In the dynamic world of real estate, effective financial oversight isn’t just a best practice; it’s the bedrock of sustained success. Property managers, landlords, and real estate investors constantly juggle a multitude of tasks, from tenant relations and maintenance requests to lease agreements and marketing. Amidst this flurry of activity, the critical function of financial planning can sometimes feel like an overwhelming additional burden, yet it’s precisely what determines profitability and long-term stability.

This is where a robust Budget Template For Property Management becomes an invaluable asset. It transforms what could be a chaotic jumble of receipts and spreadsheets into a clear, actionable financial roadmap. For anyone tasked with managing properties, understanding where every dollar comes from and where it goes is paramount, allowing for informed decisions that optimize income, control expenses, and ultimately, grow your portfolio.

The Indispensable Role of Financial Planning in Property Management

Financial planning for properties is more than just keeping tabs on income and expenses; it’s a strategic tool that empowers property managers to anticipate challenges, seize opportunities, and ensure the fiscal health of their assets. Without a clear financial framework, properties can quickly become financial drains rather than lucrative investments. A well-structured budget acts as an early warning system, highlighting potential overspending or underperforming revenue streams before they escalate into major problems.

It allows property owners and managers to set realistic financial goals, allocate resources efficiently, and make data-driven decisions regarding rent adjustments, capital improvements, and operational efficiencies. By clearly outlining projected income and expenses, a comprehensive property management budgeting tool provides the transparency needed to evaluate performance, demonstrate accountability to stakeholders, and foster trust with investors. This proactive approach significantly reduces financial surprises and contributes to a more stable and profitable operation.

What Makes an Effective Property Management Budget Template?

