So, you’ve finished a job for a client and it’s time to get paid. But before you send that cash request, you need a professional and clear invoice. This document outlines the work performed, the costs incurred, and the payment terms.

What should be included in a Contractor Invoice?

Invoice Number: Every invoice needs a unique number for easy tracking and record-keeping.

Client Name

Company Name (if applicable)

Contact Information (Phone number and Email address)

Image Source: canva.com

Billing Address

Your Company Name (if applicable)

Your Name

Your Contact Information (Phone number and Email address)

Your Business Address

Project Name (if applicable)

Brief Project Description (e.g., “Kitchen Remodel,” “Bathroom Renovation,” “Deck Construction”)

Detailed list of all services performed.

List of all materials used in the project.

Specify the hourly rate or daily rate for your labor.

Include any other expenses incurred during the project.

Clearly state the payment terms.

Specify the acceptable payment methods.

Creating a Professional Invoice

While you can create a basic invoice using a simple word processing document, there are several tools available to help you create professional-looking invoices:

Spreadsheets (like Google Sheets or Excel): These programs offer basic formatting options and formulas for easy calculations.

Tips for Getting Paid On Time

Issue invoices promptly: The sooner you send an invoice, the sooner you’ll get paid. Aim to send invoices within a week of completing the project.

Conclusion

A well-crafted contractor invoice is essential for getting paid on time and maintaining a professional relationship with your clients. By following the guidelines outlined in this article, you can create clear, concise, and professional invoices that will help you get paid for your hard work.

FAQs

1. Can I use a generic invoice template for all my projects?

While generic templates can be a starting point, it’s best to customize each invoice for the specific project. This ensures accuracy and avoids confusion.

2. What if I made a mistake on the invoice?

If you discover an error, issue a corrected invoice immediately. Clearly mark the original invoice as “VOID” and attach a copy of the corrected invoice.

3. How do I handle late payments?

Start with a polite reminder. If the payment is still not received, you may need to send a more formal letter or consider late payment fees (if applicable).

4. Should I include sales tax on my invoices?

Yes, if you are required to collect sales tax in your area, you must include it on your invoices.

5. What if my client disputes the invoice?

If your client disputes any part of the invoice, try to resolve the issue amicably. If necessary, you may need to consult with an attorney.

This comprehensive guide should provide you with the necessary information to create professional and effective contractor invoices. Remember that clear communication and professional documentation are crucial for successful business operations.

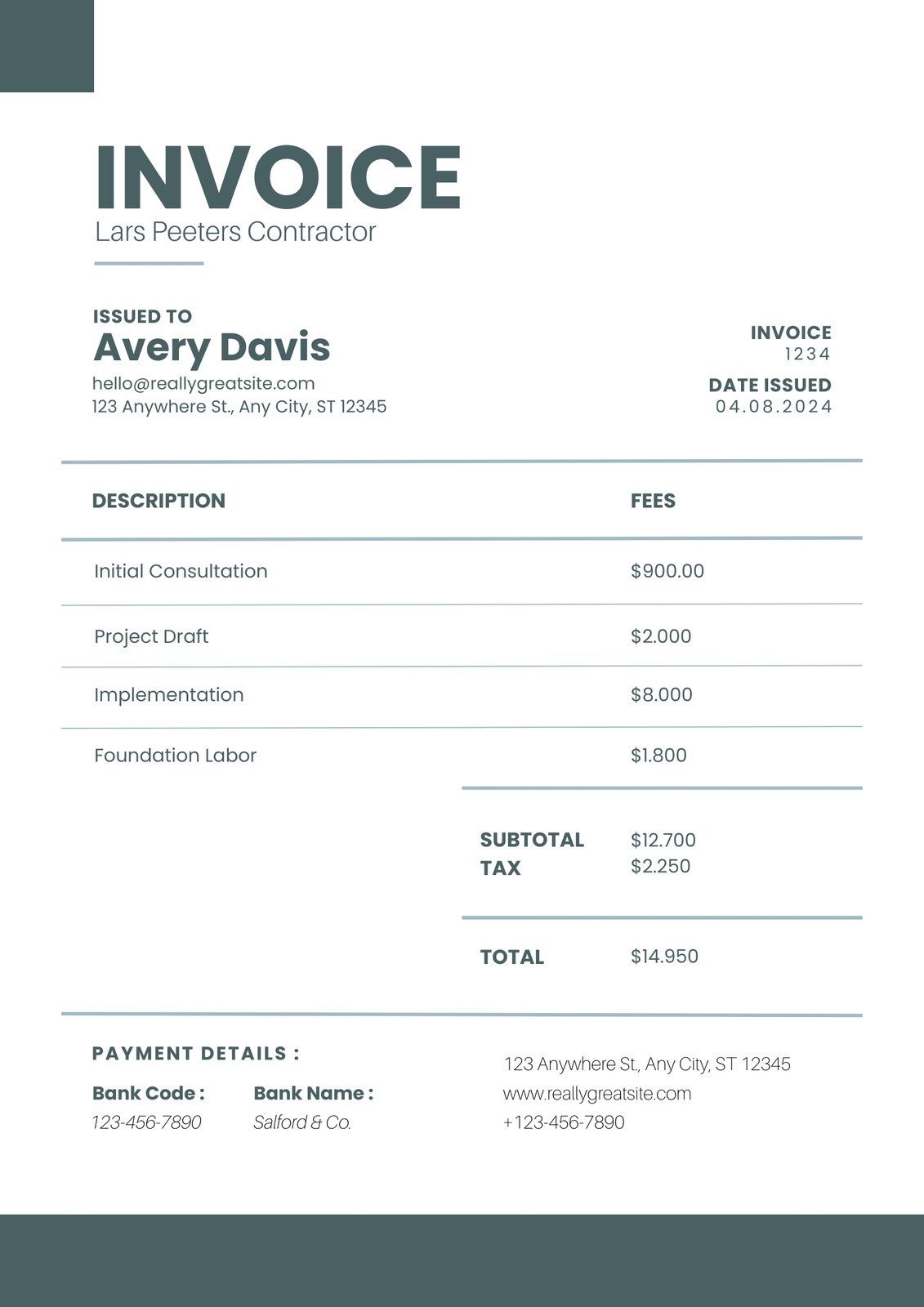

Sample Contractor Invoice