In the intricate world of financial management, foresight isn’t just a virtue—it’s a necessity. Businesses and savvy individuals alike understand that a clear vision of the future is paramount to navigating economic ebbs and flows. While income statements and cash flow projections often take center stage in financial planning, there’s another crucial tool that provides a holistic view of financial health: the projected balance sheet. It’s the silent workhorse, offering a snapshot of what your financial position is expected to look like at a future point in time.

Imagine having a roadmap that doesn’t just show you where you’re going, but also what assets you’ll acquire, what debts you’ll incur, and how your overall wealth will evolve. This is precisely what a robust Balance Sheet Budget Template delivers. It goes beyond mere expense tracking, painting a comprehensive picture of your future assets, liabilities, and equity, allowing for strategic decision-making that solidifies long-term stability and growth. For any entity, from a bustling startup to a established corporation, understanding this forward-looking statement of financial position is key to robust planning.

What is a Balance Sheet Budget, and Why Does it Matter?

A balance sheet budget, often referred to as a projected balance sheet, is a financial statement that forecasts the assets, liabilities, and owner’s equity of a business at a specific future date. Unlike an income statement, which tracks revenues and expenses over a period, or a cash flow statement, which details the movement of cash, the balance sheet provides a static, yet forward-looking, picture of your financial standing. It’s a critical component of any comprehensive master budget, linking together operational plans with their financial implications on your organization’s wealth.

Its significance lies in its ability to reveal the long-term impact of your operational and investment decisions. By projecting assets (what you own), liabilities (what you owe), and equity (the residual value), a well-constructed balance sheet budget template allows you to assess solvency, liquidity, and financial structure well in advance. This proactive approach helps identify potential financial bottlenecks, evaluate investment returns, and ensure that your capital structure supports your strategic objectives. It’s not just about predicting numbers; it’s about understanding the future implications of today’s choices.

The Unsung Hero of Financial Forecasting

While cash flow often gets the spotlight for immediate operational health, and profit and loss for performance, the projected statement of financial position quietly underpins them all. It’s the ultimate arbiter of financial health, showcasing the long-term effects of business activities. Without this vital component, financial planning is incomplete, much like trying to build a house without considering the foundation. A robust balance sheet planning tool ensures that growth is sustainable and that liquidity and solvency are maintained.

This financial health blueprint serves as a critical check and balance against other financial projections. For instance, an ambitious income statement might show significant profit, but if the corresponding balance sheet projection indicates rising inventory without corresponding sales, or an unsustainable increase in debt, it signals a deeper issue. It forces a holistic review, ensuring that all financial statements tell a consistent and viable story. This integration is essential for truly effective strategic planning and resource allocation.

