Navigating personal finances can often feel like steering a ship through unpredictable waters. For millions of Americans, the biweekly pay schedule adds a unique rhythm to this journey, offering both opportunities and occasional challenges. Understanding how to harness this payment frequency is key to achieving financial stability and growth, transforming potential hurdles into stepping stones towards your monetary goals.

A thoughtfully constructed financial plan is more than just a tracking tool; it’s a strategic roadmap that empowers you to make informed decisions about your money. When your income arrives every two weeks, it creates a specific cadence that, if managed correctly, can unlock significant financial advantages. This article will guide you through understanding, creating, and optimizing a budget tailored for your biweekly earnings, helping you move from simply managing to truly mastering your money.

The Biweekly Challenge: Why it Matters

For many, receiving pay every two weeks feels like a steady, predictable flow. However, this rhythm also means that some months will have two paychecks, while others will enjoy three. This “extra” paycheck phenomenon, occurring twice a year, can be a delightful surprise or a source of confusion if not properly integrated into your spending plan. Without a dedicated approach, it’s easy for these intermittent windfalls to be spent without a clear purpose, diluting their potential impact.

The challenge isn’t just about the occasional extra check; it’s about maintaining consistent financial discipline across all pay cycles. A generic monthly budget might not fully capture the nuances of a two-week income stream, potentially leading to miscalculations or missed opportunities for savings and debt reduction. Developing a financial framework that specifically addresses this recurring income is therefore not just beneficial, but essential for long-term fiscal health.

Decoding the Biweekly Pay Cycle

Understanding the mechanics of your pay cycle is the first step towards effective money management. A biweekly pay schedule typically means you receive 26 paychecks per year. This contrasts with a semimonthly schedule (24 checks per year, usually on the 1st and 15th), or a weekly schedule (52 checks). The critical distinction for a biweekly earner is that twice a year, you will receive three paychecks within a single calendar month.

These "bonus" months are where a well-designed budget for biweekly income truly shines. Instead of seeing the third paycheck as unallocated extra cash, it becomes a powerful lever for accelerating financial goals. Whether it’s building an emergency fund, tackling high-interest debt, or boosting retirement savings, pre-planning for these periods ensures that every dollar serves a purpose, rather than simply disappearing into everyday expenses.

Essential Elements of an Effective Biweekly Spending Plan

Creating a robust spending plan for your biweekly income involves more than just listing out what you spend. It requires foresight, categorization, and a clear understanding of your financial priorities. A successful plan will allow you to allocate funds effectively, regardless of whether it’s a two-paycheck or a three-paycheck month.

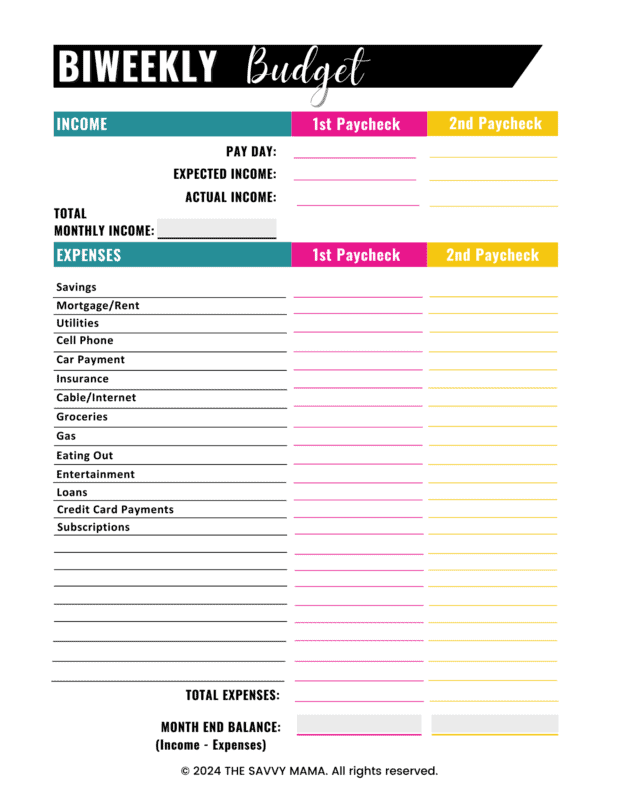

Consider these fundamental components when building your financial framework:

- **Income Sources:** Clearly list all your take-home pay from each biweekly check.

- **Fixed Expenses:** These are costs that remain relatively consistent each month, such as your **rent/mortgage**, loan payments, and insurance premiums. Note their due dates.

- **Variable Expenses:** These fluctuate, like **groceries**, utilities, transportation, and entertainment. Track these carefully to identify patterns.

- **Savings Goals:** Dedicate specific amounts to your **emergency fund**, retirement accounts, down payments, or other long-term objectives.

- **Debt Repayment:** Allocate funds towards credit cards, student loans, or other debts beyond minimum payments, especially utilizing those extra paychecks.

- **Discretionary Spending:** Factor in a reasonable amount for **personal wants** like dining out, hobbies, and shopping.

By segmenting your income and expenses in this manner, you gain clarity on where your money goes and where you can make adjustments. This foundational understanding is crucial before you dive into the specifics of budget construction.

Crafting Your Personalized Biweekly Budget

Developing a functional **Biweekly Pay Budget Template** requires a strategic approach that acknowledges the unique flow of your income. The goal is to create a system that is both flexible enough to handle two-paycheck and three-paycheck months, and rigid enough to keep you on track.

Here’s a practical step-by-step guide to constructing your personalized budget:

1. Determine Your Average Biweekly Income: Start by taking your net (take-home) pay from a standard two-week period. This is your baseline for most budget calculations.

