In an era where personal finance apps promise automated solutions and pre-built templates offer instant organization, there’s an often-overlooked power in starting from scratch. Many people find themselves trying to fit their unique financial picture into a rigid, one-size-fits-all model, leading to frustration and, ultimately, abandonment of their budgeting efforts. The truth is, your financial life is as unique as your fingerprints, and sometimes the best tool to manage it isn’t something pre-packaged, but rather a blank canvas waiting for your personal touch.

This is where the concept of a Blank Spreadsheet Household Budget Template truly shines. It’s not just an empty grid; it’s an invitation to intentionality, a powerful declaration that you are ready to take full ownership of your money story. By choosing to build your budget from the ground up, you gain an unparalleled understanding of where every dollar comes from and where it goes, fostering a deeper connection to your financial goals and empowering you to make informed decisions that resonate with your individual circumstances and aspirations.

Why a Blank Slate is Your Best Budgeting Tool

The appeal of a completely blank spreadsheet for managing your household finances lies in its inherent flexibility and the deep level of engagement it demands. Unlike rigid software or pre-formatted templates that might offer categories you don’t need or omit ones you desperately do, a blank sheet allows you to define every single parameter. This isn’t just about inputting numbers; it’s about designing a system that mirrors your actual spending habits, income streams, and financial priorities without compromise.

Starting with a blank spreadsheet encourages a foundational understanding of your money. It forces you to actively consider each income source, every fixed expense, and every variable cost that constitutes your financial flow. This process of intentional design helps demystify your money, transforming abstract numbers into concrete insights about where your resources are allocated. It transforms budgeting from a chore into a creative act of personal financial engineering.

The Core Benefits of a Custom Budget Spreadsheet

Embracing a blank spreadsheet household budget template offers a multitude of advantages that resonate with individuals and families seeking genuine financial control. The process itself is as valuable as the end product, fostering a profound connection to your money management.

- **Unrivaled Personalization:** You dictate every category, column, and formula. Whether you have an unconventional income stream or a highly specific savings goal, your custom budget template can perfectly accommodate it. This means your personal finance template truly reflects *your* life, not a generalized idea of it.

- **Enhanced Understanding:** Building your own spreadsheet-based budget requires you to critically think about every transaction. This hands-on approach naturally leads to a deeper comprehension of your financial behaviors, helping you identify spending patterns, areas for optimization, and potential savings opportunities more effectively than simply plugging numbers into pre-set fields.

- **Adaptability and Flexibility:** Life changes, and so should your budget. A custom budget template can be easily modified to reflect new jobs, family additions, debt repayment strategies, or unexpected expenses. You’re not tied to a software update or a template creator’s design choices; you hold the keys to its evolution.

- **Skill Development:** Learning to navigate and build formulas in a spreadsheet (like Excel or Google Sheets) is a highly transferable skill. Beyond budgeting, these proficiencies can aid in professional tasks, project management, and data organization across various aspects of your life.

- **Cost-Effective:** Most spreadsheet software is either free (like Google Sheets) or already included in common software suites (like Microsoft Excel). This makes a DIY financial tracker an incredibly economical solution for robust financial management.

Key Components of Your Customizable Budgeting Spreadsheet

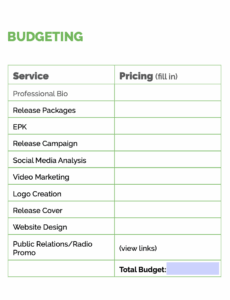

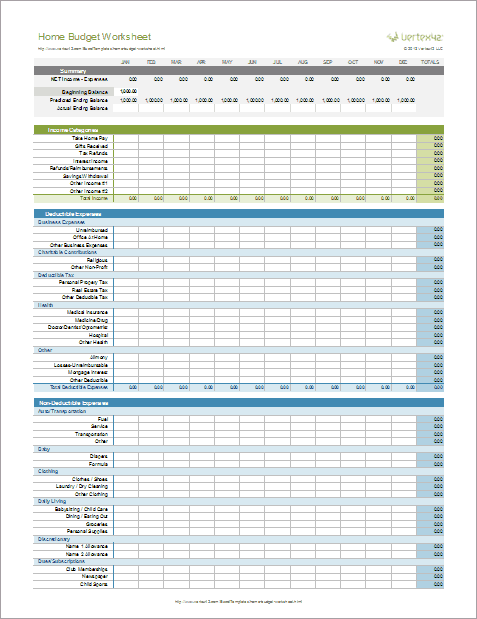

When you embark on creating your own customizable budgeting spreadsheet, you’ll want to include several essential elements to ensure it provides a comprehensive view of your financial landscape. Think of these as the building blocks upon which your entire financial planning tool will rest.

