Organizing a memorable event, whether it’s a corporate conference, a dream wedding, a community festival, or a intimate gathering, demands meticulous planning. Amidst the excitement of selecting themes, venues, and entertainment, one critical element often determines the ultimate success and sanity of the planner: the budget. Without a clear financial roadmap, even the most brilliant event concepts can quickly derail into stress, overspending, and unexpected financial burdens.

This is precisely where a well-structured Budget For Event Planning Template becomes an indispensable ally. Far more than just a spreadsheet, it’s a strategic framework that provides clarity, control, and confidence, empowering you to make informed decisions every step of the way. It transforms the daunting task of managing myriad expenses into a streamlined process, ensuring every dollar is allocated purposefully and every potential cost is accounted for, allowing you to focus on creating an unforgettable experience.

Why a Meticulous Event Budget is Non-Negotiable

Every event, regardless of its scale, is essentially a project with a defined financial scope. From the moment you begin envisioning your event, costs start to accumulate—some obvious, others surprisingly subtle. Without a dedicated financial planning for events, it’s remarkably easy to fall into the trap of reactive spending, addressing costs only as they arise, which invariably leads to budgetary blowouts and compromises on quality.

Inadequate budgeting can manifest in numerous pitfalls: running out of funds before all essential elements are secured, having to cut corners on crucial details, or even facing financial losses post-event. It can strain relationships with vendors who aren’t paid on time, cause immense personal stress, and ultimately detract from the very purpose of the event. A proactive and detailed event budgeting framework is your shield against these common challenges.

By laying out your anticipated expenses from the outset, you gain immediate insights into the feasibility of your vision and where adjustments might be needed. This structured approach fosters responsible spending, encourages strategic negotiations, and provides a clear picture of your financial health throughout the planning journey, ensuring that your event not only meets but exceeds expectations within its allocated resources.

