Every ambitious project begins with an idea, but it truly gains momentum when that vision is clearly articulated and, crucially, adequately funded. Securing the necessary resources often hinges on a compelling project proposal, and within that document, the budget section stands as its financial backbone. It’s the critical juncture where abstract plans meet concrete financial realities, demonstrating viability and inspiring confidence in potential funders, investors, or internal stakeholders.

A well-structured Budget For Project Proposal Template is more than just a document; it’s a strategic communication tool. It translates your project’s operational needs into quantifiable costs, showcasing a meticulous understanding of what it will take to achieve success. Whether you’re a non-profit seeking a grant, a startup pitching to venture capitalists, a consultant outlining services, or an internal team requesting departmental funds, a clear and justifiable budget can be the deciding factor between approval and rejection.

Understanding the Core Value of a Project Budget Template

The primary role of a comprehensive project budget template is to bring clarity and credibility to your proposal. It demystifies the financial requirements, allowing stakeholders to grasp the scope and scale of your endeavor at a glance. Without a detailed financial plan, even the most innovative and impactful project idea risks being dismissed as unrealistic or poorly planned.

Beyond merely listing numbers, a well-prepared budget articulates the financial narrative of your project. It explains how every dollar will be spent, connecting expenditures directly to project activities and expected outcomes. This transparency builds trust, demonstrating that you have thoroughly considered all aspects of the project and are prepared for the financial commitment required. It acts as a roadmap, guiding both the proposer and the reviewer through the projected costs.

Leveraging a robust Budget For Project Proposal Template can significantly streamline the proposal development process. Instead of starting from scratch, you begin with a framework that prompts you to consider all essential financial categories. This not only saves time but also reduces the risk of overlooking critical expenses, which could lead to unforeseen financial shortfalls down the line. It ensures consistency, making it easier to compare and manage multiple proposals or projects.

Key Components of an Effective Proposal Budget

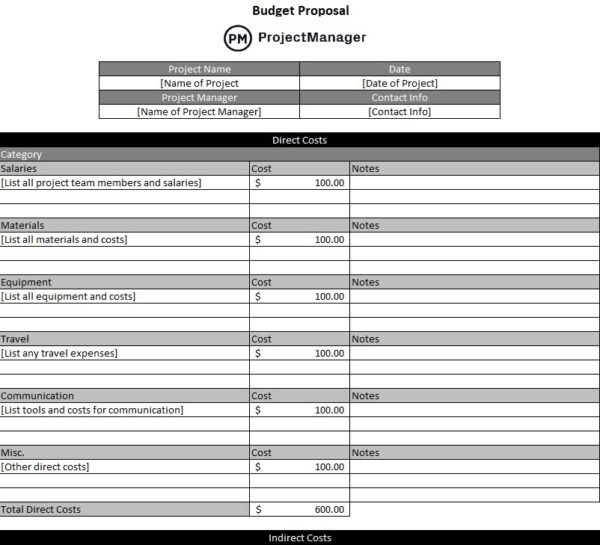

An effective proposal budget isn’t just a list of expenses; it’s a detailed financial breakdown that justifies every requested dollar. It typically organizes costs into clear, logical categories, making it easy for reviewers to understand where funds will be allocated. The level of detail will vary depending on the project’s complexity and the funder’s requirements, but certain core components are almost universally expected.

When outlining your project funding proposal, think about the full lifecycle of your project, from initial planning to final delivery. Consider not just the direct costs associated with project activities, but also the less obvious, yet equally important, overheads. A comprehensive financial plan for proposals often includes both personnel costs and operational expenses, ensuring all bases are covered.

Here are the essential categories that typically form the backbone of a strong proposal budget outline:

- Personnel Costs: This includes salaries, wages, and benefits for all team members directly involved in the project. Detail roles, hours, and rates. Don’t forget any associated payroll taxes or insurance.

- Equipment: List any necessary equipment purchases or leases, such as specialized machinery, computers, software licenses, or tools. Specify if items are new or existing and how they will be used.

