A Power of Attorney for Finances (POA for Finances) is a legal document that grants another person (called an “agent” or “attorney-in-fact”) the authority to act on your behalf in financial matters. This can be incredibly helpful in situations where you are unable to manage your own finances, such as during a medical emergency, extended travel, or if you have a disability.

Who Needs a POA for Finances?

Essentially, anyone can benefit from having a POA for Finances. Here are some common scenarios:

Seniors: As people age, they may experience cognitive decline or physical limitations that make it difficult to handle their own finances. A POA allows them to maintain control over their finances while ensuring their needs are met.

Key Provisions of a POA for Finances

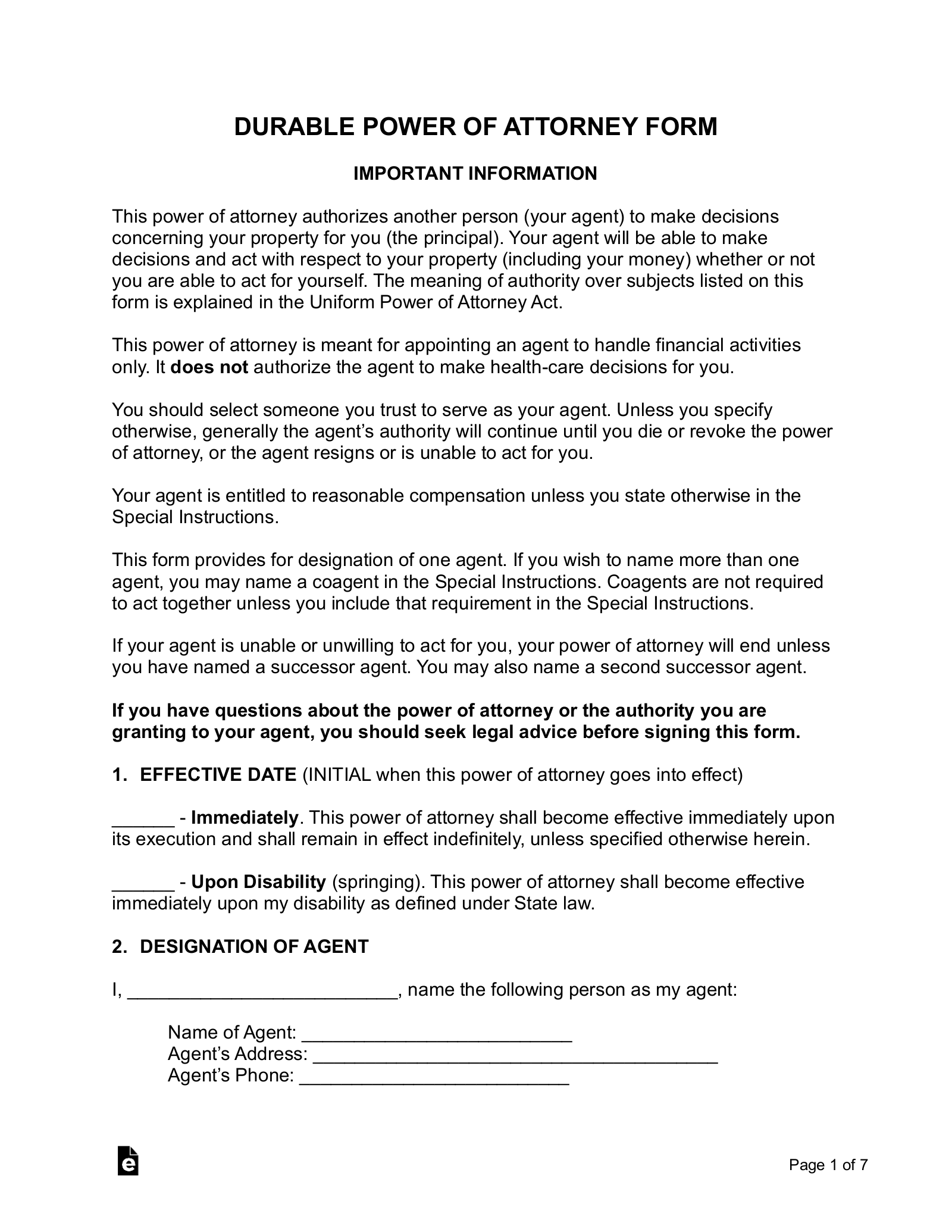

Image Source: eforms.com

A typical POA for Finances may include provisions for the following:

Banking:

Open, close, and manage bank accounts.

Access and withdraw funds from bank accounts.

Write checks and make electronic transfers.

Buy and sell stocks, bonds, and other securities.

Manage investment portfolios.

Make contributions to retirement accounts.

Buy, sell, and rent property.

Sign leases and mortgage documents.

Pay property taxes and insurance.

Pay bills for utilities, phone, internet, and other services.

Manage insurance policies, including health, life, and auto insurance.

Prepare and file tax returns.

Types of POA for Finances

There are two main types of POA for Finances:

General Power of Attorney: This is a broad document that grants your agent the authority to handle all of your financial matters.

Creating a POA for Finances

Choose Your Agent Carefully: Select someone you trust implicitly and who has the financial acumen to manage your affairs responsibly.

Important Considerations

State Laws: The laws governing POAs vary from state to state. It’s essential to consult with an attorney to ensure your POA complies with the laws of your state of residence.

Conclusion

A Power of Attorney for Finances is a valuable tool that can provide peace of mind and ensure your financial well-being. By carefully selecting an agent and having a properly executed POA in place, you can ensure that your financial affairs are managed effectively, even if you are unable to handle them yourself.

FAQs

1. Can I revoke my Power of Attorney for Finances?

Yes, you can revoke your POA at any time by providing your agent with written notice.

2. What happens if my agent misuses their authority?

If your agent misuses their authority under the POA, you may be able to take legal action against them.

3. Can I limit the duration of my Power of Attorney?

Yes, you can specify a start and end date for your POA.

4. Can I create a separate POA for different types of financial transactions?

Yes, you can create multiple POAs, each with specific limitations on your agent’s authority.

5. What happens if I become incapacitated and don’t have a POA?

If you become incapacitated and don’t have a POA, a court may need to appoint a guardian or conservator to manage your finances. This process can be time-consuming and costly.

Power Of Attorney For Finances Form