For many living in a condominium community, the intricacies of the association’s finances can seem like a distant, perhaps even mysterious, affair. Yet, at the heart of every well-managed condo community lies a clear, meticulously planned, and responsibly executed financial strategy. This strategy is embodied by the annual budget, a document that not only dictates operational spending but also directly impacts property values, resident satisfaction, and long-term community health.

Understanding and utilizing a robust Condo Association Budget Template is not merely a task for the board; it’s a foundational element for ensuring transparency, fiscal responsibility, and the sustainable well-being of the entire association. It transforms a potentially overwhelming financial undertaking into an organized, actionable process, allowing board members to make informed decisions and residents to have confidence in their community’s financial stewardship.

The Cornerstone of Community Financial Health

A condominium association’s budget serves as its financial roadmap for the fiscal year, outlining projected income and expenses. Without a well-defined financial plan, associations risk facing unexpected deficits, neglected maintenance, and potentially steep special assessments that can burden homeowners. A standardized budget framework provides a clear, consistent structure, making it easier for new board members to pick up where others left off and ensuring continuity in financial oversight.

This crucial document is more than just a list of numbers; it reflects the priorities of the community, from essential services like landscaping and utilities to critical long-term projects like roof replacements or common area renovations. It’s a living document that requires careful planning, regular review, and open communication to be effective. The process of developing an annual budget for condominiums forces a proactive approach to fiscal management, preventing many common financial pitfalls.

Why a Structured Approach Matters

The value of a robust Condo Association Budget Template cannot be overstated. It offers a standardized format that simplifies the budgeting process, reduces errors, and enhances clarity for all stakeholders. Instead of starting from scratch each year, a comprehensive template provides a ready-made framework, allowing the board to focus on analyzing data and making strategic decisions rather than building the budget’s structure itself.

Such a template also fosters greater transparency. When residents can easily understand how their assessments are being allocated, it builds trust and encourages engagement. A well-organized financial plan makes it simple to compare current expenditures against previous years, identify trends, and anticipate future needs. This level of detail and organization is invaluable for maintaining the fiscal health and stability of any homeowner association financial planning efforts.

Key Components of an Effective Association Budget

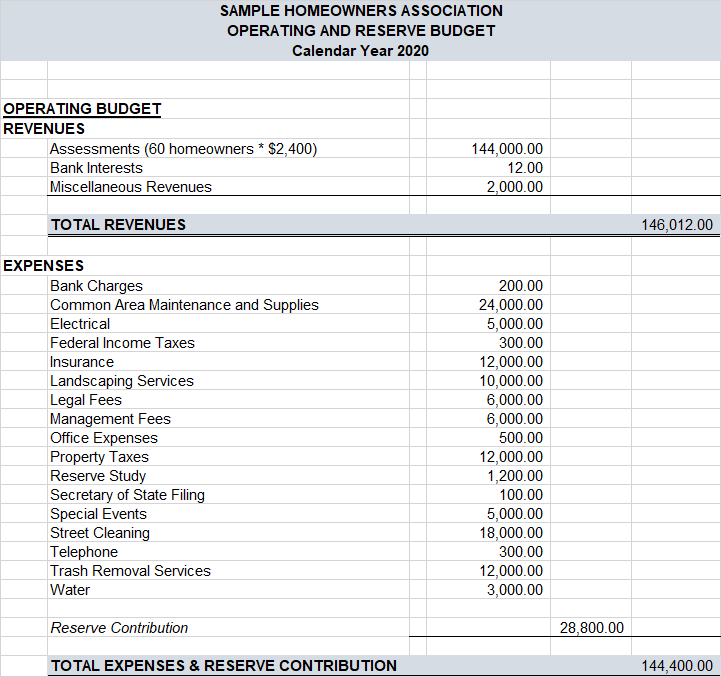

A successful community budget blueprint must encompass all aspects of the association’s financial life. This financial plan, often formalized into a comprehensive Condo Association Budget Template, typically includes both operating expenses and reserve fund contributions, carefully balancing immediate needs with future liabilities. Understanding each component is vital for creating an accurate and actionable document.

Here are the essential elements typically found within an effective budget framework for associations:

- **Revenue Sources:** Primarily includes homeowner assessments (monthly, quarterly, or annual fees). Other potential income streams might involve laundry facility income, amenity rental fees, or late payment fees.

- **Operating Expenses:** These are the day-to-day costs required to run the association.

- **Utilities:** Costs for common area electricity, water, gas, and sewer.

- **Maintenance & Repairs:** Routine upkeep of common areas, landscaping, cleaning services, pest control, and minor repairs.

- **Insurance:** Premiums for property, liability, and D&O (Directors & Officers) insurance.

- **Administrative:** Management fees, legal counsel, accounting services, office supplies, and communication costs.

- **Security:** Costs for security systems, personnel, or access control.

- **Reserve Fund Contributions:** A critical, often legally mandated, component. This allocates funds for the future repair and replacement of major common elements that have a limited useful life, such as roofs, elevators, parking lots, and major mechanical systems. A proper reserve study informs these contributions.

- **Contingency Fund:** A small percentage of the budget often set aside for unexpected, unbudgeted expenses that may arise during the year.

Crafting Your Condo Financial Plan: A Step-by-Step Guide

Developing an annual budget for condominiums is a cyclical process that benefits greatly from a structured approach. Utilizing a standardized budget format simplifies this complex task, ensuring that no critical element is overlooked and that the financial roadmap for communities is sound.