- Materials and Supplies: Detail all consumable items required for the project. This could range from office supplies to raw materials for manufacturing, or even educational resources for training programs.

- Travel: If your project involves travel, specify costs for transportation, accommodation, per diem, and any conference fees. Justify the necessity of each trip for project success.

- Contractual/Consultant Services: Include costs for any external services you plan to outsource, such as specialized consultants, freelance designers, technical support, or research services.

- Other Direct Costs: This is a catch-all for any direct expenses not covered by the above, such as printing, postage, communication costs, specific permits, or facility rental fees directly tied to the project.

- Indirect Costs (Overhead): These are expenses not directly attributable to the project but necessary for the organization’s general operation, such as administrative salaries, utilities, rent, or IT infrastructure. Often calculated as a percentage of direct costs.

- Contingency: A crucial element, this allocates a percentage (typically 5-15%) of the total budget to cover unforeseen expenses or cost overruns. It demonstrates prudent financial planning and risk mitigation.

Crafting Your Financial Narrative: Beyond Just Numbers

A budget spreadsheet filled with numbers is merely data; it becomes a powerful part of your proposal when those numbers tell a compelling story. Your cost breakdown template should not only list expenses but also explain why each expenditure is necessary and how it directly contributes to achieving the project’s objectives. This requires clear, concise justifications for every major line item.

Think of your budget as another opportunity to reinforce your project’s value proposition. For instance, if you’re requesting funds for specialized software, explain how that software will enhance efficiency or deliver superior results that wouldn’t be possible otherwise. If personnel costs seem high, elaborate on the unique expertise and experience your team brings, justifying the investment. This narrative transforms raw figures into strategic investments.

Moreover, a well-presented expenditure forecast can demonstrate your understanding of financial management. It shows that you’ve considered potential risks and have a plan to mitigate them, such as allocating for contingency. This level of foresight is highly attractive to funders, as it suggests a responsible and capable project manager who anticipates challenges rather than reacts to them. The financial section of your proposal is a testament to your professionalism.

Tips for Customizing and Utilizing Your Budget Template

While a budget planning tool provides an excellent starting point, its true power lies in its adaptability. No two projects are exactly alike, and no two funders have identical requirements. Therefore, the ability to customize your cost estimation framework is paramount for maximizing your chances of success. This involves tailoring the template to fit the specific needs of your project and the expectations of your target audience.

Begin by understanding the specific guidelines provided by the funding body. Many organizations have their own preferred format or categories for project budgets. Adhering strictly to these guidelines is not just a formality; it demonstrates attention to detail and respect for the funder’s process. Even if they don’t provide a specific budget outline, research their typical funding patterns and what types of expenses they usually support.

Consider the scale and complexity of your project. A small, internal initiative might only require a simplified budget with broad categories, whereas a multi-year, multi-partner research grant will demand an extremely detailed allocation of funds. Your project funding proposal should reflect this scope, providing enough detail to be convincing without overwhelming the reader with unnecessary minutiae. Iteration is key; your first draft will rarely be your last.

Furthermore, don’t shy away from utilizing technology. While a basic spreadsheet works, dedicated budget management software or even advanced spreadsheet functions can help you track expenses, calculate totals, and generate professional-looking reports. These tools can also aid in scenario planning, allowing you to quickly adjust figures to see the impact of changes on your overall project budget. Regularly reviewing and updating your budget throughout the proposal development phase ensures accuracy.

Avoiding Common Pitfalls in Proposal Budgeting

Even with the best template and intentions, several common mistakes can undermine the effectiveness of your proposal’s financial section. Recognizing and proactively avoiding these pitfalls can significantly strengthen your application and increase your chances of securing funding. A robust budget planning tool helps, but vigilance is always necessary.

