Creating a budget for a nonprofit organization can feel like navigating a maze. There are so many moving parts – donations, grants, program costs, staff salaries, and overhead expenses – that it’s easy to get lost. But don’t worry! This guide will walk you through the process of creating a nonprofit budget template in a way that’s easy to understand, even if you’re not a finance whiz.

1. Understand Your Mission

Before you even think about numbers, it’s crucial to revisit your nonprofit’s mission statement.

Your mission statement should guide every decision you make, including your budget.

Ask yourself:

How does this expense directly support our mission?

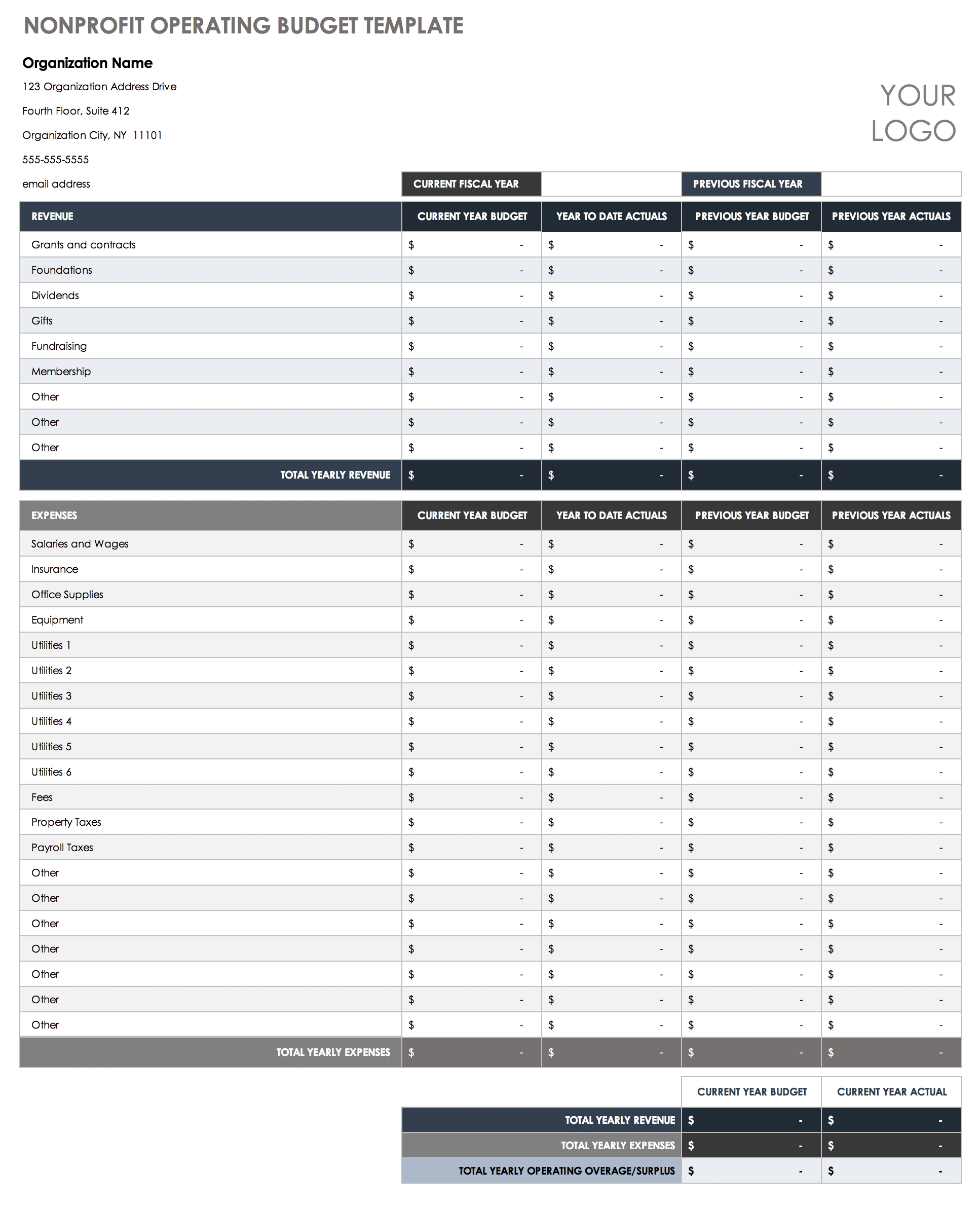

Image Source: smartsheet.com

2. Gather Your Financial Data

This is where the real work begins. You’ll need to gather all the relevant financial information, including:

Past Income Statements: Analyze past income and expenses to identify trends and areas for improvement.

3. Determine Your Revenue Sources

Nonprofit organizations rely on a diverse range of funding sources. Consider the following:

Individual Donations

Government Grants

Corporate Sponsorships

Foundation Grants

Program Fees

Special Events

Estimate the amount of revenue you expect to generate from each source. Be realistic in your projections.

4. Identify Your Expenses

This is where you’ll break down your costs into different categories:

Program Expenses: These are the costs directly associated with your programs and services.

Fundraising Expenses: This includes the costs of fundraising events, campaigns, and materials.

Administrative Expenses: This covers general operating costs, such as rent, utilities, insurance, and staff salaries.

Fundraising Expenses: This includes the costs of fundraising events, campaigns, and materials.

5. Create Your Budget Template

Now it’s time to put all the pieces together. A simple budget template might include the following sections:

Revenue:

6. Use a Budgeting Tool

There are many budgeting tools available, both free and paid. Consider using spreadsheet software like Excel or Google Sheets to create your budget. These tools can help you:

Track income and expenses

7. Monitor and Adjust

Your budget is not set in stone. It’s a living document that should be reviewed and adjusted regularly.

Track your actual income and expenses throughout the year and make necessary adjustments as needed.

This may involve:

Cutting costs in areas where spending exceeds expectations

8. Communicate Your Budget

Clearly communicate your budget to your board of directors, staff, and major donors. This will help ensure everyone is on the same page and understand how your organization is using its resources.

Conclusion

Creating a nonprofit budget may seem daunting, but it’s an essential step in ensuring the financial health and sustainability of your organization. By following the steps outlined in this guide, you can create a budget that reflects your mission, meets your financial goals, and helps you make a lasting impact on your community.

FAQs

1. What is the difference between a budget and a forecast?

2. How often should I review and adjust my budget?

3. What are some common budgeting mistakes made by nonprofits?

4. How can I improve the accuracy of my budget forecasts?

5. What resources are available to help me create a nonprofit budget?

This article provides a basic overview of creating a nonprofit budget template. Remember that every organization is unique, so you may need to adapt these steps to fit your specific needs.

Nonprofit Budget Template