An invoice receipt is essentially a formal document that records a transaction between a seller and a buyer. Think of it as a detailed bill that outlines the goods or services provided, the agreed-upon price, and any applicable taxes.

Here’s a breakdown of what typically appears on an invoice receipt:

1. Invoice Number

2. Invoice Date

3. Due Date

4. Seller Information

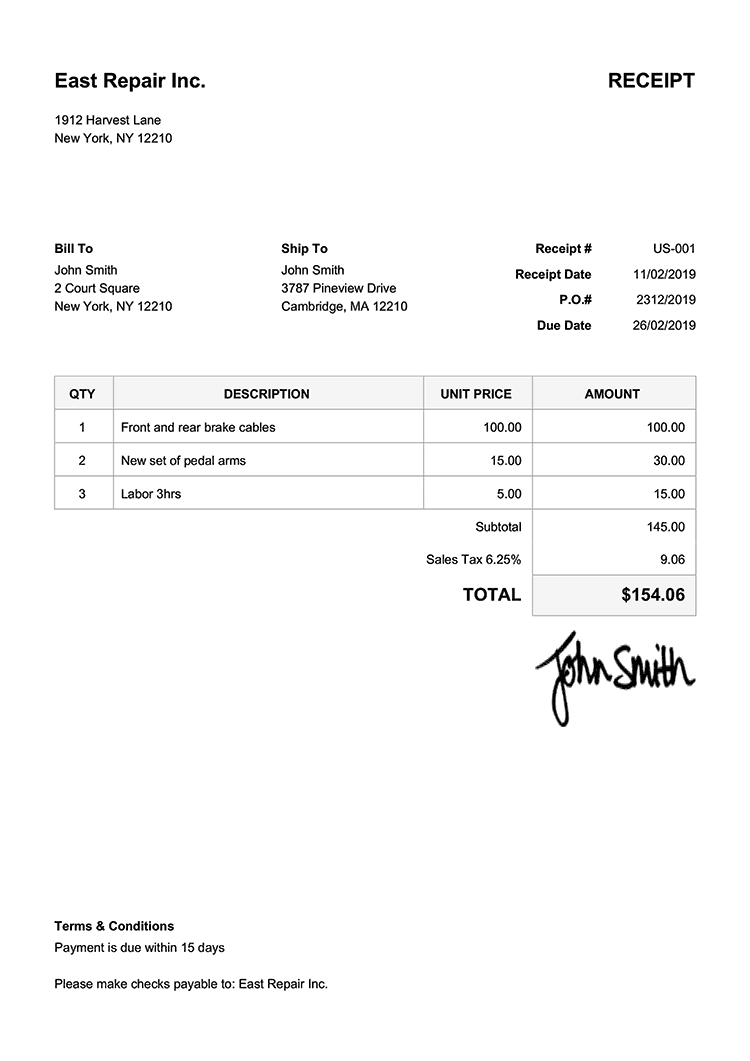

Image Source: invoicehome.com

5. Buyer Information

6. Description of Goods or Services

7. Total Amount

8. Taxes

9. Payment Terms

10. Seller’s Signature and Stamp (Optional)

Example of a Simple Invoice Receipt:

Invoice Number: INV-001

Invoice Date: July 5, 2024

Due Date: July 20, 2024

Seller:

[Seller Name]

[Seller Address]

[Seller Phone Number]

[Seller Email Address]

Buyer:

[Buyer Name]

[Buyer Address]

[Buyer Phone Number]

Description | Quantity | Unit Price | Total

—————–|————-|————–|———

Web Design | 1 | $1000.00 | $1000.00

Logo Design | 1 | $500.00 | $500.00

Subtotal: $1500.00

Sales Tax (8%): $120.00

Total: $1620.00

Payment Terms:

Payment is due within 15 days of the invoice date.

Accepted payment methods: Bank Transfer, Credit Card

[Seller Signature]

Importance of Invoice Receipts

Invoice receipts serve several crucial purposes:

Record-Keeping: They provide a detailed record of transactions for both the seller and the buyer.

Tips for Creating Professional Invoices:

Use Professional Software: Utilize invoicing software like QuickBooks, Xero, or Zoho Invoice to easily generate professional-looking invoices.

Conclusion

An invoice receipt is a vital document in any business transaction. By understanding its components and following best practices for creating and issuing invoices, you can ensure smooth and efficient financial operations while maintaining accurate records.

FAQs

1. What is the difference between an invoice and a receipt?

An invoice is a document that is issued before a payment is made, outlining the goods or services provided and the amount owed.

2. Can I create an invoice receipt using a spreadsheet software like Excel?

3. Can I deduct expenses listed on an invoice receipt for tax purposes?

4. What should I do if a client disputes an invoice?

5. Are there any legal requirements for invoice receipts?

Disclaimer: This article is for informational purposes only and does not constitute legal or financial advice.

Example Of Invoice Receipt