2. List All Fixed Expenses and Due Dates: Categorize all your bills that are due monthly (rent, car payment, insurance, subscriptions). Note their due dates. This is critical for knowing which paycheck will cover which bill.

3. Allocate Bills to Specific Paychecks: This is where the biweekly strategy diverges from a monthly one. For instance, if your rent is due on the 1st, and you get paid on the 5th and the 19th, your first paycheck of the month might be largely allocated to the rent that was just paid with funds from the *previous* month’s second check. Or, you can aim to pay certain bills with your first paycheck of the month and others with your second, ensuring all obligations are covered before their due date.

4. Calculate Variable Expenses: Review past bank statements or use a tracking app to estimate your average spending on groceries, fuel, utilities, and dining out. Divide these by two to get a biweekly target, or adjust based on your planned spending for each two-week period.

5. Incorporate Savings and Debt Repayment Goals: Assign a specific amount from each paycheck to savings, investments, or extra debt payments. For those three-paycheck months, designate the entire third check (or a significant portion) to an accelerated financial goal like paying down high-interest debt or boosting your emergency fund. This is a powerful feature of a well-designed biweekly financial plan.

6. Factor in Discretionary Spending: Give yourself a reasonable allowance for fun and flexibility. Budgeting for enjoyment helps prevent burnout and makes your plan more sustainable. Be realistic about what you need for entertainment and personal care each two weeks.

7. Review and Adjust Regularly: Financial circumstances change. Make it a habit to review your budget at least once a month, or ideally, after each paycheck. Tweak categories as needed and ensure your plan still aligns with your current financial reality and goals.

Leveraging Your Biweekly Schedule for Financial Wins

Beyond simply tracking income and expenses, a bi-weekly financial plan offers unique opportunities to accelerate your progress. Understanding how to manage biweekly pay effectively can transform your financial outlook.

One key strategy is the "zero-based" approach, where every dollar from each paycheck is assigned a job – whether it’s for bills, savings, debt, or spending. This ensures no money is left unaccounted for. Another powerful tactic is to dedicate your third paycheck, which arrives twice a year, entirely to a specific financial goal. Imagine getting two extra mortgage payments in a year, or significantly bolstering your retirement contributions!

Consider automating your savings. Set up automatic transfers to a separate savings account immediately after each paycheck lands. Even small, consistent transfers add up significantly over time. For debt, target the highest-interest accounts with any extra funds. This targeted approach can reduce interest paid and accelerate your debt-free journey.

Common Pitfalls and How to Avoid Them

Even with the best intentions, managing a biweekly income stream can present challenges. Being aware of common pitfalls can help you navigate them effectively.

One frequent mistake is not planning for the "third paycheck" months. If this extra money isn’t allocated in advance, it often gets absorbed into discretionary spending without making a significant impact. Another pitfall is failing to adjust for variable expenses. If you consistently underestimate your grocery or utility bills, your budget will always feel tight. Regular review and adjustment are crucial. Lastly, budgeting too rigidly can lead to frustration and abandonment. Build in some flexibility and a small buffer for unexpected costs, making your spending plan more sustainable and less restrictive. Remember, a budget is a tool to empower you, not to punish you.

Frequently Asked Questions

What is the difference between biweekly and semimonthly pay?

Biweekly pay means you receive a paycheck every two weeks, resulting in 26 paychecks per year. Semimonthly pay means you receive a paycheck twice a month, usually on fixed dates like the 1st and the 15th, resulting in 24 paychecks per year. The key difference is that biweekly pay includes two months per year with three paychecks.

How do I handle the “extra” third paycheck with my biweekly budget?

The best strategy is to plan for it in advance. Before these months arrive, decide exactly where that third paycheck will go. Common uses include boosting your emergency fund, making extra debt payments, saving for a large purchase, investing, or contributing to retirement accounts. Treat it as a bonus opportunity to accelerate your financial goals rather than unallocated spending money.

Should I create my budget based on two or three paychecks a month?

It’s generally recommended to create your core budget assuming two paychecks per month. This ensures that your essential bills and regular expenses are covered consistently. When the months with three paychecks occur, that third paycheck can then be treated as surplus income, dedicated entirely to specific financial goals, rather than being built into your regular monthly expense coverage.

What if my variable expenses are hard to predict?

Start by reviewing past bank statements or credit card bills to get an average for categories like groceries, utilities, and gas. Budget slightly higher than the average to create a buffer. Utilize budgeting apps that can track spending in real-time to help you see where your money is going. Over time, as you track, you’ll gain a more accurate understanding of your variable spending habits and can adjust your budget accordingly.

Is a Biweekly Pay Budget Template necessary if I just track my spending?

While tracking spending is an excellent first step, a dedicated biweekly pay budget goes further by *allocating* your income before you spend it. It helps you prioritize, plan for irregular income (like the third paycheck), and ensure all financial goals are addressed. Tracking tells you where your money went; a budget tells your money where to go, providing a more proactive and strategic approach to managing your financial health.

Adopting a tailored financial plan for your biweekly income is a powerful step towards greater financial control and peace of mind. By understanding the unique rhythm of your paychecks and proactively allocating every dollar, you transform potential financial anxieties into opportunities for growth. It’s about building a system that works for you, aligning your spending with your values and long-term aspirations.

Take the time to set up your personalized budget, review it regularly, and don’t be afraid to adjust it as your life changes. The effort you put into managing your money today will pay dividends in a more secure and prosperous future. Your financial journey is unique, and with a well-crafted biweekly spending plan, you’re equipped to navigate it with confidence and clarity.