The Lowdown on Money Receipts: A Casual Guide

Money receipts. We encounter them daily, from grabbing coffee to buying groceries. But do we really pay attention to them? Most of us probably just shove them in our wallets and forget about them. However, these seemingly insignificant pieces of paper (or digital records) hold significant value, especially when it comes to tracking expenses, returns, and even resolving disputes.

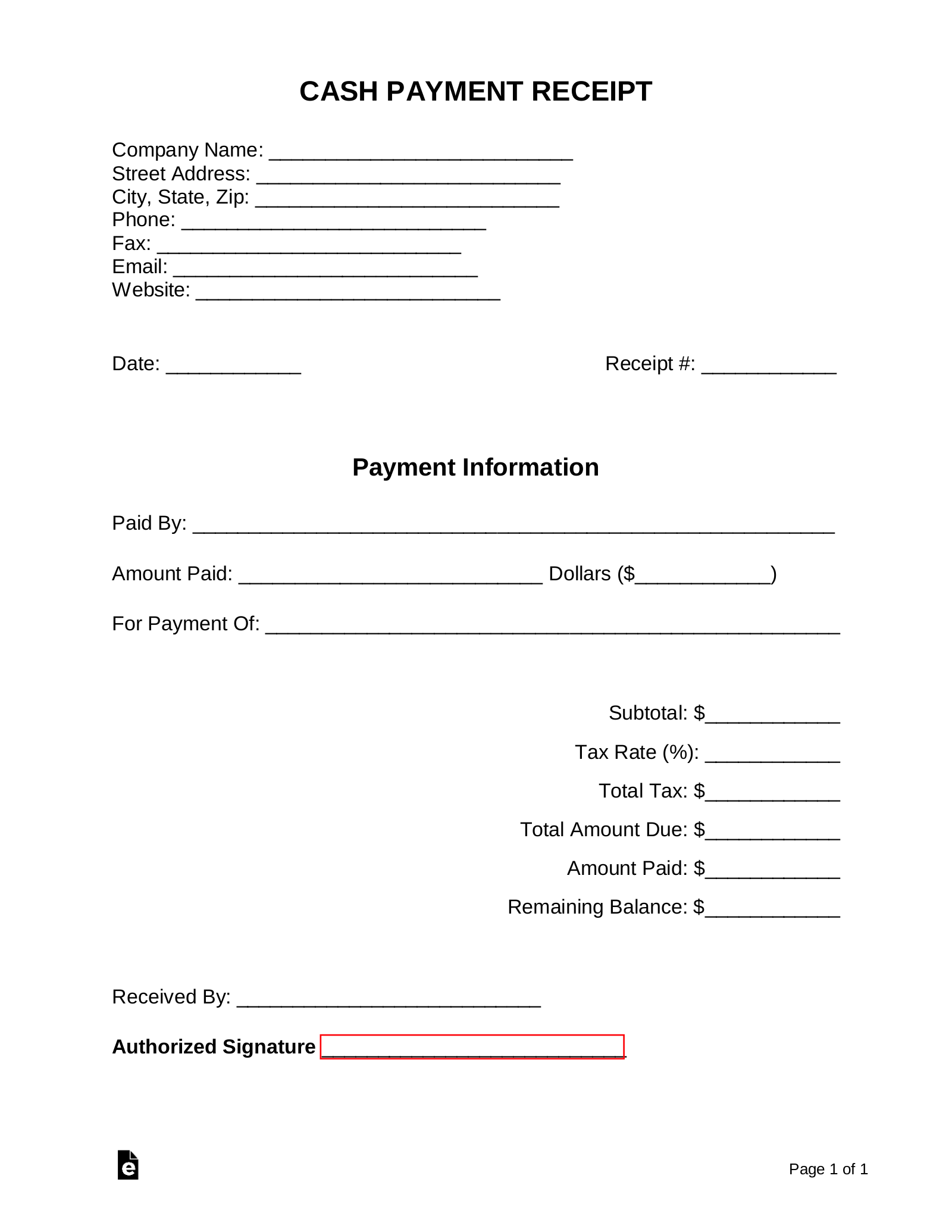

The Essentials: What Makes a Receipt a Receipt?

At its core, a money receipt is a written or printed record of a financial transaction. It serves as proof that a payment has been made and acts as a record for both the buyer and the seller.

Here’s a breakdown of the key components you’ll typically find on a standard receipt:

1. Date and Time of Transaction

Image Source: eforms.com

This is crucial for establishing when the transaction occurred. It helps in reconciling accounts and identifying potential discrepancies.

2. Transaction ID or Reference Number

This unique identifier helps both the buyer and seller track the specific transaction. It’s particularly useful for online purchases and returns.

3. Seller Information

This includes the seller’s name, address, and contact information (phone number, email address, website).

4. Buyer Information

This may include the buyer’s name, address, or contact information, depending on the type of transaction.

5. Description of Goods or Services

This section details the items purchased or services rendered. It may include quantities, prices, and any applicable taxes.

6. Payment Method

This indicates how the payment was made, such as cash, credit card, debit card, or online payment services.

7. Amount Paid

This clearly states the total amount paid for the transaction, including any discounts, taxes, or surcharges.

8. Seller’s Signature or Stamp

This often signifies the seller’s acknowledgment of the transaction and may include the name or initials of the employee who processed the payment.

Types of Receipts: A Quick Overview

Receipts come in various forms, depending on the nature of the transaction:

1. Sales Receipts

These are the most common type of receipt, issued for purchases made at retail stores, restaurants, and other businesses.

2. Invoice Receipts

Invoices are typically issued for larger purchases or services, such as those made between businesses. A receipt is generated once the invoice is paid.

3. Cash Receipts

These receipts specifically document cash payments, often used for smaller transactions.

4. Digital Receipts

With the rise of e-commerce, digital receipts are becoming increasingly prevalent. They are typically sent via email or stored in online accounts.

5. Donation Receipts

Issued by charitable organizations, these receipts acknowledge donations and are often used for tax purposes.

The Importance of Keeping Receipts

While it may seem tedious, keeping receipts offers several benefits:

Tracking Expenses: Receipts provide a detailed record of your spending, making it easier to create budgets and monitor your finances.

Tips for Organizing Your Receipts

Digital Organization: Scan or photograph receipts and store them electronically using apps like Google Drive, Evernote, or dedicated receipt-scanning apps.

Conclusion

Receipts may seem like insignificant pieces of paper, but they play a crucial role in our financial lives. By understanding the format of money receipts and keeping them organized, you can better track your spending, facilitate returns and exchanges, and ensure you have the necessary documentation for various purposes.

FAQs

1. Can I get a receipt if I pay in cash?

Yes, you should always request a receipt for any cash payment, regardless of the amount.

2. What should I do if I lose a receipt?

Contact the seller immediately and inquire about obtaining a duplicate receipt. Some businesses may be able to provide a copy from their records.

3. Are digital receipts valid?

Yes, digital receipts are generally considered valid and legally binding.

4. How long should I keep receipts?

The length of time you should keep receipts varies depending on the type of expense. For tax purposes, it’s generally recommended to keep receipts for at least three years.

5. Can I use a screenshot of a digital receipt?

While screenshots can be helpful, it’s always best to obtain an official copy of the digital receipt from the seller or your online account.

Disclaimer: This article provides general information and should not be considered financial or legal advice.

I hope this comprehensive article on the Format of Money Receipts proves helpful!

Format Of Money Receipt