- **Income Sources:** Dedicate a section to clearly list all incoming funds. This might include your primary salary, freelance income, bonuses, rental income, or any other regular payments you receive. Detail the source and the expected amount.

- **Fixed Expenses:** These are costs that typically remain the same month after month. Examples include rent or mortgage payments, loan installments (car, student, personal), insurance premiums, and subscription services like Netflix or gym memberships. Categorizing these helps you understand your baseline financial commitments.

- **Variable Expenses:** This category captures the costs that fluctuate. Groceries, dining out, entertainment, utilities (if they vary), gas, and clothing all fall under variable expenses. This is often where the most significant opportunities for saving and adjustment lie.

- **Savings and Investments:** Crucially, a good household budget worksheet treats savings as a non-negotiable expense. Include lines for your emergency fund contributions, retirement savings (401k, IRA), investment accounts, and specific goal-based savings (e.g., down payment for a house, vacation fund).

- **Debt Repayment:** Beyond minimum payments, allocate specific funds for accelerating debt repayment, especially high-interest debts like credit cards. This section should clearly outline principal payments towards reducing your overall debt burden.

- **Actual vs. Budgeted Columns:** For each income and expense item, create two columns: one for your *budgeted* amount and another for the *actual* amount spent or received. This comparison is vital for tracking your performance and identifying discrepancies, providing immediate feedback on your financial adherence.

- **Difference/Variance Column:** A calculated column showing the difference between your actual and budgeted amounts is incredibly insightful. This quickly highlights areas where you overspent or underspent, guiding future adjustments.

Building Your Household Budget Worksheet: A Step-by-Step Guide

Creating your own custom budget template doesn’t require advanced spreadsheet wizardry; it just needs a methodical approach. Here’s how to start turning that blank budget sheet into a powerful financial ally.

Step 1: Choose Your Platform

Decide whether you’ll use Microsoft Excel, Google Sheets, Apple Numbers, or another spreadsheet program. Google Sheets is an excellent free option that allows for cloud-based access and sharing, making it ideal for household budgeting.

Step 2: List All Income Sources

Start by designating a section at the top for "Income." List every source of money coming into your household for a typical month. Include your net pay (after taxes), side hustle earnings, rental income, or any other predictable funds. Add columns for "Budgeted Amount" and "Actual Amount."

Step 3: Categorize Your Expenses

Move on to expenses. Begin by listing your fixed expenses (rent/mortgage, loan payments, subscriptions). Then, brainstorm all your variable expenses. Don’t worry about being perfect initially; you can always refine categories later. Use broad categories at first, like "Housing," "Transportation," "Food," "Utilities," "Personal Care," "Entertainment," and "Savings/Debt." Add "Budgeted" and "Actual" columns for each.

Step 4: Allocate Funds and Create Formulas

Now, the core of creating your own budget in a spreadsheet: giving every dollar a job. Based on your income, assign a budgeted amount to each expense category. The goal is for your total budgeted expenses plus savings to equal your total budgeted income (a "zero-based budget" approach). Use simple formulas:

=SUM()to total your income and expense categories.=Budgeted - Actualfor a variance column.- A "Net Remaining" calculation:

=Total Income - Total Expenses - Total Savings. This number should ideally be zero or positive.

Step 5: Track Consistently

This is arguably the most critical step. Regularly (daily or weekly) input your actual spending into your spreadsheet. This requires discipline, but it’s the only way to gain accurate insights into where your money is going. Many find connecting bank and credit card statements helpful.

Step 6: Review and Adjust Periodically

Your budget isn’t static. At the end of each month, review your "Actual" spending against your "Budgeted" amounts. Identify areas where you consistently overspend or underspend. Adjust your budgeted amounts for the following month based on these insights and any changes in your financial situation or goals.

