A Limited Power of Attorney (LPOA) is a legal document that allows you to appoint someone you trust (called your “attorney-in-fact”) to make specific decisions on your behalf. Unlike a General Power of Attorney, which grants broad authority, an LPOA restricts your attorney-in-fact’s powers to specific areas of your life.

Why would you need an LPOA?

There are many situations where an LPOA can be incredibly helpful:

Medical Emergencies

Financial Matters

An LPOA can give your attorney-in-fact the authority to manage your finances. This could involve:

Real Estate Transactions

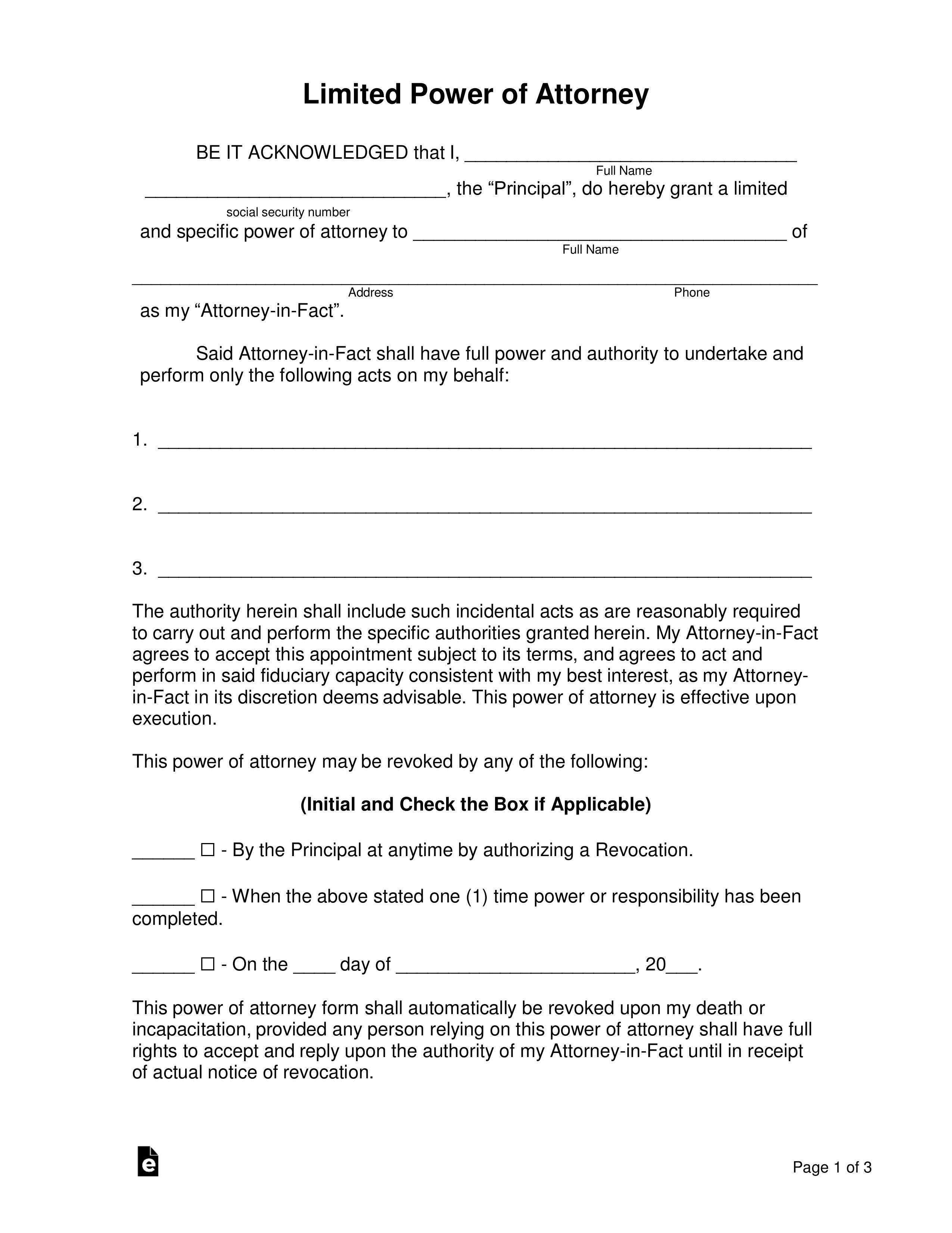

Image Source: eforms.com

If you’re unable to handle property matters yourself, an LPOA can empower your representative to:

Business Operations

For business owners, an LPOA can be essential for ensuring the smooth continuation of operations. It can allow your designated representative to:

Creating a Limited Power of Attorney:

The process of creating an LPOA may vary slightly depending on your location. However, generally, you will need to:

1. Choose your attorney-in-fact: Select a trustworthy and responsible individual who understands your wishes and is willing to act in your best interests.

2. Consult with an attorney: An attorney can guide you through the legal requirements for creating an LPOA in your jurisdiction and ensure that the document is legally sound and meets your specific needs.

3. Draft the document: You can either work with an attorney to draft the LPOA or use a pre-printed form, but it’s crucial to have an attorney review it before signing.

4. Sign and notarize the document: Once you have reviewed and understood the document, you will need to sign it in the presence of a notary public.

5. Store the document safely: Keep the original LPOA in a secure and easily accessible location, such as a safe deposit box or with a trusted family member or attorney.

Important Considerations:

Clarity and Specificity: Clearly define the scope of your attorney-in-fact’s powers. The more specific the LPOA, the less room there is for ambiguity or misuse of authority.

Conclusion

A Limited Power of Attorney is a valuable legal tool that can provide peace of mind and ensure your wishes are carried out in the event of your incapacity. By carefully considering your needs and working with an attorney to create a well-drafted LPOA, you can protect yourself and your loved ones.

FAQs

What is the difference between a Limited Power of Attorney and a General Power of Attorney?

A General Power of Attorney grants your attorney-in-fact broad and unrestricted authority to act on your behalf. In contrast, a Limited Power of Attorney restricts their powers to specific areas, such as medical decisions or financial matters.

Do I need a lawyer to create an LPOA?

While not always strictly required, it’s highly recommended to consult with an attorney when creating an LPOA. An attorney can ensure the document is legally sound, complies with your state’s laws, and accurately reflects your wishes.

Can I revoke my LPOA?

Yes, most LPOAs are revocable. You can typically revoke your LPOA at any time by creating a new document or by notifying your attorney-in-fact and any relevant parties in writing.

What happens if I become incapacitated and lack an LPOA?

If you become incapacitated and lack an LPOA, a court may need to appoint a guardian or conservator to make decisions on your behalf. This process can be time-consuming and costly, and the court’s decisions may not align with your wishes.

Can I use a pre-printed LPOA form?

Pre-printed LPOA forms are available, but it’s crucial to have an attorney review them to ensure they are appropriate for your specific circumstances and comply with your state’s laws.

Disclaimer: This article is for informational purposes only and does not constitute legal advice. You should always consult with a qualified attorney for legal guidance on any legal matter.

Limited Power Of Attorney Form