Okay, let’s talk about creating invoices for your consulting services. No need for fancy jargon here, we’re keeping it simple and effective.

First things first, what exactly should be on your invoice? Think of it as a receipt for your services, clearly outlining what you did and how much you’re charging. Here’s the must-have info:

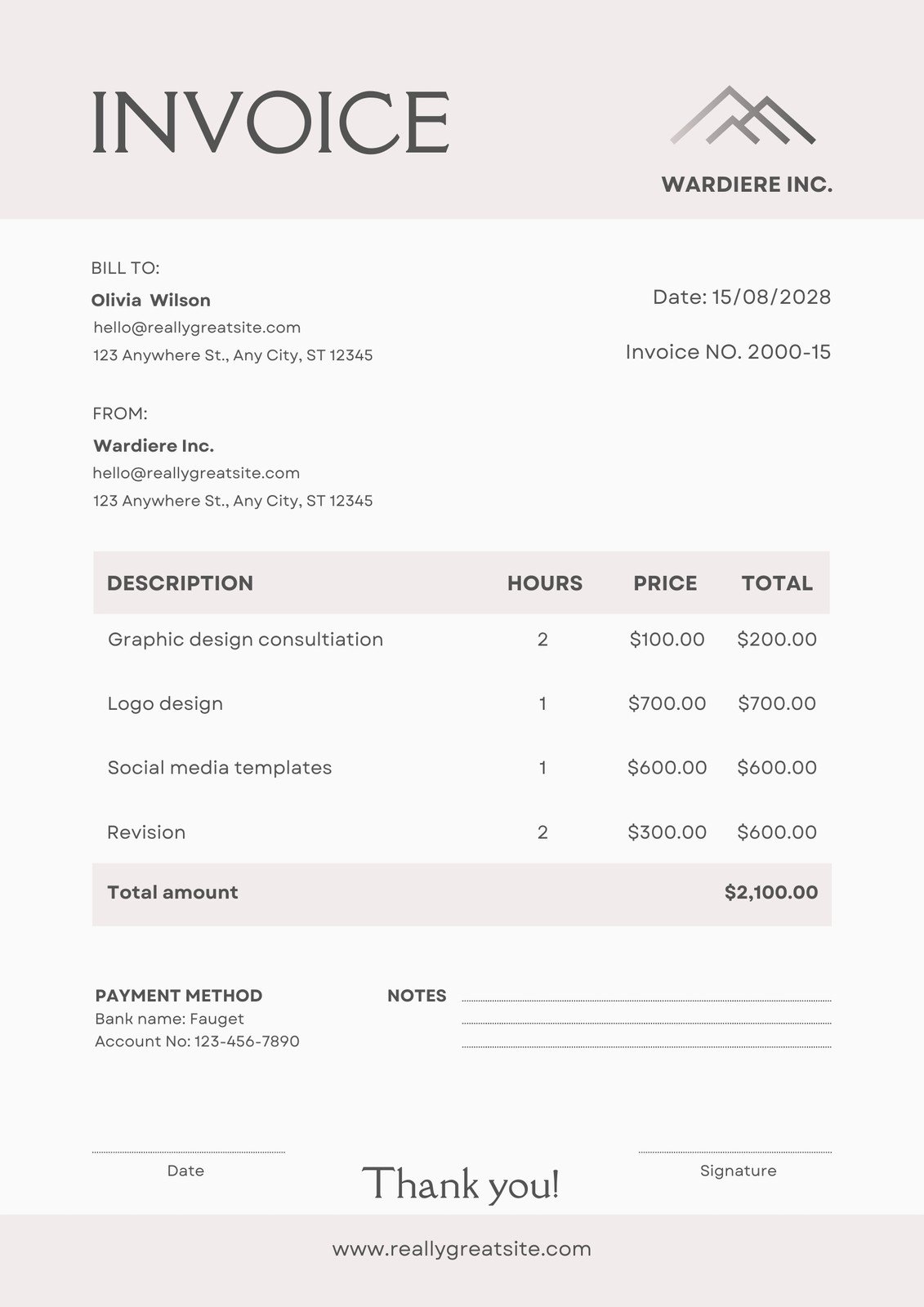

1. Your Business Information

Your Company Name: This is your brand! Make sure it’s prominent.

2. Client Information

Client Name: Who are you invoicing?

3. Invoice Details

Invoice Number: Helps you track and organize invoices. You can use a simple numbering system (e.g., INV-001, INV-002).

4. Service Description

Image Source: canva.com

This is the heart of your invoice. Be specific and clear about the services you provided:

Project Name (if applicable): Helps you and the client easily identify the work.

5. Tax Information (if applicable)

Tax Rate: If you’re required to charge sales tax, include the rate.

6. Total Amount

Subtotal: The total cost of services before tax.

7. Payment Terms

Payment Methods: List the acceptable payment methods (e.g., bank transfer, credit card, PayPal).

8. Your Signature (or Company Stamp)

A professional touch to finalize the invoice.

Tips for Creating a Professional Invoice

Use an Invoice Template: Many word processing programs (like Microsoft Word) and online tools offer free invoice templates. This saves you time and ensures a consistent look.

Choosing the Right Invoicing Software (Optional)

If you’re dealing with many clients or prefer a more automated system, consider using invoicing software. Popular options include:

FreshBooks

These tools can help you create and send invoices quickly, track payments, and manage your finances more efficiently.

Conclusion

Creating a professional invoice is crucial for any consulting business. By following these guidelines and using clear, concise language, you can ensure your clients understand exactly what they’re being charged for and get paid on time.

FAQs

What if I offer different pricing models?

No problem! Your invoice should clearly reflect your pricing. If you charge hourly, list the number of hours worked and your hourly rate. If you charge per project, outline the project scope and the total fee.

How often should I send invoices?

Generally, it’s best to send invoices as soon as the work is completed or at the end of each month (if you have recurring services).

What if the client disputes an invoice?

If a client disputes an invoice, be prepared to discuss it calmly and professionally. Review the invoice together and address any concerns they may have.

Can I include late payment fees?

You can include late payment fees, but it’s always a good idea to clearly state these fees upfront in your contract or on the invoice itself.

What are the best practices for accepting online payments?

If you accept online payments, ensure you use a secure payment gateway (like PayPal or Stripe) to protect your clients’ information.

I hope this helps! Let me know if you have any other questions.

Consultancy Invoice Format