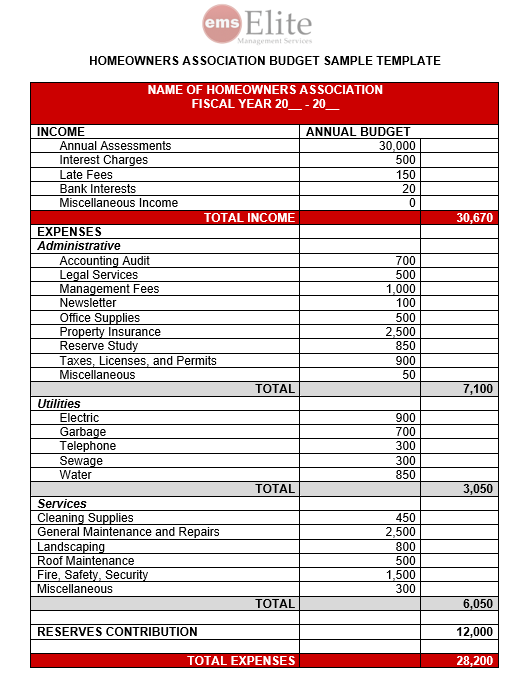

Key Components of an Effective Condo Budget

Building an effective association budget requires a thorough understanding of its core elements. It’s a living document that should reflect the specific needs and future goals of your particular community. Think of it as a comprehensive financial narrative, broken down into distinct yet interconnected chapters that address all aspects of the property’s financial life.

Primarily, it involves two main categories: operational expenses and reserve funds. Each category demands careful attention to detail, realistic projections, and a clear methodology for calculation. Understanding these foundational components is the first step toward creating a financial plan that truly serves the association’s best interests, ensuring both immediate needs and long-term security are addressed. A solid budget framework brings structure to what could otherwise be an overwhelming task.

Operational Expenses: The Day-to-Day Costs

Operational expenses cover all the routine costs associated with running and maintaining the common elements of a condominium community on a daily, weekly, or monthly basis. These are the predictable outlays that keep everything functioning smoothly. Accurately forecasting these costs is crucial for setting appropriate assessment levels and avoiding budgetary shortfalls throughout the year.

These expenditures can vary significantly based on the size, age, and amenities of the property, but some common categories are almost universally present. A detailed breakdown helps in tracking and managing where the association’s funds are being spent throughout the year, promoting fiscal responsibility and informed decision-making among board members.

- **Utilities:** Costs for common area electricity, water, gas, and sewer services.

- **Insurance:** Comprehensive master policies covering the building structure, common areas, and liability.

- **Landscaping and Grounds Maintenance:** Regular upkeep of gardens, lawns, trees, and shared outdoor spaces.

- **Cleaning and Custodial Services:** Maintenance of lobbies, hallways, elevators, and other common indoor areas.

- **Management Fees:** Compensation for professional property management services, if applicable.

- **Administrative Costs:** Office supplies, postage, legal counsel, accounting services, and banking fees.

- **Repairs and Maintenance (Routine):** Minor fixes and preventative maintenance for common elements like HVAC systems, lighting, and plumbing.

- **Security Services:** Expenses for security personnel, surveillance systems, or access control.

- **Amenities Maintenance:** Upkeep for pools, gyms, clubhouses, and other shared recreational facilities.

- **Pest Control:** Regular treatments for common areas to prevent infestations.

- **Payroll (if applicable):** Wages and benefits for any on-site staff, such as concierges or maintenance personnel.

Reserve Funds: Planning for the Future

While operational expenses handle the present, reserve funds are the cornerstone of an association’s long-term financial health. These are segregated savings accounts specifically designated for the repair, replacement, or restoration of major common elements that have a predictable useful life but infrequent expenditure. Examples include roofs, elevators, parking lot resurfacing, or exterior painting, which represent significant capital outlays.

Properly funding reserves prevents the need for large, unexpected special assessments, which can cause significant financial hardship for homeowners. A professional reserve study is an essential tool in determining the appropriate level of funding needed. This study identifies major components, estimates their remaining useful life, and projects future replacement costs, providing a robust basis for the reserve contribution portion of your annual community association budget. It’s a proactive approach to fiscal responsibility, protecting property values and ensuring the longevity of shared assets for generations to come.

Creating and Customizing Your Association’s Budget

Developing an association’s annual financial plan involves more than just plugging numbers into a spreadsheet; it requires a deep understanding of the community’s history, current needs, and future aspirations. Start by gathering historical financial data, which provides a solid baseline for projecting future expenses and revenues. Look at the past 3-5 years of income statements, balance sheets, and cash flow reports to identify trends and anomalies.