The Core Components of an Effective Event Budget Template

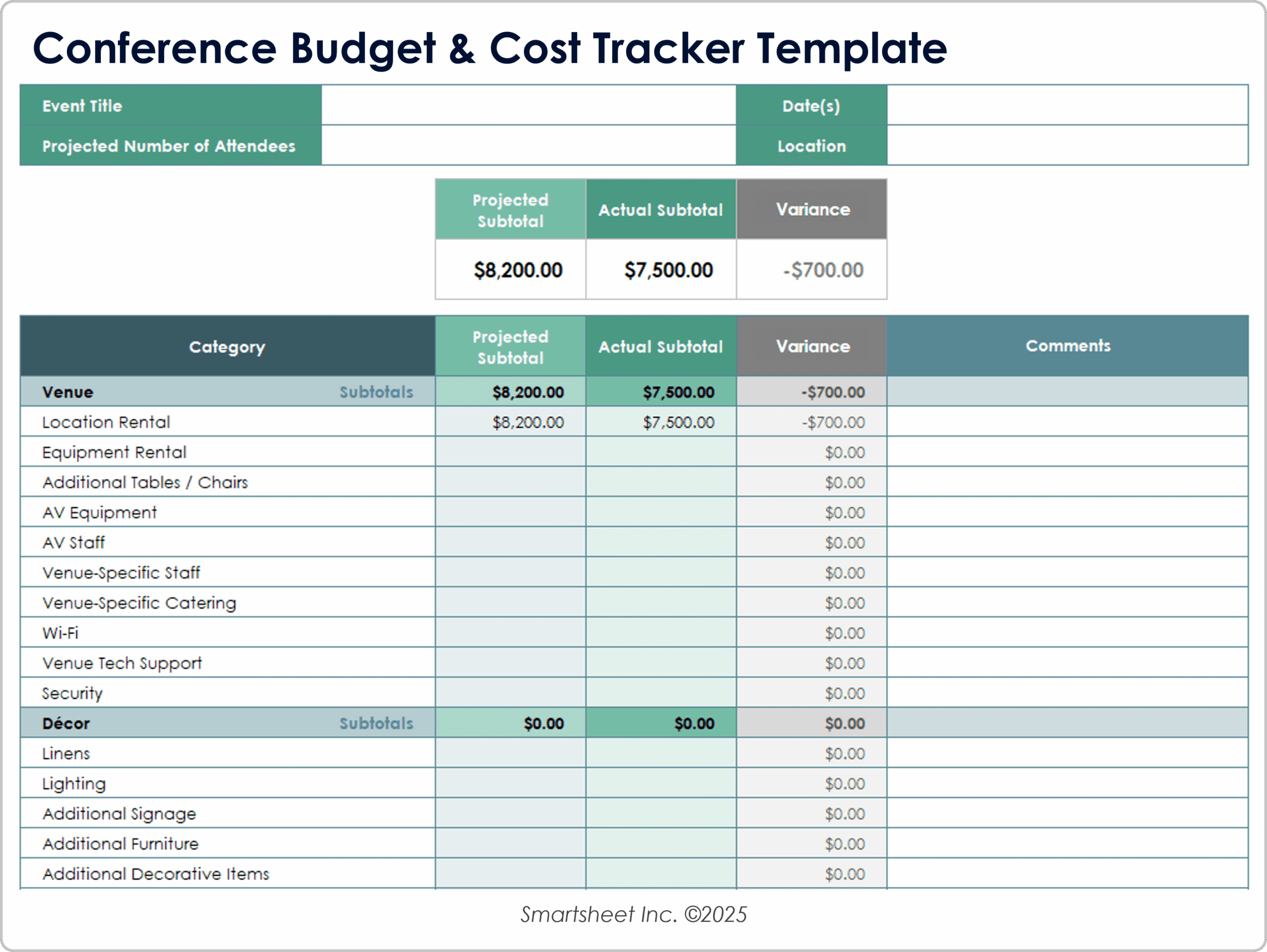

A robust event budget planning tool isn’t just a list of numbers; it’s an organized system designed to capture, categorize, and track every potential expense. Its effectiveness lies in its ability to break down the overall cost into manageable, logical categories, allowing for detailed tracking and comparison against actual spending. This comprehensive approach ensures nothing is overlooked, from the grandest expenditures to the smallest, seemingly insignificant costs.

The best financial blueprint for event success typically includes several key categories, each with multiple sub-items, providing a granular view of where funds are allocated. These categories help you systematically plan and allocate resources, ensuring that every aspect of your event is adequately funded. Understanding these components is crucial for anyone looking to master their event finances.

Here are the essential categories you’ll find in an effective event spending plan:

- **Venue** and Location Costs: Rental fees, permits, insurance, utilities, cleaning.

- **Catering** and Beverage Services: Food per person, drink packages, waitstaff, bar services, special dietary needs.

- **Audiovisual** and Production: Sound system, lighting, screens, projectors, microphones, technical support.

- **Decor** and Design: Linens, centerpieces, floral arrangements, signage, backdrops, furniture rentals.

- **Staffing** and Labor: Event managers, security, registration staff, entertainers, photographers, videographers.

- **Marketing** and Promotion: Invitations, digital ads, social media campaigns, print materials, public relations.

- **Guest** Services and Amenities: Transportation, accommodation blocks, welcome gifts, accessibility features.

- **Contingency** Fund: An essential buffer for unexpected expenses, typically 10-15% of the total budget.

- **Miscellaneous** Expenses: Licenses, permits, gratuities, taxes, unforeseen minor costs.

Each of these categories should then be broken down into specific line items. For example, under “Catering,” you might have separate entries for appetizers, main course, dessert, coffee service, and open bar, allowing for precise estimation and tracking.

Getting Started: How to Utilize Your Event Budgeting Framework

Embarking on event financial management using a comprehensive event budget begins with a clear understanding of your event’s scope and objectives. Before you input any numbers, define what success looks like for your event. What are its key goals? How many guests are you expecting? What is the desired atmosphere and experience? These foundational questions will guide your initial budgeting decisions and help establish a realistic financial outline for events.

Once your vision is clear, the next step involves research and gathering preliminary quotes. For major elements like venues, catering, and audiovisual, reach out to potential vendors to get rough estimates. These initial figures, even if not exact, provide a solid starting point for populating your Budget For Event Planning Template. Don’t be afraid to estimate on the higher side initially; it’s always better to budget cautiously and find you have extra funds than to underestimate and face shortfalls.

Input these estimated costs into the appropriate categories and line items within your event planning budget tool. This isn’t a one-time task but an iterative process. As you receive more definitive quotes and make actual bookings, update your template with the real figures. Regularly compare your "estimated" column with your "actual" column to monitor your spending and identify any areas where you might be going over or under budget, allowing for timely adjustments.

Customizing Your Event Spending Plan for Diverse Occasions

While a standard budget template for events provides an excellent foundation, true financial mastery comes from customizing it to fit the unique nature of each event. No two events are identical, and their financial requirements will vary significantly depending on type, scale, and specific goals. A corporate gala will have different cost centers than a product launch, and a wedding will prioritize different aspects than a charity fundraiser.

For example, a technology conference might require significant investment in high-tech AV equipment and robust internet infrastructure, whereas a fashion show would prioritize lighting, staging, and models. Social events like birthday parties might focus more on catering and decor, while a non-profit fundraiser could have unique line items for donor recognition and fundraising software. Your event spending plan must reflect these specific needs.

Don’t hesitate to add new categories or line items that are relevant to your specific event, or conversely, remove those that are entirely irrelevant. If your event involves travel for speakers, create a dedicated "Travel & Accommodation" section. If you’re managing sponsorships, ensure there’s a section to track expected revenue against associated fulfillment costs. This flexibility ensures your project budget for events is a living document, tailored precisely to your project’s demands, whether it’s an intimate gathering or a large-scale festival.

