In the intricate dance of managing personal finances or steering a small business, understanding where your money truly goes is paramount. Many of us start with good intentions, setting budgets that outline our financial hopes and plans. Yet, the reality of daily spending, unexpected expenses, and fluctuating incomes can quickly diverge from these initial projections, leaving us feeling adrift without a clear compass.

This is where a robust and intuitive system for financial comparison becomes indispensable. It’s not just about tracking numbers; it’s about gaining clarity, identifying patterns, and empowering yourself to make proactive financial decisions rather than reactive ones. For anyone serious about achieving their financial goals, from saving for a down payment to ensuring business profitability, a dedicated tool that shows you the real picture is a game-changer.

Why Financial Tracking Matters

Financial tracking isn’t merely an administrative chore; it’s a foundational pillar of sound financial health. Without a clear record of income and expenses, it’s impossible to identify financial leaks, understand spending habits, or plan effectively for the future. Many people feel overwhelmed by their finances because they lack a systematic way to see the ebb and flow of their money, leading to anxiety and missed opportunities for savings or investment.

For individuals, diligent tracking can reveal how much is truly spent on discretionary items versus necessities, illuminating areas where adjustments can lead to significant savings. For businesses, meticulous expense vs income comparison ensures that operations are running efficiently, profit margins are maintained, and resources are allocated optimally. It’s the difference between guessing your financial standing and knowing it with certainty.

The Power of a Budget vs. Actual Comparison

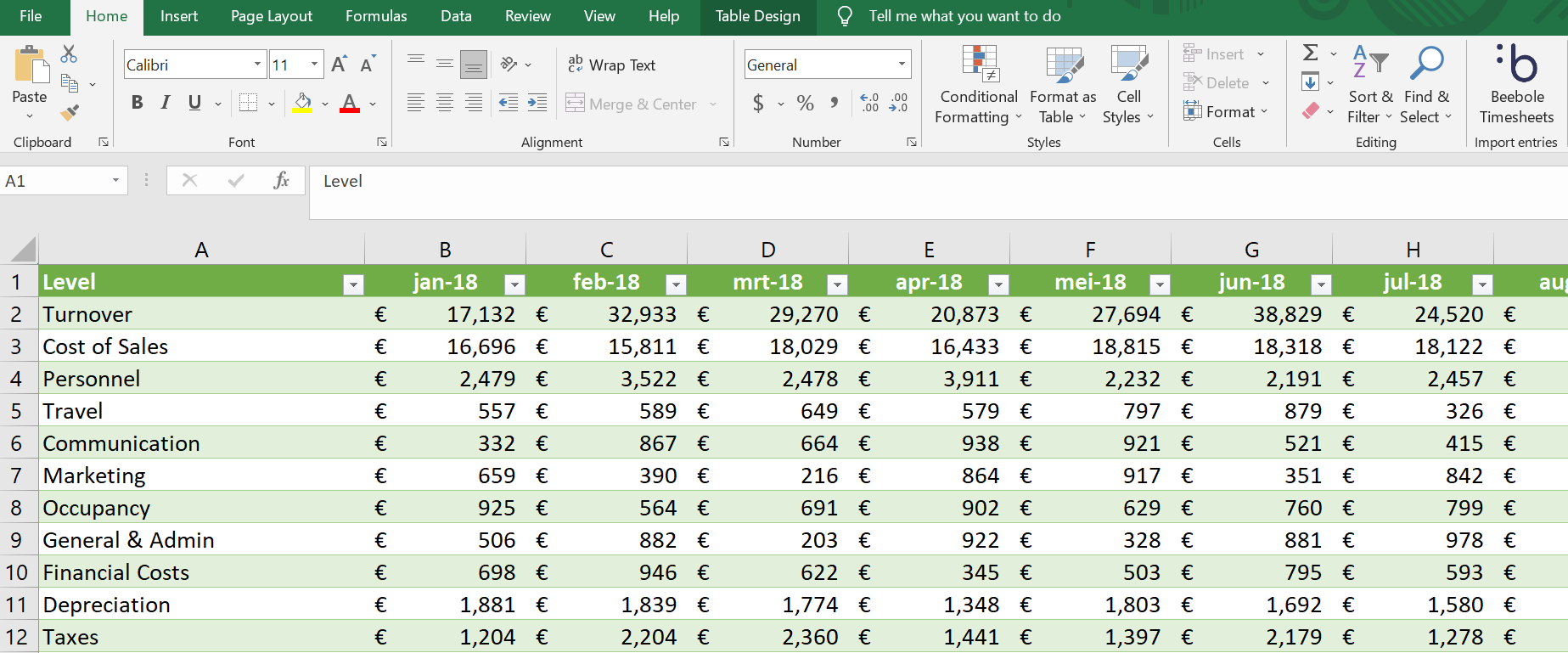

At its core, a budget vs. actual analysis is a powerful diagnostic tool. It takes your carefully constructed financial plan (the “budget”) and directly compares it against what actually happened (the “actual”). This comparison isn’t about shaming past spending; it’s about learning and adapting. It highlights variances—the differences between your planned and real-world numbers—which are crucial indicators of where your financial strategy is succeeding or needs adjustment.

