So, you’re looking to get organized with your invoices? Good for you! Invoicing is a crucial part of any business, and using a PDF format can make your life much easier.

What is an Invoice Bill?

Simply put, an invoice bill is a formal document that you send to your clients when you’ve provided them with goods or services. It outlines:

What you’ve done: A detailed description of the products or services you’ve delivered.

Why Use PDF for Invoices?

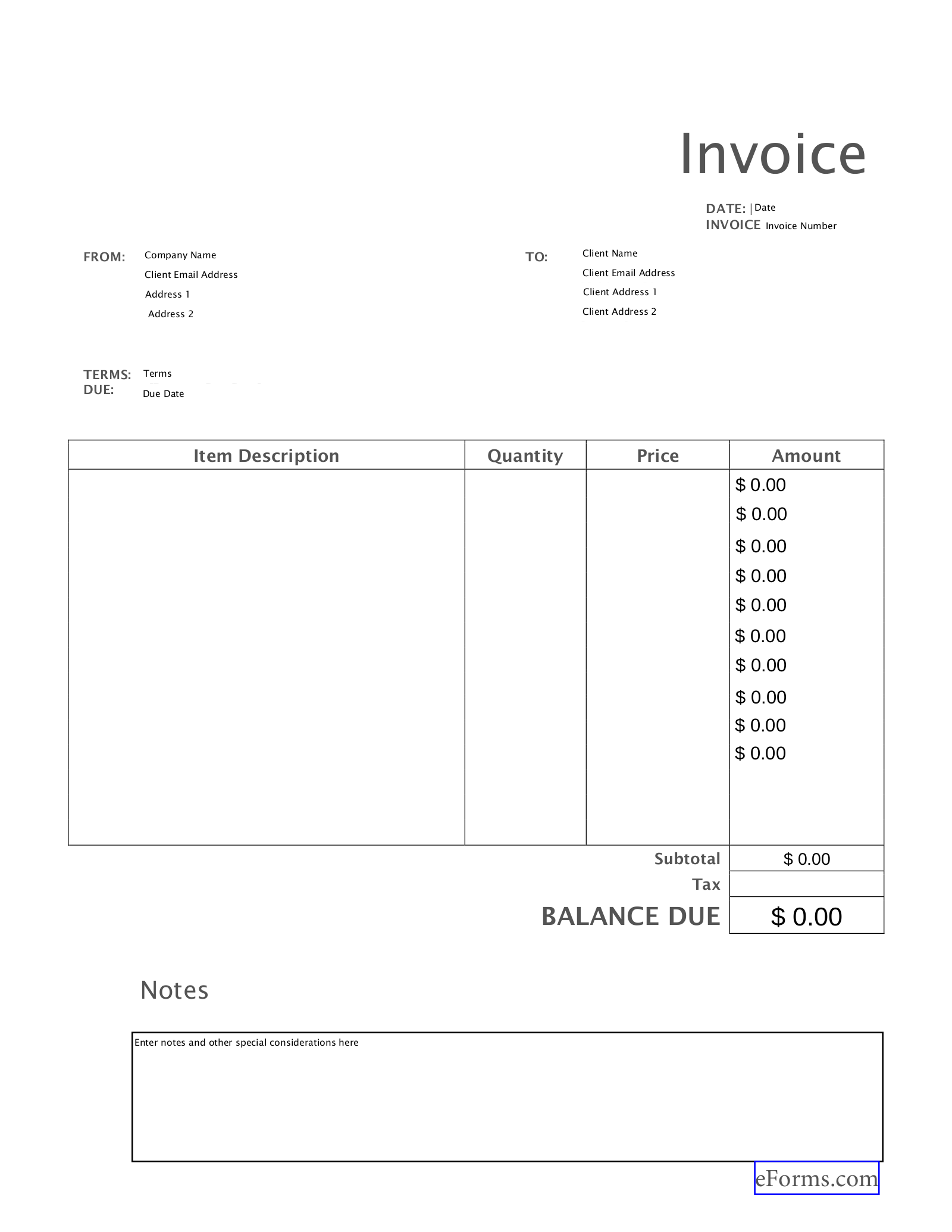

Image Source: eforms.com

PDFs offer several advantages for invoicing:

Professionalism: They present a clean, professional image of your business.

Essential Elements of an Invoice Bill

Here are the key components that every invoice bill should include:

1. Invoice Number

A unique identifier for each invoice.

2. Invoice Date

3. Due Date

The date by which the payment is expected.

4. Client Information

Full Name or Company Name

5. Your Business Information

Your Company Name

6. Invoice Items

Item Description: A detailed description of each product or service provided.

7. Total Amount Due

8. Payment Terms

Clearly state your preferred payment methods (e.g., bank transfer, credit card, online payment).

9. Payment Information

Bank Account Details: (If applicable)

Creating Your Invoice Bill PDF

There are several ways to create professional-looking invoice PDFs:

Use Invoice Software: Many software options are available, both free and paid, such as:

Tips for Effective Invoicing

Send invoices promptly: The sooner you send an invoice, the sooner you’ll get paid.

Conclusion

By following these guidelines and using a professional invoice format, you can streamline your invoicing process, improve cash flow, and maintain a positive relationship with your clients.

FAQs

1. Can I use a generic invoice template?

While generic templates can be a starting point, it’s always best to customize them to reflect your specific business and branding.

2. What if my client doesn’t pay on time?

Clearly state your late payment policy on the invoice. If necessary, send polite reminders and consider offering payment plans.

3. Can I deduct late payment fees?

Yes, you can include late payment fees in your invoice terms. However, be sure to comply with all applicable laws and regulations.

4. How can I ensure my clients receive my invoices?

Send invoices via email and consider sending a follow-up reminder. You can also offer alternative delivery methods such as postal mail or online portals.

5. Should I include terms and conditions on my invoices?

Yes, it’s a good practice to include your terms and conditions on your invoices. This helps to protect your business and manage client expectations.

I hope this guide helps you create professional and effective invoice bills!

Invoice Bill Format Pdf