The following steps outline how a board can effectively utilize and complete a comprehensive financial planning document:

1. **Gather Historical Data:** Begin by collecting financial statements from the previous 2-3 years. This includes income and expense reports, balance sheets, and bank statements. Historical data provides a baseline for projecting future costs and identifying trends.

2. **Review the Reserve Study:** The reserve study is a professional assessment of the association’s major components, their remaining useful life, and the estimated cost of their replacement. This document is crucial for determining adequate reserve fund contributions. Ensure your contributions align with the study’s recommendations to avoid future special assessments.

3. **Project Income:** Calculate the total expected revenue. The primary income source will be homeowner assessments. Consider any other consistent income streams. If a fee increase is anticipated, factor that into your projections.

4. **Estimate Operating Expenses:** Go line by line through your operating expenses. Obtain quotes for services (landscaping, snow removal, insurance) and factor in anticipated increases due to inflation or contract changes. Be realistic and account for any known upcoming projects or service level changes.

5. **Allocate for Reserves and Contingency:** Based on your reserve study and any unexpected past expenditures, allocate appropriate amounts to the reserve fund and a smaller contingency fund. This ensures you are prepared for both planned capital improvements and unforeseen emergencies.

6. **Draft the Budget:** Input all projected income and expenses into your chosen template. Ensure that projected income at least equals or ideally exceeds projected expenses, including reserve contributions.

7. **Review and Refine:** Present the draft budget to the full board for review. Encourage discussion, questions, and suggestions. It’s often beneficial to have a budget committee perform an initial review before the full board. Consider potential challenges and opportunities for cost savings.

8. **Seek Professional Advice:** For complex associations or significant financial decisions, consulting with a qualified CPA or a financial advisor specializing in HOA financial management can provide valuable insights and ensure compliance with relevant regulations.

9. **Communicate with Residents:** Once the board approves a final draft, communicate the proposed budget to residents well in advance of the annual meeting. Provide clear explanations for any significant changes, especially assessment increases. Transparency fosters trust and understanding.

10. **Adopt the Budget:** Hold a formal meeting where residents can vote on or ratify the proposed budget, as required by your association’s bylaws. Once adopted, the budget becomes the financial guide for the upcoming fiscal year.

Maximizing Your Budget’s Impact: Best Practices

Beyond merely filling in numbers, managing association finances effectively requires ongoing vigilance and strategic planning. A comprehensive community financial template is a powerful tool, but its true impact is realized through consistent application of best practices. Regularly reviewing and adapting your operational budget for condos will ensure its continued relevance and accuracy.

One crucial practice is regular financial reporting. The board should review actual income and expenses against the budget projections at least monthly, if not quarterly. This allows for early detection of variances, enabling corrective action before minor discrepancies become major problems. Another key practice involves proactive vendor management, periodically soliciting bids for services to ensure competitive pricing and high-quality work, which can lead to significant cost savings. Furthermore, clear communication with homeowners about the budget’s details and rationale is paramount. Explaining the "why" behind financial decisions helps alleviate concerns and fosters a sense of shared responsibility for the community’s fiscal health.

Leveraging Technology for Budget Management

In today’s digital age, relying solely on spreadsheets for your association budget can be inefficient. Modern property management software often includes robust financial modules that streamline the entire budgeting process. These tools can automate assessment collection, track expenses in real-time, generate detailed financial reports, and even integrate with reserve fund planning. Such technological solutions enhance accuracy, reduce manual errors, and free up board members’ time, allowing them to focus on strategic governance rather than tedious data entry. Utilizing a digital master budget document can transform how an association approaches its fiscal health guide.

Frequently Asked Questions

What is the primary purpose of an association budget?

The primary purpose of an association budget is to provide a comprehensive financial plan for the fiscal year, detailing projected income (mainly homeowner assessments) and expenses (operating costs, maintenance, reserves). It serves as a guide for financial decision-making and ensures the association can meet its obligations and maintain common elements effectively.

How often should a condo association budget be reviewed and updated?

A condo association budget should be reviewed and updated annually for formal adoption. However, board members should review actual income and expenses against the budget at least monthly or quarterly to monitor financial performance, identify variances, and make necessary adjustments throughout the year.

What is a reserve fund, and why is it important in a condo budget?

A reserve fund is a separate savings account designated for the future repair and replacement of major common elements (e.g., roofs, elevators, roads) that have a limited useful life. It’s crucial because it prevents the need for large, unexpected special assessments when these major components require costly work, ensuring long-term financial stability and property value preservation.

Can a condo association operate without a formal budget template?

While an association *can* operate without a formal template, it is highly inadvisable. Without a structured Condo Association Budget Template or similar financial plan, associations risk disorganized finances, inefficient spending, lack of transparency, difficulty in long-term planning, and potential legal issues. A formal budget provides clarity, accountability, and a roadmap for sound fiscal management.

Who is responsible for creating and approving the association budget?

The board of directors is primarily responsible for preparing and proposing the association budget. They may delegate the initial drafting to a budget committee or property manager. The final proposed budget is then typically presented to the homeowners for review and adoption or ratification, according to the association’s specific bylaws and state regulations.

Effective fiscal planning is the bedrock of a thriving condominium community. By embracing a well-structured approach to financial management, starting with a robust budget framework, associations can ensure stability, prevent financial crises, and enhance the quality of life for all residents. It’s an ongoing commitment that pays dividends in the form of well-maintained properties, satisfied homeowners, and a secure future.

Don’t let the complexity of community finances deter your board. With the right tools and a disciplined approach, creating and managing your association’s financial plan can be a streamlined and transparent process. Invest the time and effort into developing a comprehensive fiscal planning document, and watch your community flourish under sound financial stewardship.