Introduction

So, you’re a freelancer, a small business owner, or perhaps a service provider of any kind. Congratulations! You’re in the exciting world of providing value and getting paid for it. But amidst the hustle and bustle of delivering your services, it’s crucial to keep your finances organized. Enter the service bill – a simple yet powerful document that outlines the services rendered, their corresponding costs, and other important details.

This guide will break down the essential elements of a service bill in a casual and easy-to-understand manner, helping you create professional invoices that get paid faster.

1. Essential Information

Your Business Information:

Business Name:

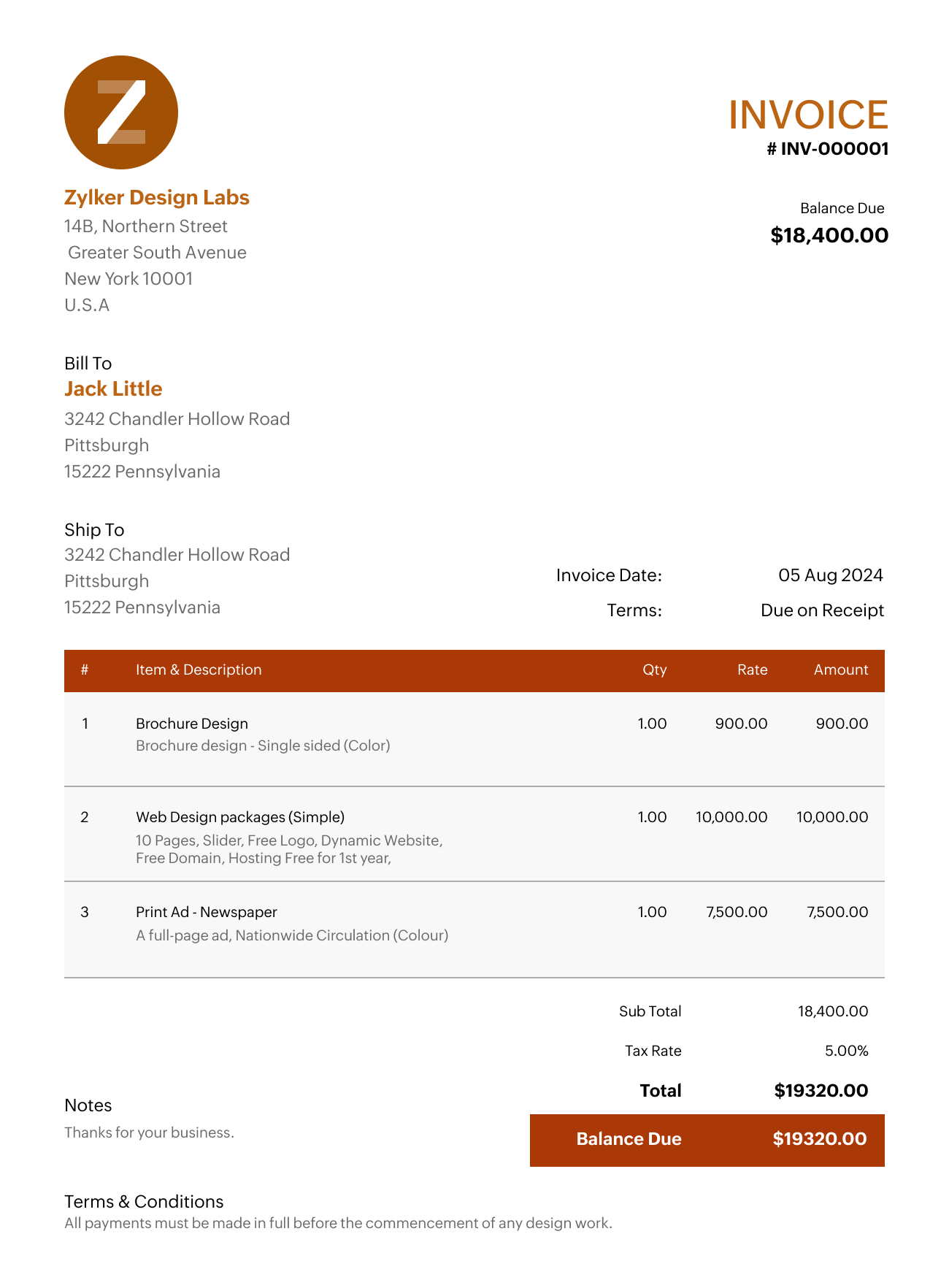

Image Source: zoho.com

Clearly state your business name.

Contact Details:

Include your phone number, email address, and physical address (if applicable).

Website (Optional):

If you have a website, include it for easy client access.

Client Information:

Client Name:

Accurately record the client’s full name or company name.

Contact Information:

Include their phone number, email address, and billing address.

Invoice Number:

Invoice Number:

Assign a unique invoice number to each bill (e.g., INV-001, INV-002). This helps with tracking and record-keeping.

Invoice Date:

Invoice Date:

Clearly state the date the invoice was issued.

Due Date:

Due Date:

Specify the date by which the payment is expected. This sets clear expectations and helps with cash flow management.

2. Service Description

This is the heart of your service bill.

Item/Service Description:

Provide a detailed description of each service performed. Be as specific as possible. For example, instead of “Web Design,” write “Website Design for [Client Name] including 5 pages, homepage slider, and contact form.”

Quantity:

If applicable, specify the quantity of each service provided (e.g., “Number of hours,” “Number of revisions”).

Rate/Price:

Clearly state the rate or price per unit of service.

Amount:

Calculate the total cost for each service item (Quantity x Rate).

3. Payment Terms

Payment Methods:

Accepted Payment Methods:

List the acceptable payment methods, such as credit card, bank transfer, PayPal, or check.

Late Payment Fees (Optional):

If applicable, state any late payment fees or penalties.

4. Tax Information

Tax Information:

If applicable, include any applicable taxes (e.g., sales tax, VAT).

5. Notes and Special Instructions

Notes and Special Instructions:

This section allows you to add any important notes or special instructions related to the invoice. For example:

6. Total Amount

Total Amount:

Subtotal:

Calculate the total cost of all services.

Tax (if applicable):

Calculate the total amount of tax.

Grand Total:

Calculate the total amount due, including taxes.

7. Signatures

Client Signature:

Include a space for the client to sign and date the invoice upon receipt.

Your Signature:

Include a space for your signature and the date.

Creating Your Service Bill: Tips and Tools

Use a Template: Many online platforms and software offer free or paid invoice templates. This can save you time and ensure a professional look.

Conclusion

Creating a professional service bill is a crucial step in running a successful business. By following the guidelines outlined in this guide, you can ensure that your invoices are clear, concise, and easy to understand. This not only improves your professional image but also helps you get paid faster and maintain healthy cash flow.

FAQs

1. What is the difference between an invoice and a receipt?

2. Can I use a generic invoice template for all my clients?

3. How often should I send invoices to my clients?

4. What should I do if a client doesn’t pay on time?

5. Where can I find free invoice templates?

I hope this guide helps you create professional and effective service bills!

Service Bill Format