Navigating the financial landscape of a church can often feel like a delicate balance between spiritual stewardship and practical management. While the primary mission revolves around ministry, community outreach, and spiritual growth, these vital endeavors require a stable and transparent financial foundation to truly flourish. Without a clear financial roadmap, even the most well-intentioned efforts can falter, leading to missed opportunities and potential challenges in fulfilling the congregation’s vision.

This is where a structured approach to financial planning becomes not just beneficial, but essential. Imagine a tool that empowers your leadership to allocate resources wisely, track progress, ensure accountability, and communicate financial health effectively to your members. Such a tool transforms abstract financial goals into concrete, actionable steps, providing peace of mind and clarity for everyone involved in your ministry’s operations.

Why a Robust Financial Plan is Crucial for Ministry

A comprehensive financial strategy serves as the backbone of any thriving church, providing much more than just a numerical overview. It embodies a commitment to responsible stewardship, reflecting the congregation’s values and priorities in tangible ways. When funds are managed effectively, ministries can expand, outreach programs can reach more people, and the core mission of the church can be pursued with greater impact.

Beyond simply paying the bills, a well-thought-out financial framework fosters an environment of trust and transparency. Members are more likely to contribute generously when they understand how their donations are being utilized to further the Kingdom. This transparency also builds confidence within the leadership team, enabling them to make informed decisions that align with both spiritual goals and fiscal realities. A strong financial plan empowers churches to anticipate future needs, prepare for unexpected challenges, and seize new opportunities for growth and service.

Beyond the Numbers: The Broader Impact of a Solid Spending Plan

The benefits of a meticulously crafted spending outline extend far beyond mere accounting practices. A clear congregational spending guide acts as a powerful communication tool, bridging the gap between financial realities and spiritual aspirations. It allows leadership to articulate their vision for the coming year, demonstrating how every dollar contributes to that overarching mission. This narrative helps members connect their giving directly to the tangible outcomes of the church’s work, fostering a deeper sense of ownership and collective purpose.

Moreover, a well-defined financial roadmap minimizes internal friction and promotes unity. When financial decisions are made transparently and are rooted in an agreed-upon plan, potential misunderstandings regarding resource allocation are significantly reduced. It provides an objective basis for discussions and adjustments, ensuring that all voices are heard and that the church’s resources are directed towards the greatest good. Ultimately, a sound financial strategy is a testament to wise leadership and a catalyst for sustained spiritual impact.

Key Components of an Effective Ministry Financial Blueprint

Developing a strong ministry financial blueprint requires attention to several core categories. Understanding these components is the first step toward creating a document that truly serves your church’s unique needs and vision.

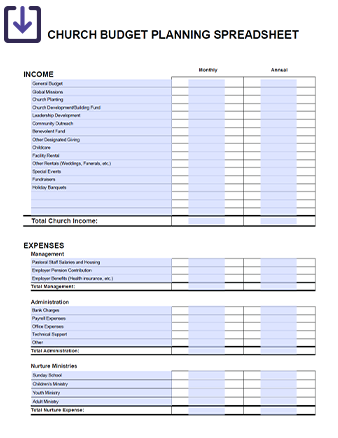

- Income Sources: This section details all anticipated revenue streams. For most churches, this primarily includes tithes and offerings from members. However, it can also encompass designated gifts, fundraising events, facility rentals, grant income, or even revenue from specific ministries like a bookstore or café. It’s crucial to estimate these figures realistically based on historical data and projected growth.

- Operating Expenses: These are the day-to-day costs required to keep the church running. They typically fall into several sub-categories:

- Personnel: Salaries, benefits, payroll taxes for pastors, administrative staff, worship leaders, and other employees. This is often the largest expense category.

- Facilities: Mortgage or rent payments, utilities (electricity, gas, water), insurance, maintenance, repairs, and janitorial services.

- Program & Ministry Expenses: Costs associated with specific ministries like children’s programs, youth group activities, adult education, worship services (music, AV, supplies), outreach events, and mission support.

