Embarking on the journey of planting a new church is an exhilarating adventure, filled with spiritual passion, community vision, and profound hope. It’s a calling that requires immense faith and dedication, but also meticulous planning. Beyond the theological groundwork and outreach strategies, a robust financial strategy is absolutely critical. Many aspiring church planters, consumed by the spiritual and relational aspects, often underestimate the significant financial infrastructure required to launch and sustain a vibrant ministry.

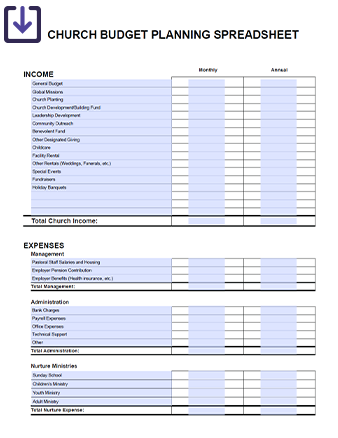

This is where a well-structured Church Plant Budget Template becomes an indispensable tool. It’s more than just a spreadsheet; it’s a living document that translates your vision into actionable financial steps, providing clarity, accountability, and peace of mind. For church planters, their core teams, and even potential donors, understanding the financial landscape from the outset is paramount to building a resilient foundation that can withstand the initial challenges and foster long-term growth.

Why a Solid Financial Foundation is Crucial for New Churches

Launching a new ministry is akin to starting any new venture; it demands careful stewardship of resources. Without a clear financial roadmap, even the most passionate and Spirit-led initiatives can stumble. A comprehensive financial plan helps avoid common pitfalls such as running out of funds prematurely, making reactive financial decisions, or failing to meet operational needs. It empowers leadership to be proactive, strategic, and transparent with their community and stakeholders.

A well-thought-out church planting financial plan enables leaders to accurately project income and expenses, identify potential funding gaps, and plan for sustainable growth. It fosters an environment of trust, demonstrating to donors and congregants alike that resources are being managed responsibly and aligned with the church’s mission. This level of transparency is not just good practice; it’s a testimony to prudent stewardship that honors God and inspires confidence in the ministry.

What to Expect in a Comprehensive Church Planting Financial Plan

A robust financial template for church plants isn’t just about listing expenses; it’s a dynamic document that covers all facets of your ministry’s financial life, from initial startup costs to ongoing operational expenses and future growth. It provides categories and line items designed specifically for the unique needs of a new faith community, ensuring no critical area is overlooked. Thinking through each of these elements is vital for long-term viability.

When you utilize a detailed new church financial blueprint, you’ll find it typically breaks down costs and income into manageable, understandable sections. This clarity is essential for decision-making and for communicating your financial needs effectively to supporters. Here are some key categories you should anticipate:

- Startup Costs: Initial, one-time expenses before the first public service. This includes things like legal fees for incorporation, branding and website development, initial equipment purchases (sound, projection), first month’s rent deposit, signage, and administrative setup.

- Personnel Expenses: Salaries and benefits for staff, starting with the lead pastor and potentially administrative or worship leaders. Don’t forget associated costs like payroll taxes, health insurance, and retirement contributions.

- Facility Costs: Rent or lease payments, utilities (electricity, water, internet), maintenance, and potential build-out or renovation expenses if you’re acquiring a permanent space early on. For portable churches, this includes rental fees for weekend venues.

- Program & Ministry Expenses: Costs associated with specific ministries like children’s programs (curriculum, supplies, background checks), worship production (music licenses, equipment maintenance, instruments), outreach events, small group materials, and discipleship resources.

- Marketing & Outreach: Advertising, social media campaigns, print materials, community engagement events, and tools to connect with prospective congregants.

- Administrative & Operational: Office supplies, software subscriptions (e.g., giving platforms, church management systems), insurance (liability, property), accounting services, and professional development for staff.

- Contingency Fund: An absolutely crucial element, typically 10-15% of your total budget, set aside for unexpected expenses or revenue shortfalls. This buffer provides financial stability during unforeseen circumstances.

- Income Projections: Alongside expenses, the budget should include realistic projections for giving from initial launch team members, grants, denominational support, and future congregational giving.

Crafting Your Ministry’s Financial Blueprint: Key Considerations

While a Church Plant Budget Template provides a solid framework, its true value lies in how you customize it to fit your unique vision, location, and launch strategy. No two church plants are identical, and your financial plan should reflect your specific context. Consider the distinct characteristics of your community and your chosen approach to ministry.

The first step in tailoring your new church financial blueprint is to conduct thorough research into local costs. What are typical rental rates for commercial spaces or school auditoriums in your target area? What are the average salaries for ministry staff? Are there specific permits or insurance requirements unique to your state or city? Gathering this localized data will make your budget far more accurate and realistic. Furthermore, think about your initial staffing model. Will you launch with a fully paid team, or will many roles be volunteer-based in the early stages? This significantly impacts your personnel expenses.

