Creating a Last Will and Testament might seem daunting, but it’s a crucial step in ensuring your wishes are carried out after you’re gone. This document outlines how you want your assets to be distributed, who will care for your children (if applicable), and who you appoint to manage your estate.

While it’s always best to consult with an attorney to draft a legally binding will, understanding basic examples can help you grasp the essential components.

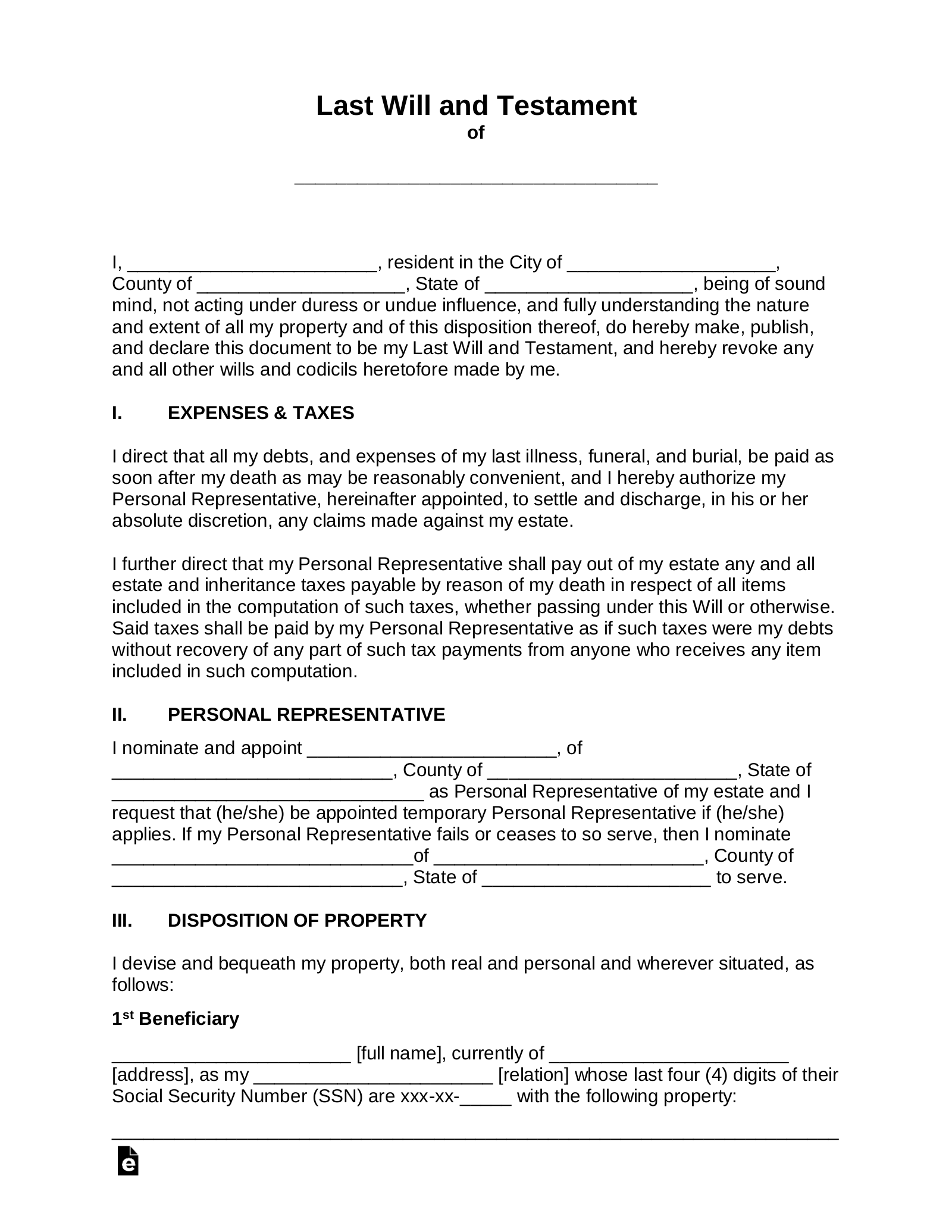

Here are a few common scenarios and how they might be reflected in a Last Will and Testament:

1. Simple Will: Leaving Everything to a Spouse

This is a straightforward scenario where you leave your entire estate to your spouse.

Example:

Image Source: eforms.com

“I, [Your Full Name], of [Your City and State], being of sound mind and memory, do hereby make, publish, and declare this to be my Last Will and Testament, hereby revoking all prior wills and codicils.” (This is a standard opening clause.)

2. Will with Children: Dividing Assets Between Spouse and Children

If you have children, you might choose to divide your assets between your spouse and them.

Example:

[Standard opening clause as above]

3. Will with Special Provisions: Charitable Giving

You can include provisions for charitable donations in your will.

Example:

[Standard opening clause as above]

4. Will with Guardianship for Minor Children

If you have minor children, your will should designate a legal guardian to care for them.

Example:

[Standard opening clause as above]

5. Will with a Trust: Managing Assets for Beneficiaries

A trust can be a valuable tool for managing assets, especially for minor children or beneficiaries with special needs.

Example:

[Standard opening clause as above]

Important Considerations:

State Laws: Will laws vary by state, so it’s crucial to understand the specific requirements in your jurisdiction.

Conclusion:

Creating a Last Will and Testament is an essential part of estate planning. These examples provide a basic overview of common will scenarios, but they are not substitutes for legal advice. Remember to consult with an estate planning attorney to draft a will that accurately reflects your wishes and complies with all applicable laws.

FAQs

1. Do I need a lawyer to create a will?

While you can find DIY will kits or use online will-making services, consulting with an attorney is highly recommended. They can ensure your will is legally valid, addresses your specific needs, and complies with all relevant laws.

2. How often should I review my will?

It’s a good practice to review your will periodically, such as every 3-5 years, or whenever there are significant life changes, such as marriage, divorce, the birth of a child, or the acquisition of substantial assets.

3. Can I change my will after I’ve signed it?

Yes, you can change your will at any time. You can create a new will that revokes the previous one, or you can create a codicil, which is an amendment to your existing will.

4. What happens if I die without a will?

If you die without a valid will (intestate), state laws will determine how your assets are distributed. This may not align with your desired outcome and can lead to lengthy and potentially contentious legal proceedings.

5. Where should I store my will?

Keep your original will in a secure and easily accessible location, such as a safe deposit box or with a trusted attorney or family member.

Last Will Examples