Stepping onto a college campus is an exhilarating journey, a time brimming with new experiences, academic challenges, and newfound independence. For many, it’s also their first encounter with true financial autonomy. While the excitement of campus life can be all-consuming, mastering personal finance during these formative years is arguably one of the most crucial life skills a student can acquire. It’s not about restricting fun, but about empowering smart choices that pave the way for a stress-free academic experience and a strong financial future.

Navigating tuition, housing, textbooks, and daily expenses can feel like a complex puzzle, especially when balancing income from part-time jobs, loans, or parental contributions. Without a clear roadmap, it’s easy to overspend, accumulate debt, or simply feel overwhelmed. This is precisely where a well-structured financial plan becomes indispensable. It serves as your personal financial compass, guiding you through the ebbs and flows of college expenditures and ensuring you stay on track toward your academic and personal goals.

Why Financial Savvy is Your Best Campus Companion

Embracing financial management early on provides a multitude of benefits that extend far beyond just avoiding overdraft fees. It lays a foundational understanding of money that will serve you throughout your life. College is an ideal low-stakes environment to practice these skills before bigger financial responsibilities come knocking.

Developing a robust financial framework offers immediate and long-term advantages:

- **Reduces Stress:** Knowing where your money goes and where it needs to go significantly alleviates financial anxiety, allowing you to focus on your studies and social life.

- **Prevents Debt Accumulation:** By understanding your spending limits, you can avoid unnecessary credit card debt or excessive student loans, which can burden your post-graduation life.

- **Builds Good Habits:** Establishing consistent saving and spending habits now will serve as a strong foundation for future financial success, from buying a home to planning for retirement.

- **Increases Independence:** Taking control of your finances fosters a greater sense of responsibility and self-sufficiency, key traits for adulthood.

- **Funds Fun Experiences:** A clear budget allows you to allocate funds strategically for social activities, travel, or hobbies without guilt, knowing you’ve covered your essentials.

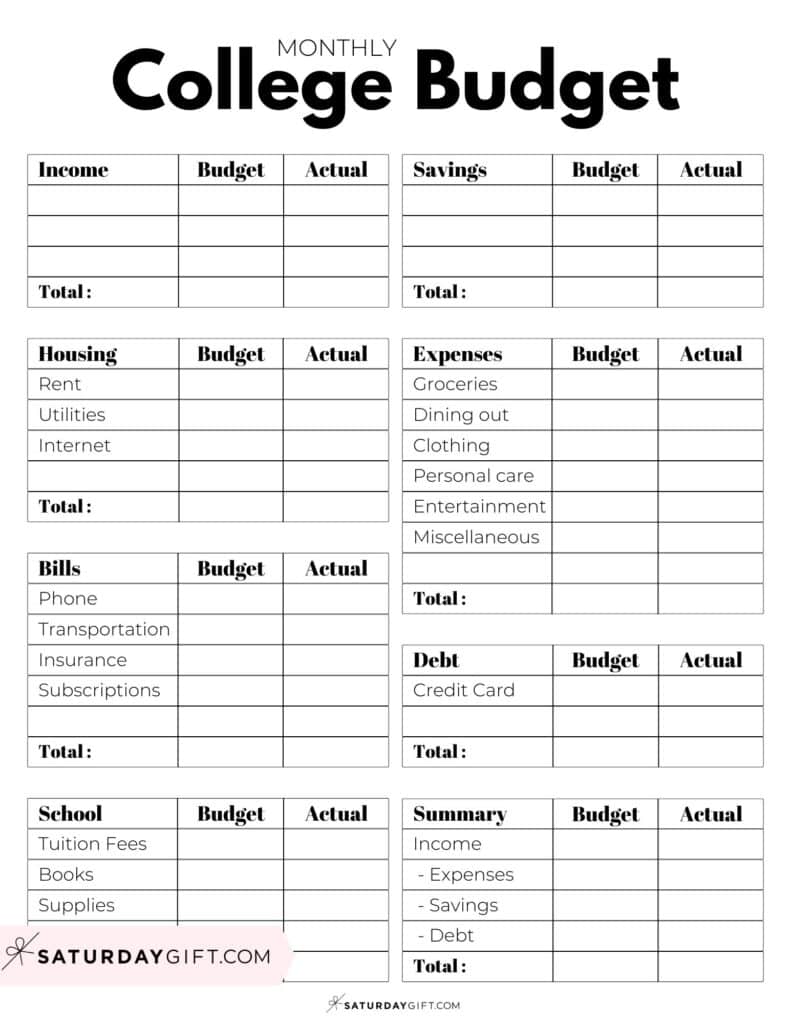

Deconstructing the College Budget: Key Elements

A college student budgeting tool isn’t a one-size-fits-all solution; it’s a personalized reflection of your unique financial situation. However, all effective student financial plans share common components that need careful consideration. Breaking down your income and expenses into clear categories is the first step toward gaining control.

