Navigating the financial landscape as a self-employed individual can feel like steering a ship through a perpetual storm. Unlike traditional employees who receive a predictable paycheck and have taxes automatically withheld, freelancers, consultants, and independent contractors shoulder the full responsibility for their income, expenses, and future financial security. This unique position demands a proactive and meticulous approach to money management, where understanding every dollar in and out is not just a good idea, but an absolute necessity for survival and growth.

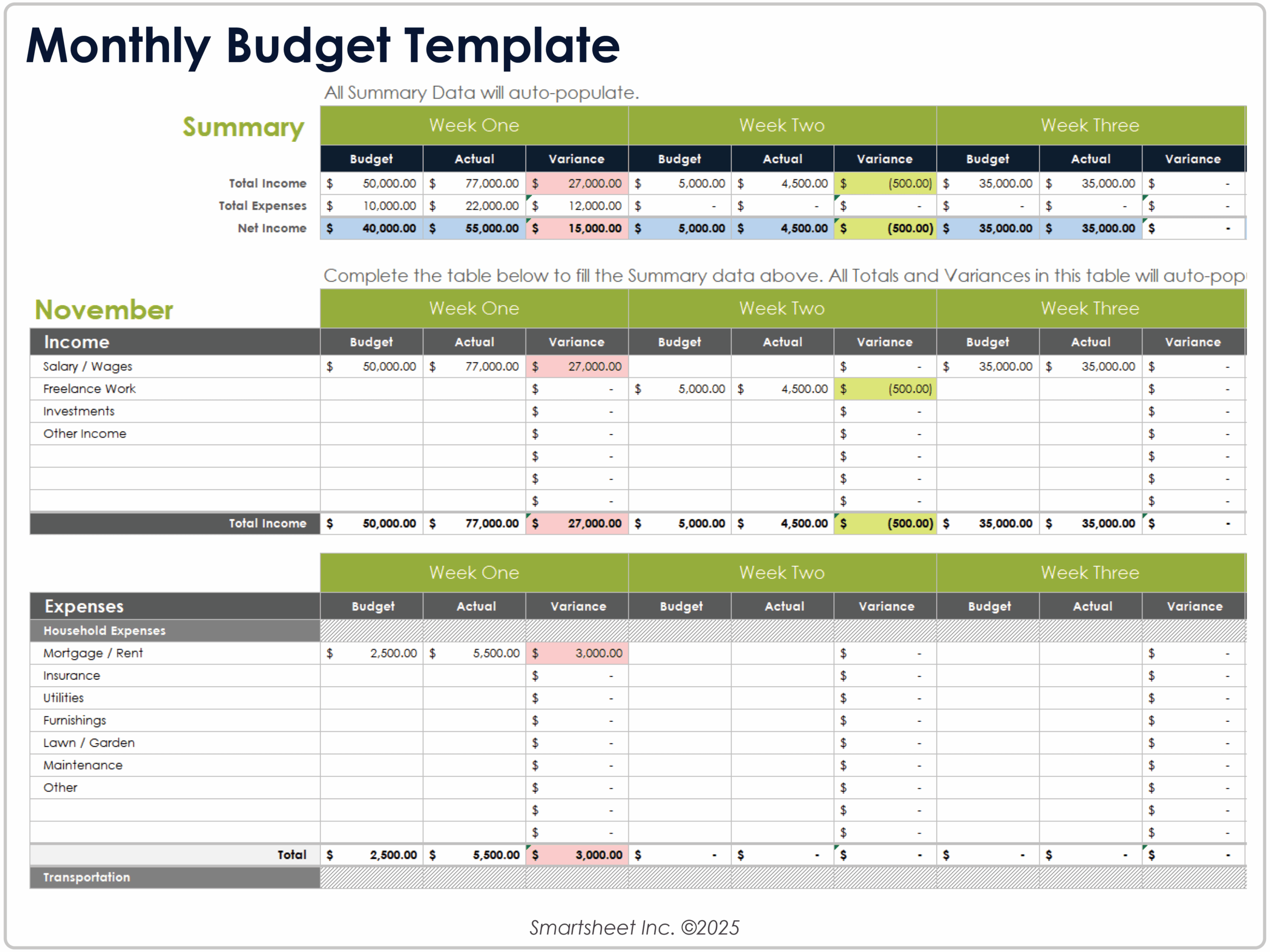

Without a robust system in place, the unpredictable ebb and flow of project payments and operating costs can quickly lead to stress, missed tax payments, and even business failure. This is where a strategic financial management tool becomes indispensable, transforming chaos into clarity. For many, the answer lies in leveraging a Budget Control Template Excel Self Employed, a powerful yet accessible solution that empowers solo entrepreneurs to take firm control of their financial destiny. It’s more than just a spreadsheet; it’s your personal CFO, providing the insights needed to make informed decisions and build a resilient business.

