The journey to “I do” is often envisioned as a whirlwind of joy, romance, and beautiful decisions, from selecting the perfect dress to finding the dream venue. While the magic is undeniably real, the practicalities of planning a wedding can quickly become overwhelming, especially when finances enter the picture. Without a clear financial roadmap, the excitement can easily turn into stress, leading to potential overspending and disagreements. This is where a meticulously crafted financial plan becomes not just helpful, but absolutely essential.

Imagine navigating your wedding preparations with complete clarity, knowing exactly where every dollar is going, what’s been paid, and what’s still due. This level of control is precisely what a robust wedding budget template offers. It transforms a potentially daunting task into a manageable process, empowering you to make informed choices that align with your financial comfort zone and your vision for the big day. It’s the silent partner that ensures your dreams don’t break the bank, allowing you to focus on the love, the celebration, and the beginning of your new life together.

Why a Wedding Budget Is Non-Negotiable

Embarking on the journey of marriage is one of life’s most exciting adventures, but the financial aspect of a wedding can often overshadow the joy if not managed properly. A wedding budget isn’t about imposing limits or stifling creativity; it’s about empowerment. It provides a structured framework that enables couples to make conscious decisions about their spending, prioritize what truly matters to them, and allocate funds wisely.

This critical financial planning guide serves as your anchor, preventing you from drifting into unforeseen expenses and ensuring that your aspirations remain aligned with your reality. It fosters open communication between partners about financial expectations, helps prevent common arguments about money, and ultimately ensures that your celebration is both memorable and financially responsible. Without a clear financial organizer, it’s all too easy for costs to spiral out of control, leading to regret and stress long after the confetti has settled.

What Makes a Budget Tool “The Best”?

When searching for the ideal financial planning guide for weddings, it’s important to understand that “best” isn’t a one-size-fits-all definition. However, certain characteristics elevate a simple spreadsheet to an indispensable wedding cost planner. An exceptional budget tool goes beyond mere number crunching; it acts as a dynamic, evolving document that adapts to your unique planning journey.

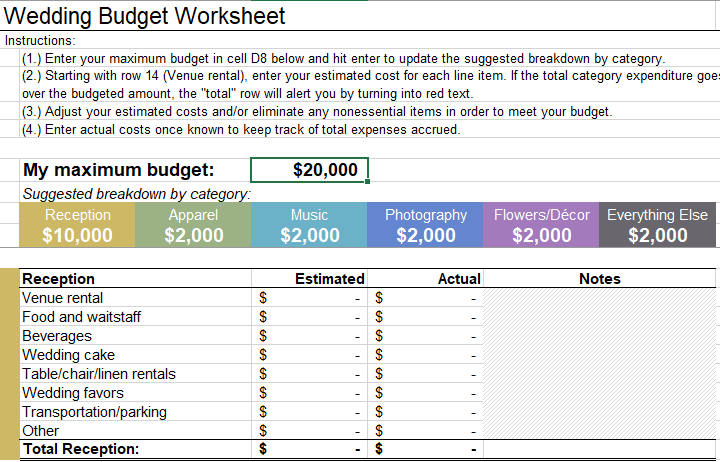

The ultimate wedding financial planner should be intuitively designed, making it easy for anyone to understand and use, regardless of their financial expertise. It must offer comprehensive categories to capture every potential expense, from the obvious to the easily overlooked, ensuring no cost surprises. Crucially, it needs to be flexible enough to allow for extensive customization, reflecting your priorities and personal preferences. Real-time tracking capabilities, showing both estimated and actual costs, are vital for maintaining an accurate financial picture throughout the entire planning process, transforming it from a static document into a living, breathing expense tracker.

Key Elements of an Effective Wedding Budget Planner

A truly effective budgeting spreadsheet for your big day breaks down the myriad of potential costs into digestible, organized categories. This granular approach is fundamental, as it ensures that every single detail, no matter how small, is considered and accounted for within your overall financial strategy. A well-structured template will typically feature columns for the estimated cost, the actual amount spent, the date of payment, and a notes section for specific vendor information or special instructions.

