Every structure, from a bustling downtown skyscraper to a quiet suburban apartment complex, is a living entity that requires constant care and attention to thrive. Just as the human body needs proper nutrition and regular check-ups, buildings demand ongoing maintenance to ensure their longevity, functionality, and safety. Neglecting this crucial aspect can lead to costly emergencies, tenant dissatisfaction, and significant devaluation of your property asset.

This is where a meticulously crafted facility maintenance budget becomes indispensable. It’s more than just a list of expenses; it’s a strategic blueprint that guides your spending, anticipates future needs, and safeguards your investment. Whether you’re a property manager, a building owner, or part of a facilities management team, understanding how to construct and utilize this vital financial tool is paramount for operational efficiency and long-term success.

The Unsung Hero of Property Management

Imagine trying to navigate a ship without a map or fuel gauge. That’s akin to managing a building without a clear, comprehensive maintenance budget. This financial roadmap allows you to allocate resources effectively, plan for both routine upkeep and unexpected repairs, and make informed decisions that impact your bottom line. It transforms reactive, crisis-driven spending into proactive, strategic investment.

A well-defined maintenance spending plan acts as the backbone of responsible property stewardship. It ensures that critical systems like HVAC, plumbing, electrical, and structural components receive the attention they need before minor issues escalate into major, expensive problems. This forward-thinking approach not only saves money in the long run but also contributes significantly to tenant retention and regulatory compliance.

Key Benefits of a Robust Maintenance Budget

Implementing and adhering to a detailed property upkeep budget offers a multitude of advantages that extend far beyond simple cost control. These benefits collectively enhance the value, safety, and operational efficiency of any building.

- Cost Savings and Avoidance: Perhaps the most immediate benefit, a planned budget helps avoid the high costs associated with emergency repairs. By allocating funds for preventative maintenance, you catch small problems before they become catastrophic and far more expensive to fix.

- Extended Asset Lifespan: Regular maintenance, funded by your budget, significantly extends the life of critical building systems and components. This means delaying costly capital replacements for items like roofs, boilers, or elevators, thus maximizing your initial investment.

- Enhanced Safety and Compliance: A properly funded maintenance schedule ensures that all safety systems, from fire alarms to emergency exits, are in top working order. It also helps meet regulatory standards and avoids potential fines or legal liabilities.

- Improved Tenant Satisfaction: Buildings that are well-maintained offer a better living or working environment. Fewer breakdowns, quicker resolution of issues, and aesthetically pleasing common areas contribute directly to higher tenant satisfaction and retention rates.

- Better Financial Forecasting: With a clear expenditure blueprint, you gain greater insight into your operational costs. This allows for more accurate long-term financial planning, investor reporting, and setting appropriate rental rates or service charges.

- Increased Property Value: A building with a proven track record of excellent maintenance is a more attractive asset. It signals to potential buyers or investors that the property has been well cared for, commanding a higher market value.

Essential Components of Your Maintenance Budget

Creating an effective maintenance budget involves meticulously categorizing and estimating all potential expenses related to your building’s upkeep. While the specifics will vary by property type and age, certain core components are universally applicable.

- Preventative Maintenance (PM): This category includes all scheduled, routine tasks designed to prevent failures, such as:

- HVAC system inspections and filter changes

- Plumbing checks for leaks and pipe maintenance

- Electrical system diagnostics and safety checks

- Roof inspections and minor repairs

- Landscaping and groundskeeping services

- Fire safety equipment testing and servicing

- Reactive Maintenance (RM) / Emergency Repairs: Funds set aside for unexpected breakdowns and urgent repairs that require immediate attention. While PM aims to reduce these, they are an unavoidable part of building ownership. Examples include:

- Burst pipes

- HVAC system failures

- Electrical outages

- Storm damage repairs

- Capital Expenditures (CapEx): These are significant investments in major upgrades or replacements of building components that have reached the end of their useful life. These are typically large, infrequent expenses, such as:

- Roof replacement

- Boiler or chiller replacement

- Elevator modernization

- Major exterior facade repairs

- Large-scale renovations or system upgrades

- Utilities and Services (Operations-related): While not strictly "maintenance," operational costs directly support the functionality and often intertwine with maintenance activities. This might include:

- Electricity, gas, water

- Waste management and recycling

- Pest control services

- Security system maintenance and monitoring

- Administrative and Overhead Costs: Expenses related to managing the maintenance function itself, such as:

- Software licenses for CMMS (Computerized Maintenance Management System)

- Staff training and certifications

- Permits and licensing fees

- Consulting services for specialized assessments

Developing Your Maintenance Budget: A Step-by-Step Guide

Constructing a reliable facility maintenance budget requires a systematic approach. This process helps ensure all critical areas are covered and estimates are as accurate as possible.

