Navigating the financial landscape as a non-profit organization can often feel like steering a ship through a complex storm. With limited resources, diverse funding streams, and an unwavering commitment to your mission, meticulous financial planning isn’t just a good idea—it’s absolutely essential for survival and growth. A well-structured financial framework provides the clarity and control needed to ensure every dollar serves its purpose effectively.

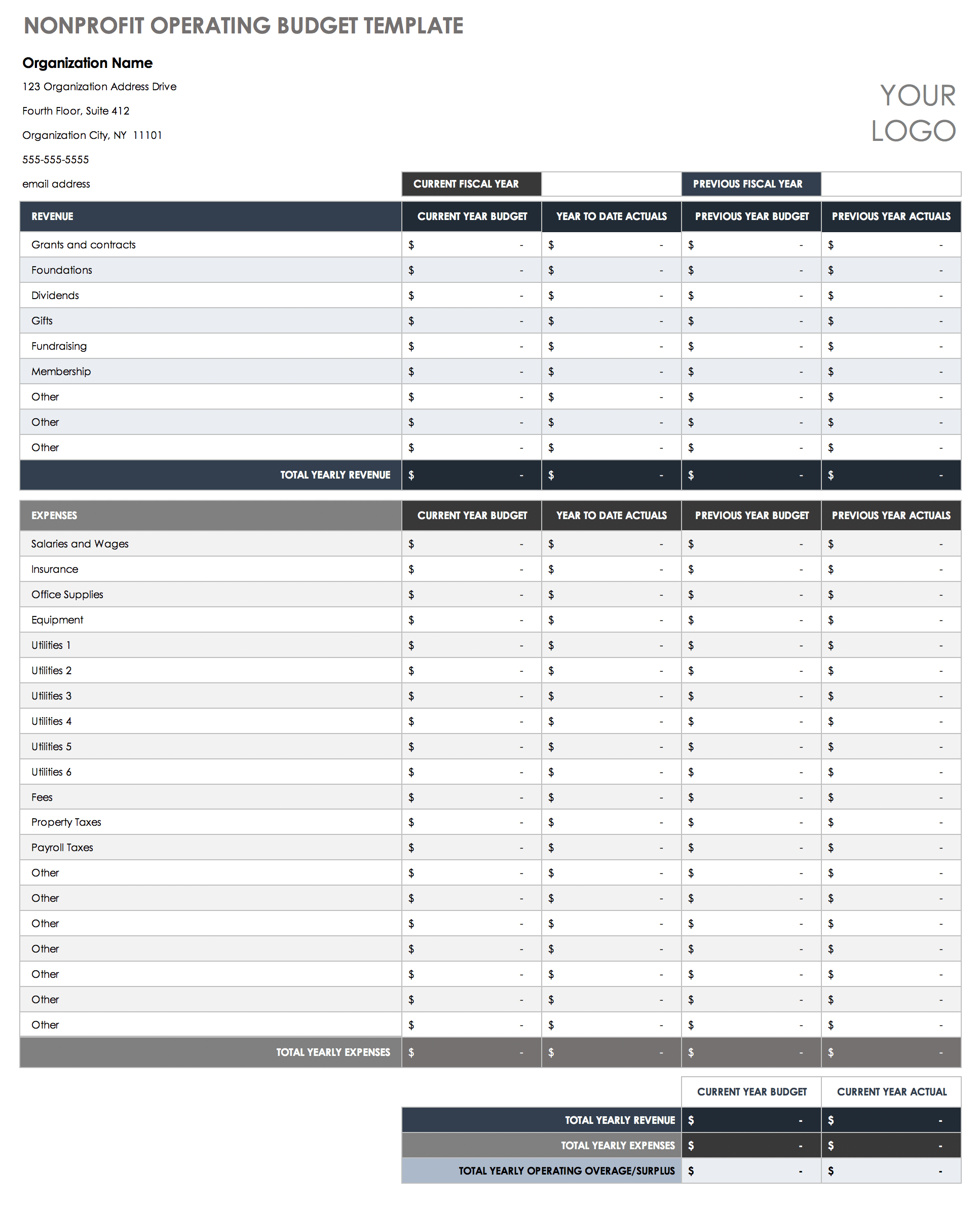

For many charitable entities, the concept of a robust financial blueprint can seem daunting, conjuring images of intricate spreadsheets and endless calculations. However, with the right tools and understanding, developing a comprehensive non-profit budgeting tool becomes an empowering exercise rather than a burdensome chore. It transforms abstract financial data into actionable insights, illuminating pathways to greater impact and sustained organizational health.

