Securing grant funding is a pivotal step for non-profits, researchers, educational institutions, and community organizations aiming to bring their impactful projects to life. While the project description often captures the heart and soul of your initiative, the accompanying budget summary serves as its indispensable financial backbone, translating your vision into tangible costs. This financial overview isn’t just a formality; it’s a critical component that demonstrates your organization’s fiscal responsibility and understanding of the resources required to achieve your stated goals.

A meticulously prepared financial summary can often be the deciding factor between a funded project and a missed opportunity. It reassures potential funders that their investment will be managed judiciously and effectively, directly supporting the project’s objectives. Organizations that present clear, justifiable, and comprehensive financial details inherently build a stronger case, showcasing their preparedness and ability to execute the proposed work with precision and transparency.

Why a Well-Structured Grant Budget is Non-Negotiable

A well-structured grant budget goes far beyond merely listing expenses; it tells a concise financial story that aligns perfectly with your project narrative. Funders are not just looking for innovative ideas; they are scrutinizing the feasibility and sustainability of your project, and the budget is their primary lens for this assessment. It proves you’ve thought through every aspect of project implementation, from staffing to supplies, and have a realistic grasp of the financial commitment involved.

Without a clear, itemized financial breakdown, even the most compelling project description can fall flat. A disorganized or vague budget raises red flags, suggesting a lack of planning or an inability to manage funds effectively. Conversely, a detailed and logical budget summary reinforces your credibility, signaling that your organization is professional, capable, and prepared to handle the responsibilities that come with grant funding. It also serves as an essential internal planning tool, guiding your project’s financial management from start to finish.

