In the dynamic world of business, access to capital is often the lifeblood that fuels growth, innovation, and day-to-day operations. Whether you’re a burgeoning startup seeking seed funding, an established enterprise expanding into new markets, or an individual lending funds to a business venture, the process of exchanging capital carries inherent risks and responsibilities. While handshake deals might seem appealing for their perceived simplicity, the complexities of financial transactions demand a far more robust and legally sound foundation.

This is where a meticulously crafted business loan agreement template becomes an invaluable asset. It serves as the definitive roadmap for both lenders and borrowers, outlining every detail of their financial relationship. Far more than just a formality, this document is a cornerstone of legal protection and clarity, providing a structured framework that mitigates misunderstandings and disputes. Business owners, financial advisors, legal professionals, and anyone involved in the lending or borrowing of funds can significantly benefit from understanding and utilizing such a comprehensive tool.

The Imperative of Formalizing Lending Arrangements

In today’s fast-paced business environment, the need for clear, written agreements has never been more critical. The digital age has blurred lines and increased the potential for miscommunication, making concrete documentation essential. A verbal agreement, while sometimes legally binding, is notoriously difficult to prove and enforce in a court of law, often devolving into a "he said, she said" scenario.

A properly executed written agreement provides undeniable proof of the terms and conditions agreed upon by all parties. It eliminates ambiguity, sets clear expectations regarding repayment, interest, and potential default scenarios, and establishes a transparent legal framework for the transaction. This not only protects the financial interests of both the lender and the borrower but also fosters trust and professionalism, which are vital for any successful business relationship. Without such a document, both parties expose themselves to significant financial and legal vulnerabilities, risking not just capital but also business reputation and continuity.

Unlocking the Advantages of a Pre-Structured Framework

Utilizing a well-designed business loan agreement template offers a multitude of benefits that extend beyond mere legal compliance. First and foremost, it provides unparalleled clarity. Every aspect of the loan, from the principal amount to the interest rate, repayment schedule, and consequences of default, is explicitly stated, leaving no room for misinterpretation. This level of detail ensures both parties understand their rights and obligations from the outset.

Beyond clarity, the template serves as a powerful risk mitigation tool. By proactively addressing potential issues like late payments, breaches of covenants, or changes in circumstances, it establishes a clear path for resolution, reducing the likelihood of costly and time-consuming disputes. Moreover, a standardized framework ensures consistency across multiple loan agreements, especially beneficial for lenders who engage in numerous transactions. It saves significant time and resources that would otherwise be spent drafting documents from scratch or consulting legal counsel for every single loan. Ultimately, this foundational document provides peace of mind, allowing businesses to focus on growth rather than legal squabbles.

Adapting the Core Structure to Unique Scenarios

While a robust business loan agreement template provides an excellent starting point, its true value often lies in its adaptability. Not all loans are created equal, and the nuances of various industries, business structures, and specific financial arrangements necessitate thoughtful customization. A template designed for an unsecured personal loan to a small business will differ significantly from one intended for a multi-million dollar asset-backed loan to a corporation.

Considerations like the type of collateral involved (real estate, inventory, intellectual property), specific industry regulations, or unique repayment structures (e.g., revenue-based financing, convertible notes) require careful tailoring of clauses. For instance, a tech startup might need specific intellectual property clauses, while a manufacturing firm might focus on equipment liens. The flexibility of a comprehensive template allows users to insert, modify, or remove sections to perfectly align the agreement with the specific needs of their transaction, ensuring legal compliance and practical efficacy across a diverse range of lending situations. This careful adaptation ensures the document is not just legally sound but also perfectly suited to its unique purpose.