Why a Robust Financial Blueprint is Crucial for Non-Profits

At its core, financial planning for non-profits is about accountability and impact. Donors, grant-making foundations, and the community at large place immense trust in these organizations, expecting responsible stewardship of funds dedicated to a cause. A clearly articulated budget demonstrates this commitment to transparency and financial prudence, building confidence among stakeholders.

Beyond mere compliance, an effective organizational budget framework serves as a strategic roadmap. It helps leadership make informed decisions about resource allocation, program expansion, and potential areas for cost savings. Without such a framework, organizations risk overspending, underfunding critical initiatives, or missing opportunities for growth due to a lack of financial foresight.

Moreover, a well-defined financial model aids in fundraising efforts. Grant applications frequently require detailed budgetary information, and a polished, professional budget can significantly enhance a proposal’s credibility. It shows potential funders that the non-profit understands its financial needs and has a viable plan to achieve its programmatic goals. This makes it easier to secure the vital funding needed to sustain operations and fulfill the mission.

Key Elements of an Effective Non-Profit Budget

Developing a non-profit budget requires careful consideration of both income and expenditures, tailored specifically to the unique operational model of charitable organizations. It’s not just about listing numbers; it’s about categorizing them in a way that provides clarity and insight into the organization’s financial health. Understanding these core components is the first step toward building a truly useful financial framework for a non-profit.

An effective budget will typically separate operational costs from program-specific expenses, allowing stakeholders to see how much directly supports the mission. It also accounts for both restricted and unrestricted funds, which is critical for non-profits dealing with various types of grants and donations. This level of detail ensures that funds are used in accordance with donor intent and regulatory requirements.

Here are the essential components that should be included:

- **Revenue Sources:** Detail all incoming funds, including grants (restricted and unrestricted), individual donations, corporate sponsorships, fundraising events, earned income, and in-kind contributions.

- **Personnel Expenses:** Cover salaries, wages, benefits, payroll taxes, and any professional development costs for staff directly involved in the organization’s mission and administration.

- **Program Expenses:** Allocate funds directly to the programs and services offered, such as supplies, direct service costs, outreach materials, and specific project expenditures.

- **Administrative and Operational Costs:** Include rent, utilities, insurance, office supplies, technology, professional fees (e.g., accounting, legal), and marketing expenses not tied to specific programs.

- **Fundraising Expenses:** Budget for costs associated with securing funding, such as donor management software, fundraising event costs, and marketing for appeals.

- **Capital Expenditures:** Account for significant investments in assets like equipment, vehicles, or property that will benefit the organization over a long period.

- **Reserves and Contingency Funds:** Designate a portion of the budget for unforeseen circumstances or to build up an operating reserve, crucial for long-term stability.

Crafting Your Organizational Budget: A Step-by-Step Guide

Creating a comprehensive organizational budget is a cyclical process that begins with planning and extends through monitoring and adjustments. It’s not a one-time task but an ongoing commitment to sound financial stewardship. This budgeting process for non-profits empowers an organization to align its financial resources directly with its strategic objectives and impact goals.

The initial phase involves looking back at past financial performance to inform future projections. Analyzing previous years’ actual income and expenses provides a realistic baseline for forecasting. Simultaneously, it’s crucial to look forward, considering any new programs, shifts in funding opportunities, or changes in operational costs that might impact the upcoming fiscal year. This dual perspective ensures the budget is both grounded in reality and forward-thinking.

Once historical data is reviewed and future plans are outlined, organizations can begin populating their financial framework. This often involves departmental input, where program managers and administrative leads submit their projected expenses and revenue contributions. This collaborative approach fosters ownership and ensures that all areas of the organization are adequately represented in the budget.

- Gather Historical Financial Data: Collect actual income and expenditure reports from the past 1-3 fiscal years. This provides a baseline for realistic projections.

- Define Strategic Goals and Programs: Identify all programs, initiatives, and administrative functions that will operate in the upcoming fiscal year. This links financial planning to mission delivery.

- Estimate Revenue Sources: Project income from all anticipated sources, distinguishing between restricted and unrestricted funds. Be realistic and consider potential fluctuations.

- Project Expenses: Detail all anticipated expenses, categorizing them into personnel, program, administrative, and fundraising costs. Obtain input from department heads.

- Distinguish Between Fixed and Variable Costs: Understand which costs remain constant (e.g., rent) and which fluctuate with activity levels (e.g., program supplies).