Understanding these key components helps couples track their spending with precision and confidence, offering a clear overview of where funds are being allocated. Here are some of the essential categories you should expect to find in a comprehensive financial roadmap for nuptials:

- Venue & Catering: This encompasses the site fee, food and beverage costs, service charges, and any minimum spend requirements.

- Attire & Accessories: Budget for the wedding dress, suit or tuxedo, alterations, shoes, jewelry, and any bridal party outfits you are covering.

- Photography & Videography: Include packages, additional hours, a second shooter, engagement sessions, albums, and raw footage.

- Flowers & Decor: This category covers bouquets, boutonnieres, centerpieces, ceremony decorations, lighting, linens, and special rentals.

- Music & Entertainment: Account for a DJ, live band, ceremony musicians, sound equipment rentals, and any special performances.

- Stationery: Factor in save-the-dates, wedding invitations, RSVPs, thank-you cards, menus, place cards, and postage.

- Officiant & Legal Fees: The cost of your officiant, their travel, and the marriage license fee.

- Transportation: Consider limousines, shuttles for guests, car rentals, and any other necessary travel arrangements for the wedding party.

- Gifts & Favors: Budget for gifts for your wedding party, parents, and any guest favors you plan to provide.

- Miscellaneous/Buffer: This is a crucial, often overlooked category for unexpected expenses, tips for vendors, and any last-minute additions. Always allocate a **contingency fund** of 5-10%.

Getting Started: How to Use Your Budget Sheet

Initiating your wedding financial blueprint might seem daunting, but breaking it down into simple steps makes the process manageable and even enjoyable. The very first action is to sit down with your partner and honestly establish your overall spending limit. This initial figure, based on your combined savings and any contributions from family, will serve as the guiding principle for all subsequent decisions. It’s crucial to be realistic about what you can comfortably afford without incurring unnecessary debt.

Once your total budget is determined, you can begin populating the estimated costs within your detailed budget framework. This involves researching average costs for various services in your desired location and gathering initial quotes from potential vendors. Don’t be afraid to adjust these figures as you learn more; the early stages are for broad estimations. As you start making deposits and receiving final invoices, diligently update the "actual cost" column. This proactive approach ensures your wedding spending plan remains accurate and reflective of your real-time financial situation, allowing you to track payments and monitor your remaining funds efficiently.

Customizing Your Financial Plan for Your Unique Day

Every couple’s vision for their wedding is distinct, and therefore, their financial organizer should be just as unique. The true power of a comprehensive wedding budget template lies in its adaptability and flexibility. It’s not a rigid document; rather, it’s a dynamic tool that should be molded to reflect your personal preferences and priorities. This customization is key to ensuring that your budget genuinely supports the wedding you both dream of.

Take the time to discuss what elements are most important to you as a couple. If lavish floral arrangements are a must-have, then strategically allocate a larger portion of your funds to flowers and explore areas where you can comfortably cut back, perhaps on less elaborate stationery or simplified favors. Conversely, if exceptional photography is your non-negotiable, then make sure your budget reflects that investment. Don’t hesitate to add new categories that are specific to your celebration or remove any that aren’t relevant. This personalized approach transforms a generic cost management tool into your own bespoke nuptial financial strategy, making it a truly useful and empowering asset throughout your planning process.

Common Pitfalls and How to Avoid Them

Even with the most meticulously detailed budget framework in place, couples can sometimes encounter financial setbacks if they’re not aware of common pitfalls. Being proactive and informed about these potential traps is the best way to safeguard your wedding spending plan and ensure a smooth financial journey. Anticipating these challenges allows you to build resilience into your financial organizer.

Here are some common mistakes and strategies to avoid them:

- Forgetting a Buffer: One of the most frequent errors is not including a **contingency fund**. Always allocate 5-10% of your total budget for unexpected expenses or last-minute changes.