Engage with contractors and service providers to obtain current bids for recurring services like landscaping, cleaning, and utility providers, factoring in potential inflation. Factor in any planned capital improvements or special projects identified in the reserve study, adjusting for current market costs. It’s crucial to involve all relevant stakeholders, including the board, management, and possibly key resident committees, to ensure the budget accurately reflects the community’s priorities and collective vision. This collaborative approach helps tailor the budget to the unique characteristics of your condominium.

Tips for Successful Budget Management

Once the budget is approved, effective management throughout the fiscal year is paramount to its success. This isn’t a “set it and forget it” task; it requires ongoing vigilance, adaptability, and clear communication. Regular financial reviews are essential to track performance against the established plan and make timely adjustments as needed.

- **Monthly Financial Reviews:** The board should review financial statements monthly, comparing actual income and expenses to budgeted figures. This helps identify discrepancies and potential issues early.

- **Variance Analysis:** Investigate significant variances between budgeted and actual amounts. Understanding *why* expenses are higher or lower than anticipated can inform future budgeting and operational decisions.

- **Contingency Planning:** Always build a small contingency into the operating budget for unforeseen minor expenses. This acts as a buffer against minor shocks without disrupting overall financial stability.

- **Transparent Communication:** Clearly communicate the association’s financial health and budget performance to residents. Regular updates, perhaps through newsletters or open board meetings, build trust and understanding.

- **Regular Reserve Study Updates:** Ensure your reserve study is updated every 3-5 years by a qualified professional. This keeps your long-term funding plan accurate and aligned with component lifecycles and current replacement costs.

- **Professional Guidance:** Don’t hesitate to seek advice from accountants, reserve specialists, or experienced property managers. Their expertise can be invaluable in navigating complex financial situations and ensuring compliance.

- **Annual Review and Adjustment:** Treat the annual financial plan as a living document. Be prepared to adjust future years’ budgets based on current year performance, changing market conditions, and evolving community needs.

Leveraging a Budget Framework for Financial Clarity

Using a structured financial framework, such as a well-designed Condominium Association Budget Template, offers numerous advantages beyond simply listing revenues and expenditures. It provides a standardized format that simplifies data entry, improves accuracy, and ensures consistency from year to year. This consistency is vital for comparative analysis, allowing boards to easily identify trends, measure performance, and make informed decisions about resource allocation.

A good template acts as a comprehensive guide, prompting associations to consider all necessary financial categories and ensuring no critical elements are overlooked during the planning process. It streamlines the budget preparation process, making it less intimidating for volunteer board members and more efficient for property managers. Ultimately, adopting a robust budgeting framework elevates financial oversight from a reactive task to a proactive strategy, empowering the association to manage its resources effectively and secure its future for all homeowners.

Frequently Asked Questions

What is the primary purpose of a condo association budget?

The primary purpose is to outline the anticipated income (primarily homeowner assessments) and expenses for a specific fiscal year, ensuring the financial stability and operational continuity of the condominium community. It acts as a financial roadmap for the board and provides transparency to homeowners regarding how their contributions are utilized.

How often should an association budget be prepared?

A comprehensive association budget should be prepared and approved annually, typically before the start of the new fiscal year. However, financial performance against the budget should be reviewed monthly or quarterly by the board of directors to ensure compliance and make any necessary mid-year adjustments.

What happens if actual expenses exceed the budget?

If actual expenses consistently exceed the budget, the board must investigate the reasons for the overruns. This could lead to adjustments in future budgets, a re-evaluation of current spending, or, in severe cases, the need for a special assessment or an increase in regular assessments to cover the shortfall and maintain financial solvency.

Is a reserve study legally required for all condominium associations?

The requirement for a reserve study varies significantly by state law. Many states, including Florida, California, and Virginia, have statutes mandating periodic reserve studies and full or partial funding of reserves. Even where not legally required, it is universally considered a best practice for sound financial management and long-term asset protection.

Who is responsible for preparing and approving the budget?

Typically, the condominium association’s board of directors, often with the assistance of a property manager or a dedicated financial committee, prepares the initial draft of the budget. It then must be formally approved by the board and usually presented to the homeowners, though specific homeowner approval requirements can vary by state statutes or the association’s governing documents.

A well-structured and diligently managed budget is undeniably the backbone of a successful condominium association. It transcends a mere collection of numbers, embodying the collective commitment to maintaining property values, fostering community well-being, and ensuring long-term financial health. Embracing a systematic approach to financial planning empowers boards to make informed decisions, build trust with residents, and navigate potential challenges with foresight and confidence.

By adopting robust budgeting practices and utilizing resources like a comprehensive financial planning tool, your association can move beyond reactive spending to proactive financial stewardship. This dedication to fiscal clarity not only secures the present but also lays a strong foundation for a prosperous and harmonious future for all homeowners within your community. It’s an investment in the longevity and vibrancy of shared living, ensuring the association’s financial health for years to come.