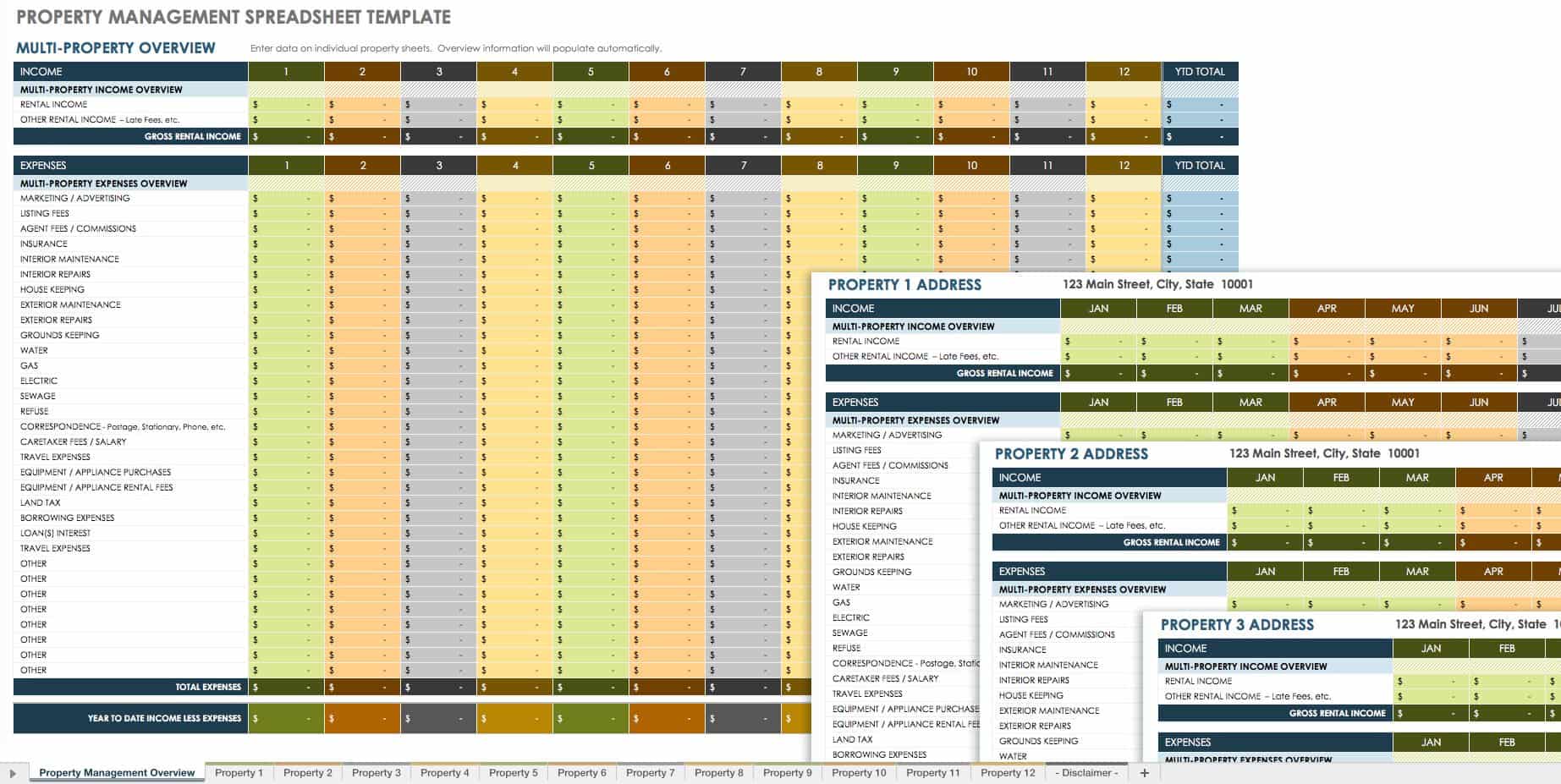

An effective property management budget template serves as a comprehensive financial snapshot, detailing all anticipated income and expenditures over a specific period, typically a quarter or a year. It’s not just about numbers; it’s about providing structure and clarity to complex financial data. The best templates are intuitive, adaptable, and sufficiently detailed to capture the nuances of real estate financial management, whether you’re overseeing a single-family home or a multi-unit apartment complex.

At its core, any good template balances ease of use with thoroughness. It should clearly delineate between various types of income and meticulously categorize all expenses. This distinction is crucial for accurate financial reporting, tax preparation, and strategic planning. A well-designed financial management in property template helps you track actual performance against projections, providing invaluable insights into where your budget is on target and where adjustments may be necessary.

Key Income Categories to Include

Understanding all potential revenue streams is the first step in creating an accurate budget for your properties. Many managers might only consider base rent, but a truly comprehensive property financial planning template accounts for a wider array of income sources, ensuring a complete picture of your gross revenue potential. Each income item, no matter how small, contributes to the overall profitability and should be accounted for.

- **Rental Income:** This is typically the largest component, encompassing base monthly rent from all occupied units. It should also include any specific pet fees, parking fees, or other monthly charges explicitly stated in the lease agreement.

- **Late Fees:** While ideally avoided, late payment fees are a legitimate income source that should be projected and tracked. These can add up over time and contribute to the overall financial health.

- **Application Fees:** Fees collected from prospective tenants for processing their rental applications. It’s important to track these separately as they are generally non-refundable.

- **Laundry/Vending Income:** For properties with shared laundry facilities or vending machines, this passive income stream can be significant and should be part of the income projection.

- **Amenity Fees:** If your property offers amenities like a gym, pool, or clubhouse for which tenants pay an additional fee, these should be included.

- **Miscellaneous Income:** Any other one-off income, such as insurance payouts, security deposit forfeitures (following local regulations), or tenant chargebacks for damages, should have a category.

Essential Expense Categories for Your Budget

Managing expenses effectively is just as critical as maximizing income. A detailed breakdown of all potential costs, both routine and unexpected, is what distinguishes a robust budget from a superficial one. Overlooking even minor expenses can quickly throw your entire financial projection off balance. A thorough property management budgeting tool will ensure you’re prepared for every financial outflow.

- **Property Taxes:** These are a significant fixed cost and must be accurately budgeted based on assessed values and local tax rates.

- **Property Insurance:** Premiums for landlord insurance, liability insurance, and any other relevant coverage are non-negotiable expenses.

- **Utilities:** Depending on lease agreements, this can include water, sewer, trash removal, electricity, and gas for common areas or vacant units.

- **Maintenance & Repairs:** This is a broad category covering everything from routine upkeep (e.g., landscaping, cleaning common areas) to specific repairs (e.g., plumbing leaks, appliance fixes). It’s wise to budget a contingency for unexpected repairs.

- **Administrative Fees:** Costs associated with running the property management operation itself. This might include property management software subscriptions, office supplies, background check fees, and professional association dues.

- **Advertising & Marketing:** Expenses incurred to attract new tenants, such as online listings, signage, and professional photography.

- **Legal & Professional Fees:** Costs for attorneys (e.g., eviction proceedings, lease reviews) or accountants for tax preparation and financial advice.

- **Vacancy Costs:** While not a direct expense, the lost rental income during vacant periods is a crucial factor to consider. It’s also important to factor in the costs of turning over a unit, such as cleaning, painting, and minor repairs between tenants.

- **Capital Expenditures (CapEx):** These are significant expenses for major improvements or replacements that add to the value of the property or extend its useful life, such as a new roof, HVAC system replacement, or major renovations. These are typically depreciated over several years rather than expensed in the year they occur.

- **Debt Service:** If the property has a mortgage, the principal and interest payments are a primary expense that must be accounted for.