- Conduct a Comprehensive Building Assessment: Begin by thoroughly inspecting your property. Document the age and condition of all major systems (HVAC, electrical, plumbing, roof, structure, etc.). Identify any existing issues, deferred maintenance, or areas of concern.

- Review Historical Data: Look at past maintenance expenditures for your property or similar properties. This provides a valuable baseline for estimating future costs for both routine and unexpected repairs. Categorize these expenses to understand where the most money has been spent.

- Prioritize Maintenance Tasks: Not all maintenance is created equal. Categorize tasks by urgency and importance:

- Critical: Safety-related, regulatory compliance, essential systems.

- High Priority: Preventative maintenance that prevents major breakdowns.

- Medium Priority: Aesthetic improvements, minor repairs.

- Low Priority: Non-urgent upgrades or enhancements.

- Estimate Costs for Each Category:

- Preventative: Get quotes from contractors for regular service contracts.

- Reactive: Based on historical data, allocate a contingency fund (typically 10-15% of your total maintenance budget).

- Capital: Plan for major replacements based on estimated asset lifespans and obtain current market quotes for future projects.

- Utilities/Admin: Review past bills and anticipate future usage or service contract costs.

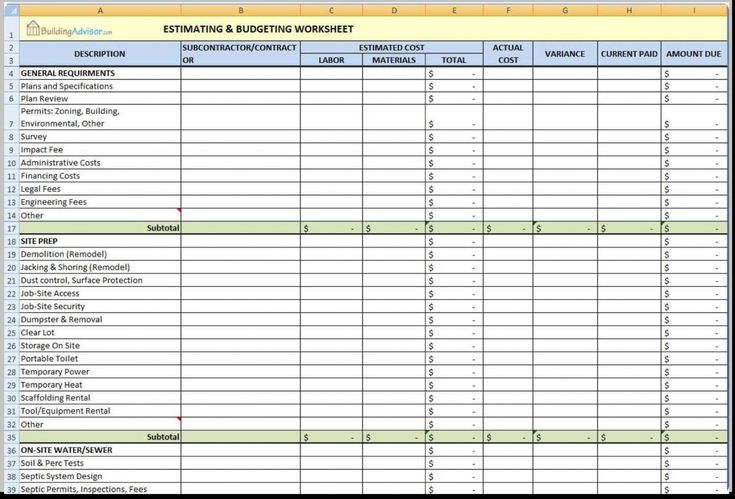

- Create a Detailed Spreadsheet or Use a Building Maintenance Budget Template: This allows you to organize all costs, compare actual spending against budgeted amounts, and track expenditures by category. A well-designed Building Maintenance Budget Template can streamline this process significantly, providing pre-formatted sections for various expense types.

- Secure Approval and Implement: Present your proposed budget to stakeholders (owners, board members) for approval. Once approved, communicate the budget to your maintenance team and ensure everyone understands their roles in adhering to it.

- Monitor and Adjust Regularly: A budget is a living document. Continuously track actual spending against your budget. Review it quarterly or semi-annually to make necessary adjustments based on changing conditions, new regulations, or unforeseen issues.

Strategies for Optimizing Your Maintenance Spending

Beyond just creating a budget, actively managing and optimizing your maintenance financial planning can lead to substantial long-term savings and improved building performance.

- Embrace Preventative Maintenance: This cannot be stressed enough. Investing proactively in routine inspections and servicing drastically reduces the likelihood and cost of emergency repairs. A well-executed PM program is the cornerstone of an efficient maintenance budget.

- Negotiate Vendor Contracts: Regularly review and re-negotiate service contracts with suppliers and contractors. Seek competitive bids and consider long-term agreements for better rates. Don’t be afraid to compare pricing annually.

- Utilize Lifecycle Costing: When considering new equipment or system replacements, look beyond the initial purchase price. Factor in energy consumption, expected maintenance costs, and lifespan to determine the true long-term cost of ownership.

- Invest in Staff Training: A well-trained in-house maintenance team can perform many tasks efficiently, reducing reliance on expensive external contractors. Continuous training on new technologies and best practices is a valuable investment.