Key Elements of an Effective Grant Budget Summary

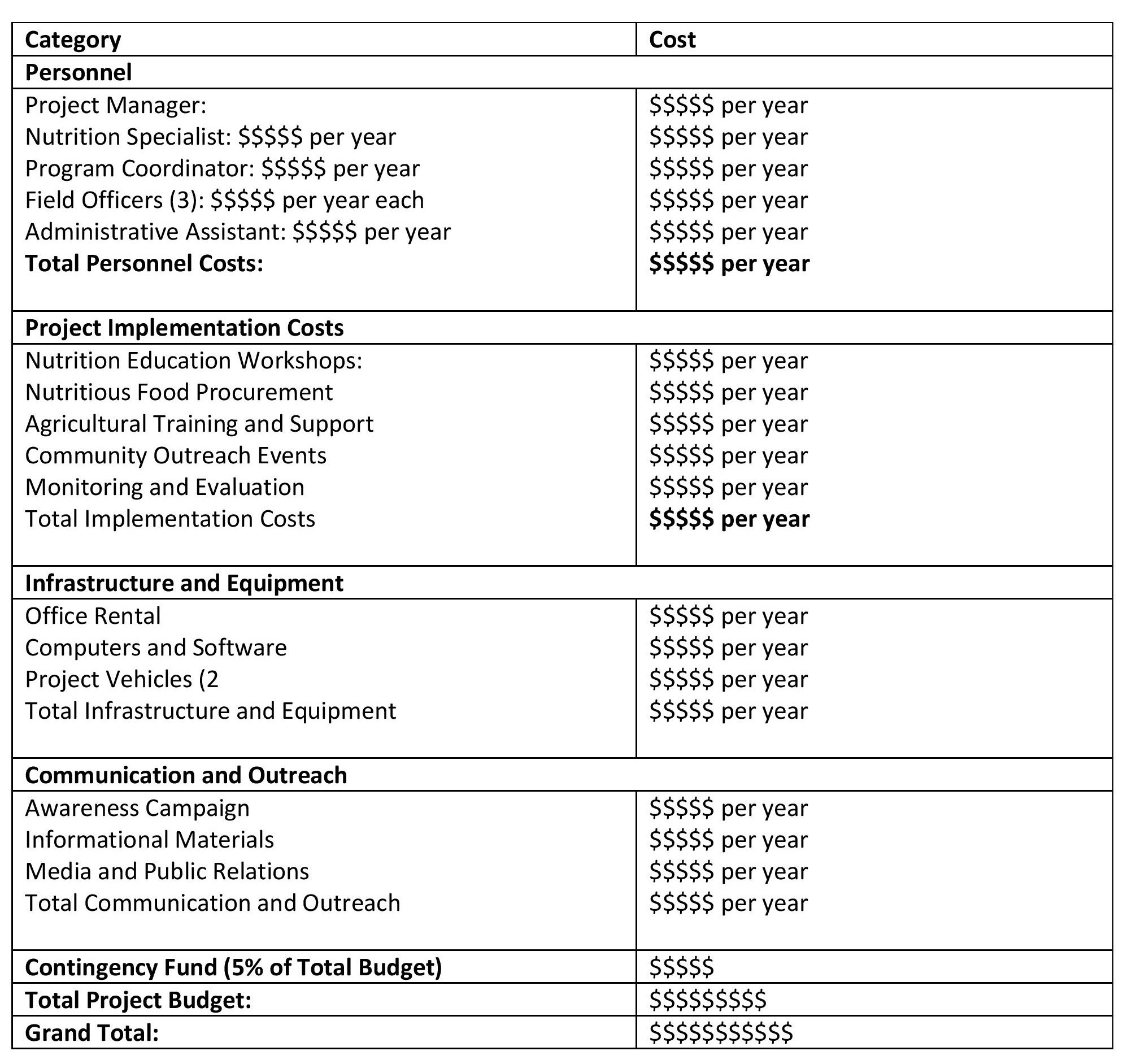

Crafting a robust financial summary for a grant application involves more than simply adding up numbers. It requires categorizing expenses thoughtfully and ensuring each line item is justifiable and directly linked to project activities. A strong budget outlines all anticipated costs, providing a transparent look at how grant funds will be utilized.

Here are the essential components typically found in a comprehensive project budget summary:

- Personnel Costs: This includes salaries, wages, and benefits for staff directly involved in the project. Clearly delineate roles, time commitment (e.g., FTE, percentage), and salary rates.

- Fringe Benefits: Often calculated as a percentage of salaries, these cover health insurance, retirement contributions, FICA, and other payroll taxes for project staff.

- Travel: Itemize anticipated travel expenses, including transportation (airfare, mileage), lodging, and per diem for project-related trips, conferences, or field work.

- Equipment: List specific equipment purchases necessary for the project, providing details such as type, quantity, and estimated cost. Justify why each piece of equipment is essential.

- Supplies: Detail consumable materials and supplies required, such as office supplies, lab materials, software licenses, or specific program resources.

- Contractual/Consultant Services: Outline fees for any external consultants, contractors, or specific services needed for the project, along with their roles and deliverables.

- Other Direct Costs: This category covers any other expenses directly attributable to the project but not falling into the above categories, such as printing, postage, communication costs, or training materials.

- Indirect Costs (Facilities & Administrative – F&A): These are costs not directly attributable to a specific project but necessary for the general operation of the organization (e.g., utilities, rent, administrative staff salaries). Funders often have specific rates or caps for indirect costs.

Leveraging a Budget Summary Template For Grant Project Success

Using a well-designed Budget Summary Template For Grant Project Description can dramatically streamline the grant application process. Such a template provides a standardized framework, ensuring that no critical cost category is overlooked and that all necessary financial information is presented clearly and consistently. It acts as a guide, prompting you to consider every potential expense and justify its inclusion.

Beyond simply organizing data, a good template promotes accuracy and reduces errors, which are common pitfalls in complex financial documents. It helps maintain consistency across multiple grant applications, making it easier to adapt your project’s financial details to different funder requirements. By providing pre-defined categories and often including formulas for calculations (like fringe benefits or indirect costs), a template saves valuable time and allows project teams to focus on the strategic aspects of their proposal rather than manual data entry and formatting. This structured approach not only impresses funders with its professionalism but also serves as an excellent tool for internal financial planning and tracking once the project is underway.

Customizing Your Budget Summary for Different Funders

While a standardized template offers consistency, it’s crucial to understand that not all funders are alike. Each grant-making organization often has its own specific guidelines, preferred budget formats, and allowable costs. Therefore, adapting your project budget summary to align with each funder’s unique requirements is a critical step towards a successful application. This isn’t about altering your project’s true costs but rather presenting them in a way that resonates with the specific funder’s priorities and conventions.

For instance, some funders may have strict caps on administrative overhead or specific categories for personnel effort, while others might prioritize direct program costs. A funder focused on community engagement might want to see detailed breakdowns of outreach materials, whereas a research-focused funder would expect robust equipment and lab supply allocations. Always read the Request for Proposals (RFP) or grant guidelines meticulously. Tailoring your financial template for grant proposals to mirror their structure and terminology shows due diligence and respect for their processes, significantly increasing your proposal’s chances of standing out positively.