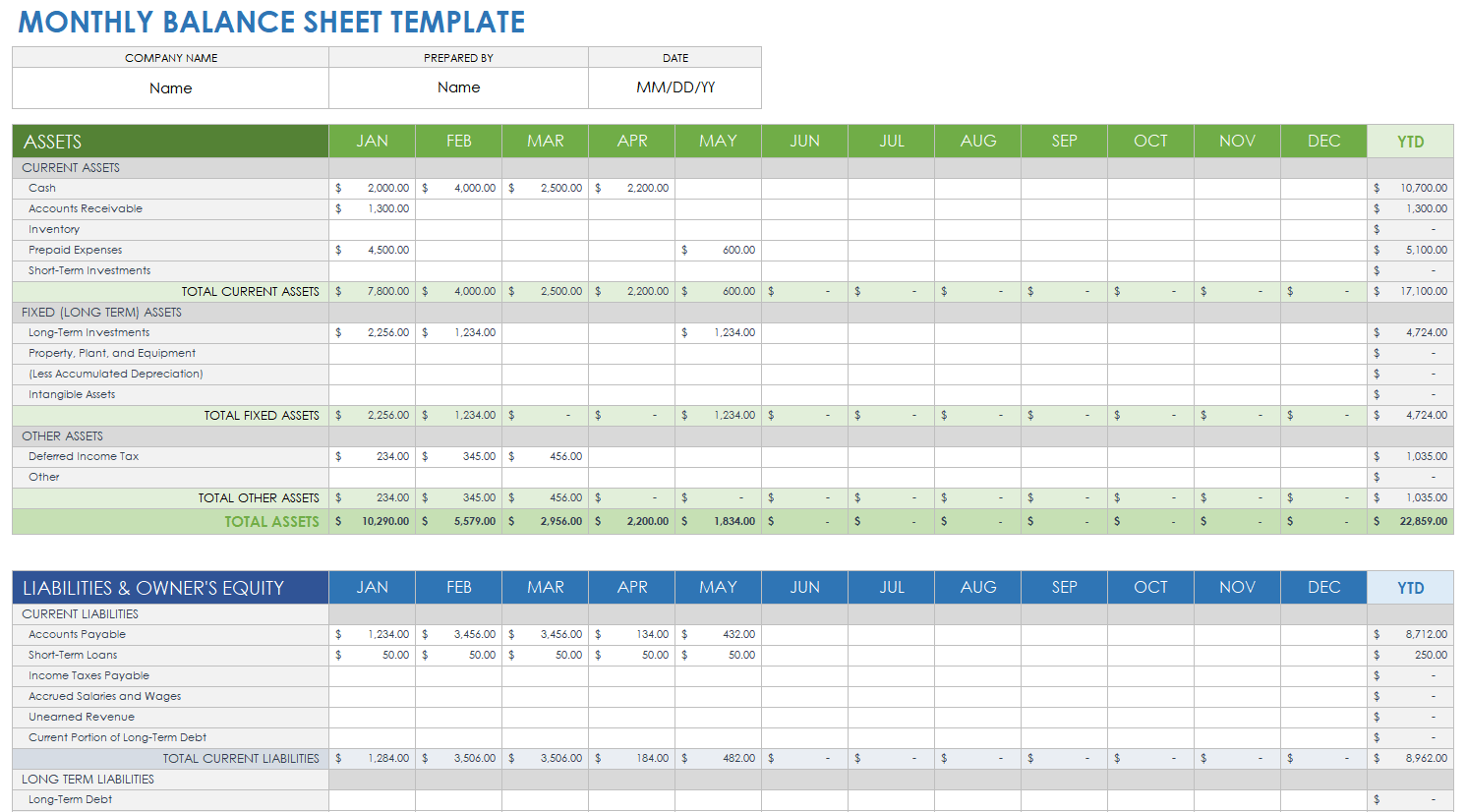

Key Components of an Effective Balance Sheet Budget Template

Building an accurate future balance sheet model requires a detailed understanding of its core components, derived from assumptions about future operations and financing. A comprehensive template will clearly lay out sections for assets, liabilities, and equity, with granular line items under each. The accuracy of these projections hinges on sound forecasting of sales, expenses, capital expenditures, and financing activities.

Here are the primary categories and common elements you’ll find within a projected balance sheet:

- **Assets:** These are what the business owns.

- **Current Assets:** Expected to be converted to cash within one year.

- **Cash:** Projected cash balance, heavily influenced by the cash flow budget.

- **Accounts Receivable:** Expected money owed by customers.

- **Inventory:** Value of goods available for sale, based on sales forecasts and purchasing plans.

- **Prepaid Expenses:** Payments made in advance for future services.

- **Non-Current Assets:** Long-term assets not easily converted to cash.

- **Property, Plant, and Equipment (PP&E):** Value of land, buildings, machinery, and vehicles, adjusted for depreciation and new capital expenditures.

- **Accumulated Depreciation:** Total depreciation expensed over time.

- **Intangible Assets:** Patents, trademarks, goodwill (if applicable).

- **Current Assets:** Expected to be converted to cash within one year.

- **Liabilities:** These are what the business owes to others.

- **Current Liabilities:** Obligations due within one year.

- **Accounts Payable:** Money owed to suppliers.

- **Short-Term Debt:** Loans or credit lines due within the year.

- **Accrued Expenses:** Expenses incurred but not yet paid (e.g., salaries, utilities).

- **Deferred Revenue:** Payments received for services not yet delivered.

- **Non-Current Liabilities:** Long-term obligations.

- **Long-Term Debt:** Mortgages, bonds, or loans due beyond one year.

- **Deferred Tax Liabilities:** Future tax obligations.

- **Current Liabilities:** Obligations due within one year.

- **Equity:** The residual value belonging to the owners.

- **Owner’s Equity/Shareholder’s Equity:**

- **Common Stock/Capital:** Funds raised from issuing shares.

- **Retained Earnings:** Accumulated profits that have not been distributed as dividends, directly linked to projected net income from the income statement and any dividend policies.

- **Owner’s Equity/Shareholder’s Equity:**

Who Benefits from Using This Financial Tool?

Virtually any entity engaged in financial planning can derive significant value from projecting their statement of financial position. This powerful financial planning template isn’t exclusive to large corporations; its principles are scalable and beneficial across various scales and sectors.

For small to medium-sized businesses (SMBs), it offers a structured way to anticipate future capital needs, assess the impact of expansion plans, and understand how investment in new equipment or technology will affect their overall financial standing. It helps in making informed decisions about taking on debt or seeking equity financing.

Large corporations rely on sophisticated balance sheet budgeting for strategic financial management, mergers and acquisitions analysis, capital expenditure planning, and complex financing arrangements. It’s an essential component for communicating future financial health to investors, creditors, and internal stakeholders.

Even individual investors and personal finance enthusiasts can adapt the concept to track their net worth projections. By forecasting assets like investments and real estate against liabilities like mortgages and student loans, they can strategically plan for retirement, major purchases, or debt reduction, effectively creating their own personal statement of financial position projection.