The Imperative of Financial Clarity for the Self-Employed

For the self-employed, financial clarity isn’t a luxury; it’s the bedrock of sustainable business operation and personal well-being. Unlike an employee with a fixed salary, your income often fluctuates, making consistent cash flow a constant challenge. This variability means that without diligent tracking, it’s easy to overspend during prosperous months and find yourself in a bind when client payments are delayed or projects dry up.

A clear picture of your finances allows you to anticipate lean periods, save for taxes, invest in your business, and plan for personal expenses without undue stress. It provides the empirical data needed to assess the profitability of your services, adjust your pricing, and identify areas where you can cut unnecessary costs. Ultimately, effective budget management fosters peace of mind, enabling you to focus on what you do best: building your business.

Why Excel is the Ideal Partner for Your Financial Journey

While numerous sophisticated accounting software options exist, Excel remains a formidable and often superior choice for many self-employed individuals, particularly when starting out or when seeking a highly customizable solution. Its accessibility, flexibility, and robust analytical capabilities make it an excellent platform for creating a detailed independent contractor budgeting spreadsheet.

Excel allows you to tailor your financial management tool precisely to your unique business model, income streams, and expense categories. You’re not confined by predefined fields or subscription fees. With a little setup, you can build a dynamic system that grows with your business, offering deep insights without requiring an accounting degree. Its power lies in its ability to handle complex calculations, generate visual reports, and adapt to changing financial needs.

Key Components of an Effective Self-Employed Budget Template

Building an effective financial planning spreadsheet requires more than just listing numbers. It needs a structured approach that captures all relevant financial data points. A well-designed Excel budget template for entrepreneurs should include several core sections to provide a comprehensive view of your financial health.

Here are the essential elements to consider:

- **Income Sources:** Detail all incoming money. This might include project fees, consulting rates, product sales, royalties, or any other revenue streams. Categorizing these helps you understand which areas of your business are most profitable.

- **Fixed Expenses:** These are costs that typically remain constant each month, such as web hosting, software subscriptions, insurance premiums, loan payments, or rent for an office space. Knowing these helps establish your baseline operating costs.

- **Variable Expenses:** These expenses fluctuate based on your business activity. Examples include marketing spend, supplies, travel costs, professional development, and subcontractor fees. Tracking these is crucial for identifying areas where you can adjust spending.

- **Tax Savings:** As a self-employed individual, you’re responsible for estimated quarterly taxes. A dedicated section to allocate a percentage of your income for taxes (both income and self-employment taxes) is non-negotiable.

- **Personal Expenses (Optional but Recommended):** While primarily a business budget, many self-employed individuals integrate personal finances to ensure they’re paying themselves adequately and covering household costs. This could include groceries, housing, utilities, transportation, and personal savings.

- **Cash Flow Tracking:** This section helps you understand the movement of money in and out of your business over time, projecting future balances. It’s essential for anticipating potential shortages or surpluses.

- **Profit and Loss Summary:** A simple P&L allows you to see your net income after all business expenses. This is vital for assessing profitability over a given period.

Crafting Your Own Budget Control Template in Excel

Creating a custom budgeting solution doesn’t have to be intimidating. Start simple and build it out as you become more comfortable. The beauty of a Budget Control Template Excel Self Employed is its adaptability.

Begin by setting up clear columns for "Date," "Category," "Description," "Income," "Expense," and "Balance." You can then add specific worksheets for different periods (e.g., "January 2024," "February 2024") or for different financial aspects like "Invoice Tracker" or "Tax Savings." Use Excel’s sum functions (=SUM()) to calculate monthly totals for income and expenses, and a running balance to see your cash position at any given time. Conditional formatting can be used to highlight overdue invoices or expenses that exceed a certain limit, making your data more visually informative.

For tracking income, consider a separate tab where you list invoices, their due dates, and payment status. This helps you monitor accounts receivable and chase payments promptly. Similarly, an expense log can be detailed, allowing you to categorize expenses for tax purposes, such as office supplies, professional development, or software subscriptions, making tax season significantly less stressful. Remember to label everything clearly and consistently for ease of use.