Strategic Tips for Mastering Event Financial Management

Beyond simply filling in numbers, effective cost management for events involves strategic thinking and continuous oversight. It’s about leveraging your budget template not just as a record-keeping tool, but as a dynamic instrument for decision-making and risk mitigation. Adopting a proactive mindset will transform your approach to event finances, turning potential challenges into opportunities for smart spending and efficiency.

Consider these strategic tips to elevate your organizing event finances:

- **Track** Expenses Real-Time: Don’t wait until the end of the month to update your budget. Log expenses as they occur to maintain an accurate and up-to-date financial picture.

- **Regularly Review** and Adjust: Schedule weekly or bi-weekly check-ins with your budget. This allows you to spot discrepancies early and make necessary adjustments before they escalate.

- **Negotiate** with Vendors: Always ask if there’s flexibility in pricing. Bundling services or offering early booking can often lead to savings. Don’t be afraid to get multiple quotes.

- **Prioritize** Spending: Understand what elements are most critical to your event’s success and allocate funds accordingly. Distinguish between “must-haves” and “nice-to-haves.”

- **Build** a Contingency: As mentioned, a 10-15% contingency fund is crucial. It protects you from unexpected costs, ensuring you don’t have to cut essential elements at the last minute.

- **Consider** Hidden Costs: Think beyond direct vendor invoices. Taxes, delivery fees, service charges, gratuities, and overtime can quickly add up. Factor these into your initial estimates.

- **Post-Event** Analysis: After your event, compare your final actual costs against your budgeted estimates. This feedback is invaluable for improving your planning tool for event expenses for future events.

By implementing these strategies, your comprehensive event budget becomes a powerful asset, guiding you towards financially sound decisions and ultimately contributing to a seamlessly executed and successful event.

The Benefits of a Structured Approach to Event Finances

The advantages of diligently utilizing an expense tracker for events extend far beyond merely preventing overspending. A well-maintained budget serves as a foundational element for overall event success, influencing every decision from vendor selection to attendee experience. It instills a sense of control and professionalism that resonates throughout the planning process and the event itself.

Firstly, it significantly reduces stress. Knowing precisely where your money is going and having a clear projection for future expenses eliminates much of the anxiety typically associated with event planning. This allows you, or your team, to focus energy on creative elements and guest satisfaction, rather than constantly worrying about financial viability. Moreover, a transparent budget facilitates better communication and trust with stakeholders, sponsors, and team members, as everyone understands the financial parameters.

Secondly, a professional event budget enhances decision-making. With detailed cost breakdowns, you can easily compare options, negotiate from a position of strength, and allocate resources to maximize impact. It empowers you to prioritize spending on elements that truly matter to your event’s objectives, ensuring that every investment contributes directly to a memorable and impactful experience. Ultimately, leveraging a Budget For Event Planning Template leads to more efficient resource utilization, fewer surprises, and a greater likelihood of achieving your event goals with financial confidence.

Frequently Asked Questions

What is the ideal contingency percentage for an event budget?

Most event professionals recommend allocating a contingency fund of 10-15% of your total estimated budget. This buffer is crucial for covering unforeseen expenses, last-minute changes, or unexpected price increases without derailing your entire financial plan.

How often should I review my event financial plan?

During the active planning phase, it’s advisable to review and update your event financial plan at least weekly. As your event date approaches, or as actual expenses come in, a continuous review ensures your budget remains accurate and allows for timely adjustments.

Can this budget planning tool be used for small personal events?

Absolutely. While often associated with large corporate or public events, a budget planning tool is incredibly beneficial for any event, regardless of size. Even for a personal gathering like a birthday party or family reunion, tracking expenses can prevent overspending and provide peace of mind.

What’s the biggest mistake people make with an event budget?

One of the most common mistakes is not tracking actual expenses against the budget in real-time. Another significant error is underestimating or completely overlooking hidden costs like taxes, service charges, tips, permits, or unexpected administrative fees, which can quickly add up.

Should I include my time as a cost in the event budget?

For professional event planners or when organizing a corporate event, it’s excellent practice to include labor costs, even if it’s your own internal team’s time. This provides a truer reflection of the event’s total investment and helps in future project costing and resource allocation.

The journey of event planning, while exciting and creative, is inherently complex. The myriad decisions, vendor coordinations, and logistical challenges can quickly become overwhelming without a solid foundation. This is why embracing a structured financial approach, anchored by a reliable Budget For Event Planning Template, is not just a best practice—it’s a fundamental requirement for success.

By systematically outlining, tracking, and managing every anticipated cost, you transform potential financial anxieties into opportunities for strategic planning and smart execution. Such a detailed framework empowers you to maintain control, optimize spending, and ensure that your event’s financial health remains robust from conception to conclusion. Invest in the power of diligent financial planning; it’s the invisible force that will guide your vision to a perfectly executed reality, leaving you with not just a successful event, but also peace of mind and valuable insights for your next endeavor.