Implementing Your Balance Sheet Budget: Best Practices

Creating an accurate and useful future balance sheet projection involves more than just plugging numbers into a spreadsheet. It requires careful consideration, robust data, and a iterative approach.

- Start with Solid Assumptions: Your projected balance sheet is only as good as the assumptions it’s built upon. Base your forecasts for sales, cost of goods sold, operating expenses, and capital expenditures on historical data, market trends, and strategic plans. Document these assumptions clearly.

- Integrate with Other Budgets: The balance sheet budget doesn’t stand alone. It’s deeply intertwined with the income statement budget and the cash flow budget. Changes in sales affect accounts receivable and inventory. Profits (or losses) impact retained earnings. Capital expenditures change PP&E and cash. Ensure all budgets are consistent and flow logically into one another.

- Use a Rolling Forecast Approach: Instead of a static annual budget, consider updating your projected balance sheet periodically (e.g., quarterly or monthly). This allows you to incorporate actual results and adjust future projections, making your financial planning more dynamic and responsive to changing conditions.

- Model Scenarios: Explore different "what-if" scenarios. What if sales are 10% lower? What if interest rates increase? By modeling best-case, worst-case, and most-likely scenarios, you can assess potential risks and opportunities, and develop contingency plans.

- Reconcile and Validate: After populating your template, ensure that the fundamental accounting equation holds true: Assets = Liabilities + Equity. If it doesn’t balance, meticulously review your calculations and assumptions. Validate key projections against industry benchmarks and your strategic goals.

Beyond the Numbers: Strategic Insights

The true power of a comprehensive asset and liability budgeting process extends far beyond mere numerical prediction. It transforms into a strategic tool, offering profound insights into the long-term viability and growth potential of an enterprise. By meticulously mapping out the future state of assets, liabilities, and equity, organizations gain clarity on critical questions that inform high-level decision-making.

For example, a detailed balance sheet budget can highlight potential liquidity challenges before they arise, signaling a need to adjust cash management strategies or explore new financing options. It can also quantify the impact of significant capital investments, allowing management to evaluate return on investment (ROI) not just in terms of profits, but also in how it strengthens the organization’s asset base. Furthermore, it serves as a robust framework for assessing the implications of debt levels, ensuring that the company maintains a healthy debt-to-equity ratio that supports rather than hinders growth. This forward-looking approach to financial statement budgeting empowers leaders to make proactive, data-driven choices, ensuring a resilient and prosperous future.

Frequently Asked Questions

Is a balance sheet budget only for large businesses?

Absolutely not. While large corporations use complex versions, the core principles of projecting assets, liabilities, and equity are beneficial for businesses of all sizes, including startups and small businesses. It helps even the smallest ventures plan for growth, manage debt, and understand their future financial position.

How often should I update my projected balance sheet?

The frequency depends on the volatility of your business and your planning cycle. Many businesses create an annual projected balance sheet as part of their master budget. However, for more dynamic environments, a quarterly or even monthly update (a rolling forecast) can be highly beneficial, allowing you to react quickly to changes and maintain accuracy.

What’s the difference between a cash flow budget and a balance sheet budget?

A cash flow budget tracks the actual movement of cash in and out of your business over a period, focusing on liquidity. A balance sheet budget, conversely, is a snapshot of your assets, liabilities, and equity at a specific future point in time, indicating overall financial health and solvency. They are interconnected: cash flow affects the cash balance on the balance sheet, and changes in balance sheet items (like inventory or debt) impact cash flows.

Can this budget template help with securing financing?

Yes, definitively. Lenders and investors typically require comprehensive financial projections, including a projected balance sheet, before approving loans or investing capital. A well-prepared and realistic projected balance sheet demonstrates financial prudence and a clear understanding of your business’s future financial needs and capacity to repay debt or generate returns.

What if my projected balance sheet doesn’t balance (Assets = Liabilities + Equity)?

If your projected balance sheet doesn’t balance, it indicates an error in your calculations or assumptions. The most common reasons include mistakes in linking to the income statement (especially retained earnings) or cash flow statement, incorrect capital expenditure or debt repayment calculations, or simply arithmetic errors. You must meticulously review each line item and its source to identify and correct the discrepancy.

Embracing the development of a projected statement of financial position is more than just an accounting exercise; it’s a strategic imperative. It empowers you to move beyond reactive decision-making, providing the foresight needed to navigate complex financial landscapes with confidence. By meticulously planning for your future assets, liabilities, and equity, you lay the groundwork for sustainable growth and long-term financial resilience.

Don’t let your financial future be a matter of guesswork. Leverage the power of a well-constructed Balance Sheet Budget Template to gain unparalleled clarity and control over your financial destiny. It’s the essential blueprint that will guide your organization towards robust health, informed growth, and unwavering stability in an ever-evolving market. Start building your future today, one well-planned financial statement at a time.