Creating professional invoices is crucial for any business, whether you’re a freelancer, a small business owner, or a large corporation. While there are many invoicing software options available, using Excel can be a cost-effective and customizable solution. This guide will walk you through creating a basic invoice bill format in Excel, making it easy to track your income and expenses.

1. Setting Up Your Worksheet

Create a New Worksheet: Start by opening a new Excel workbook and creating a new sheet.

2. Formatting Your Invoice

Headers and Footers:

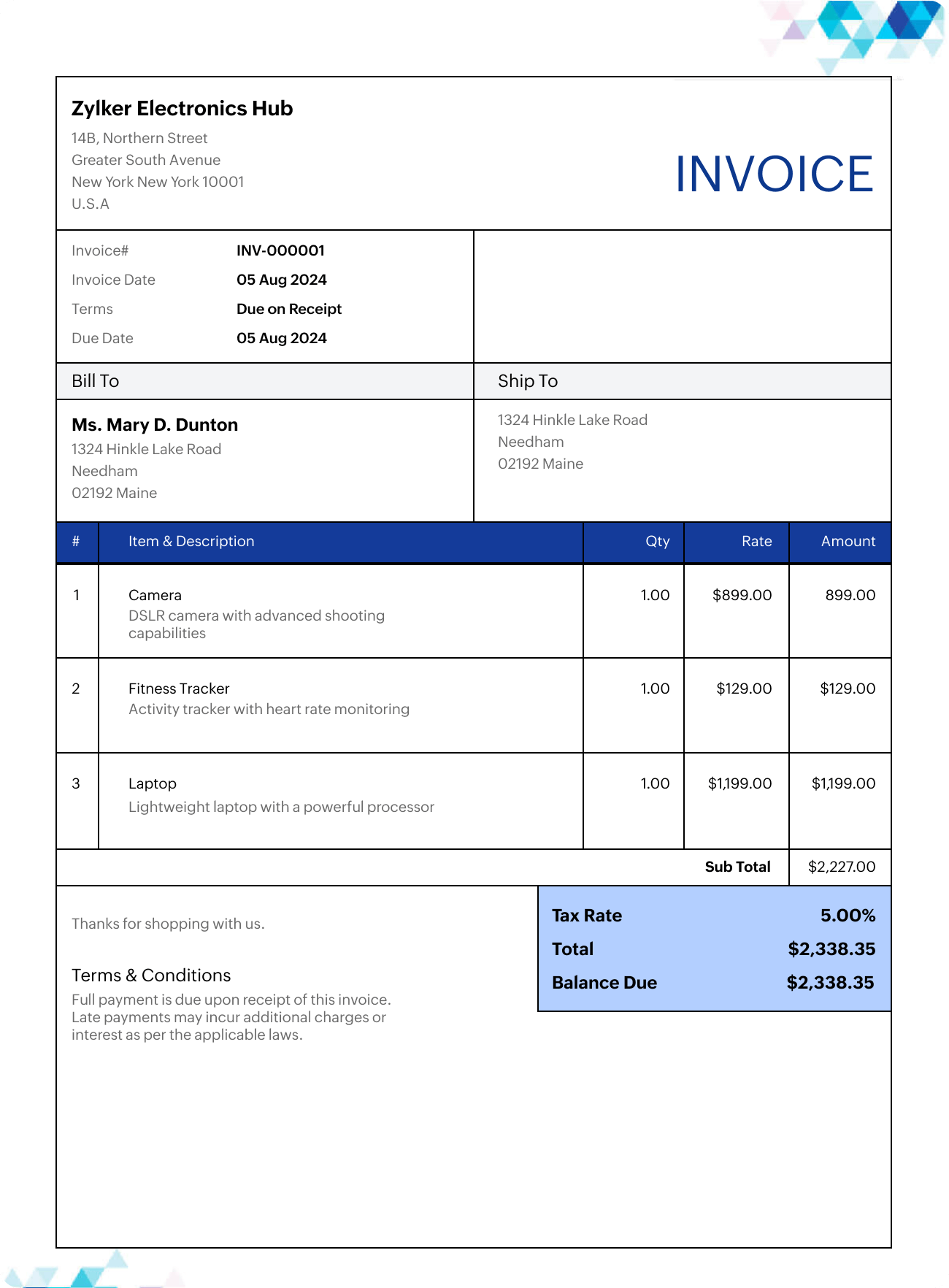

Image Source: zoho.com

Cell Formatting:

Borders and Shading:

3. Automating Calculations

Formulas: Use Excel formulas to automate calculations:

4. Creating Invoice Numbers

Auto-Increment: Use Excel’s auto-increment feature to automatically generate unique invoice numbers.

5. Adding Professional Touches

Conditional Formatting: Use conditional formatting to highlight overdue invoices.

6. Tips for Effective Invoice Creation

Be Clear and Concise: Use clear and concise language in your invoice descriptions.

Conclusion

By following these steps, you can easily create professional and effective invoice bill formats in Excel. This will help you streamline your invoicing process, improve cash flow, and maintain accurate financial records. Remember to customize your invoice to suit your specific business needs and preferences.

FAQs

1. Can I use Excel templates for invoicing?

Yes, you can easily find and use pre-designed invoice templates in Excel. These templates provide a ready-to-use structure and formatting, saving you time and effort.

2. How can I track invoice payments in Excel?

You can add a “Payment Date” column to your invoice sheet and manually enter the date when payment is received. Alternatively, you can use Excel’s built-in features such as conditional formatting to highlight unpaid invoices.

3. Can I integrate Excel with other business tools?

Yes, you can integrate Excel with other business tools such as accounting software, project management tools, and CRM systems. This can help you streamline your workflow and improve efficiency.

4. How can I ensure the security of my invoices?

To ensure the security of your invoices, avoid sending sensitive information via email. Consider using secure file transfer methods or password-protecting your invoices.

5. What are the advantages of using Excel for invoicing?

Some of the advantages of using Excel for invoicing include cost-effectiveness, flexibility, and customization options. Excel is a widely available and affordable software that allows you to create invoices that meet your specific business needs.

Invoice Bill Format In Excel