A Letter of Attorney (POA) is essentially a legal document that empowers one person (the “principal”) to grant another person (the “attorney-in-fact”) the authority to act on their behalf. This can be anything from handling financial matters to making medical decisions.

Why do you need a Letter of Attorney?

Life throws curveballs. You might face situations where you’re unable to handle your own affairs due to:

Medical emergencies: Illness, injury, or surgery can leave you incapacitated.

Key Elements of a Letter of Attorney

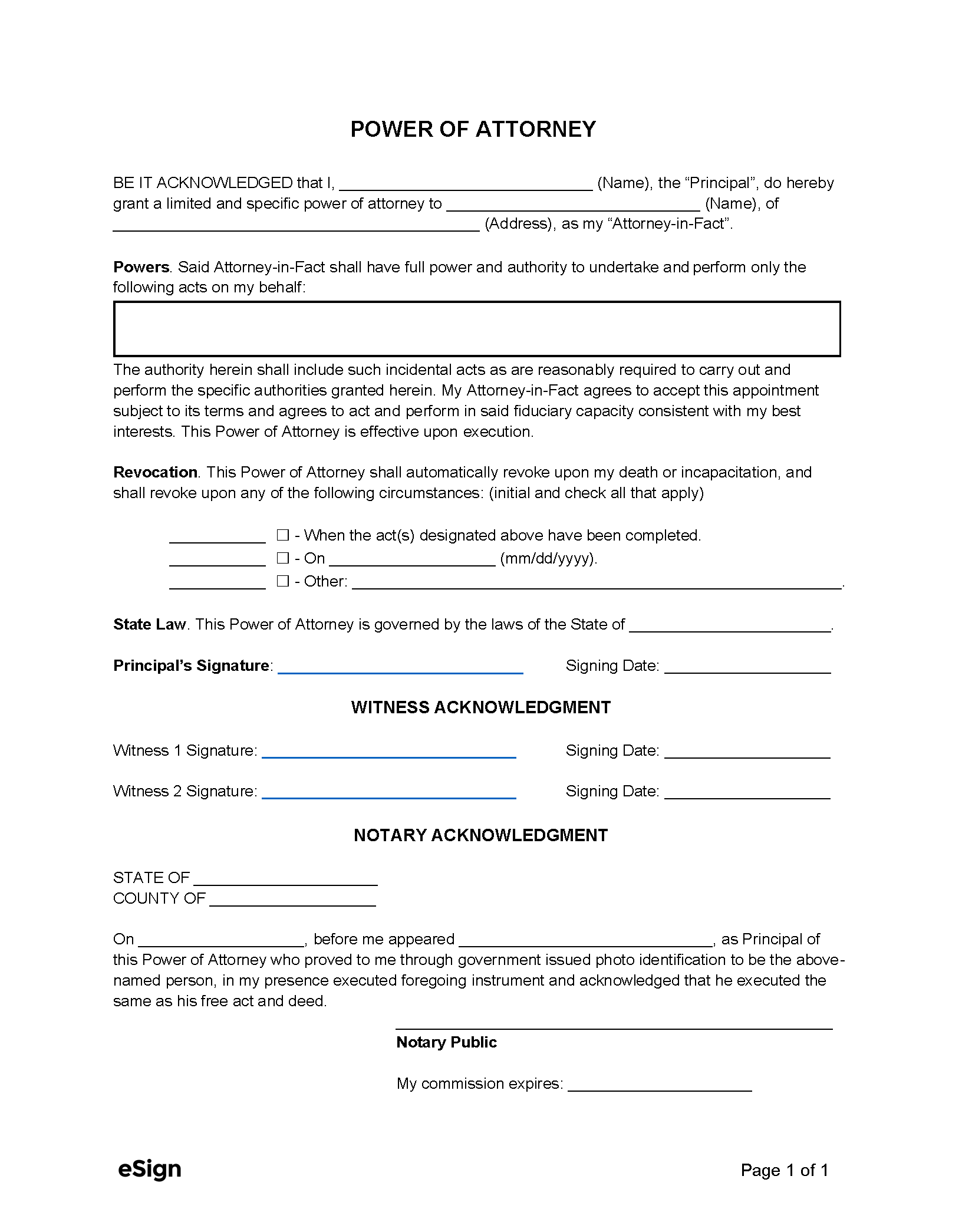

Image Source: esign.com

A valid POA typically includes the following:

Principal’s Information: Full name, address, and contact information.

Financial Powers:

Medical Powers:

Legal Powers:

Duration of Authority: Specify the start and end dates of the POA. You can choose a specific date or have it expire upon a certain event (e.g., your recovery).

Types of Letters of Attorney

There are several types of POAs, each with specific purposes:

General Power of Attorney: Grants broad authority to the attorney-in-fact to handle most financial and legal matters.

Where to Obtain a Letter of Attorney

You can obtain a Letter of Attorney in several ways:

Download a template: Many legal websites offer free or low-cost POA templates.

Important Considerations

Choose your attorney-in-fact wisely: Select someone you trust completely and who is capable of handling the responsibilities.

Conclusion

A Letter of Attorney is a valuable legal tool that can provide peace of mind and ensure your affairs are managed effectively in case of unexpected circumstances. By understanding the key elements, choosing your attorney-in-fact wisely, and seeking professional guidance when necessary, you can create a POA that meets your individual needs and provides you with the security and control you deserve.

FAQs

Can I revoke a Letter of Attorney?

Yes, you can revoke a Letter of Attorney at any time. However, the method for revocation may vary depending on the type of POA and the state laws.

Do I need a lawyer to create a Letter of Attorney?

While you can find templates and use online services, consulting with an attorney is highly recommended to ensure your POA is legally valid and meets your specific needs.

What if my attorney-in-fact becomes incapacitated?

You may want to designate a successor attorney-in-fact in your POA to assume the responsibilities if your initial choice becomes unable to serve.

Can a Letter of Attorney be used for tax purposes?

Yes, a Power of Attorney can be used to authorize someone to represent you for tax purposes, such as filing returns or dealing with the IRS.

Is a Letter of Attorney the same as a will?

No, a Letter of Attorney deals with your legal and financial affairs while you are still alive, while a will determines how your assets will be distributed after your death.

Disclaimer: This information is for general knowledge and informational purposes only and does not constitute legal advice. You should consult with a qualified attorney for advice on your specific situation.

Letter Of Attorney Sample