Beyond the Basics: Strategic Uses of Your Budget Template

While the primary function of a budget is to track income and expenses, a well-implemented rental property budgeting framework offers a wealth of strategic benefits that extend far beyond simple accounting. It transforms raw financial data into actionable intelligence, empowering property managers to optimize performance and plan for future growth. Leveraging your budget template for property management in these advanced ways can significantly enhance your operational efficiency and profitability.

One of the most powerful strategic uses is performance monitoring. By regularly comparing actual income and expenses against your budgeted figures, you can quickly identify trends, variances, and areas needing attention. Are utility costs consistently higher than expected? Is maintenance spending escalating in a particular property? This real-time insight allows for swift corrective action, preventing minor issues from becoming major financial drains. This granular view is essential for effective financial management in property.

Furthermore, a detailed budget serves as a robust tool for forecasting and planning. Analyzing past budget performance can inform future rent adjustments, help predict cash flow, and guide decisions on capital improvements or expansions. If your property financial planning template reveals consistent surplus, you might consider investing in upgrades that increase property value or tenant satisfaction. Conversely, consistent deficits might prompt a re-evaluation of rental rates or a search for cost-cutting measures. It also becomes indispensable for crafting investor reports, providing transparent and professional financial statements that build confidence and attract further investment. For tax preparation, having all your income and expenses meticulously categorized within a budget template simplifies the process, reducing stress and potentially uncovering deductions you might otherwise miss.

Customizing Your Property Management Financial Tool

While generic budget templates provide an excellent starting point, the true power of a **budget template for property management** lies in its adaptability. No two properties or portfolios are identical, and an effective financial tool must reflect the unique characteristics of your operation. Customization ensures that your budget accurately represents your specific financial landscape, making it a truly useful and relevant guide.

Consider the size and type of your portfolio. A template for a single-family rental will differ significantly from one designed for a multi-unit commercial building. Your customized budget should include categories relevant to your specific properties, such as HOA fees for condos, specific utility breakdowns for commercial tenants, or differing maintenance schedules for various property ages. Geographic location also plays a role; local tax structures, utility rates, and common maintenance costs can vary widely. Your financial planning for properties needs to account for these regional differences.

Regularly review and adjust your budget. Financial environments are fluid, and what was accurate last year might not be this year. Market conditions, interest rates, unforeseen repairs, and even tenant turnover rates can impact your financial projections. It’s crucial to treat your property management financial tool as a living document, revisiting it at least annually, if not quarterly, to ensure it remains aligned with current realities. Don’t hesitate to add new expense categories that emerge, or remove those that become irrelevant. This iterative process of adaptation and refinement ensures your budget remains a precise and powerful instrument for financial success.

Frequently Asked Questions

How often should I update my property management budget?

While annual budgeting for projections is standard, you should ideally update your budget with actual income and expenses on a monthly or at least quarterly basis. This allows for continuous monitoring of performance against your initial plan and enables timely adjustments.

Can a single budget template work for multiple properties?

Yes, a single template can be adapted for multiple properties. Many property managers use separate worksheets within one spreadsheet file for each property, or they include a “Property” column to filter data. For very diverse portfolios, a master template with property-specific subsections might be more effective.

What’s the difference between operating expenses and capital expenditures?

Operating expenses (OpEx) are routine costs necessary to maintain and run the property, like utilities, regular maintenance, and insurance, which are typically expensed in the year they occur. Capital expenditures (CapEx) are significant expenses for major improvements or replacements (e.g., new roof, HVAC system) that extend the property’s useful life or increase its value, and are usually depreciated over several years.

Do I need specialized software for property financial planning?

While specialized property management software can offer integrated solutions, it’s not strictly necessary. A well-designed budget template in a spreadsheet program like Excel or Google Sheets can be incredibly powerful and sufficient for most property managers, especially those with smaller portfolios. The key is consistent data entry and understanding the financial categories.

How does a budget template help with tax preparation?

A detailed budget template organizes all your income and expenses into clear, categorized lists throughout the year. When tax season arrives, this organized data simplifies the process of identifying deductible expenses and reporting income accurately, saving you time and potentially reducing your tax burden.

Embracing a structured approach to your property finances through a dedicated budget template for property management is not just about crunching numbers; it’s about building a foundation for sustainable growth and peace of mind. It demystifies the complex financial landscape of real estate, transforming uncertainty into clarity and potential pitfalls into opportunities for strategic intervention.

By meticulously tracking every dollar, anticipating future costs, and continuously refining your financial planning for properties, you empower yourself to make smarter decisions. This diligence not only maximizes the profitability of your current portfolio but also positions you advantageously for future investments, ensuring that your property management ventures are consistently successful and financially sound.