Another crucial consideration is your launch strategy. Are you starting as a portable church, renting space week-to-week, or do you intend to secure a permanent facility from day one? Each approach has vastly different financial implications regarding facility costs and equipment. A portable church might have higher upfront equipment costs for mobile sound and projection, but lower recurring facility costs, while a permanent space involves significant down payments, renovations, and ongoing mortgage or lease payments. Being honest about these choices early on will define the shape of your startup costs for a church.

Budgeting Best Practices for Sustainable Growth

Developing your initial budget is an important first step, but the real work begins with ongoing financial management. A successful ministry start-up budget isn’t a static document; it’s a dynamic tool that requires regular review and adjustment. Implementing sound budgeting practices from the beginning will set your new church on a path toward financial health and sustainable growth.

One key best practice is to review your budget at least quarterly, if not monthly, with your leadership team or finance committee. This allows you to compare actual income and expenses against your projections, identify variances, and make necessary adjustments. Are you overspending in one area? Is giving lower than anticipated? Proactive adjustments prevent minor issues from becoming major crises. Furthermore, always strive for transparency in your financial reporting to your congregation and donors. Clear, concise summaries of your financial health build trust and encourage continued support for your ministry launch budget.

Another critical practice is to cultivate a culture of generosity and faithful stewardship within your emerging community. Teach on biblical principles of giving, not just as a means to fund the budget, but as an act of worship and spiritual discipline. Provide convenient and diverse giving options, including online giving platforms. Finally, remember to plan for growth. As your congregation expands, so will your needs for space, staff, and programs. Your initial financial strategy for church planting should have a scalable component, allowing you to gradually expand your operational expenses for a new church without overstretching your resources.

Leveraging Technology for Financial Management

In today’s digital age, technology offers powerful solutions to streamline the financial management of a new ministry. Moving beyond simple spreadsheets, specialized software and platforms can significantly enhance accuracy, efficiency, and transparency. Embracing these tools early on can free up valuable time for church planters and their teams, allowing them to focus more on ministry and less on administrative burdens.

Consider implementing a dedicated church management system (ChMS) that integrates giving, donor management, and basic accounting features. These systems often provide robust reporting capabilities, making it easier to track donations, generate giving statements, and monitor budget adherence. Online giving platforms are also non-negotiable for modern churches, providing convenient options for congregants to contribute regularly and securely. Furthermore, utilizing cloud-based accounting software tailored for non-profits can simplify bookkeeping, expense tracking, and financial reporting, ensuring your financial framework is always up-to-date and accessible.

These technological tools not only help manage the current financial landscape but also provide valuable data for future financial planning and strategic decisions. They can help analyze giving trends, identify areas of overspending, and project future income more accurately. Investing in the right financial technology solutions early on is an investment in the long-term health and efficiency of your new ministry, ensuring that your church’s financial framework remains robust and responsive to its evolving needs.

Frequently Asked Questions

How often should we update our Church Plant Budget Template?

Ideally, you should review and update your new church financial blueprint monthly, or at least quarterly. This allows you to compare actual income and expenses against projections, make necessary adjustments, and stay agile in your financial planning. Major revisions might occur annually, but regular check-ins are crucial for managing cash flow effectively.

What are the biggest financial mistakes new church plants make?

Common mistakes include underestimating startup costs, not having a sufficient contingency fund, failing to project realistic income, being unclear about staff compensation, and neglecting to invest in proper financial systems from the beginning. These oversights can quickly derail even the most promising church launch budget.

Should we seek professional accounting help for our new ministry?

Yes, absolutely. Even if you have a finance-savvy team member, consulting with a professional accountant experienced in non-profit or church accounting is highly recommended. They can help with proper legal structure, tax compliance, payroll setup, and setting up robust internal controls, which are vital for long-term financial integrity and transparency.

How do we balance faith and financial prudence in church planting?

Balancing faith and financial prudence means trusting God’s provision while also being a wise steward of the resources He provides. This involves prayerful planning, setting realistic goals, seeking wise counsel, and being transparent with your community. It’s not about choosing one over the other, but integrating both into a holistic approach to ministry and financial management.

The journey of planting a church is an incredible undertaking, demanding spiritual fervor, strategic vision, and practical wisdom. While the spiritual aspect rightly takes center stage, overlooking the financial health of your emerging ministry can create unnecessary obstacles. A thoughtfully developed and consistently managed Church Plant Budget Template is more than a formality; it’s a foundational pillar that supports your vision and helps ensure the long-term viability and impact of your new community.

By embracing a comprehensive financial strategy, diligently planning for both anticipated and unexpected expenses, and leveraging modern tools for financial oversight, you empower your church to not only survive but thrive. It enables you to focus on the core mission of making disciples, serving your community, and spreading the Gospel, knowing that the financial framework is sound. Take the proactive step today to secure your ministry’s future by building a robust and adaptable financial plan.