What is a Demand Letter to Pay?

In the simplest terms, a demand letter to pay is a formal written request for someone to pay you money they owe you. It’s essentially a polite but firm “pay up” notice. This could be for anything from unpaid rent or overdue bills to money lent to a friend or a debt owed by a business.

Why is a Demand Letter Important?

Before you jump into writing a demand letter, it’s crucial to understand its significance.

Establishes a Record: The primary purpose is to create a documented record of the debt. This is vital if you decide to take further legal action.

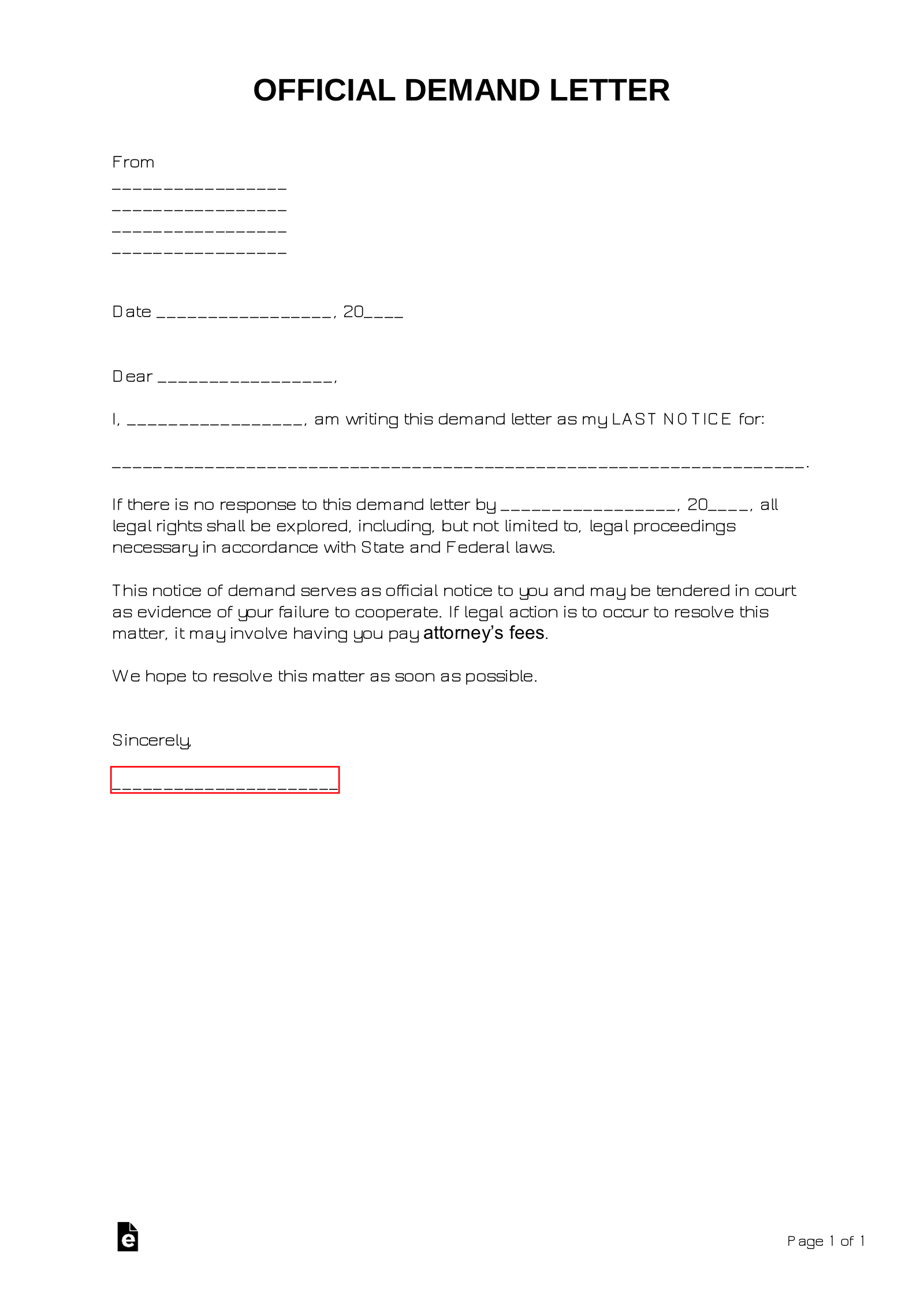

Image Source: eforms.com

Key Elements of a Strong Demand Letter

A well-written demand letter is concise, clear, and professional. Here are the essential elements:

Your Contact Information: Include your full name, address, phone number, and email address.

Sample Demand Letter Template

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Debtor’s Name]

[Debtor’s Address]

Subject: Demand for Payment of Outstanding Debt

Dear [Debtor’s Name],

This letter constitutes a formal demand for payment of the outstanding debt of [amount] owed to me. This debt arises from [briefly describe the nature of the debt].

Supporting documentation for this debt includes [list any supporting documentation, e.g., “invoices dated July 1st and July 15th,” “a copy of the loan agreement”].

Payment in full of [amount] is required within 10 business days of the date of this letter. Please make the payment by [preferred method of payment, e.g., “check payable to [Your Name],” “bank transfer to [Your Account Number]”].

Please be advised that failure to make payment within the specified timeframe may result in the following consequences:

Legal action: I may be forced to initiate legal proceedings to recover the outstanding debt, including filing a lawsuit.

I trust this matter can be resolved amicably. Please contact me at [Your Phone Number] or [Your Email Address] within [number] days of receiving this letter to discuss payment arrangements.

Sincerely,

[Your Signature]

[Your Typed Name]

Important Considerations

State Laws: Familiarize yourself with the debt collection laws in your state.

Conclusion

A demand letter to pay is a crucial step in recovering a debt. By following the guidelines outlined above, you can create a clear, concise, and effective demand letter that increases your chances of successful debt recovery. Remember to maintain professionalism, keep accurate records, and consider consulting with an attorney if you encounter any difficulties.

FAQs

1. What if the debtor ignores the demand letter?

If the debtor ignores the demand letter, you may need to take further action, such as:

Sending a second demand letter: A second letter may reiterate the seriousness of the situation and provide a shorter deadline for payment.

2. Can I use a template for my demand letter?

Yes, you can use a template as a starting point. However, it’s essential to customize the template to fit your specific situation and ensure it complies with all applicable laws.

3. How long should I wait before sending a demand letter?

There is no set waiting period. However, it’s generally advisable to send a demand letter as soon as possible after the debt becomes overdue.

4. Do I need to send the demand letter by certified mail?

While not always required, sending the letter via certified mail with return receipt requested provides proof of delivery, which can be helpful if you need to take further legal action.

5. What if the debtor claims they don’t owe the money?

If the debtor disputes the debt, you will need to gather evidence to support your claim. This may include invoices, contracts, receipts, and any other relevant documentation. If the dispute cannot be resolved amicably, you may need to seek legal advice.

Demand Letter To Pay