Leveraging Your Budget for Growth and Stability

A financial management tool for freelancers is not just about tracking past transactions; it’s a powerful instrument for strategic planning. By regularly reviewing your digital finance organizer, you can identify trends, pinpoint seasonal fluctuations in income, and understand where your money is truly going. This knowledge empowers you to make informed decisions that drive growth and ensure financial stability.

Perhaps you notice a significant portion of your budget going towards a particular software subscription that you rarely use. Your budget can highlight this inefficiency, prompting you to cancel it and save money. Conversely, if you see that investing in a specific marketing channel consistently yields high returns, your budget provides the data to justify increasing that spend. It helps you set realistic financial goals, whether that’s saving for a new piece of equipment, building an emergency fund, or planning for retirement. This proactive approach turns your spreadsheet into a dynamic tool for business development.

Tips for Sustained Budgeting Success

Consistency is paramount when it comes to maintaining any financial control system. A brilliant independent contractor budgeting spreadsheet is only as good as the data you feed into it. Develop habits that ensure your budget remains up-to-date and reflects your true financial picture.

Consider these tips for long-term success:

- **Regular Updates:** Make it a habit to update your money management for sole proprietors spreadsheet at least **weekly**, if not daily. Reconcile transactions against bank statements to catch errors and ensure accuracy.

- **Categorize Meticulously:** The more granular your categories, the better insights you’ll gain. Distinguish between different types of **marketing expenses** or **software subscriptions**.

- **Set Realistic Goals:** Use your budget to set achievable financial targets, like saving a certain amount each month or reducing a specific **expense category**.

- **Review and Adjust:** At the end of each month or quarter, review your actual income and expenses against your budget. Identify discrepancies and adjust your future spending or income projections accordingly. This continuous feedback loop is crucial for **effective budget management**.

- **Automate Where Possible:** Link your bank or credit card accounts (if using a more advanced Excel-compatible system or a custom import script) to pull transactions, minimizing **manual data entry**.

- **Build a Buffer:** Always aim to have an emergency fund for both personal and business needs. Your budget should help you systematically build this **financial cushion**.

Frequently Asked Questions

Do I really need a dedicated budget control template if I use accounting software?

While accounting software offers robust features, a custom budget management tool in Excel provides unparalleled flexibility and a hands-on understanding of your finances. It allows for deeper dives into specific categories, custom reporting, and a visual representation tailored exactly to your needs, which can complement or even stand in for accounting software, especially for solopreneurs.

How often should I review and update my self-employed budget?

Ideally, you should review your income and expenses at least weekly to ensure accuracy and catch any discrepancies early. A more in-depth review should be conducted monthly to analyze trends, assess profitability, and make any necessary adjustments to your spending plan for the coming period.

What if my income is highly unpredictable? How can I budget effectively?

For highly unpredictable income, focus on an average income over the past 3-6 months. Prioritize building a substantial savings buffer (3-6 months of living and business expenses). Your budget should emphasize tracking variable expenses closely and identifying areas where you can reduce costs during lean months. It’s about setting realistic spending limits based on your historical lowest income.

Should I separate business and personal finances in my Excel template?

Yes, absolutely. While many self-employed individuals manage both in one overarching spreadsheet, it is critical to use separate categories or even separate worksheets for business and personal income and expenses. This is essential for tax purposes, clearly understanding business profitability, and maintaining good financial hygiene.

Are there pre-built Excel templates available, or should I create my own?

Many excellent pre-built templates are available online, including from Microsoft itself. These can be a great starting point. However, the true power of a Budget Control Template Excel Self Employed comes from customizing it to fit your unique business and personal financial situation. Feel free to download a template and then modify it extensively to suit your specific needs.

Taking control of your finances as a self-employed individual is not just about crunching numbers; it’s about empowering yourself to make strategic decisions that foster growth and stability. A well-constructed and diligently maintained Excel budget template becomes an invaluable asset, demystifying your financial situation and shining a light on opportunities for improvement. It transforms what can feel like a daunting task into a manageable and rewarding aspect of running your own business.

Embrace the power of a customized financial template to gain clarity, reduce stress, and propel your entrepreneurial journey forward. By investing a little time upfront to set up your income and expense tracking system, you’ll reap significant rewards in peace of mind, informed decision-making, and long-term financial success. Start building your financial fortress today, one spreadsheet cell at a time.