Common Pitfalls to Avoid in Your Grant Financials

Even with a comprehensive budget outline for grant projects, certain mistakes can undermine an otherwise strong application. Being aware of these common pitfalls can help you navigate the process more effectively and present a more compelling financial case. Avoiding these issues demonstrates professionalism and a thorough understanding of financial management.

One frequent error is failing to align the budget narrative with the project description. Every cost item in your grant application budget outline should have a clear justification within the project activities. Another pitfall is underestimating or overestimating costs significantly; both can raise questions about your project’s feasibility or your organization’s financial planning skills. Be realistic and base your figures on current market rates and reliable quotes.

Furthermore, neglecting to account for in-kind contributions (donated services or materials) or matching funds, if required or beneficial, can weaken your proposal. Ignoring funder-specific rules, such as maximum percentages for indirect costs or non-allowable expenses, is also a critical mistake. Finally, presenting a poorly organized or unclear project cost breakdown template makes it difficult for reviewers to assess your financial plan, potentially leading to rejection regardless of project merit.

Tips for Crafting a Compelling Budget Narrative

A budget summary, no matter how detailed, is only as effective as its accompanying narrative. The budget narrative is your opportunity to explain and justify every line item, drawing a clear connection between the requested funds and the successful execution of your project goals. It transforms a list of numbers into a persuasive argument for funding.

Here are some tips for writing a compelling budget narrative:

- Directly link costs to activities: For every expense, explain why it’s needed and how it directly contributes to achieving a specific project objective. For example, explain why certain staff hours are allocated to specific tasks.

- Be clear and concise: Use plain language. Avoid jargon where possible, and ensure your explanations are easy to understand for reviewers who may not be experts in your specific field.

- Justify all personnel: Detail the roles and responsibilities of each project staff member, justifying their salary and time commitment by linking it to project tasks.

- Explain calculations: If you’re using estimates or specific formulas (e.g., per diem rates, fringe benefit percentages), briefly explain how these figures were derived.

- Address indirect costs: Clearly state your organization’s approved indirect cost rate, or if you’re charging less, explain why. Some funders cap this, so ensure compliance.

- Highlight other resources: Mention any leveraged resources, in-kind contributions, or matching funds that demonstrate broader support for your project, even if they aren’t part of the direct grant request.

- Anticipate questions: Think like a reviewer. What questions might they have about a particular expense? Address those proactively in your narrative.

Frequently Asked Questions

What is the primary benefit of using a grant budget summary template?

The primary benefit of using a budget summary template for grant projects is enhanced clarity, consistency, and efficiency. It ensures all necessary financial components are included, reduces the risk of errors, and streamlines the process of adapting your budget for different funders, ultimately strengthening your grant application.

How often should I update my project cost breakdown template during the grant writing process?

You should continually update your project budget summary template throughout the grant writing process. As your project description evolves or as you receive new quotes for services/materials, your financial plan needs to reflect these changes accurately. A final review should always occur just before submission.

Can a single grant application budget outline be used for all types of grant projects?

While a general financial template for grant proposals can serve as a strong starting point, it’s rare for one outline to fit all types of grant projects perfectly. You’ll likely need to customize it based on the specific project’s scope (e.g., research, education, community service) and, more importantly, to align with the unique budget guidelines and priorities of each specific funder.

What if I don’t have exact figures for every budget item when preparing my grant financial overview?

It’s common not to have exact figures for every item initially. For expenses where exact costs are unknown, use realistic estimates based on market research, vendor quotes, or historical data from similar projects. Clearly indicate in your budget narrative that these are estimates and explain your methodology for arriving at those figures to maintain transparency.

Are indirect costs always allowed in grant applications?

No, indirect costs are not always allowed, or they may be capped at a certain percentage, depending on the funder. Always review the grant guidelines or Request for Proposals (RFP) carefully to understand the funder’s policy on indirect costs. Some funders explicitly state they will not cover indirect costs or will only cover a limited percentage.

In the competitive landscape of grant funding, the difference between approval and rejection often hinges on the clarity and credibility of your financial presentation. A meticulously prepared budget summary template for grant project description is more than just a document; it’s a testament to your organization’s preparedness, fiscal responsibility, and commitment to achieving its mission. By leveraging a structured approach to your project’s financial overview, you demonstrate not only what you plan to do, but also how you plan to sustain it.

Ultimately, presenting a clear, justified, and well-organized financial summary helps funders visualize the impact of their investment and assures them that their resources will be managed with the utmost care. It transforms a complex financial requirement into a powerful tool for advocacy, solidifying your case and paving the way for your project’s successful realization. Embrace the power of a detailed budget, and unlock the potential for your next transformative initiative.