Introduction

So, you’re owed money. Whether it’s from a client who hasn’t paid for your services, a friend who borrowed cash, or a business that owes you for a delivered product, it’s frustrating when you’re out of pocket. Sending a demand for payment letter is a formal way to request the outstanding amount and, hopefully, get your money back.

This guide will break down how to write a clear and effective demand for payment letter in a casual, easy-to-understand style.

What is a Demand for Payment Letter?

Essentially, a demand for payment letter is a formal document that:

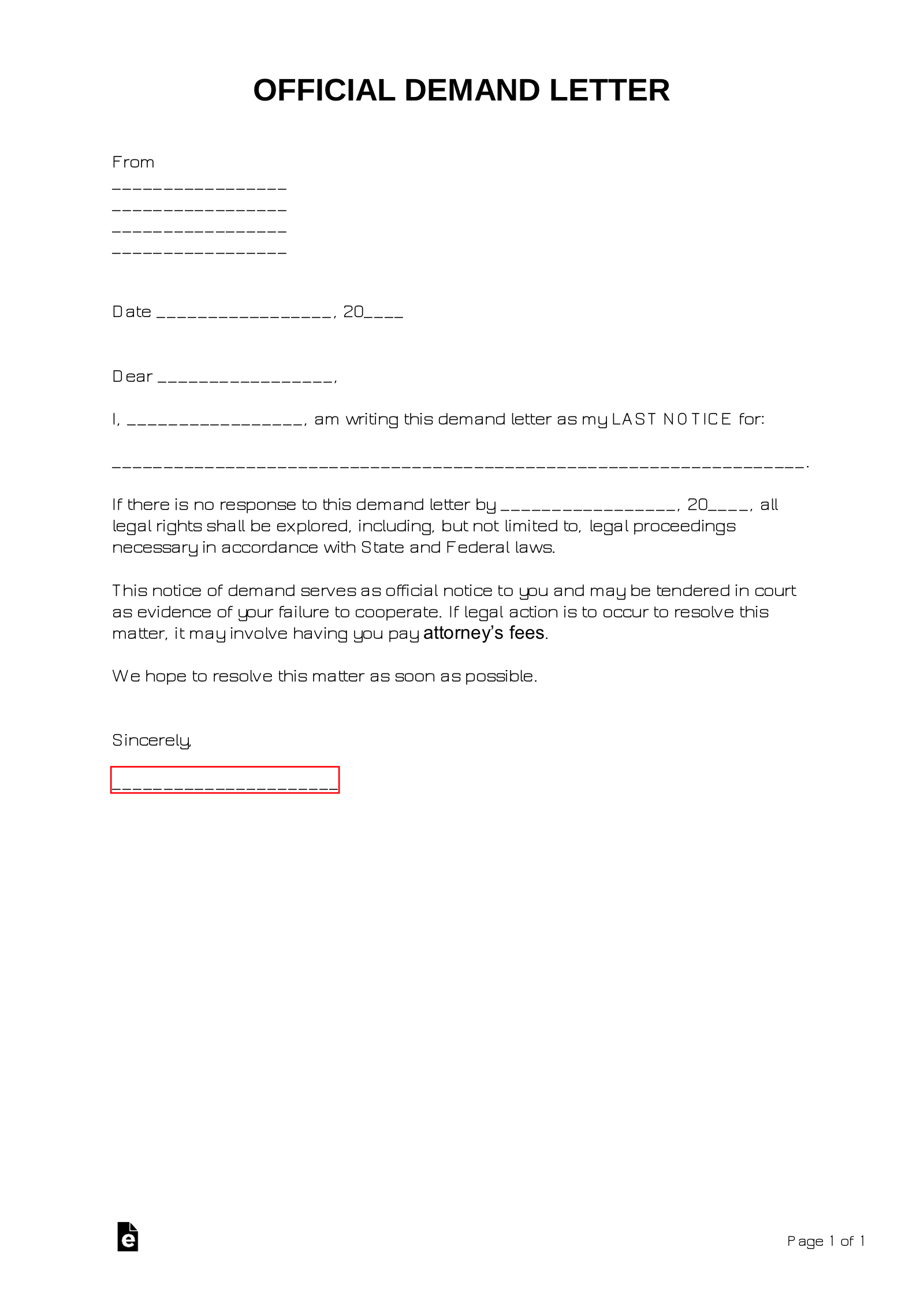

Image Source: eforms.com

States the debt: Clearly outlines the amount owed, the reason for the debt, and any relevant dates (e.g., invoice date, due date).

Why Send a Demand for Payment Letter?

Before diving into the letter itself, let’s understand why this step is crucial:

Establishes a Record: The letter creates a written record of the debt and your attempts to recover it. This is essential if you decide to pursue legal action later.

Key Elements of a Strong Demand for Payment Letter

1. Your Contact Information:

2. Date:

3. Recipient’s Information:

4. Subject Line:

5. Formal Greeting:

6. State the Debt:

7. Request for Payment:

8. Consequences of Non-Payment:

9. Contact Information:

10. Closing:

11. Your Signature:

12. Enclosure:

Sample Demand for Payment Letter

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Recipient Name]

[Recipient Address]

Subject: Demand for Payment – Invoice [Invoice Number]

Dear [Recipient Name],

This letter is to formally demand payment for outstanding invoice [Invoice Number] dated [Date] for [Services/Products] in the amount of [Amount].

The invoice was due on [Due Date], and as of the date of this letter, the payment remains outstanding.

We kindly request that you remit the full amount of [Amount] within [Number] days of receiving this letter. Please make the payment by [Method of Payment, e.g., check, bank transfer] to [Account Information].

Please note that if payment is not received within [Number] days, we will be forced to take legal action to recover the outstanding debt. This may include referring the matter to a debt collection agency, which can negatively impact your credit score.

We encourage you to contact us at [Phone Number] or [Email Address] to discuss alternative payment arrangements if you are unable to meet the above deadline.

Sincerely,

[Your Signature]

[Your Typed Name]

Enclosure: Invoice [Invoice Number]

Tips for Writing an Effective Demand for Payment Letter

Keep it concise and to the point. Avoid unnecessary jargon or overly complex language.

Conclusion

Sending a demand for payment letter is a crucial step in recovering outstanding debts. By following the guidelines outlined in this guide, you can create a clear, concise, and effective letter that increases your chances of getting paid.

Remember to be professional, polite, and firm in your communication. If you are unable to resolve the issue amicably, you may need to consult with an attorney to explore your legal options.

FAQs

What happens if the debtor ignores the demand letter?

If the debtor ignores the demand letter, you may need to take further action, such as:

Can I use a template for my demand letter?

Yes, you can use a template as a starting point for your demand letter. However, it’s important to customize the template with your specific information and adjust it to suit your particular situation.

Do I need to send the demand letter by certified mail?

While not always required, sending the letter by certified mail with return receipt requested provides you with proof of delivery. This can be valuable evidence if you need to take legal action later.

What if the debtor claims they don’t owe the money?

If the debtor disputes the debt, you will need to gather evidence to support your claim. This may include invoices, contracts, emails, or other documentation. You may also need to be prepared to negotiate or even litigate the matter.

Can I include emotional language in my demand letter?

No, you should avoid using emotional language in your demand letter. Keep the tone professional and objective. Emotional outbursts can damage your relationship with the debtor and may not be effective in resolving the issue.

I hope this guide has been helpful. If you have any further questions, please feel free to consult with a legal professional.

Demand For Payment Letter