Navigating the complexities of personal finance or managing a small business’s bottom line can feel like steering a ship through a perpetual fog. Without a clear compass, it’s easy to drift off course, facing unexpected expenses, missed savings opportunities, or even significant financial stress. That’s where a structured approach to understanding your money comes into play, providing the clarity needed to make informed decisions and achieve your economic goals.

Imagine having a precise map of your financial landscape—a tool that not only tracks where your money goes but also helps you plan where you want it to go. This isn’t just about cutting costs; it’s about gaining control, fostering financial discipline, and ultimately building a more secure future. Whether you’re a recent college graduate aiming to save for a down payment, a growing family managing household expenses, or an entrepreneur striving for profitability, a well-crafted financial overview is indispensable.

The Cornerstone of Financial Clarity

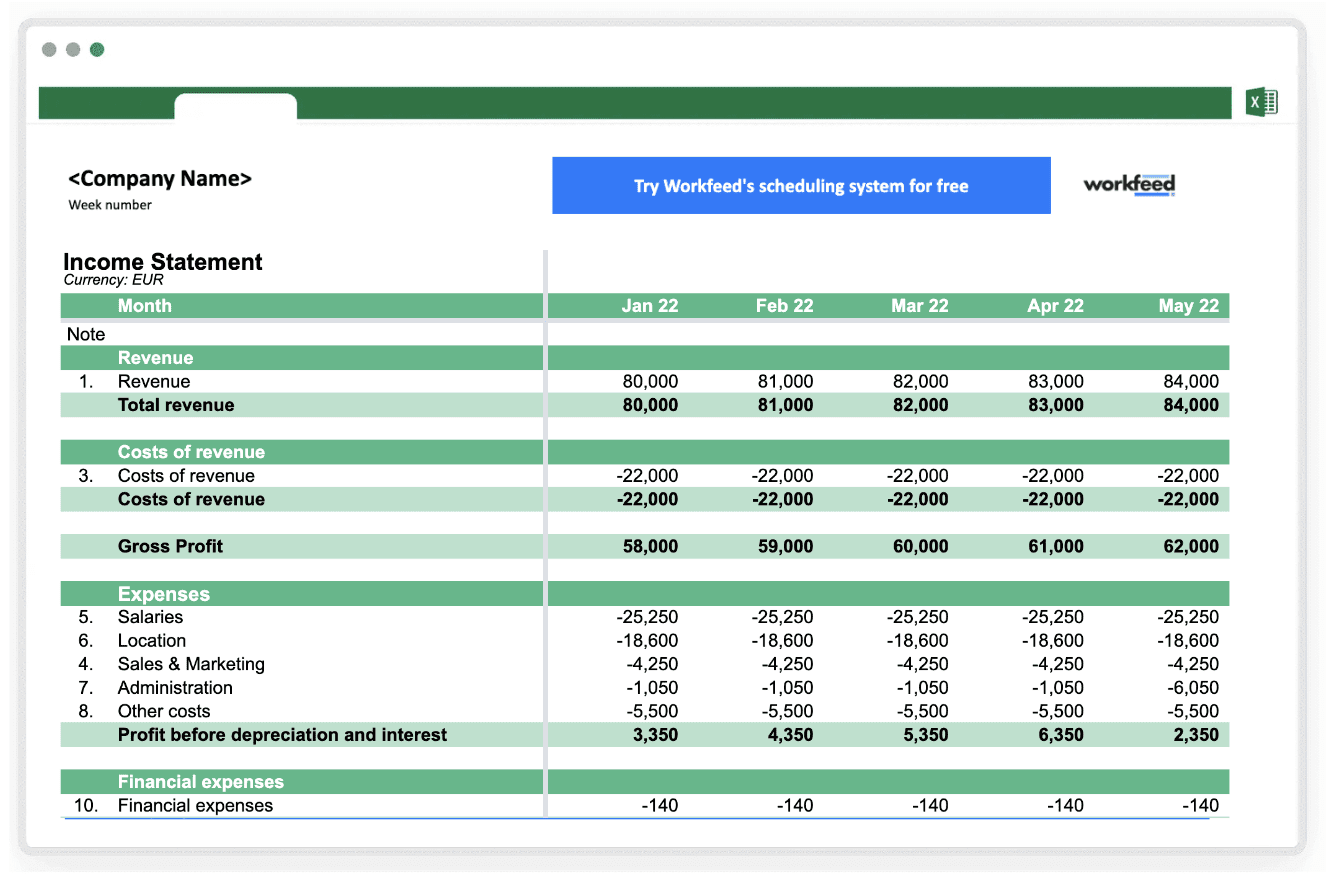

At its heart, a budget financial statement template serves as a foundational document for comprehensive financial planning. It’s more than just a list of numbers; it’s a living document that captures the ebb and flow of your income and expenditures, providing a snapshot of your financial health at any given moment. This structured approach allows individuals and organizations alike to move beyond mere guesswork, transforming financial aspirations into actionable plans. It demystifies where every dollar originates and where it ultimately lands, shedding light on spending habits and revealing areas for potential optimization.