Start by identifying all sources of money coming in:

- **Income Sources:** This might include student loans, scholarships, grants, parental contributions, part-time job wages, or savings you brought from home. Be realistic about the regularity and amount of each.

Next, list out your expenses. These typically fall into two main categories: fixed and variable.

Fixed Expenses: These are costs that generally stay the same month-to-month and are often non-negotiable.

- **Tuition & Fees:** If not fully covered by financial aid or scholarships, ensure you factor in payment deadlines.

- **Housing:** Rent for off-campus apartments, dorm fees, or utilities (electricity, internet, water) if not included in rent.

- **Phone Bill:** A regular and often essential expense.

- **Insurance:** Health, car, or renter’s insurance premiums.

- **Subscriptions:** Streaming services, gym memberships, or software subscriptions.

**Variable Expenses:** These costs fluctuate based on your choices and usage, offering more opportunities for adjustments.

- **Groceries & Dining Out:** A significant category that can be controlled with meal planning and cooking.

- **Textbooks & Supplies:** Often a large upfront cost at the beginning of each semester. Look for used books or rentals.

- **Transportation:** Gas, public transit passes, ride-shares, or parking fees.

- **Personal Care:** Toiletries, haircuts, laundry supplies.

- **Entertainment & Socializing:** Movies, concerts, going out with friends, campus events.

- **Clothing:** New apparel or accessories.

- **Miscellaneous/Emergency Fund:** It’s wise to set aside a small amount for unexpected costs, like a sudden doctor’s visit or a broken laptop.

Building Your Personalized Financial Roadmap

Creating your own financial plan for university students doesn’t require an accounting degree. It’s a straightforward process that involves tracking, categorizing, and adjusting. The goal is to build a spending plan that supports your academic goals without unnecessary financial strain.

Follow these steps to construct your effective student spending tracker:

- **Gather Your Financial Information:** Collect statements from bank accounts, credit cards, loan documents, and any income statements. Know your starting point.

- **Calculate Your Monthly Income:** Sum up all regular sources of money you expect to receive each month. If income varies, use a conservative estimate or an average.

- **List All Fixed Expenses:** Write down every fixed cost with its due date and amount.

- **Estimate Variable Expenses:** This is where tracking previous spending for a month or two can be incredibly helpful. If you’ve never tracked, make educated guesses based on what you think you typically spend on groceries, entertainment, etc. Be honest with yourself.

- **Subtract Expenses from Income:** Your goal is for your total income to be greater than or equal to your total expenses. If expenses exceed income, you’ll need to make adjustments.

- **Allocate Funds for Savings:** Even a small amount set aside monthly for an emergency fund or future goals (like a spring break trip) can make a big difference. Treat savings as a non-negotiable expense.

- **Choose Your Budgeting Tool:**

- **Spreadsheet:** A custom Excel or Google Sheets document offers flexibility.

- **Budget Template For College Students (Pre-made):** Many free online options are available and can be downloaded and customized.

- **Budgeting Apps:** Mint, YNAB (You Need A Budget), EveryDollar, or PocketGuard offer automated tracking and categorization.

- **Notebook & Pen:** For those who prefer a tactile approach.

- **Review and Adjust Regularly:** Your budget is a living document. Life happens, and your financial situation will change. Make it a habit to review your student budget framework weekly or monthly.

Making Your Budget Work: Tips for Success

Having a meticulously crafted financial blueprint is only half the battle. The real magic happens when you consistently stick to it and adapt it as needed. Here are some practical tips to help you succeed with your university budget framework:

- Be Honest with Yourself: Don’t sugarcoat your spending habits. Accurate tracking is crucial for an effective personal finance for students.

- Track Every Dollar: Especially when starting, monitor every expenditure. This helps identify "leakage" where small, unnoticed purchases add up quickly.