- Administrative: Office supplies, postage, printing, software subscriptions, communication tools, and professional services (accounting, legal).

- Designated Funds & Restricted Gifts: These are funds given by donors for a specific purpose (e.g., missions, building fund, youth camp scholarships). They must be tracked separately and spent only according to the donor’s intent, not as part of the general operating fund.

- Capital Expenditures: Large, one-time expenses for significant assets or improvements, such as a new sound system, building renovation, vehicle purchase, or major equipment upgrade. These are typically planned for separately from annual operating costs and may be funded through specific campaigns or savings.

- Contingency/Reserve Funds: A vital component often overlooked, this allocation provides a safety net for unexpected expenses, emergencies, or revenue shortfalls. Maintaining a healthy reserve fund is a sign of fiscal prudence.

Building Your Church’s Financial Framework: A Step-by-Step Guide

Creating an effective annual spending plan for a church might seem daunting, but by following a structured process, your team can develop a robust financial framework that supports your mission. This methodical approach ensures thoroughness, transparency, and buy-in from key stakeholders.

- Review Past Performance: Start by analyzing the previous 2-3 years of actual income and expenses. This historical data provides a realistic baseline for projections and helps identify trends, seasonal fluctuations, and areas where costs might have been consistently over or under budget. Look at both overall financial health and specific ministry spending.

- Define Ministry Goals and Priorities: Before assigning numbers, leadership should clearly articulate the church’s spiritual and strategic goals for the upcoming year. What new ministries are being launched? Are there existing programs that need more resources? Is there a capital project on the horizon? The financial plan should directly reflect and enable these priorities.

- Gather Departmental Requests: Solicit budget requests from ministry leaders, committees, and departments. Provide them with guidelines, past spending data for their area, and the overall church priorities. Encourage them to justify their requests based on specific activities and desired outcomes.

- Estimate Income: Based on historical giving patterns, projected membership growth, planned stewardship initiatives, and any other anticipated revenue sources, make a realistic estimate of expected income. It’s often prudent to be conservative in income projections.

- Draft the Initial Spending Outline: The finance committee or treasurer typically takes the lead in compiling all the requests and income estimates into a preliminary annual financial plan. This draft will likely require adjustments to ensure that expenses do not exceed anticipated income and that the budget aligns with the strategic priorities. This iterative process often involves tough decisions and prioritization.

- Seek Review and Feedback: Present the draft financial outline to key leadership bodies, such as the elder board, deacons, or church council. Allow ample time for review, questions, and discussion. This collaborative phase is crucial for ensuring that the final document reflects collective wisdom and support.

- Present to the Congregation for Approval: For many churches, the congregational financial planning tool requires approval from the broader membership, often at an annual business meeting. Present the yearly financial outline clearly, explaining the rationale behind key allocations and how it supports the church’s mission. Be prepared to answer questions transparently.

- Implement and Monitor Regularly: Once approved, the spending guide becomes the official financial roadmap. Implement it by ensuring that spending adheres to the allocations. Regular monitoring—monthly or quarterly—by the finance committee and leadership is essential to track actual performance against the budget, identify variances, and make necessary adjustments.

Best Practices for Managing Your Congregation’s Finances

Effective financial management goes beyond simply creating an annual spending plan; it involves ongoing diligence and adherence to sound principles. Implementing these best practices will enhance the long-term fiscal health and integrity of your ministry.

First, maintain strict internal controls. This includes segregating duties (e.g., different people handling collections, deposits, and record-keeping), requiring two signatures on checks above a certain amount, and ensuring regular reconciliation of bank statements by someone not involved in day-to-day cash handling. These measures prevent errors and protect against misuse of funds. Second, communicate financial information transparently. Regular updates to the congregation about the church’s financial health, stewardship efforts, and how funds are being used builds trust and encourages consistent giving. This doesn’t mean sharing every line item, but providing clear, digestible summaries.

