So, you’re thinking about lending or borrowing money? Whether it’s a friend in need, a small business loan, or even a family member needing a hand, it’s crucial to have everything documented properly. That’s where a loan agreement template comes in handy.

A loan agreement is essentially a legally binding contract that outlines the terms and conditions of a loan between two parties: the lender and the borrower. This document protects both parties involved by clearly defining:

The amount of the loan: This seems obvious, but it’s vital to have the exact loan amount clearly stated.

Why is a Loan Agreement Important?

You might be thinking, “We’re just friends/family, we don’t need a formal contract.” While that might seem true in some cases, a loan agreement offers several key benefits:

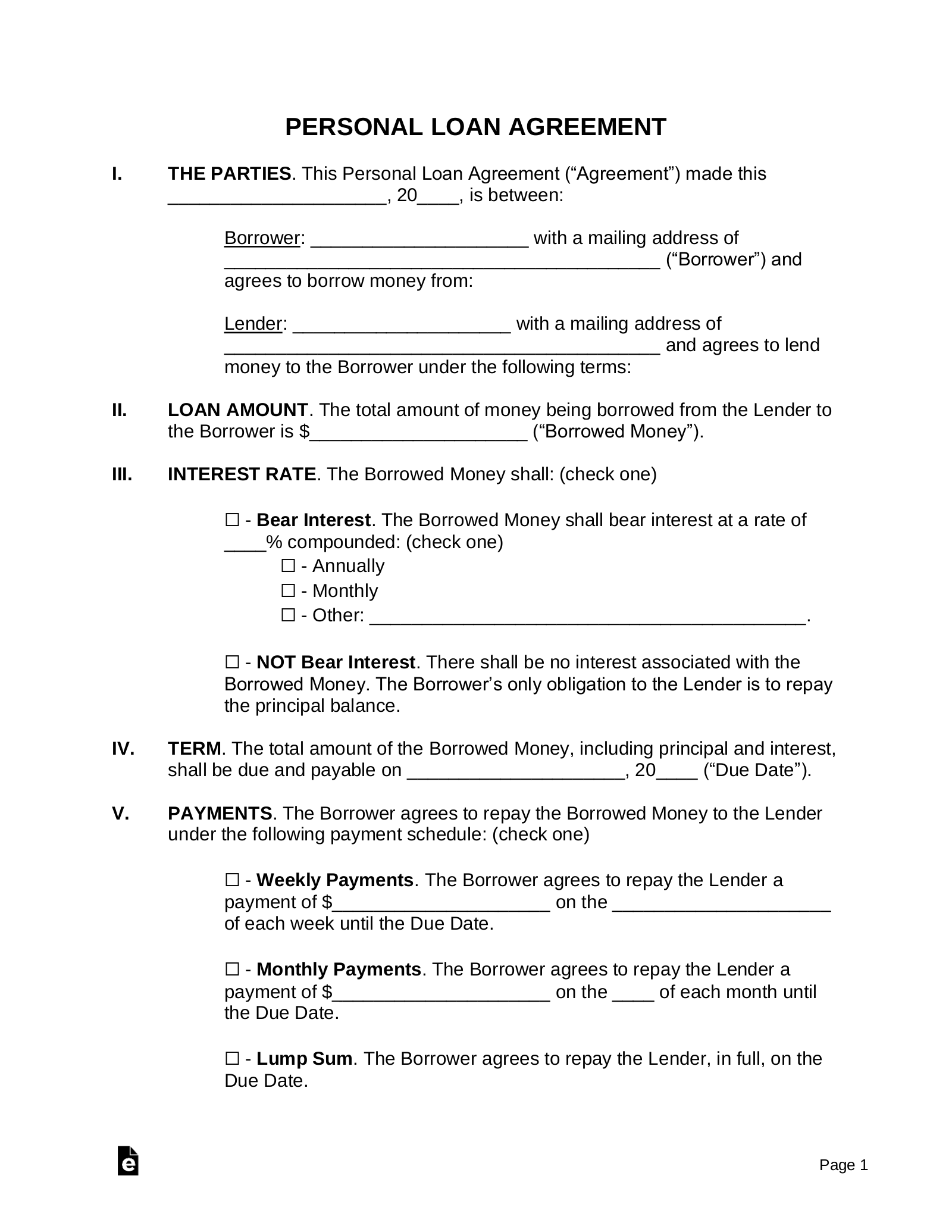

Image Source: eforms.com

Protects both parties: It clearly outlines the responsibilities and expectations of both the lender and the borrower.

Where to Find a Free Loan Agreement Template

The good news is that you don’t need to hire a lawyer to draft a loan agreement. Many resources offer free templates that you can easily adapt to your specific needs. Here are a few popular options:

Online Legal Resources: Websites like Rocket Lawyer, LegalZoom, and Nolo provide free loan agreement templates and often offer other legal resources as well.

Tips for Using a Loan Agreement Template

While free templates are a great starting point, it’s crucial to review and customize them to fit your specific situation. Here are some key tips:

Read the template carefully: Before you start filling in the blanks, make sure you understand all the terms and conditions of the template.

Beyond the Basics: Key Considerations

Interest Rates: Determine a fair interest rate based on prevailing market conditions and the risk associated with the loan.

Conclusion

A well-drafted loan agreement is an essential tool for any lending or borrowing situation. By using a free template and taking the time to customize it to your specific needs, you can protect yourself and ensure that the loan process is smooth and transparent for all parties involved.

FAQs

1. What happens if the borrower defaults on the loan?

2. Can I modify a free loan agreement template?

3. Do I need to have the loan agreement notarized?

4. What types of loans require a formal agreement?

5. Can I use a loan agreement template for personal loans between friends and family?

This article provides a basic overview of loan agreements. It’s important to remember that this information is for general guidance only and should not be considered legal advice.

Disclaimer: This information is provided for general knowledge and informational purposes only and does not constitute legal, financial, or other professional advice.

I hope this comprehensive guide helps you understand the importance of a loan agreement and empowers you to make informed decisions when lending or borrowing money.

Loan Agreement Template Free