- Ignoring Small Costs: Shipping fees, sales tax, corkage fees, vendor meals, and alteration costs can **add up quickly** and are often overlooked in initial estimates. Scrutinize all contracts for hidden charges.

- Not Tracking Payments Consistently: Failing to regularly update your wedding expense tracker with actual payments can lead to **confusion and late fees**. Implement a strict schedule for financial reviews.

- Setting Unrealistic Expectations: Basing your budget solely on Pinterest dreams without researching local vendor costs can lead to disappointment. **Research local averages** before setting your initial numbers.

- Emotional Spending: The pressure to have the “perfect” day can lead to impulse purchases or upgrades that aren’t truly necessary. Stick to your budget and **avoid emotional decisions** that compromise your financial plan.

- Underestimating Guest Count Impact: Every additional guest increases costs across multiple categories like catering, invitations, and favors. Be firm with your **guest list management**.

Beyond the Numbers: The Peace of Mind

While the primary function of a wedding cost planner is undoubtedly financial management, its most significant, albeit intangible, benefit is the profound sense of peace of mind it provides. Navigating the complexities of wedding planning can be inherently stressful, with countless decisions and expenses to juggle. Knowing that you have a clear, comprehensive financial organizer in place allows you to breathe easier.

This assurance frees you from the constant worry about overspending or forgetting a critical payment, enabling you to fully immerse yourselves in the joyous aspects of preparing for your big day. It fosters greater transparency and collaboration between partners, reducing potential financial arguments and strengthening your bond as you tackle this important project together. Ultimately, an effective financial organizer empowers you to enjoy the journey to the altar, confident that your finances are securely managed, leaving you free to focus on the love, the celebration, and the beautiful future ahead.

Frequently Asked Questions

How often should I update my wedding cost planner?

Ideally, you should update your wedding expense tracker at least once a week, or immediately after any financial transaction related to your wedding, such as making a deposit, receiving an invoice, or making a final payment. Consistent, regular updates ensure your financial organizer remains accurate and gives you the most current overview of your spending.

Is a free budgeting spreadsheet sufficient, or should I invest in a paid one?

For most couples, a well-designed free wedding budget template, often available from reputable wedding planning websites or as a downloadable Google Sheet or Excel file, is perfectly sufficient. These free tools usually offer all the necessary features for effective cost management. Paid versions might provide advanced analytics or integrations, but the core functionality for an excellent financial roadmap is readily available without cost.

What if I go over budget in one category?

It’s a common occurrence in wedding planning! The flexibility of a good wedding financial blueprint means you can make adjustments. If you find yourself exceeding your allocation in one area, look for opportunities to cut back or reallocate funds from another, less critical category to balance your overall wedding spending plan. This is where the holistic view of your financial organizer becomes invaluable.

Should I include honeymoon expenses in my wedding budget?

While planning a honeymoon often happens concurrently with wedding planning, it is generally advisable to keep honeymoon expenses separate from your main wedding financial blueprint. This distinction helps maintain clarity, ensuring that your funds for the wedding day itself are precisely allocated without being diluted by travel costs. Create a separate travel budget for your post-nuptial trip.

The excitement of planning your wedding should never be overshadowed by financial anxieties. By embracing a strategic approach with the Best Wedding Budget Template, you transform potential stress into empowered decision-making, ensuring every dollar spent contributes to the celebration of your dreams. This powerful tool isn’t just about tracking money; it’s about safeguarding your peace of mind and allowing you to savor every moment of this unique journey.

Take the proactive step today to secure your financial foundation for your big day. Utilize a comprehensive wedding budget template to gain clarity, assert control, and alleviate the stress associated with wedding expenses. This simple act of organization will empower you to make confident choices, communicate effectively with your partner, and ultimately enjoy a planning process that is as joyful and memorable as the wedding day itself.

Start your married life together on the strongest possible financial footing, knowing that your first grand celebration was managed with wisdom and care. Your future selves will thank you for the foresight and planning that went into creating not just a beautiful wedding, but a financially sound beginning to your new chapter.