Third, prioritize stewardship education. Help members understand the biblical principles of giving and the importance of supporting the church’s mission. A well-informed congregation is a more engaged and generous one. Fourth, build a healthy reserve fund. Aim to have at least 3-6 months of operating expenses in reserve. This provides stability, allows for unforeseen expenses, and prevents the church from having to make rash financial decisions during lean times. Finally, conduct an annual independent review or audit. Even for smaller churches, having an outside party review financial records periodically adds an extra layer of accountability and credibility, reassuring both leadership and members.

Customizing Your Spending Guide for Unique Ministry Needs

While a standardized framework provides an excellent starting point, the true power of a Church Annual Budget Template lies in its adaptability. Every church is unique, with distinct sizes, demographics, mission focuses, and growth trajectories. A one-size-fits-all approach rarely suffices, making customization a critical step in developing a truly effective financial blueprint for ministry.

Consider the size of your congregation. A small, volunteer-led church will have different line items and complexities than a large multi-staff church with extensive programs. A template can be scaled down by consolidating categories or scaled up by adding granular detail to specific ministry areas. Likewise, a church deeply involved in community outreach might allocate a larger portion of its funds to local missions and benevolence, whereas a church focused on theological education might prioritize resources for guest speakers, curriculum development, and library expansion.

The "Church Annual Budget Template" should also evolve with your church’s strategic plan. If a capital campaign for a new building is underway, the template needs to incorporate the tracking of campaign pledges and expenses separately. If your church is experiencing rapid growth, you’ll need to account for increased personnel costs, expanded facilities, and new program initiatives. Conversely, if your church is navigating a season of decline, the template can help identify areas for careful reduction and strategic reallocation. Don’t view your yearly financial outline as a rigid document, but rather as a living tool that can be shaped to best serve your ministry’s current reality and future aspirations.

Frequently Asked Questions

How often should a church budget be reviewed?

While an annual budget sets the financial direction for the year, it should be reviewed much more frequently. A monthly or quarterly review by the finance committee or leadership team is highly recommended. This allows for timely identification of variances between actual spending and budgeted amounts, enabling necessary adjustments and ensuring financial health throughout the year.

What’s the difference between a cash-basis and accrual-basis budget for churches?

A **cash-basis** budget records income when cash is received and expenses when cash is paid out. It’s simpler and common for many churches. An **accrual-basis** budget, on the other hand, records income when it’s earned (even if cash hasn’t been received yet) and expenses when they’re incurred (even if not yet paid). Accrual provides a more accurate picture of financial commitments but is more complex to manage.

Can a small church truly benefit from a detailed financial plan?

Absolutely. Even small churches with limited resources benefit immensely from a detailed financial plan. It fosters accountability, ensures resources are directed to core ministries, prevents overspending, and builds trust among members. While the level of detail might be different, the principles of planning and transparency are just as vital.

Who should be involved in the budget creation process?

Typically, the budget process involves the senior pastor, treasurer, finance committee, and relevant ministry heads or team leaders. For many churches, the final annual spending plan for a church is presented to and approved by the entire congregation or an elected board, emphasizing broad ownership and accountability.

What are common pitfalls to avoid when developing a church’s financial outline?

Common pitfalls include overly optimistic income projections, underestimating expenses (especially for maintenance or utilities), failing to include a contingency fund, not involving key stakeholders in the planning process, and neglecting to monitor the budget regularly after approval. A lack of transparency can also erode trust and lead to future financial challenges.

Embracing a systematic approach to financial planning through a well-designed financial management tool for churches is more than just good business practice; it’s an act of faithful stewardship. It demonstrates a commitment to transparency, accountability, and the wise allocation of the resources God has entrusted to your congregation. By providing clarity and direction, a robust financial framework empowers your leadership to focus less on financial worries and more on fulfilling the spiritual mission that defines your ministry.

Invest the time and effort into developing a tailored financial blueprint. It will not only streamline your operations but also strengthen trust within your community and provide the stability needed to pursue your vision with renewed vigor. A thoughtful and well-executed financial plan is a powerful instrument for advancing the Kingdom, ensuring your church can continue to be a beacon of hope and service for years to come.