So, you’re thinking about your future and want to make sure your finances are taken care of, even if you’re unable to handle them yourself. That’s where a Durable Financial Power of Attorney (DPOA) comes in. In simple terms, it’s a legal document that allows someone you trust (called your “agent” or “attorney-in-fact”) to make financial decisions on your behalf.

Why is it called “Durable”?

The “durable” part is key. Unlike a regular Power of Attorney, which usually becomes invalid if you become mentally incapacitated, a Durable Power of Attorney remains in effect even if you can’t make your own decisions due to illness, injury, or mental incapacity.

Who Needs a Durable Power of Attorney?

Honestly, most adults should consider having one. It’s especially important if:

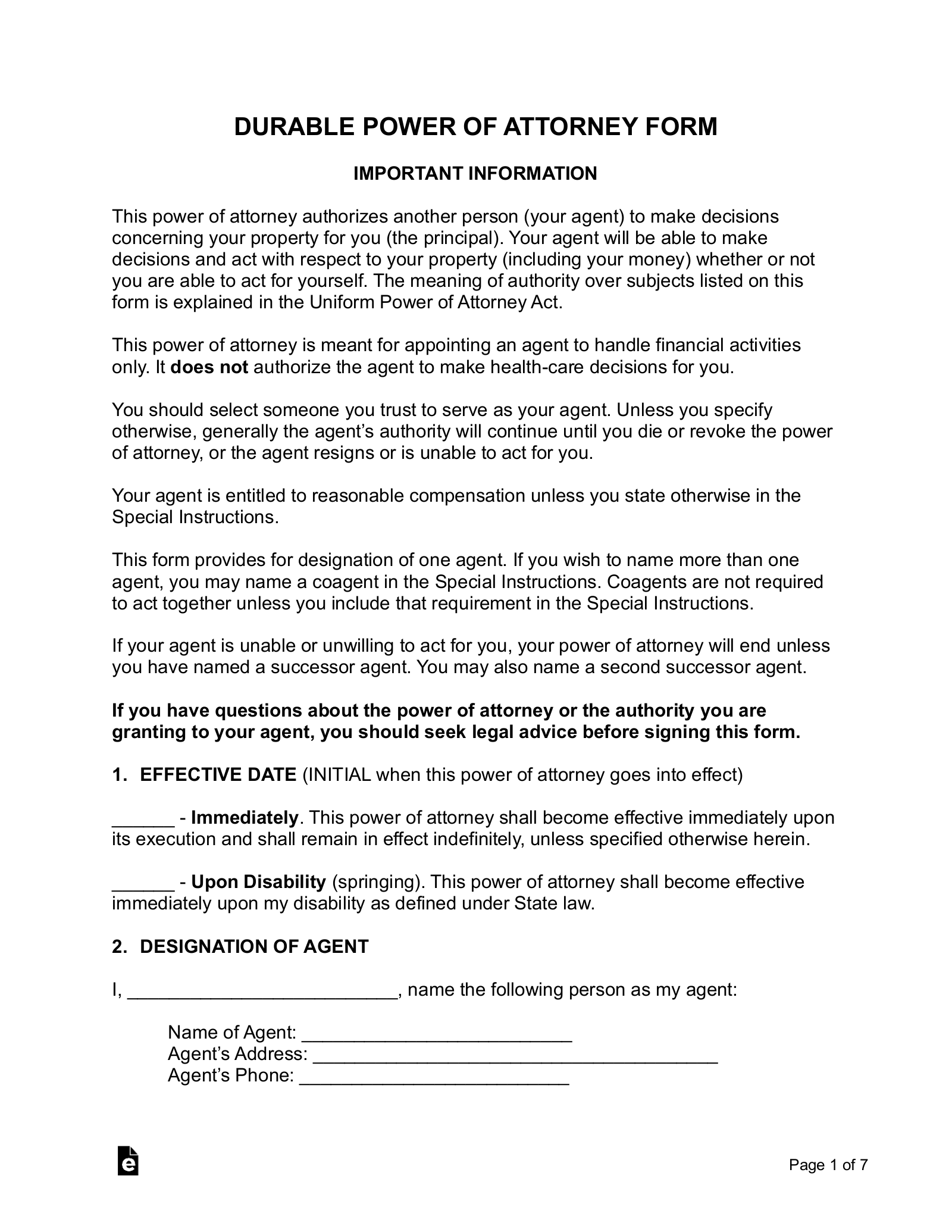

Image Source: eforms.com

You’re getting older: As we age, our health can decline, and we may need help managing our finances.

What Can a Financial Power of Attorney Do?

The scope of a DPOA can vary depending on how you draft it. Generally, your agent can:

Manage your bank accounts: This includes withdrawing funds, depositing checks, paying bills, and transferring money.

Choosing Your Agent Wisely

Selecting the right person as your agent is crucial. Consider someone you:

Trust implicitly: This person should be someone you completely trust and know will act in your best interests.

Creating Your Durable Power of Attorney

You can create a DPOA yourself using a template, but it’s highly recommended to consult with an attorney. An attorney can:

Ensure your DPOA is legally valid: They can help you draft the document correctly to meet the legal requirements in your state.

Important Considerations

State laws vary: The laws governing Durable Powers of Attorney vary from state to state. Make sure your DPOA complies with the laws in your state of residence.

Conclusion

A Durable Financial Power of Attorney is an essential legal document that can provide peace of mind and ensure your financial well-being in case you are unable to manage your own affairs. By carefully selecting your agent and working with an attorney to create a legally sound document, you can take control of your future and protect your financial interests.

FAQs

What happens if I become incapacitated and don’t have a DPOA?

If you become incapacitated and don’t have a DPOA, your family may need to go through a lengthy and potentially costly legal process to gain the authority to manage your finances. This process can be time-consuming and stressful for your loved ones.

Can I revoke my DPOA?

Yes, you can revoke your DPOA at any time as long as you are mentally competent. You can usually revoke it by creating a new document that revokes the original DPOA.

Can I limit the powers granted to my agent?

Yes, you can limit the powers granted to your agent by specifically stating which financial decisions they are authorized to make.

What if I disagree with my agent’s decisions?

If you disagree with your agent’s decisions while you are still mentally competent, you can revoke their authority and choose a new agent.

Can I change my agent at any time?

Yes, you can change your agent at any time by creating a new DPOA that designates a new agent.

I hope this article provides you with a better understanding of the Durable Financial Power of Attorney and its importance.

Disclaimer: This article is for informational purposes only and does not constitute legal advice. You should consult with an attorney to discuss your specific legal needs and circumstances.

Durable Financial Power Of Attorney Form