- Automate Savings: If possible, set up automatic transfers from your checking account to a savings account each payday. Even $10-$20 a week makes a difference.

- Find Student Discounts & Free Activities: Many businesses offer student discounts. Take advantage of free campus events, lectures, and resources.

- Cook More, Eat Out Less: Dining out is a major budget killer. Meal prepping and cooking at home or with roommates can save a significant amount of money.

- Use the Library: Rent textbooks, use study spaces, and borrow entertainment instead of buying or subscribing.

- Limit Impulse Buys: Give yourself a "cooling off" period before making non-essential purchases. Ask if you truly need it.

- Build an Emergency Fund: Even $100-$200 set aside can prevent a small emergency (like a flat tire) from derailing your entire financial plan.

- Regular Check-ins: Dedicate 15-30 minutes each week to review your spending, update your accounts, and make any necessary adjustments. This helps in managing money in college effectively.

- Don’t Be Afraid to Adjust: If your initial budget isn’t working, don’t abandon it. Analyze what went wrong and make realistic changes. A budget is a tool to help you, not a rigid prison.

Beyond the Spreadsheet: Tools and Resources

While a physical budget template for college students or a simple spreadsheet can be highly effective, many digital tools are designed to streamline the process and provide deeper insights into your spending habits.

Consider exploring these options to support your student financial planning:

- **Budgeting Apps:**

- **Mint:** Free, connects to bank accounts, tracks spending, categorizes transactions, sets budget limits.

- **You Need A Budget (YNAB):** Paid, but offers a free trial and student discount. Emphasizes giving every dollar a job, promoting proactive budgeting.

- **EveryDollar:** Free and paid versions, based on Dave Ramsey’s budgeting principles, focuses on zero-based budgeting.

- **Banking Apps:** Most major banks offer robust mobile apps that allow you to track transactions, set up alerts, and often include basic budgeting features.

- **Campus Financial Aid Office:** Often overlooked, your college’s financial aid or student services office may offer workshops, free financial counseling, and resources specifically tailored to students.

- **Online Resources & Blogs:** Websites like NerdWallet, The Balance, and reputable financial institutions offer a wealth of articles, tips, and often free downloadable budgeting tools.

Frequently Asked Questions

How often should I update or review my budget?

Ideally, you should review your campus spending guide at least once a week. This allows you to catch overspending early, make small adjustments, and stay on top of your financial goals. A more thorough review, perhaps monthly or at the start of each semester, is also beneficial to account for bigger changes like new classes or housing situations.

What if my income changes frequently, like with a part-time job?

If your income is irregular, it’s best to budget based on your lowest expected income for the month. Any additional income can then be treated as “extra,” which you can allocate towards savings, debt repayment, or a specific goal. Alternatively, you can use an average of your past few months’ income to create a more stable baseline for your financial management tool for students.

Is it okay to spend money on fun and entertainment?

Absolutely! A sustainable budget isn’t about deprivation; it’s about intentional spending. In fact, cutting out all discretionary spending can make a budget feel restrictive and hard to stick to. Allocate a realistic amount for entertainment, social activities, and hobbies. This helps ensure your money management resource for college life is balanced and enjoyable.

What’s the biggest mistake college students make with their money?

One of the biggest pitfalls is not tracking spending, leading to an “out of sight, out of mind” mentality. This often results in overspending on variable expenses like dining out or impulse buys, accumulating credit card debt, and neglecting savings. Another common mistake is failing to build an emergency fund, leaving them vulnerable to unexpected costs.

Where can I find a ready-made college student budgeting tool?

Many financial websites offer free, downloadable Excel or Google Sheets templates. Websites like NerdWallet, Investopedia, or even many banks often provide these as resources. Additionally, budgeting apps like Mint or YNAB come with built-in frameworks that you can customize to your specific needs, acting as an excellent budgeting tool for campus living.

Taking charge of your finances in college is more than just managing money; it’s about investing in your future self. By implementing a thoughtful and adaptable financial framework, you’re not just creating a student budgeting guide for today, but building lifelong skills that will empower you through every financial decision you face. The small effort you put into planning now will pay dividends in reduced stress, increased confidence, and a more secure financial foundation for years to come.

Don’t wait for financial problems to arise before taking action. Start today, even if it’s just by tracking your spending for a week. Every small step towards financial awareness is a step towards greater control and peace of mind. Embrace this opportunity to master your money, so you can fully embrace the incredible experience that college offers.