One of the most frequent errors is underestimating costs. This can stem from incomplete research, an overly optimistic view of expenses, or a desire to make the project seem more affordable. Underbudgeting often leads to project shortfalls, requiring additional funding requests or compromising project quality, neither of which is desirable. Always conduct thorough research for all line items and err on the side of caution.

Another pitfall is lack of detail or justification. A budget that simply lists figures without explaining the rationale behind them raises red flags. Reviewers want to understand why you need that specific amount for equipment, personnel, or services. Generic categories or lump sums without breakdown can appear unprofessional or suggest a lack of understanding of the project’s true costs. Provide clear, concise explanations for every major expense.

Ignoring indirect costs is also a common oversight, particularly for organizations new to grant writing. Indirect costs, or overheads, are real expenses associated with running an organization and enabling the project to happen. Failing to include them not only means you’re leaving money on the table but also that your organization will have to absorb these costs, potentially impacting its sustainability. Understand your organization’s indirect cost rate and include it appropriately.

Finally, lack of alignment with the project narrative can weaken your entire proposal. Your budget should clearly support and reflect the activities described in the rest of your proposal. If your narrative emphasizes extensive fieldwork but your travel budget is minimal, there’s a disconnect. Ensure that every item in your cost estimation framework directly corresponds to a proposed activity or outcome, creating a cohesive and believable story.

Frequently Asked Questions

What is the primary difference between a project budget and a project proposal budget?

A project budget is a comprehensive internal financial plan that guides the entire execution of a project, often updated and tracked throughout the project lifecycle. A project proposal budget, while derived from the overall project budget, is a specific financial snapshot presented to external or internal stakeholders to request funding. It is typically more focused on justifying expenses to secure approval, often tailored to the funder’s specific requirements, and is generally fixed once submitted and approved.

How much detail should I include in my proposal budget?

The level of detail required for a proposal budget depends heavily on the project’s complexity, the total amount requested, and the specific guidelines of the funding organization. Generally, it’s better to provide more detail than less, especially for larger requests. Each major category should have sub-categories or specific line items with clear justifications. Avoid lump sums for significant costs. Aim for a balance that provides clarity without overwhelming the reviewer with irrelevant minutiae.

Should I always include contingency funds in my project funding proposal?

Yes, including a contingency fund is almost always a good idea and demonstrates prudent financial planning. Projects rarely go exactly as planned, and unforeseen expenses or minor cost overruns are common. A contingency line item, typically 5-15% of direct costs, allows for flexibility without having to request additional funding later or compromise project deliverables. It signals to funders that you have anticipated risks and planned for them responsibly.

Can one cost breakdown template be used for all types of proposals?

While a foundational cost breakdown template can serve as a strong starting point, it’s rarely advisable to use the exact same one for every proposal without customization. Different funders have distinct reporting requirements, preferred categories, and even specific formats. Project types also vary significantly; a budget for a software development project will look different from one for a community outreach program. Always tailor your financial plan for proposals to match the specific project and the funder’s guidelines to maximize effectiveness.

How do I effectively justify my project’s costs in the budget section?

Effective justification involves explaining the necessity and value of each expenditure. For personnel, link salaries to specific roles and required expertise for project tasks. For equipment, explain its function and why it’s essential for achieving project goals. For services, describe the deliverables and why outsourcing is the most efficient or effective approach. Quantify benefits where possible and show how each cost contributes directly to the project’s successful outcomes. The goal is to demonstrate that every dollar requested is a strategic investment in the project’s success.

Crafting a compelling project proposal is an art, and the budget is its foundation of logic and credibility. It’s where your innovative ideas transform into a practical, fundable plan. By thoughtfully developing your financial section, you not only present a clear accounting of resources but also build immense trust with potential stakeholders, proving your capability to manage the project effectively.

Embrace the process of meticulous budget development, viewing it as an integral part of your project’s success strategy. A well-prepared budget empowers your proposal to stand out, clearly articulating not just what you want to achieve, but precisely what it will take to get there. It’s the ultimate demonstration of foresight, planning, and commitment to your project’s vision.