Core Components of a Robust Loan Agreement

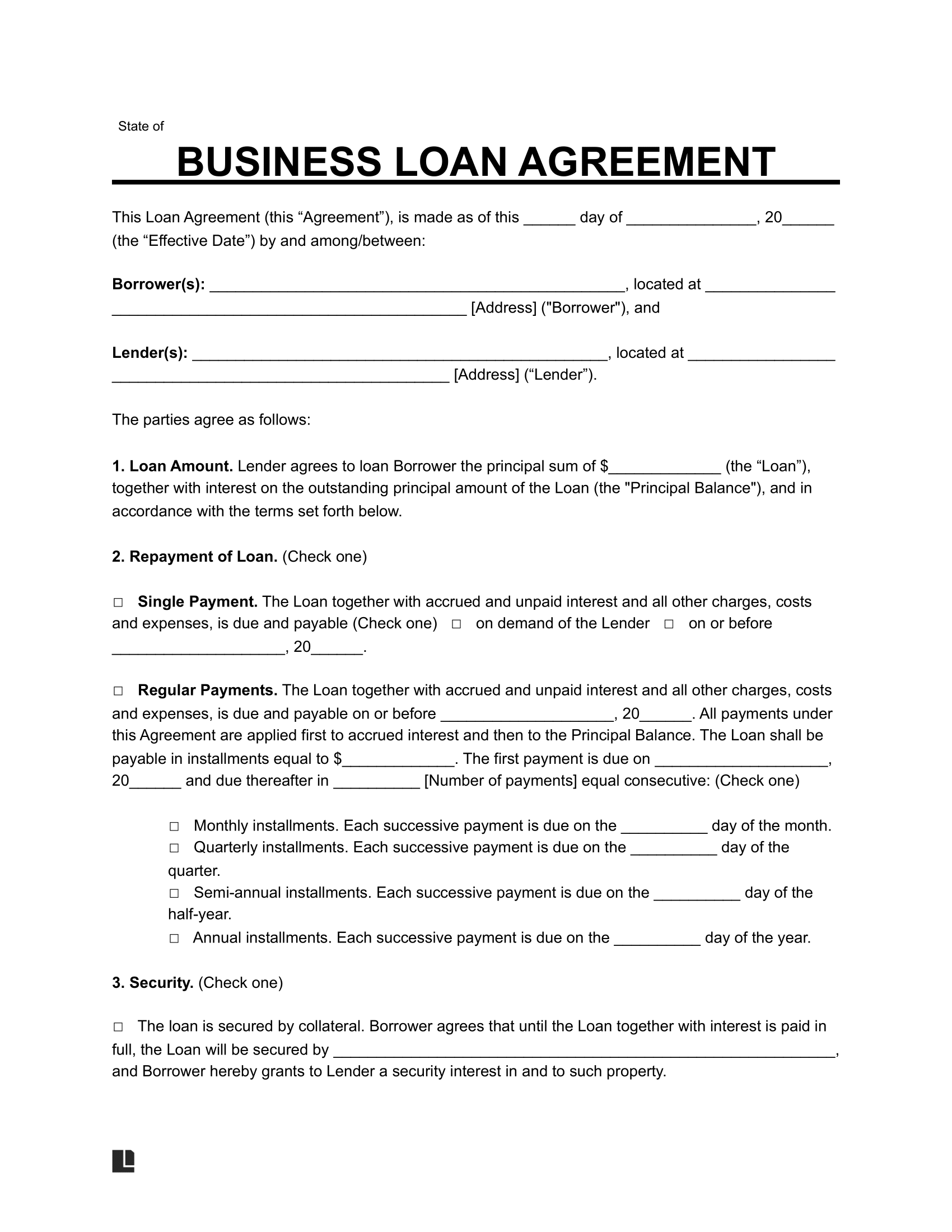

Every effective loan agreement, regardless of its specific context, must contain several fundamental clauses to be legally sound and practically useful. These sections establish the basic parameters of the loan and protect the interests of both the lender and the borrower. A comprehensive business loan agreement template will incorporate the following essential elements:

- Identification of Parties: Clearly state the full legal names, addresses, and any relevant business registration details of both the lender and the borrower. This ensures there is no ambiguity about who is bound by the agreement.

- Loan Amount and Interest Rate: Precisely specify the principal amount being borrowed and the agreed-upon interest rate, whether fixed or variable. Details on how interest is calculated (e.g., simple, compound) and applied should also be included.

- Repayment Schedule and Terms: Outline the exact dates and amounts of each payment, the total number of payments, and the loan’s maturity date. This section should also specify the method of payment and where payments should be directed.

- Default Provisions: Detail what constitutes an event of default (e.g., missed payments, breach of covenants, bankruptcy) and the actions the lender can take if a default occurs, such as accelerating the loan or seizing collateral.

- Collateral and Security (if applicable): If the loan is secured, this clause will describe the assets pledged as collateral and grant the lender a security interest in them. It should also outline the lender’s rights regarding the collateral in case of default.

- Representations and Warranties: Statements made by both parties, usually the borrower, confirming certain facts (e.g., good standing, legal capacity to enter the agreement, accuracy of financial statements).

- Covenants: Promises made by the borrower to do (affirmative covenants, e.g., maintain insurance) or not to do (negative covenants, e.g., incur additional debt beyond a certain limit) specific actions during the loan term.

- Governing Law: Specifies the jurisdiction whose laws will govern the interpretation and enforcement of the agreement, typically the state where the lender or borrower operates.

- Dispute Resolution: Outlines the process for resolving any disagreements, such as mediation, arbitration, or litigation, and often specifies the venue for such proceedings.

- Prepayment Options and Penalties: Clarifies whether the borrower can repay the loan early, and if so, whether any prepayment penalties will apply.

- Miscellaneous Provisions: Includes standard boilerplate clauses such as entire agreement, severability, waiver, notices, and assignment.

- Signatures: Spaces for the authorized representatives of both the lender and borrower to sign and date the agreement, often with provisions for witnesses or notarization to ensure legal enforceability.

Optimizing for Clarity and Practical Use

Beyond the legal substance, the presentation and structure of any legal document significantly impact its usability and effectiveness. For a business loan agreement template, practical tips for formatting, usability, and readability are paramount, whether for print or digital consumption. A well-organized document ensures that key information is easily locatable and understandable by all parties, including non-legal professionals.

Firstly, use clear, descriptive headings and subheadings. Breaking the document into logical sections with intuitive titles enhances navigation. Employing a clean, professional font (e.g., Arial, Times New Roman, Calibri) in a readable size (10-12pt) is crucial. Generous use of white space, including adequate margins and line spacing, prevents the text from appearing dense and overwhelming. Bullet points and numbered lists, as demonstrated in the previous section, are excellent for presenting complex information or enumerating conditions clearly. For digital use, consider documents that are searchable and bookmarkable. If the agreement is to be signed digitally, ensure the platform used is legally compliant and secure. For print, a logical flow and organized table of contents (if lengthy) further aid readability and reference. Ultimately, a user-friendly format minimizes confusion and encourages thorough review by all stakeholders.

Crafting or adapting a business loan agreement template is more than a mere administrative task; it is a critical step in securing the financial health and legal standing of any business transaction. It serves as an unequivocal statement of intent and a legally binding commitment, protecting both parties from unforeseen challenges and potential disputes. By investing the time to properly implement and customize such a document, businesses solidify their financial relationships on a foundation of clarity and trust.

In an era where precision and legal compliance are non-negotiable, leveraging a comprehensive business loan agreement template is a testament to professional due diligence. It not only streamlines the lending process but also provides a robust shield against future complications, saving invaluable time, resources, and potential legal fees. For any enterprise embarking on a financial venture, this tool is not merely an option, but an essential component for secure and successful dealings.