Understanding how such a fiscal management tool operates is crucial for anyone serious about improving their economic standing. It offers a systematic way to compare actual financial performance against planned expectations, identifying variances that require attention. This ongoing analysis empowers users to make timely adjustments, ensuring they stay on track toward their objectives, whether that’s debt reduction, wealth accumulation, or simply maintaining a healthy cash flow.

Who Needs a Standardized Budget Overview?

The utility of a robust financial statement template extends far beyond corporate boardrooms. In fact, its power lies in its versatility and adaptability to various contexts and user needs.

- Individuals and Families: For personal use, a detailed spending plan outline helps manage household income, track recurring bills, allocate funds for discretionary spending, and set aside money for long-term goals like retirement or a child’s education. It fosters open communication about finances within a family unit.

- Small Businesses and Startups: Entrepreneurs often juggle multiple roles, and financial oversight can sometimes take a back seat. A clear economic planning document is vital for monitoring operational costs, forecasting revenue, managing cash flow, and making strategic decisions about growth, investment, or expansion. It’s an indispensable tool for securing funding or presenting a clear financial picture to stakeholders.

- Non-Profit Organizations: For non-profits, transparent financial reporting is paramount for donor trust and grant compliance. A budgetary framework helps track funds received, allocate them to specific programs, and report expenditures accurately, ensuring accountability and demonstrating responsible stewardship of resources.

- Freelancers and Gig Workers: With fluctuating income streams, these professionals benefit immensely from a cash flow management document that helps them set aside funds for taxes, manage irregular earnings, and ensure financial stability during lean periods.

Essentially, anyone who wishes to gain a deeper understanding of their financial position, make informed monetary decisions, and actively work towards their economic goals will find immense value in utilizing a well-designed financial health blueprint.

Key Components of an Effective Financial Planning Document

When you delve into a comprehensive budget financial statement template, you’ll find it meticulously organized to capture all relevant financial data. While templates can vary, core elements remain consistent, ensuring a holistic view of your financial activities.

- Income Sources: This section details all money flowing into your accounts. For individuals, this might include wages, freelance income, investment returns, or benefits. Businesses would list sales revenue, service fees, or other income streams. Clarity here is paramount to understand your total financial inflow.

- Fixed Expenses: These are costs that typically remain constant each month and are often contractual. Examples include rent or mortgage payments, loan installments (car, student), insurance premiums, and subscriptions. Identifying these helps in forecasting your baseline expenditure.

- Variable Expenses: Unlike fixed expenses, these costs fluctuate from month to month based on usage or choices. Groceries, utilities (which can vary), entertainment, transportation, and dining out fall into this category. Managing variable expenses offers the most flexibility for budget adjustments.

- Savings & Investments: A dedicated section for allocating funds towards future goals is critical. This includes contributions to retirement accounts, emergency funds, down payments, or investment portfolios. Prioritizing savings transforms financial goals from aspirations into actionable steps.

- Debt Repayment: Beyond minimum payments included in fixed expenses, this section can track additional payments made towards credit cards, personal loans, or other debts. Aggressively tackling debt often frees up significant cash flow in the long run.

- Net Income/Cash Flow: This is the bottom line—your total income minus your total expenses. A positive number indicates a surplus, while a negative number signals a deficit, prompting a review of income or spending habits.

These elements, when clearly laid out in an income and expense report, provide the structure necessary for effective financial analysis and proactive management.

Crafting Your Personalized Fiscal Management Tool

While a pre-designed budget financial statement template offers an excellent starting point, its true power is unleashed when customized to fit your specific needs and circumstances. Tailoring this financial tracking template ensures it remains relevant, easy to use, and genuinely helpful in your unique financial journey.