Tips for Maximizing Your DIY Financial Tracker

Embarking on the journey of creating a Blank Spreadsheet Household Budget Template is a powerful step, and a few strategic tips can help ensure its long-term success and effectiveness. These suggestions will help you stay motivated, organized, and truly in control of your financial destiny.

- Start Simple and Iterate: Don’t try to build the most complex spreadsheet on day one. Begin with basic income and expense categories. As you become more comfortable and understand your needs better, you can add more detail, sub-categories, or advanced features like graphs and pivot tables.

- Be Brutally Honest: The effectiveness of your custom budget template hinges on accuracy. Don’t sugarcoat your spending. Track every dollar, even the small ones. Those "latte factors" can add up surprisingly quickly.

- Automate Where Possible: While the spreadsheet is manual, leverage automation in your banking. Set up automatic transfers to savings accounts or bill pay for fixed expenses. This reduces the mental load and helps ensure you stick to your plan.

- Utilize Spreadsheet Features: Explore features like conditional formatting to highlight overspending in red, or use data validation to create dropdown lists for categories. Charts and graphs can visually represent your financial health, making trends easier to spot.

- Set Realistic Goals: An overly restrictive budget is often a recipe for failure. Build in some "fun money" or discretionary spending. Your budget should serve you, not imprison you.

- Don’t Fear Mistakes: You will make errors, overspend in categories, or forget to track something. That’s perfectly normal. The key is to learn from these instances, adjust your budget, and keep moving forward.

- Incorporate a Buffer: Consider adding a small "Miscellaneous" or "Buffer" category to absorb unexpected minor expenses. This prevents small surprises from derailing your carefully planned categories.

- Integrate Financial Goals: Make your savings and debt repayment goals prominent within your spreadsheet. Seeing these goals alongside your regular income and expenses can be a powerful motivator.

Frequently Asked Questions

How often should I update my budget?

Ideally, you should track your spending and income almost daily or at least several times a week. This regular input keeps your data accurate and prevents a daunting backlog. A comprehensive review and adjustment of your categories and budgeted amounts should happen at the end of each month.

Is a spreadsheet better than a budgeting app?

Neither is inherently “better”; it depends on your preference and goals. A spreadsheet offers unparalleled customization and forces a deeper engagement with your finances, building valuable skills. Apps often provide automation and connectivity to bank accounts, saving time. Many people find a hybrid approach effective, using an app for initial tracking and a spreadsheet for detailed analysis and custom goal setting.

What if my income is irregular?

For irregular income, it’s best to budget based on your lowest expected monthly income. Any additional income can then be allocated strategically towards savings, debt repayment, or specific financial goals, rather than being factored into baseline expenses. Another strategy is to build a “buffer” month’s worth of expenses in savings, allowing you to pay yourself a consistent salary.

How do I handle one-time or annual expenses?

For large, infrequent expenses (like annual insurance premiums, car registration, or holiday spending), break them down into monthly savings goals. For instance, if car insurance is $1,200 annually, budget to save $100 per month into a dedicated savings fund so the money is available when the bill arrives. This “sinking fund” approach prevents these large bills from disrupting your monthly cash flow.

I’m not good with spreadsheets. Is this still for me?

Absolutely! The beauty of a blank spreadsheet is its simplicity to start. You don’t need to be an Excel guru. Basic functions like SUM are usually sufficient. There are countless online tutorials for beginner spreadsheet users, and the learning curve is often much gentler than perceived. The effort invested in learning these basic skills pays dividends in financial clarity and control.

Taking control of your finances doesn’t have to mean conforming to someone else’s idea of how you should spend or save. It means building a system that understands and adapts to your life. The Blank Spreadsheet Household Budget Template isn’t just a document; it’s a testament to your commitment to financial empowerment, offering a clear, customizable, and deeply personal path to understanding and mastering your money.

Embrace the freedom of the blank page. Start sketching out your financial future, one cell at a time. The clarity and control you’ll gain from this personalized approach to money management will not only transform your financial outlook but also instill a profound sense of confidence in your ability to navigate life’s economic currents, no matter how they shift. Your journey to financial mastery begins with that first, deliberate keystroke.