A well-designed budget vs. actual spreadsheet template simplifies this critical process. It transforms raw data into actionable insights, showing you precisely which categories are over budget, under budget, or right on track. This insight allows you to pinpoint specific areas for improvement, whether it’s reducing dining out expenses, finding more cost-effective suppliers for your business, or reallocating funds to achieve a specific savings goal faster. The transparency offered by such a financial tracking worksheet is invaluable for both corrective action and strategic planning.

Key Components of an Effective Template

An effective financial performance tracker needs to be comprehensive yet easy to use. While specific needs may vary, several core components are essential for a robust budget management spreadsheet. These elements work together to provide a holistic view of your financial standing and highlight areas for attention.

- Income Categories: A clear breakdown of all sources of revenue. This could include your salary, freelance income, investment dividends, or business sales revenue.

- Expense Categories: Detailed classification of where your money goes. Think housing, utilities, groceries, transportation, entertainment, loan payments, or business operational costs.

- Budgeted Amounts: The amounts you planned to spend or earn for each category over a specific period (e.g., month, quarter).

- Actual Amounts: The real-world figures of what you actually spent or earned for each category during that same period.

- Variance Column: A calculated field showing the difference between the actual and budgeted amounts. This is often displayed as a positive or negative number, indicating whether you were under or over budget.

- Date Range Selector: Allows you to easily adjust the period you’re analyzing, such as monthly, quarterly, or annually.

- Summaries/Totals: Sections that aggregate income, expenses, and overall net financial position for both budgeted and actual figures.

Setting Up Your Financial Tracker

Getting started with your financial planning tool doesn’t have to be complicated. The beauty of using a spreadsheet for this process is its flexibility and accessibility. Many individuals and small businesses opt for a customizable financial template to tailor it precisely to their unique circumstances.

First, define your income and expense categories clearly. For personal use, this might mean differentiating between "Dining Out" and "Groceries." For a business, it could involve distinguishing "Marketing Costs" from "Office Supplies." The more granular you are (within reason), the more insight you’ll gain. Next, input your budgeted amounts for each category for the upcoming period. Be realistic; an overly strict budget is hard to stick to, while one that’s too loose won’t provide much guidance. As the period progresses, diligently record your actual spending and income into the designated columns. Consistency is key here. Make it a habit to update your actual spending vs planned budget entries regularly, perhaps weekly or even daily, to prevent data accumulation from becoming overwhelming.

Maximizing Your Financial Insight

Simply filling out a budget comparison document is a great start, but the real power comes from analyzing the data it provides. Once you’ve populated your actual spending figures, take the time to review the variance column. Large positive variances (actual spending significantly less than budgeted) might indicate opportunities to save more or reallocate funds. Large negative variances (actual spending significantly more than budgeted) demand attention.

Ask yourself: Why did this discrepancy occur? Was it an unexpected expense, poor planning, or simply a misjudgment of typical spending? This reflection is where you truly learn and adapt your financial behavior. Consider using charts and graphs within your spreadsheet to visualize trends over time, making it easier to spot patterns and areas of consistent overspending or underspending. A well-maintained budget vs actual spreadsheet template evolves with you, becoming a dynamic tool for ongoing financial health and future goal achievement. Don’t be afraid to adjust your budget based on the insights gained; it’s a living document meant to guide you, not rigidly control you.

Frequently Asked Questions

What is the primary benefit of using a budget vs. actual comparison?

The primary benefit is gaining clear insight into your financial habits and performance. It reveals discrepancies between your planned spending/income and what actually occurred, allowing you to identify areas of overspending, underspending, or unexpected income, and make informed adjustments to achieve your financial goals.

How often should I update my financial tracking worksheet?

For optimal benefit, you should update your financial tracking worksheet regularly. Many find daily or weekly updates most effective, especially for expenses, to prevent a backlog of transactions. Income can often be updated less frequently, such as bi-weekly or monthly, depending on its regularity.

Can a small business use a personal budget template?

While a personal budget template shares similar principles, a small business generally requires a more specialized budget management spreadsheet. Business templates often include specific categories for operational costs, payroll, taxes, different revenue streams, and project-based budgeting that differ from personal finance needs.

What if my actual spending consistently exceeds my budget?

If your actual spending consistently exceeds your budget, it’s a clear signal that adjustments are needed. First, review your budget for realism – perhaps your initial estimates were too low. Second, identify the specific categories where overspending occurs and explore ways to reduce expenses in those areas. This might involve cutting back, finding cheaper alternatives, or re-evaluating priorities. Sometimes, increasing income might also be part of the solution.

Are there free tools for this type of financial analysis?

Yes, many free options are available. Spreadsheet software like Google Sheets or Microsoft Excel offers robust capabilities to create your own budget vs actual analysis from scratch or by using pre-made templates. Various free online budgeting apps and software also provide similar comparison features, often with automated transaction syncing from your bank accounts.

Taking control of your finances doesn’t have to be a daunting task. With the right tools and a commitment to understanding your money, you can transform uncertainty into clarity. A well-implemented budget vs actual spreadsheet template serves as your personal financial dashboard, empowering you to navigate the complexities of income and expenses with confidence and precision.

Embrace the power of knowing where every dollar goes and where it should be. By regularly comparing your budgeted plans against your actual financial reality, you unlock the ability to course-correct, optimize your spending, and accelerate your journey toward financial freedom. Start building or utilizing your financial performance tracker today, and begin charting a clearer path to your financial future.