- Leverage Technology: Adopt CMMS software to schedule PM tasks, track work orders, manage inventory, and monitor equipment performance. This data-driven approach allows for better decision-making and resource allocation.

- Implement an Energy Management Program: Utilities often represent a significant portion of a building’s operational costs. Investing in energy-efficient lighting, HVAC systems, and insulation can yield substantial savings that directly impact your overall building operational budget.

Customizing Your Budget for Unique Needs

No two buildings are exactly alike, and neither should their maintenance budgets be. A budget for a historical landmark will look vastly different from one for a newly constructed commercial office building or a multi-family residential complex. Tailoring your maintenance expenditure blueprint is essential for its effectiveness.

Consider the age of the building: Older structures often require more extensive capital expenditure planning for major system replacements and have higher reactive maintenance needs due to aging infrastructure. Newer buildings might have lower immediate maintenance costs but need robust preventative plans to preserve warranties and extend the life of new systems.

The type of building also dictates specific budget line items. A manufacturing plant will have heavy machinery maintenance, while a retail space focuses on public area upkeep and aesthetic presentation. Residential properties prioritize tenant amenity maintenance and common area cleanliness. Geographical location plays a role too, with buildings in harsh climates needing more funds for exterior protection and heating system maintenance. Your property’s specific characteristics must inform every category and allocation within your annual maintenance plan.

Leveraging Technology for Budget Management

In today’s fast-paced world, managing a complex maintenance budget manually with spreadsheets can be time-consuming and prone to error. Fortunately, technology offers powerful solutions to streamline and optimize this process.

Computerized Maintenance Management Systems (CMMS) are at the forefront of this technological revolution. These platforms not only help in scheduling preventative maintenance and tracking work orders but also integrate seamlessly with financial modules. This allows for real-time tracking of expenses, comparison of actual vs. budgeted costs, and robust reporting. The insights gained from such systems can be invaluable for making data-driven adjustments to your building operational costs. From detailed expense categorization to automated variance reporting, CMMS helps transform a static budget document into a dynamic, actionable financial management tool.

Frequently Asked Questions

What is the typical percentage of operating budget dedicated to maintenance?

While it varies greatly by building type, age, and condition, a common benchmark for commercial properties is around 10-15% of the total operating budget. Residential properties can be slightly lower or higher depending on amenities. It’s crucial to tailor this to your specific property, rather than relying solely on averages.

How often should I review and update my building maintenance budget?

You should conduct a formal review at least annually when preparing for the next fiscal year. However, it’s highly recommended to monitor your actual spending against the budget on a monthly or quarterly basis. This allows you to identify variances early and make necessary adjustments to your maintenance financial planning throughout the year.

What’s the difference between OpEx (Operating Expenses) and CapEx (Capital Expenditures) in a maintenance budget?

Operating expenses (OpEx) are the day-to-day costs of running and maintaining a building, such as routine repairs, preventative maintenance, utilities, and cleaning services. Capital expenditures (CapEx) are significant investments in assets that extend their useful life or improve the property’s value, like a new roof, HVAC system replacement, or a major renovation. CapEx items are typically depreciated over time, while OpEx items are expensed in the year they occur.

How do I account for unexpected emergencies or large, unforeseen repairs?

It’s vital to include a contingency fund or a line item for “contingencies” or “emergency repairs” within your maintenance budget. This typically represents a percentage (e.g., 5-15%) of your total planned maintenance expenses. For very large, rare emergencies, a dedicated reserve fund separate from the annual maintenance budget might also be necessary.

Can a Building Maintenance Budget Template be used for multiple properties?

Yes, a well-designed Building Maintenance Budget Template can certainly be adapted for multiple properties. However, you’ll need to customize the specific line items, cost estimates, and priorities for each individual property based on its unique characteristics, age, condition, and operational requirements. It provides a consistent framework, but the content must be tailored.

Creating and diligently managing a maintenance budget is not just an administrative task; it’s a strategic imperative for any property owner or manager. It empowers you to transition from a reactive, crisis-management approach to a proactive, value-driven strategy. By understanding your building’s needs, planning for the future, and leveraging the right tools, you protect your investment, enhance operational efficiency, and ensure tenant satisfaction.

Embrace the discipline of meticulous financial planning for your facility. A robust maintenance plan, anchored by a comprehensive budget, is your best defense against unexpected costs and your most powerful tool for ensuring the longevity and profitability of your valuable assets. Start building your budget today, and pave the way for a more secure and efficient tomorrow for your property.