Begin by understanding the level of detail you require. Some might prefer broad categories, while others need granular tracking of every coffee purchase. Don’t be afraid to add or remove categories that don’t apply to you. For instance, if you have no children, remove "Childcare Expenses." If you’re saving for a specific vacation, create a dedicated "Vacation Fund" line item. Think about your income frequency—weekly, bi-weekly, or monthly—and ensure the template accommodates this scheduling for accurate reporting.

Consider incorporating visual elements. Charts and graphs can quickly illustrate where your money is going, highlight spending trends, and provide an intuitive overview of your financial health. Many spreadsheet programs offer built-in charting tools that can transform raw data into insightful visuals with minimal effort. Regularly reviewing and refining your personalized budget template will ensure it continues to serve as an effective guide for your financial decisions.

Leveraging Technology for Your Spending Plan Outline

In today’s digital age, managing your finances has never been more accessible, thanks to a plethora of technological tools. While a simple spreadsheet application like Microsoft Excel or Google Sheets can serve as a powerful expenditure tracking sheet, numerous dedicated budgeting apps and software platforms offer enhanced features.

These applications often include automated transaction categorization, linking directly to your bank accounts for real-time updates. This reduces manual data entry, saving time and minimizing errors. Many also provide advanced reporting features, goal tracking, and even alerts for upcoming bills or overspending in specific categories. Popular options include Mint, YNAB (You Need A Budget), Personal Capital, and Simplifi, each offering a slightly different approach to personal or small business financial management.

The choice of tool ultimately depends on your comfort level with technology, the complexity of your financial situation, and your willingness to invest in a premium service versus a free option. Regardless of the platform, the underlying principles of the budgeting aid remain the same: systematically track income and expenses, plan for the future, and regularly review your financial performance.

Beyond the Numbers: The Behavioral Impact of Budgeting

While the immediate benefits of using a clear budget financial statement template are tangible—such as improved savings, debt reduction, and better cash flow—the long-term psychological and behavioral impacts are equally significant. Engaging with a financial overview regularly cultivates a greater sense of control over your money. This control can reduce financial anxiety, a common stressor for many Americans.

Budgeting fosters a mindset of intentional spending rather than reactive spending. Instead of wondering where your paycheck went, you become aware of every dollar’s purpose. This shift in perspective can lead to more mindful consumer choices, aligning spending with personal values and long-term goals. It encourages discipline, patience, and a forward-thinking approach to financial management, empowering individuals to make choices today that positively impact their financial tomorrow.

Frequently Asked Questions

Is a financial statement template only for people with large incomes or complex finances?

Absolutely not. A financial statement template is beneficial for anyone, regardless of income level or financial complexity. It provides clarity and control, which are essential whether you earn a little or a lot. For those with simpler finances, it can be a straightforward way to track basic income and expenses; for complex situations, it offers the structure to manage multiple streams and outlays.

How often should I update my financial tracking template?

The frequency depends on your financial activity and goals. For most individuals and small businesses, a weekly or bi-weekly review is ideal. This allows you to catch discrepancies early, adjust spending as needed, and stay closely connected to your financial reality. At a minimum, a monthly update is crucial to reconcile accounts and review overall performance.

What’s the difference between a budget and a forecast?

A budget is a plan for future income and expenses, setting specific targets for how much you intend to earn and spend over a period. A forecast, on the other hand, is an estimate of what might happen in the future, often based on historical data and current trends, but without the specific targets and limits of a budget. While a budget is prescriptive, a forecast is predictive; both can be used alongside a robust financial statement template for comprehensive planning.

Can I really stick to a spending plan outline in the long term?

Yes, you absolutely can! The key to long-term success with any spending plan outline is consistency, flexibility, and realistic goal setting. Start small, be kind to yourself when you occasionally overspend, and remember that a budget is a tool to empower you, not to restrict you to an impossible degree. Regular review and adjustment will help you adapt it to changing circumstances and make it a sustainable habit.

Implementing a well-structured financial overview in your life is one of the most impactful steps you can take toward achieving financial peace of mind. It’s not just about managing money; it’s about managing your future, making informed choices, and gaining the freedom that comes with true financial literacy. By harnessing the power of a comprehensive and customized financial statement template, you transform abstract financial concepts into concrete, actionable steps.

Don’t let uncertainty dictate your economic destiny. Take control today by exploring the myriad of available tools and starting your journey towards greater financial clarity and security. The benefits—from reduced stress to accelerated goal achievement—are immense and lasting, making the effort profoundly worthwhile.