Creating invoices can be a tedious and time-consuming process, especially for small businesses and freelancers. Thankfully, with the power of Excel, you can easily streamline this process and create professional invoices in minutes. In this article, we’ll guide you through creating a basic billing template in Excel that will help you save time, reduce errors, and improve your cash flow.

1. Basic Structure

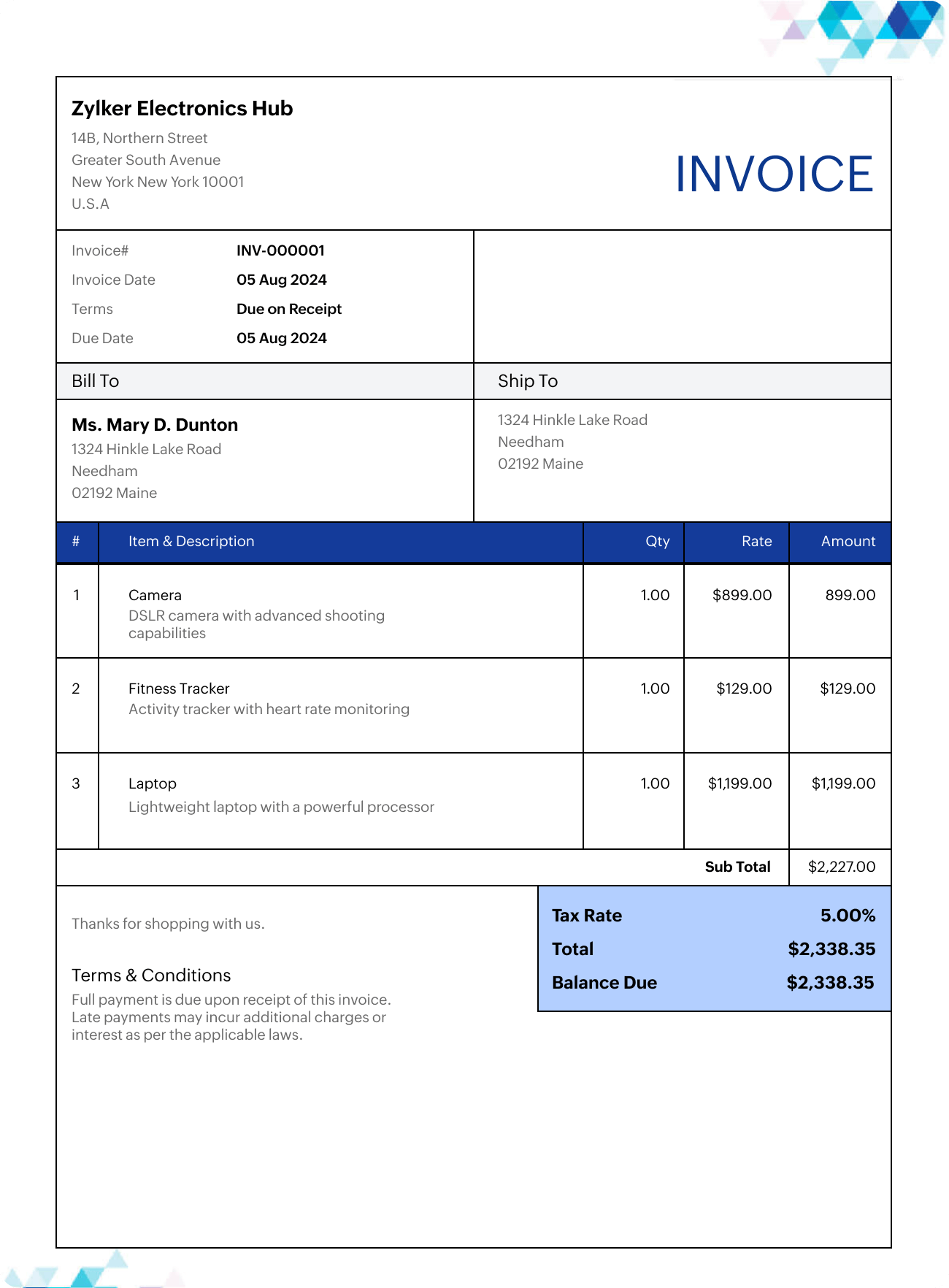

Client Information:

Client Name

Company Name (if applicable)

Contact Information (Phone, Email, Address)

Image Source: zoho.com

Invoice Number

Invoice Date

Due Date

Description

Quantity

Unit Price

Amount

Payment Methods (e.g., Bank Transfer, Credit Card)

Late Payment Fees (if applicable)

Subtotal

Tax (if applicable)

Total Amount Due

2. Formatting

Use clear and concise headings.

3. Formulas

Automate calculations: Use formulas to automatically calculate the total amount for each item (Quantity Unit Price).

4. Adding Features

Create a drop-down list for common services or products. This saves time and reduces errors.

5. Tips for Efficient Use

Save the template as a separate file. This allows you to reuse the template for all future invoices.

6. Going Further

Explore advanced Excel features:

Conclusion

By creating a customized billing template in Excel, you can significantly streamline your invoicing process. With a well-designed template, you can save time, reduce errors, and improve cash flow. Remember to regularly review and update your template to ensure it remains efficient and meets your evolving business needs.

FAQs

How do I add a logo to my Excel invoice?

Can I track payments in my Excel invoice?

How do I protect my invoice template from accidental changes?

Can I send invoices directly from Excel?

How do I ensure my invoices are professional?

I hope this comprehensive guide helps you create effective billing templates in Excel!

Billing Template Excel