- Allocate Indirect Costs: Determine how shared costs (e.g., administrative salaries, utilities) will be allocated across different programs or funding sources, especially for grant reporting.

- Review, Revise, and Approve: Share the draft budget with key stakeholders, including the board of directors, for feedback and final approval. This ensures alignment and buy-in.

- Monitor and Adjust: Once approved, continuously track actual financial performance against the budget. Be prepared to make necessary adjustments throughout the year.

Leveraging Your Budget for Strategic Growth and Transparency

A carefully constructed budgeting guide for charitable organizations is far more than just a list of numbers; it’s a dynamic tool that can drive strategic growth and enhance transparency. When used effectively, it becomes an integral part of the organization’s overall management strategy, providing a clear picture of financial health and potential. This allows leadership to make proactive decisions rather than reactive ones.

By consistently comparing actual results to the approved budget, non-profits can identify trends, pinpoint areas of over- or under-spending, and assess the efficiency of their operations. This continuous monitoring enables timely adjustments, preventing minor deviations from becoming major financial challenges. It also provides valuable data for future planning cycles, refining the accuracy of subsequent financial blueprints.

Furthermore, a well-managed budget significantly boosts transparency, both internally and externally. Internally, it clarifies financial expectations for staff and board members, ensuring everyone understands their role in responsible resource management. Externally, it serves as a powerful communication tool for donors, grantmakers, and the public, demonstrating prudent stewardship and accountability. This transparency strengthens trust and fosters greater engagement with the community.

Customizing Your Financial Framework

While a standard non-profit budgeting tool provides an excellent starting point, every organization has unique needs, and its financial framework should reflect that individuality. A smaller, all-volunteer organization will have different budgeting requirements than a large non-profit with multiple programs and dozens of staff members. The key is to adapt the template to fit the specific scale, mission, and operational complexity of your charity.

Customization might involve adding specific line items relevant to your unique services, such as specialized equipment for a medical non-profit or unique outreach costs for an advocacy group. It also means adjusting the level of detail. A small organization might combine several expense categories, while a larger one might need to break them down further for more granular tracking and reporting. The goal is to create a budget that is both comprehensive and manageable.

Consider integrating specific reporting requirements from major funders directly into your budget structure. This proactive approach can save significant time and effort during grant reporting periods, ensuring that all necessary data is readily available and categorized correctly. Tailoring your budgetary planning for charities to your operational realities ensures it remains a practical and highly valuable asset.

Frequently Asked Questions

How often should a non-profit budget be reviewed?

Ideally, a non-profit budget should be reviewed at least monthly by financial staff and quarterly by the board of directors. This frequent review allows for timely adjustments and ensures the organization stays on track with its financial goals and mission.

What’s the difference between restricted and unrestricted funds in a budget?

Unrestricted funds can be used for any purpose that supports the organization’s mission, offering flexibility. Restricted funds, however, come with specific donor-imposed conditions on how they must be used, often for particular programs or projects, and must be tracked carefully.

Can a small non-profit effectively use a complex budget template?

While a complex template might offer extensive detail, small non-profits should simplify and customize it to fit their capacity. Focus on core revenue and expense categories that are most relevant to your operations. The goal is to create a tool that is helpful, not overwhelming.

How does a budget help with grant applications?

A well-prepared budget demonstrates financial planning and accountability, which are critical for grantmakers. It provides a clear breakdown of how grant funds will be utilized, aligning with program goals and showing the grantmaker that their investment will be managed responsibly and effectively.

What if actual expenses significantly exceed the budgeted amount?

If actual expenses consistently exceed the budget, it’s a red flag. Investigate the reasons immediately: are projections unrealistic, or are there unforeseen costs? This situation necessitates a budget revision, potential cost-cutting measures, or an increase in fundraising efforts to maintain financial stability.

Embracing a robust financial planning for non-profits isn’t merely about managing money; it’s about amplifying impact, fostering trust, and ensuring the enduring legacy of your vital work. It transforms the often-abstract concept of financial health into a tangible strategy that underpins every program, every initiative, and every life touched by your organization.

By dedicating time and resources to developing a meticulously crafted Budget Template For Non Profit Organisation, you are investing in the long-term sustainability and effectiveness of your mission. This foundational tool empowers you to navigate economic uncertainties with confidence, respond to evolving community needs with agility, and continually demonstrate unwavering accountability to those you serve and those who support your cause. Take the proactive step to refine your financial strategy today, and watch your organization flourish.